- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

ISLM analysis an extension of the keynesian framework презентация

Содержание

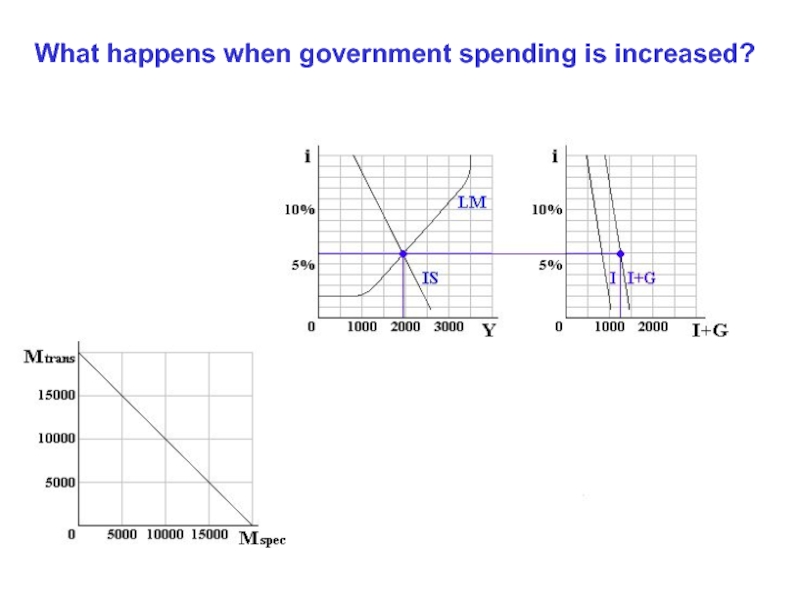

- 3. What happens when government spending is increased?

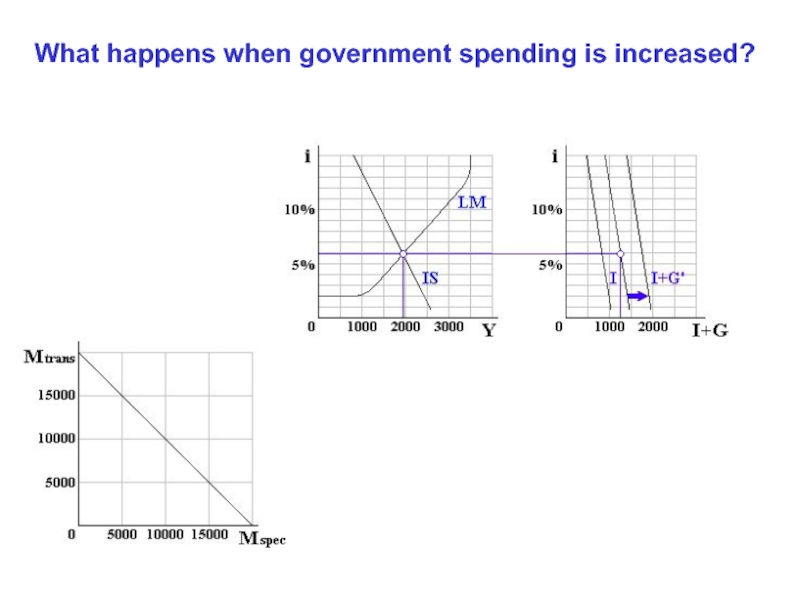

- 4. What happens when government spending is increased?

- 5. What happens when government spending is increased?

- 6. What happens when government spending is increased?

- 7. What happens when government spending is increased?

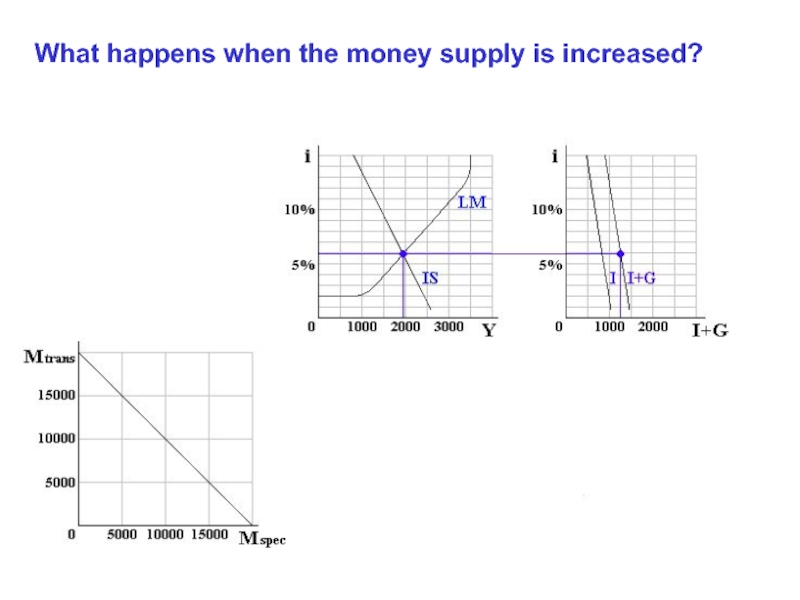

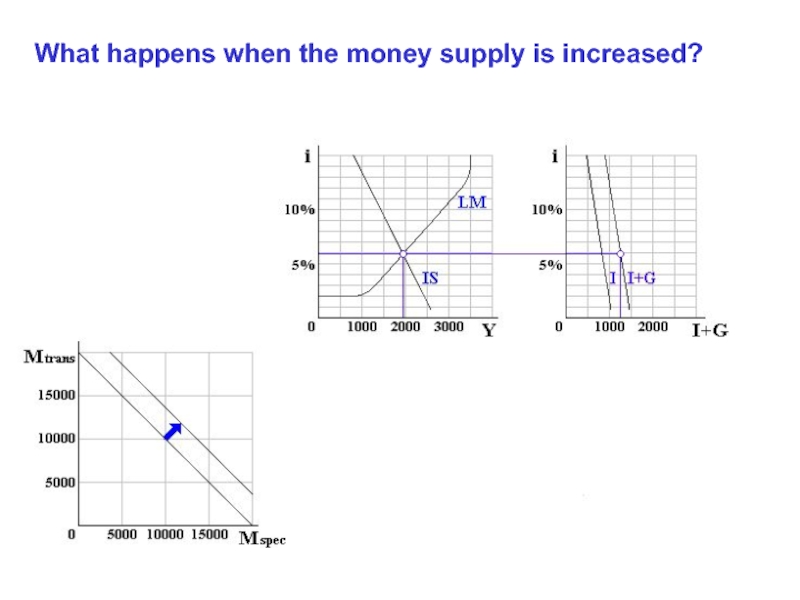

- 8. What happens when the money supply is increased?

- 9. What happens when the money supply is increased?

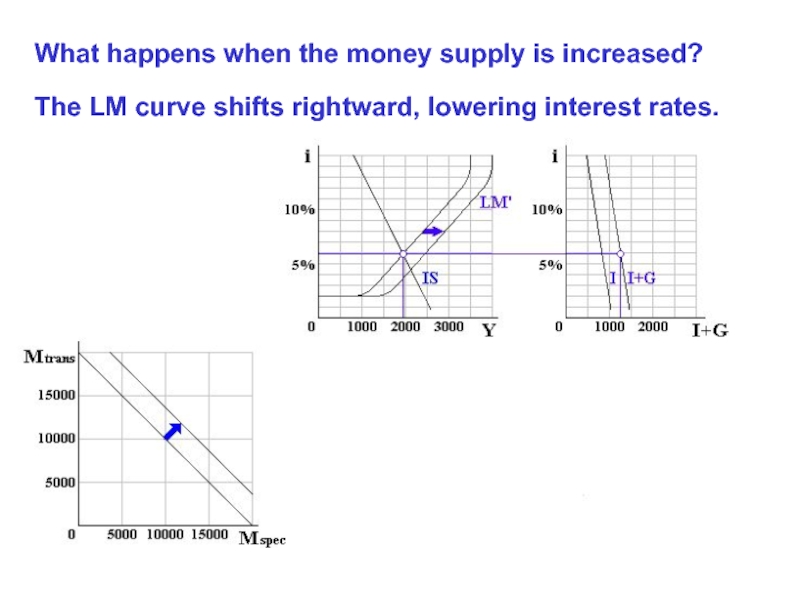

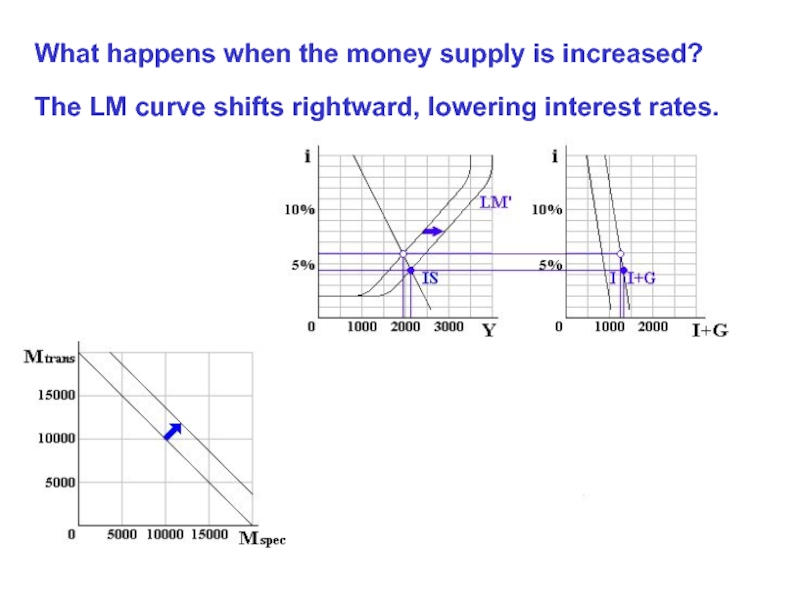

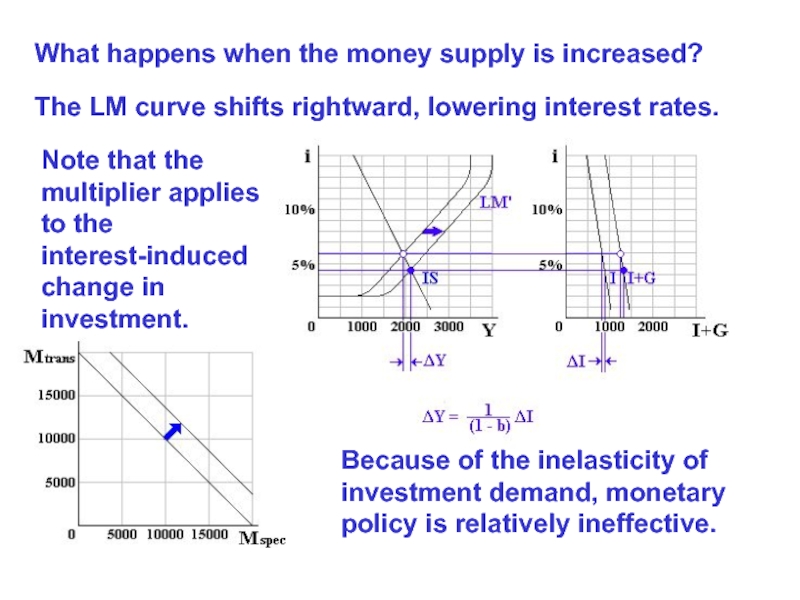

- 10. The LM curve shifts rightward, lowering interest

- 11. What happens when the money supply is

- 12. What happens when the money supply is

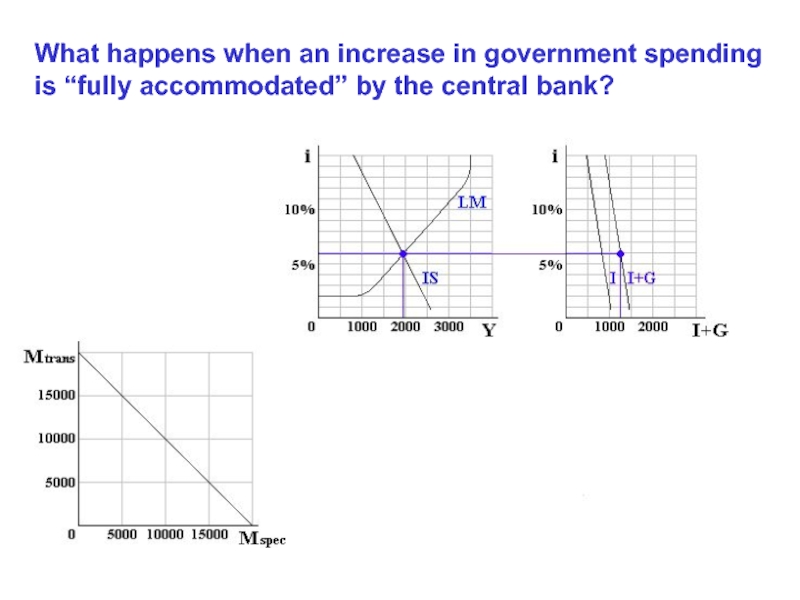

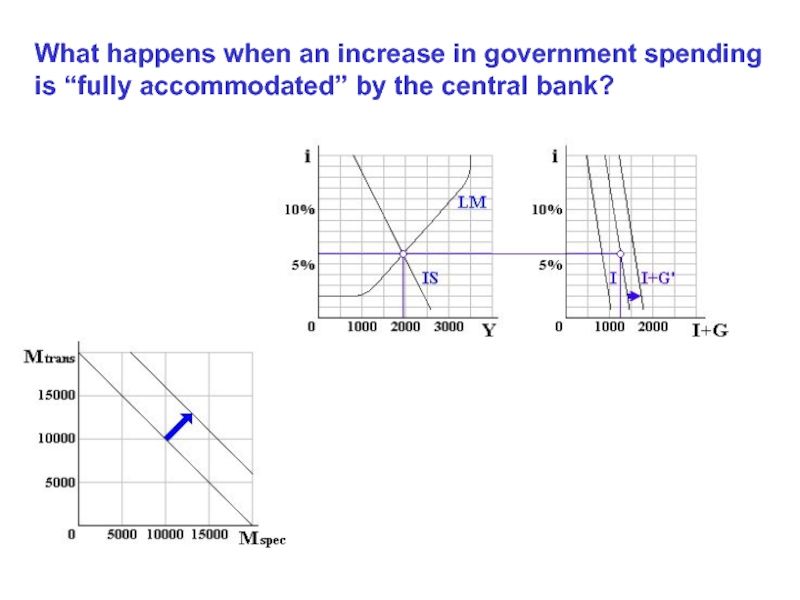

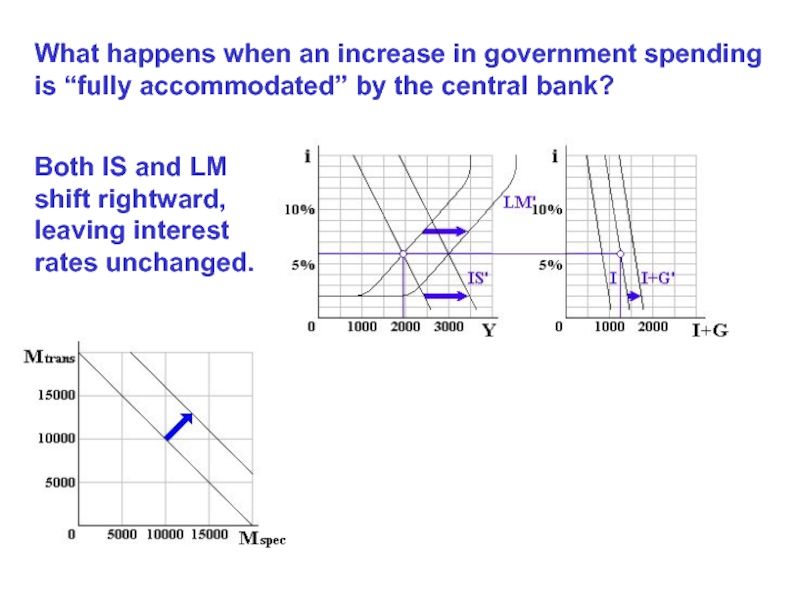

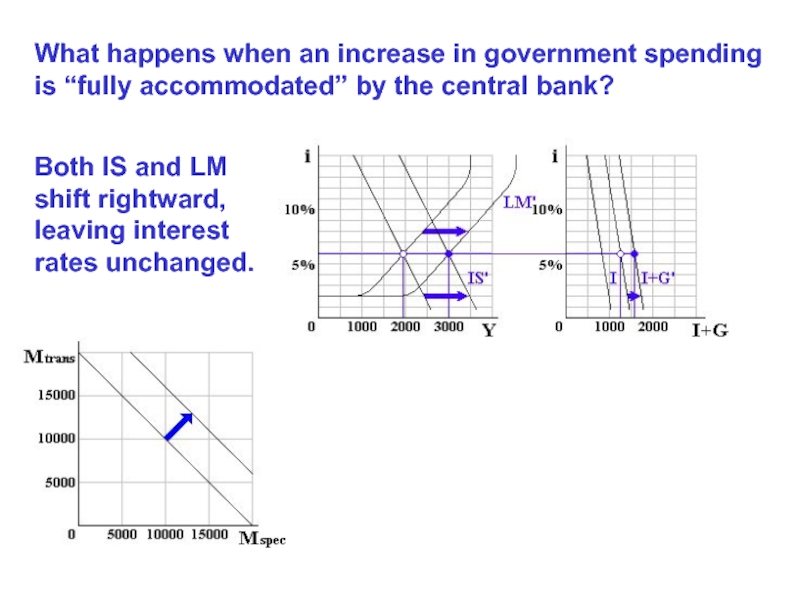

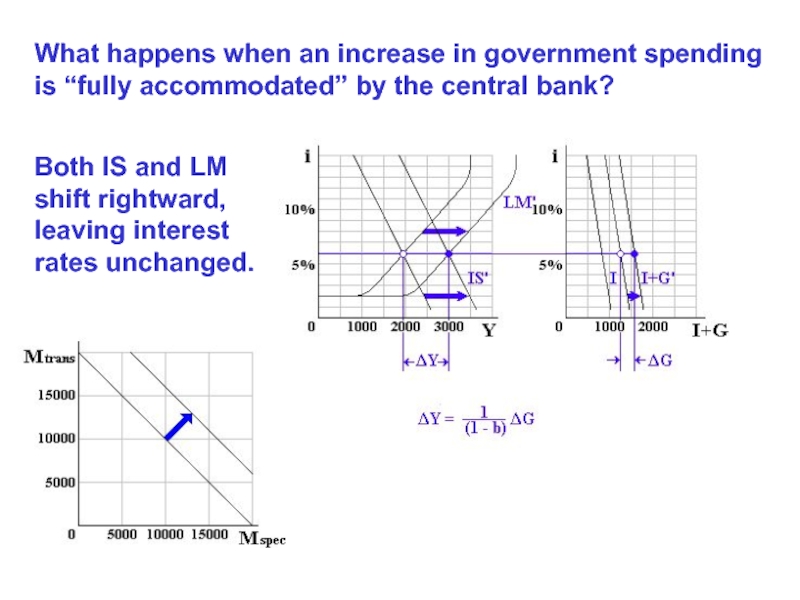

- 13. What happens when an increase in government

- 14. What happens when an increase in government

- 15. What happens when an increase in government

- 16. What happens when an increase in government

- 17. What happens when an increase in government

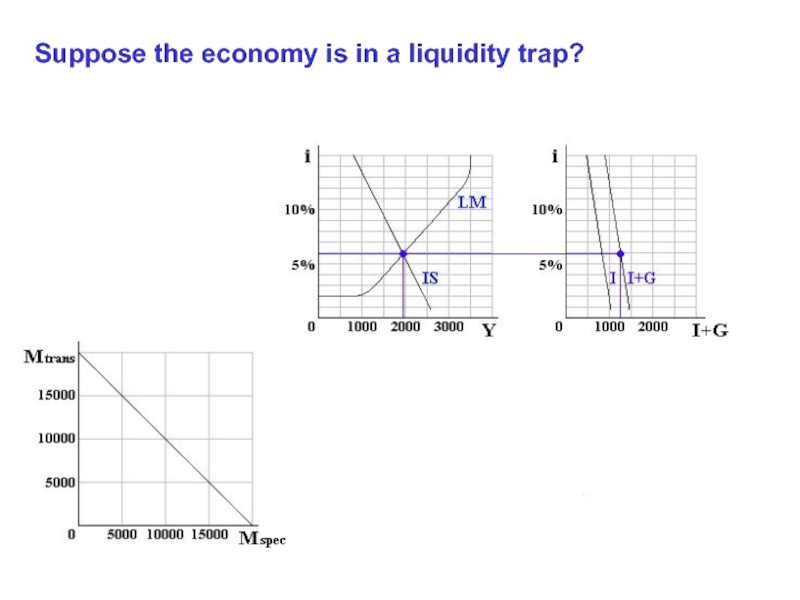

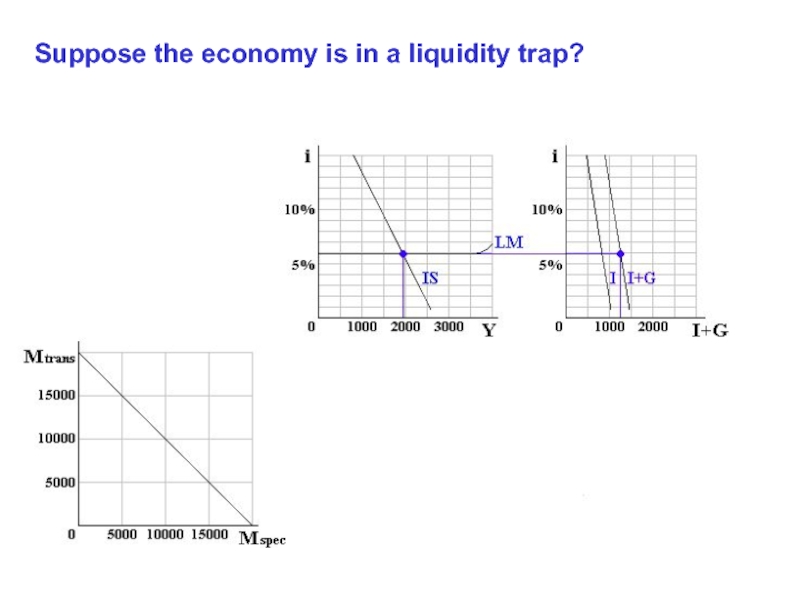

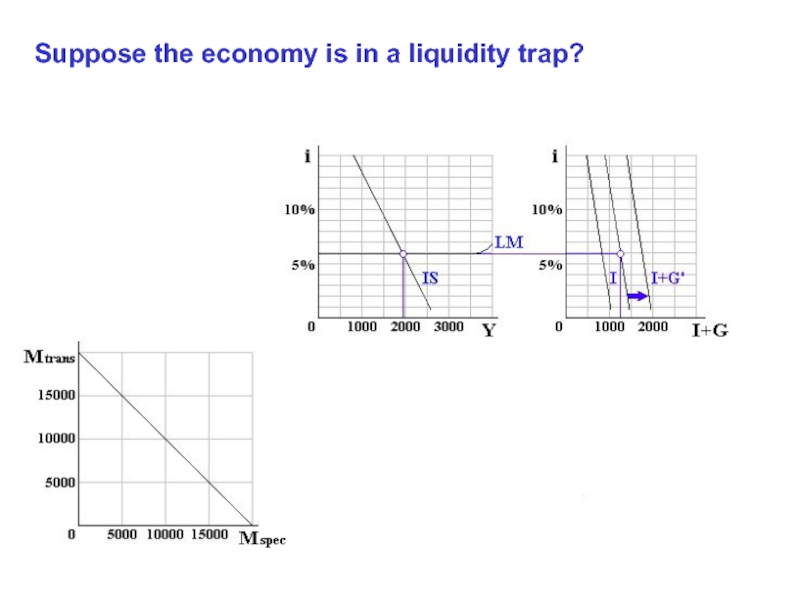

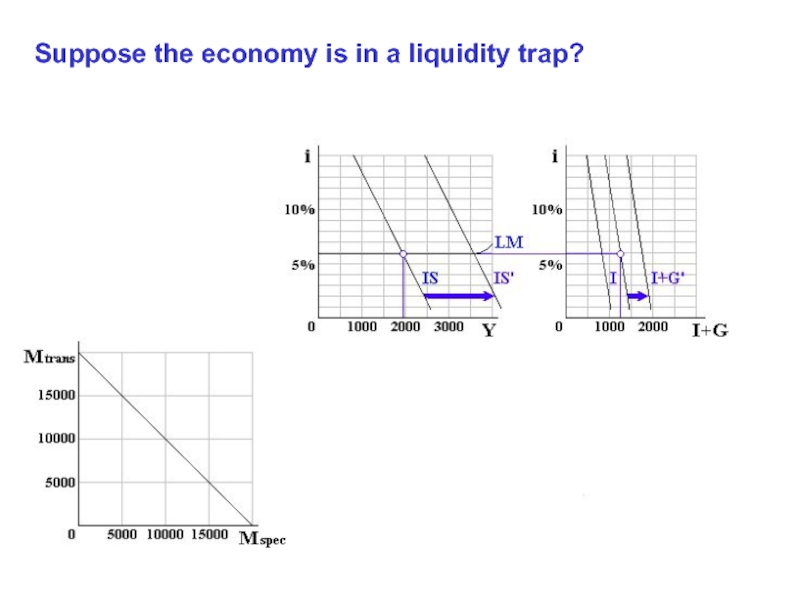

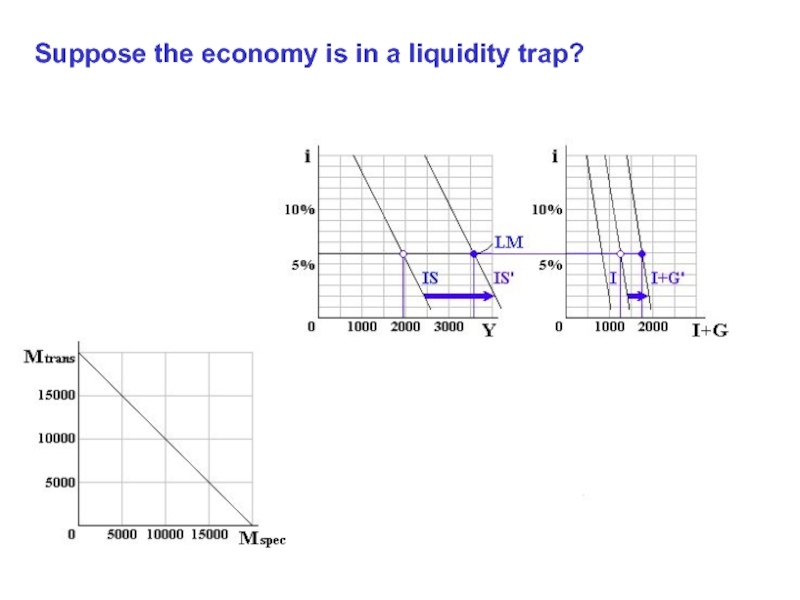

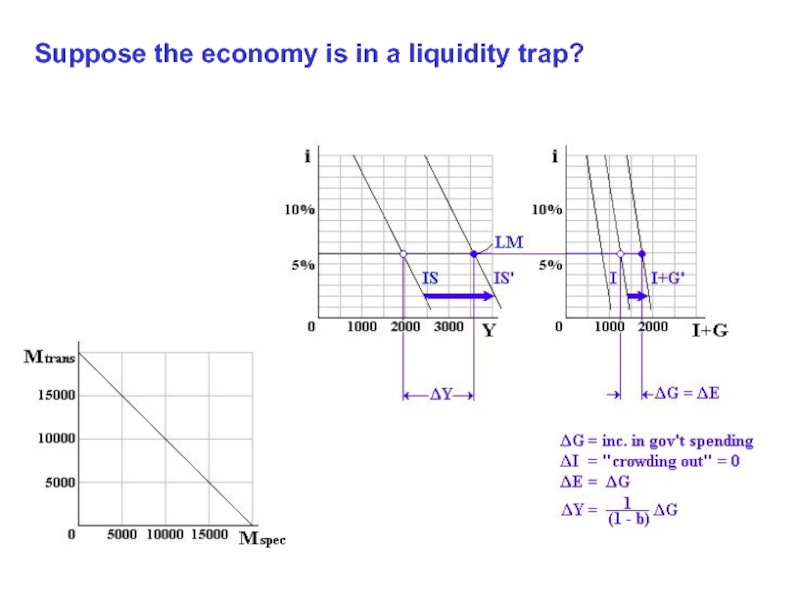

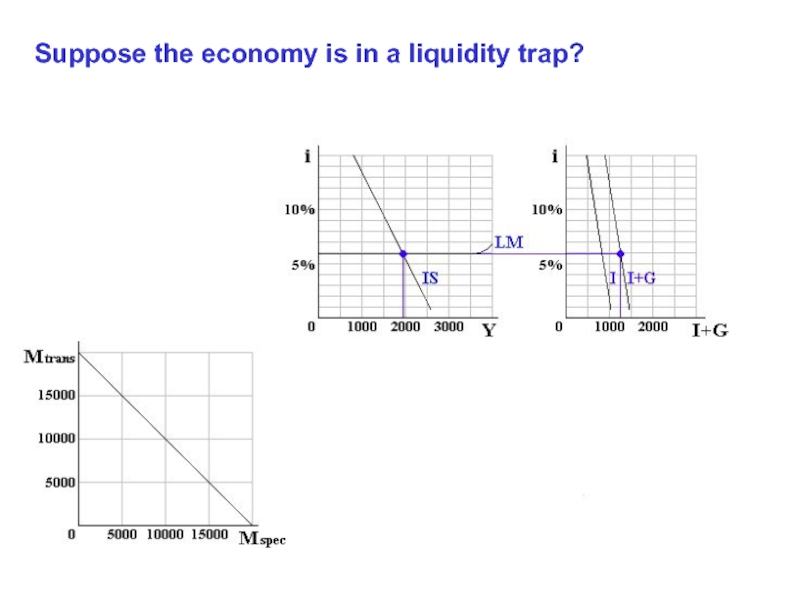

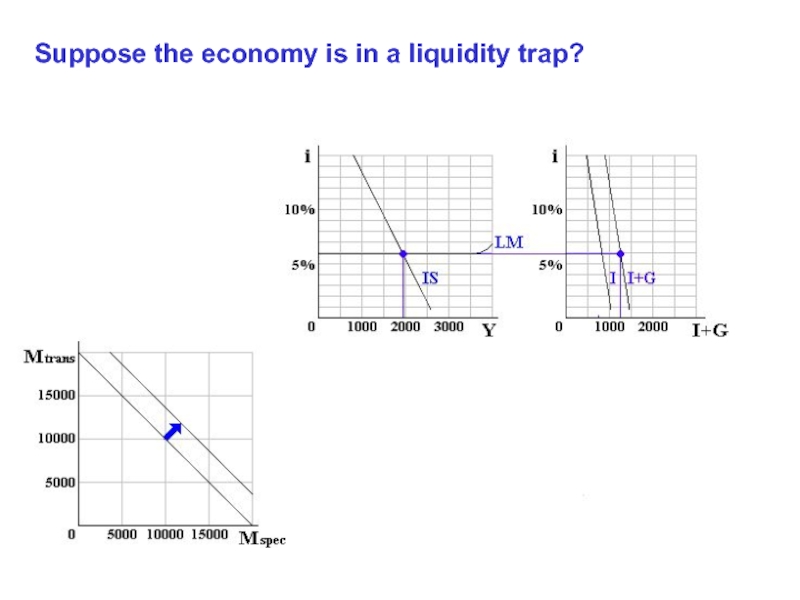

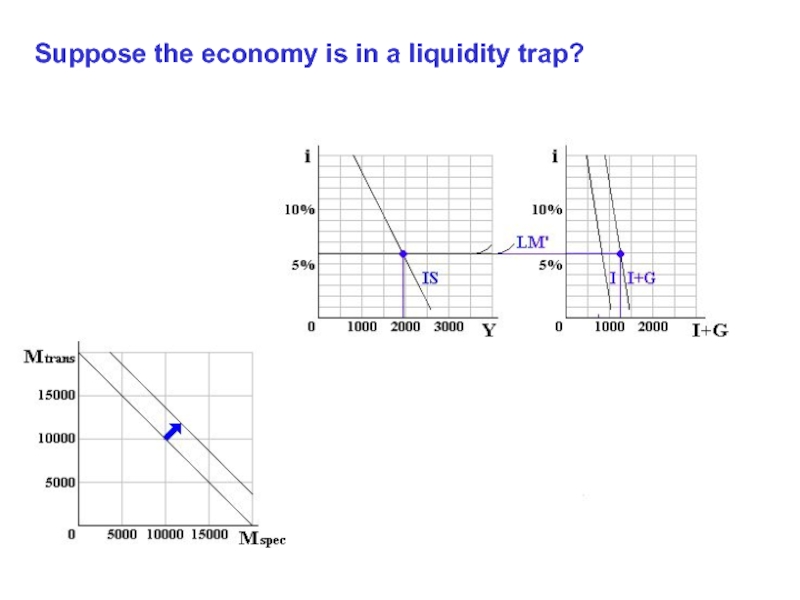

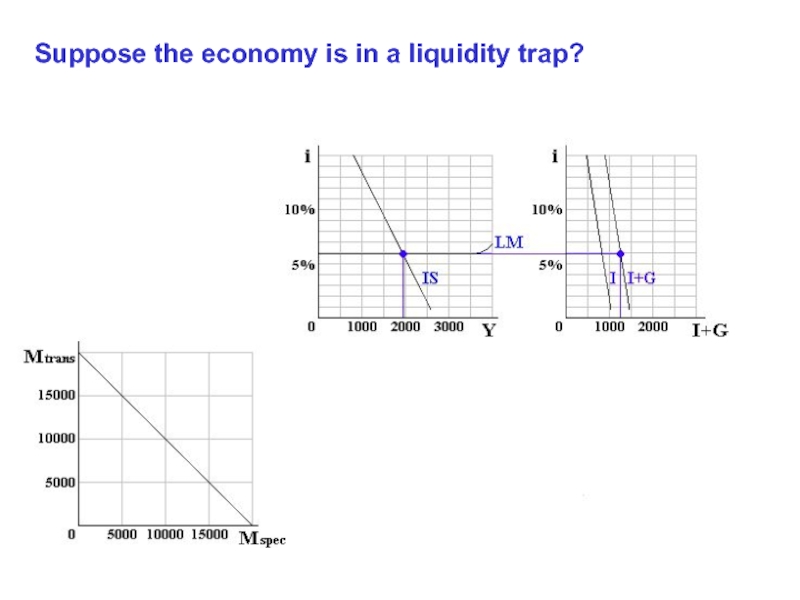

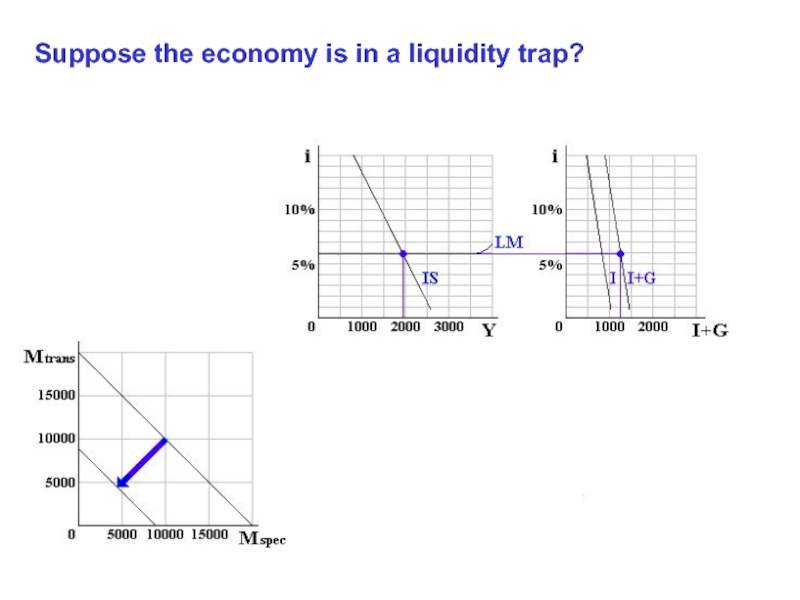

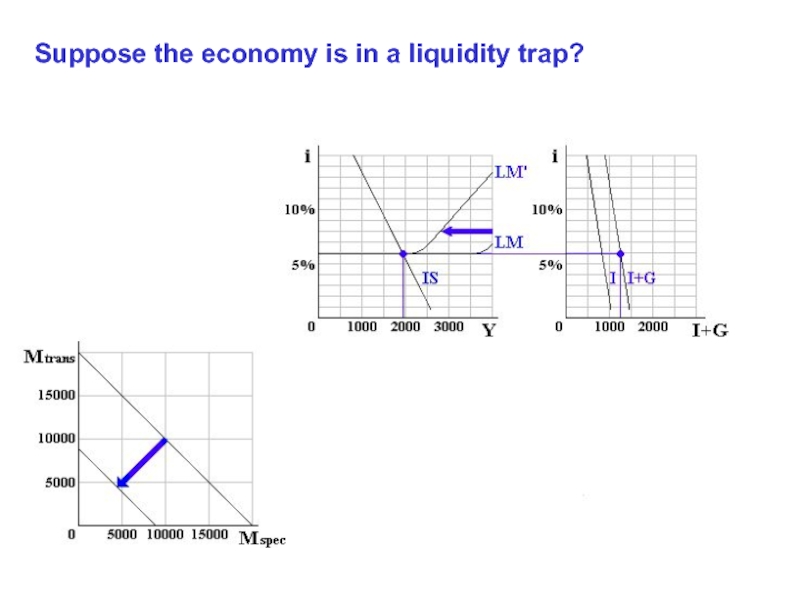

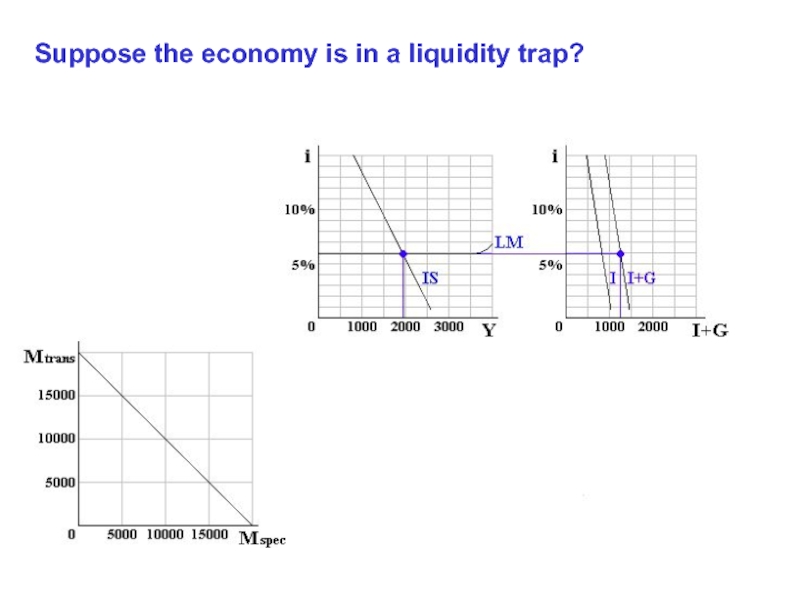

- 18. Suppose the economy is in a liquidity trap?

- 19. Suppose the economy is in a liquidity trap?

- 20. Suppose the economy is in a liquidity trap?

- 21. Suppose the economy is in a liquidity trap?

- 22. Suppose the economy is in a liquidity trap?

- 23. Suppose the economy is in a liquidity trap?

- 24. Suppose the economy is in a liquidity trap?

- 25. Suppose the economy is in a liquidity trap?

- 26. Suppose the economy is in a liquidity trap?

- 27. Suppose the economy is in a liquidity trap?

- 28. Suppose the economy is in a liquidity trap?

- 29. Suppose the economy is in a liquidity trap?

- 30. Suppose the economy is in a liquidity trap?

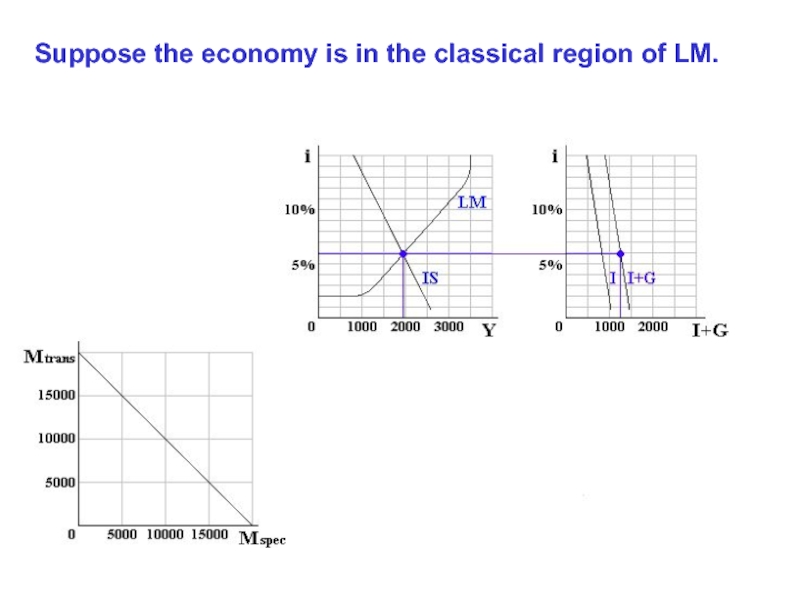

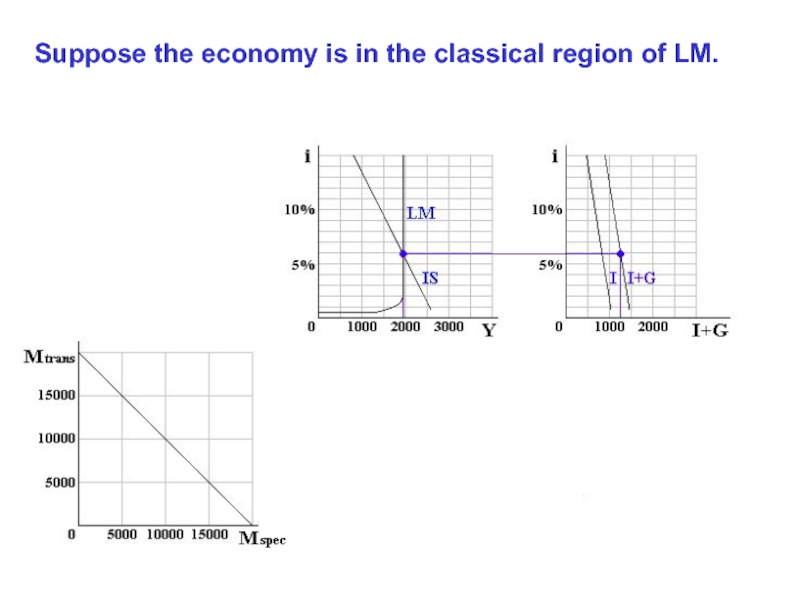

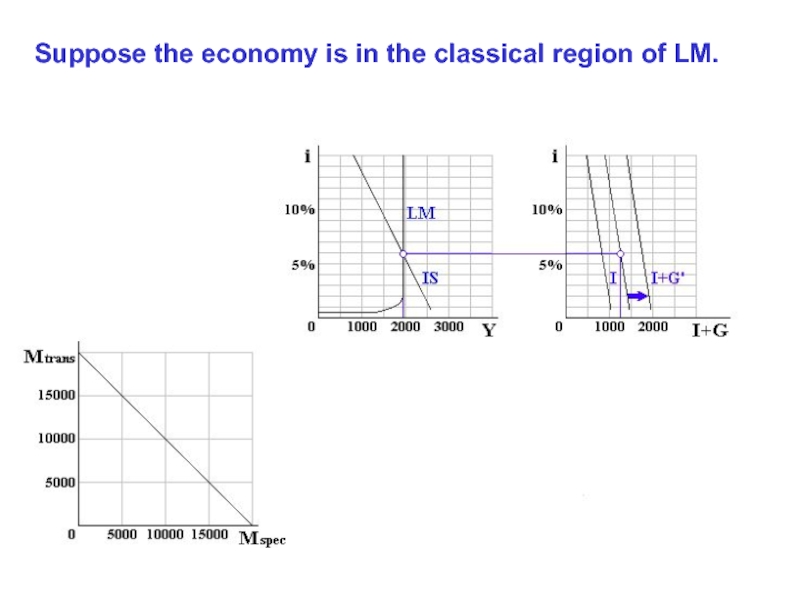

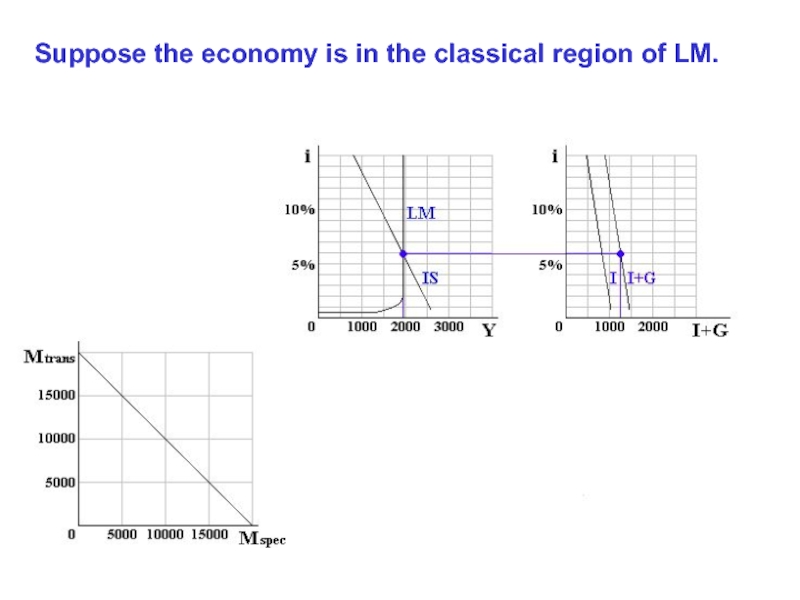

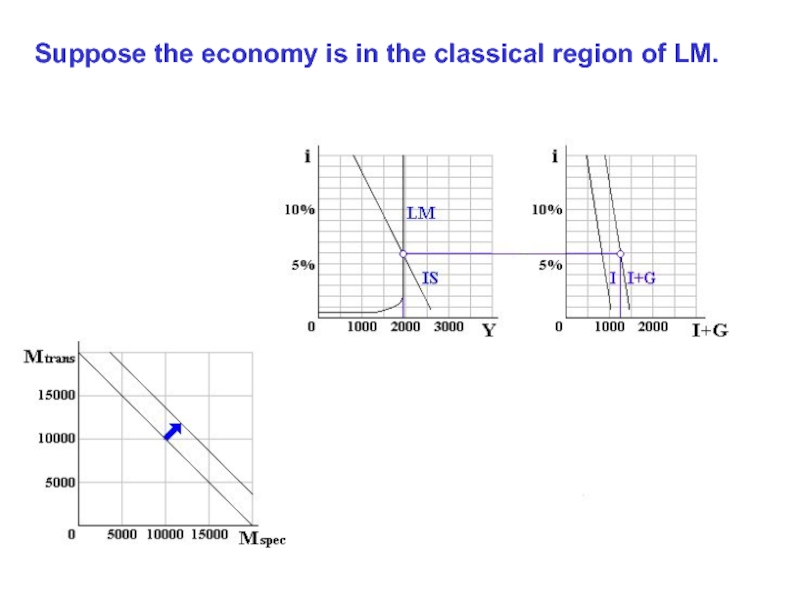

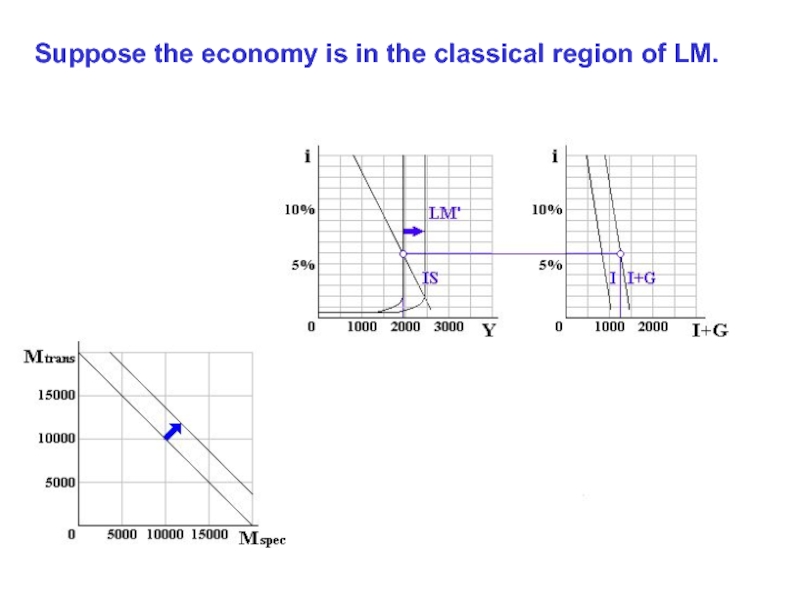

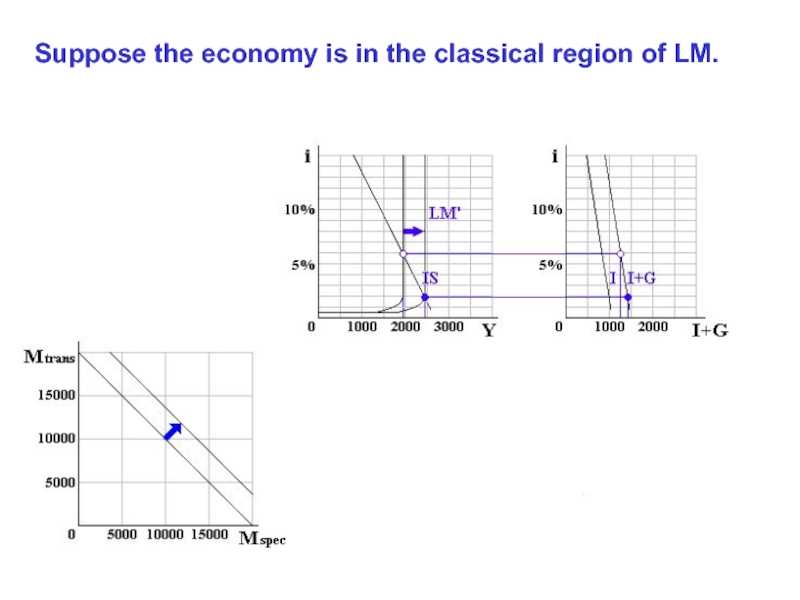

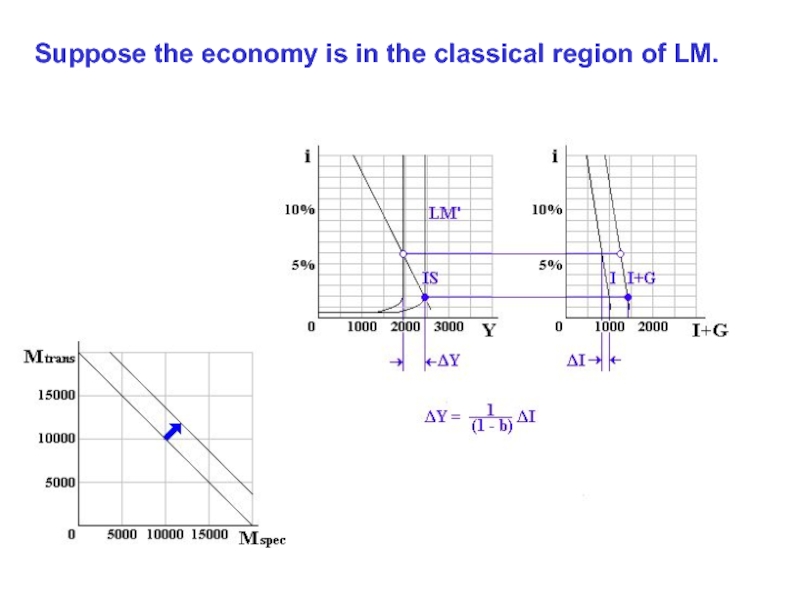

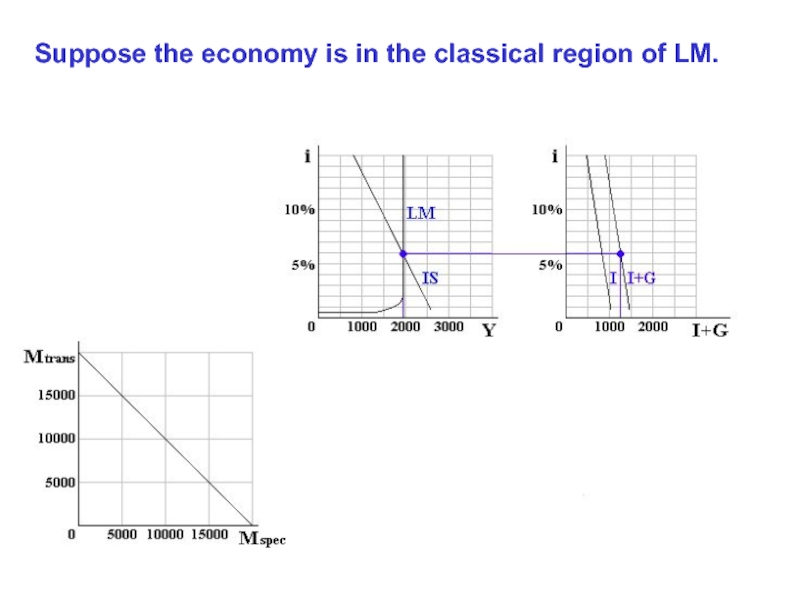

- 31. Suppose the economy is in the classical region of LM.

- 32. Suppose the economy is in the classical region of LM.

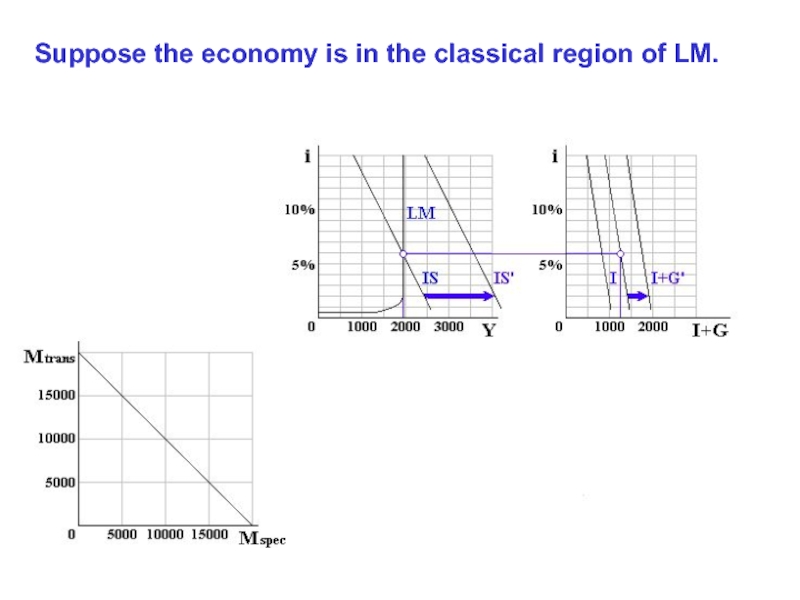

- 33. Suppose the economy is in the classical region of LM.

- 34. Suppose the economy is in the classical region of LM.

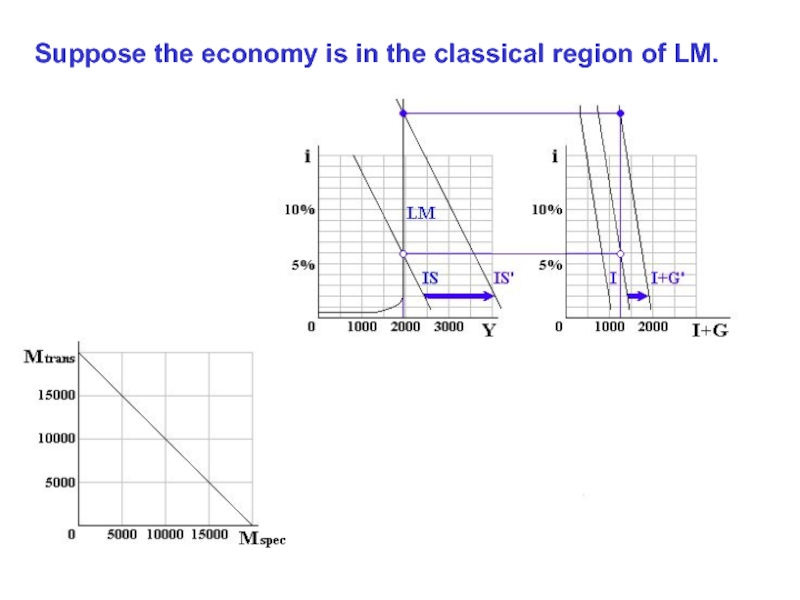

- 35. Suppose the economy is in the classical region of LM.

- 36. Suppose the economy is in the classical region of LM.

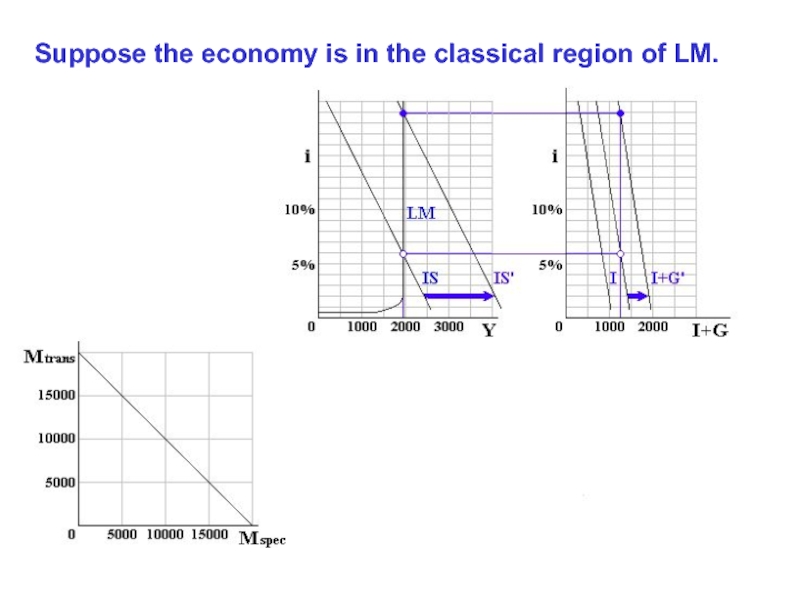

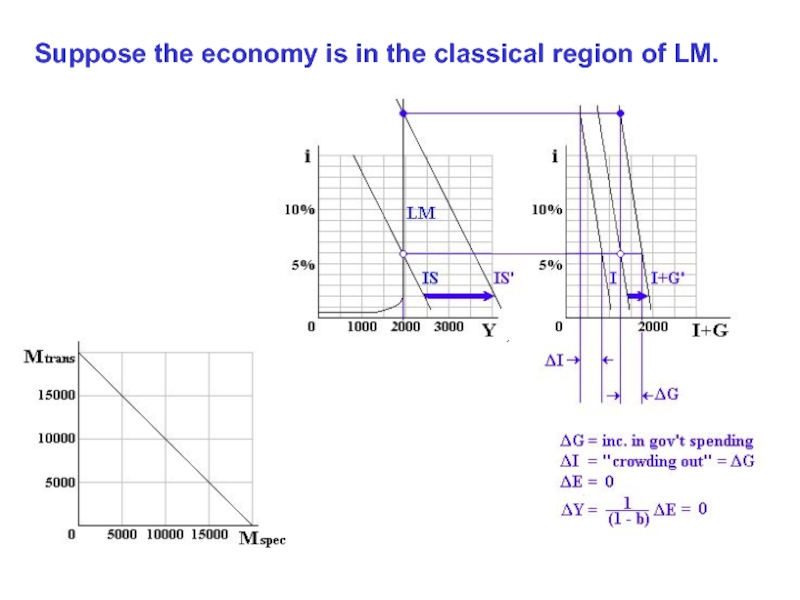

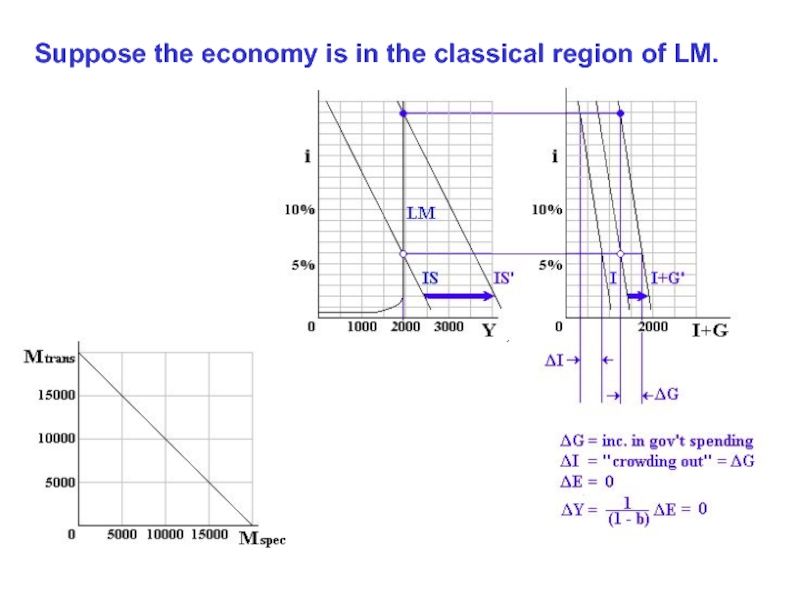

- 37. Suppose the economy is in the classical region of LM.

- 38. Suppose the economy is in the classical region of LM.

- 39. Suppose the economy is in the classical region of LM.

- 40. Suppose the economy is in the classical region of LM.

- 41. Suppose the economy is in the classical region of LM.

- 42. Suppose the economy is in the classical region of LM.

- 43. Suppose the economy is in the classical region of LM.

- 44. Suppose the economy is in the classical region of LM.

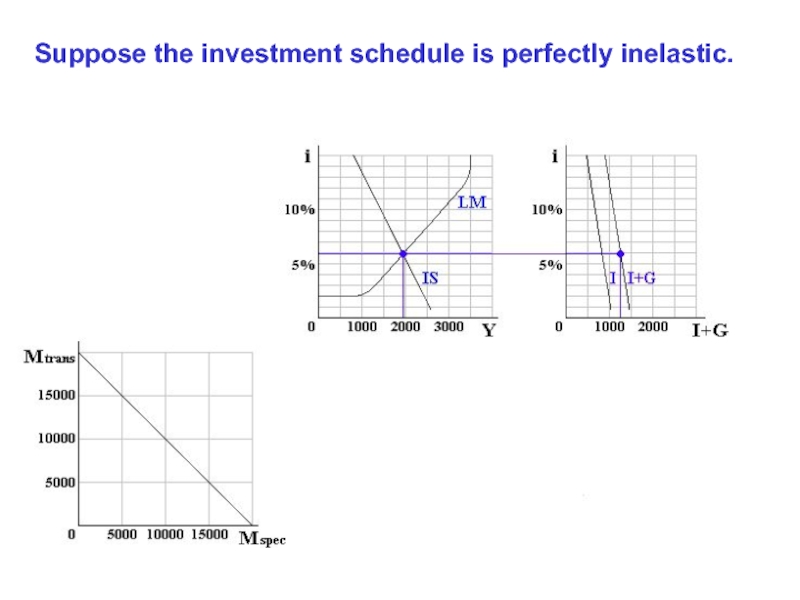

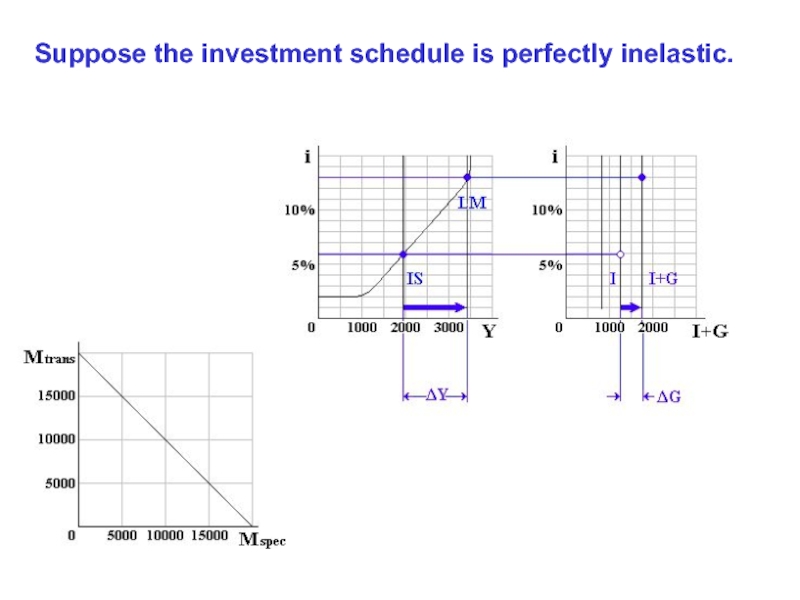

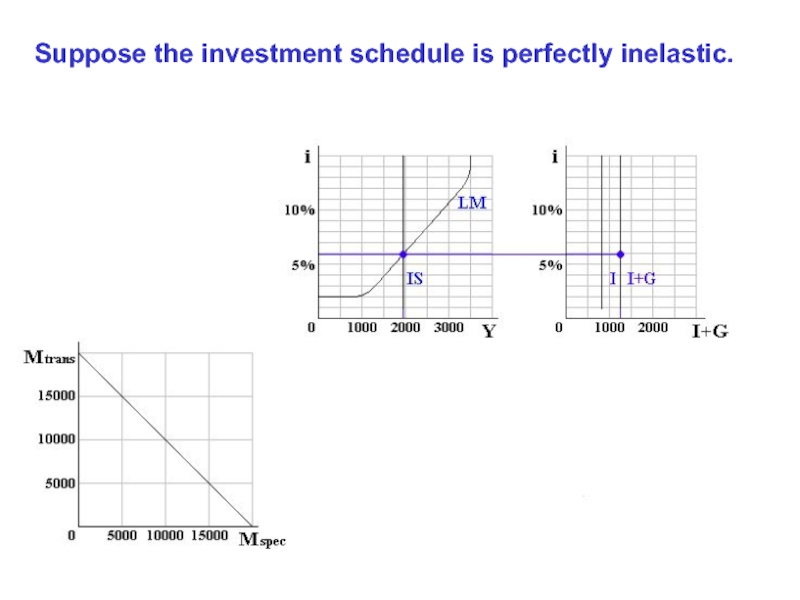

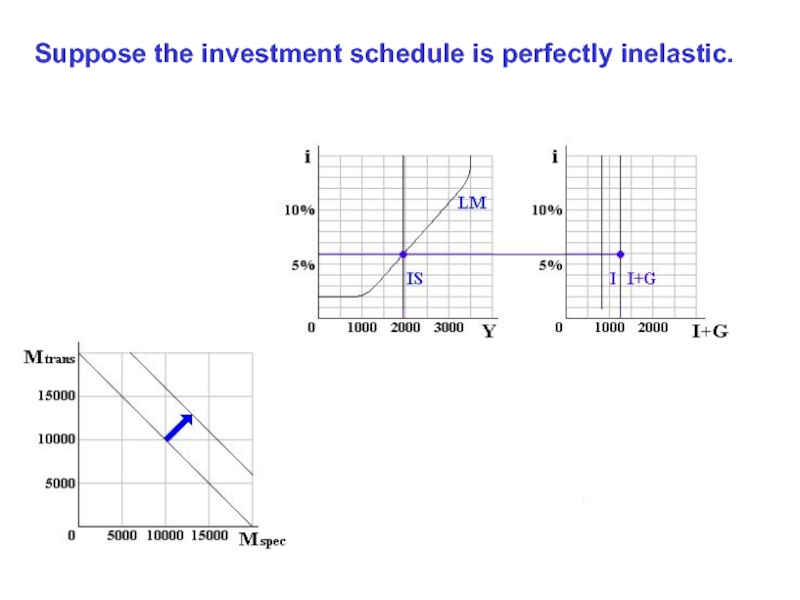

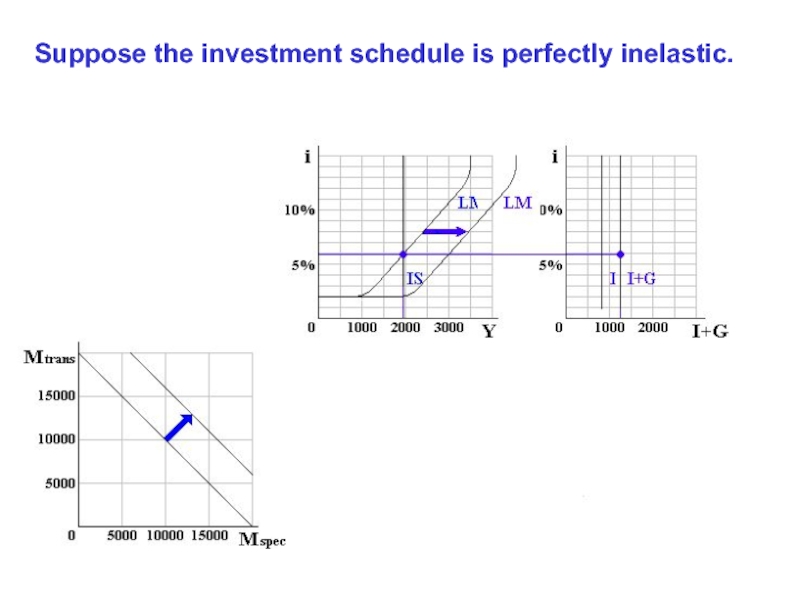

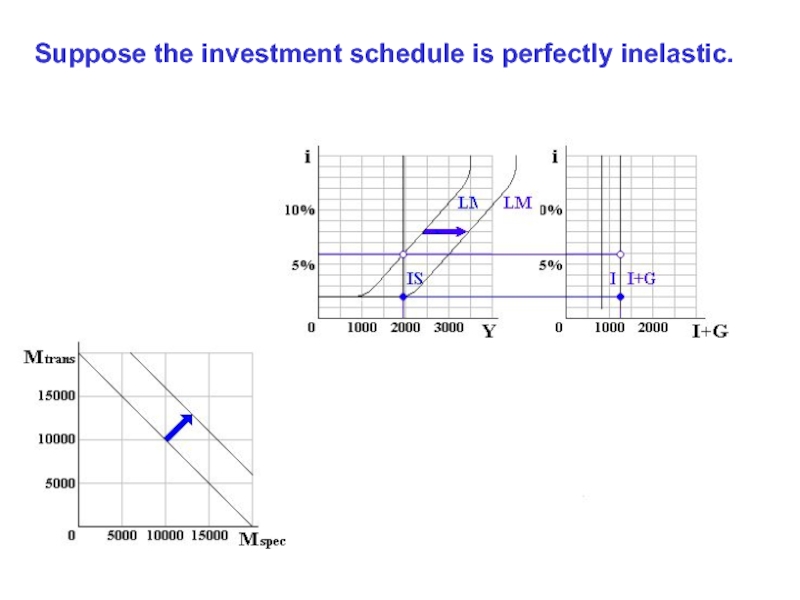

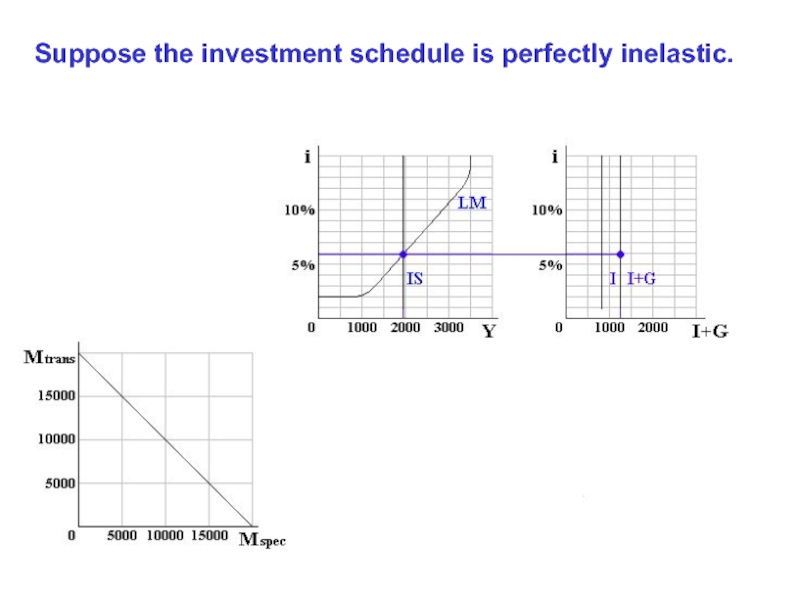

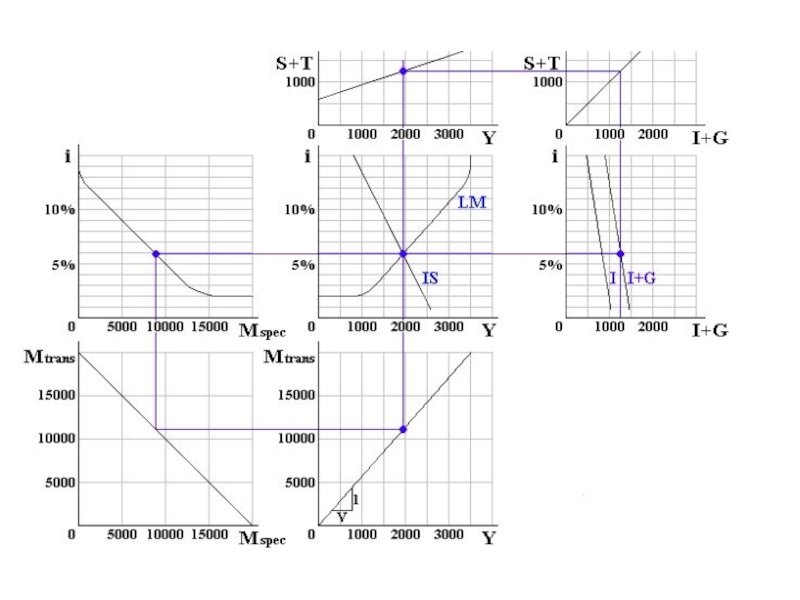

- 45. Suppose the investment schedule is perfectly inelastic.

- 46. Suppose the investment schedule is perfectly inelastic.

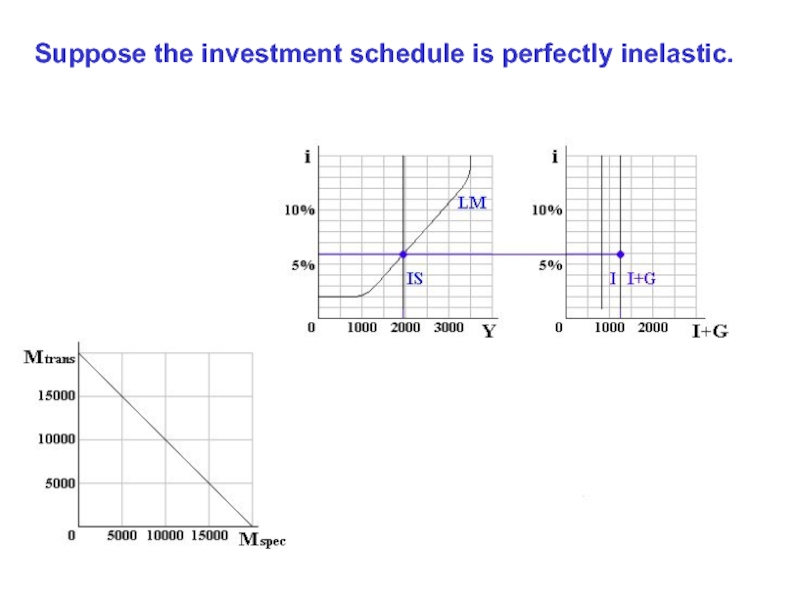

- 47. Suppose the investment schedule is perfectly inelastic.

- 48. Suppose the investment schedule is perfectly inelastic.

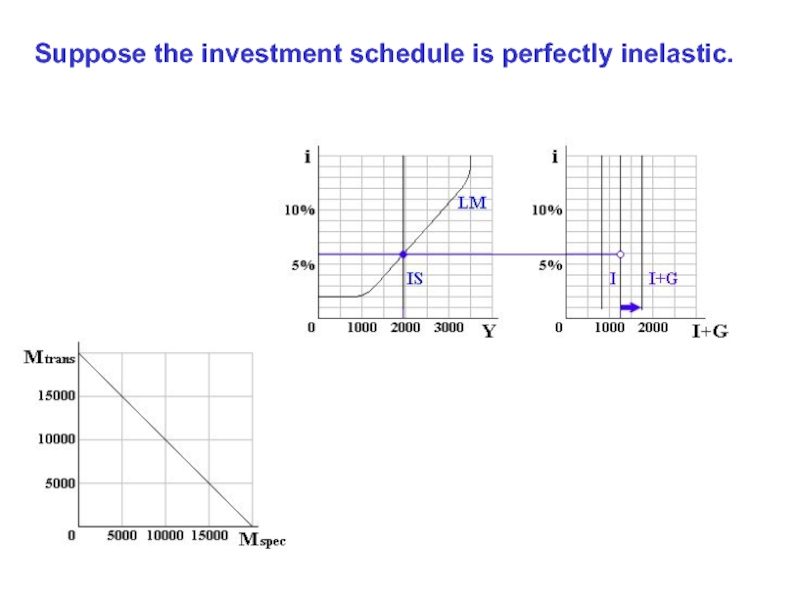

- 49. Suppose the investment schedule is perfectly inelastic.

- 50. Suppose the investment schedule is perfectly inelastic.

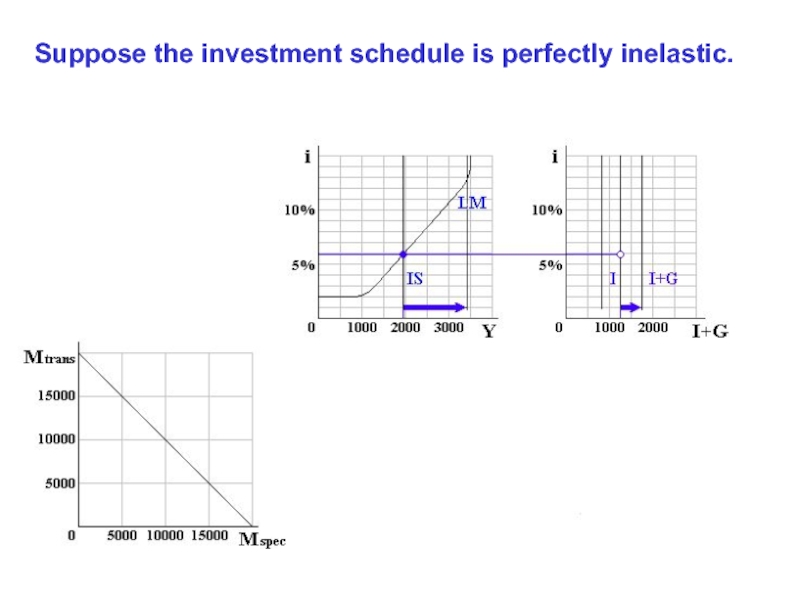

- 51. Suppose the investment schedule is perfectly inelastic.

- 52. Suppose the investment schedule is perfectly inelastic.

- 53. Suppose the investment schedule is perfectly inelastic.

- 54. Suppose the investment schedule is perfectly inelastic.

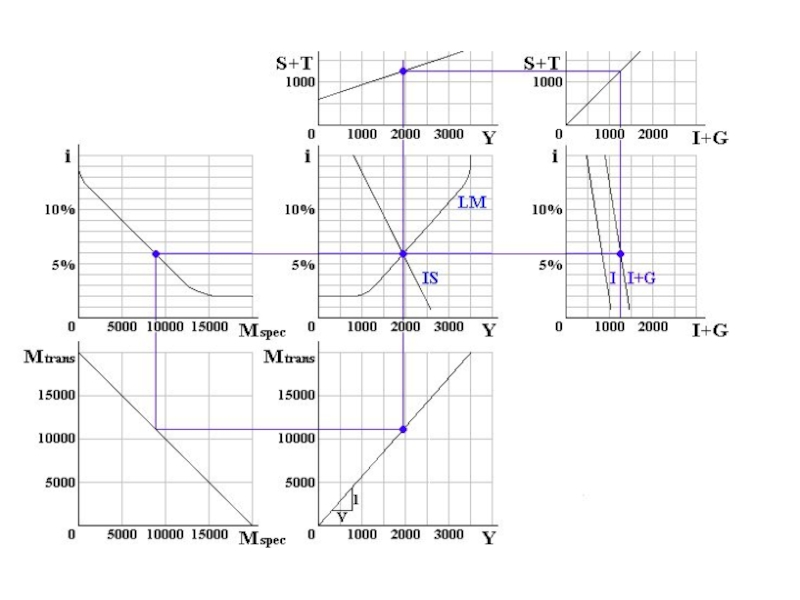

- 56. ISLM analysis builds upon the simple Keynesian

- 57. Examples of conditions or instances in which

- 58. Examples of conditions or instances in which

- 59. The question "Can I use the simple

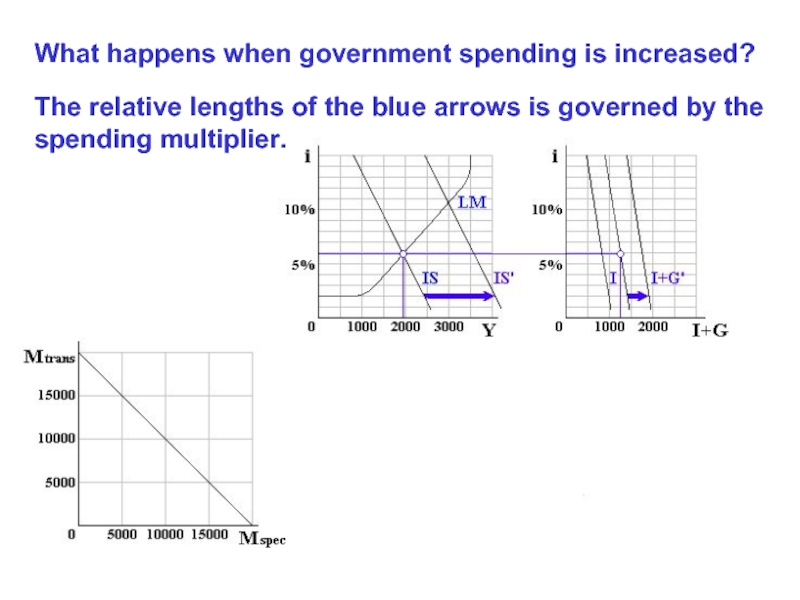

Слайд 5What happens when government spending is increased?

The relative lengths of the

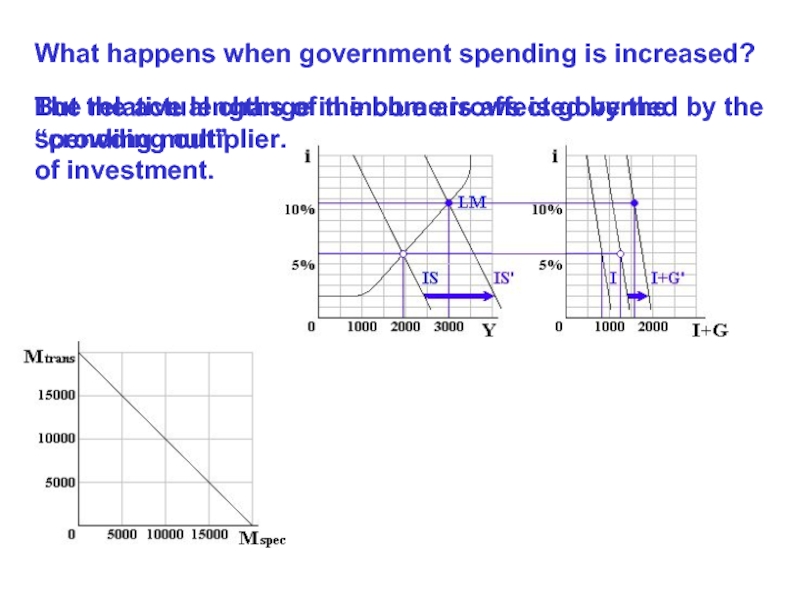

Слайд 6What happens when government spending is increased?

But the actual change in

The relative lengths of the blue arrows is governed by the spending multiplier.

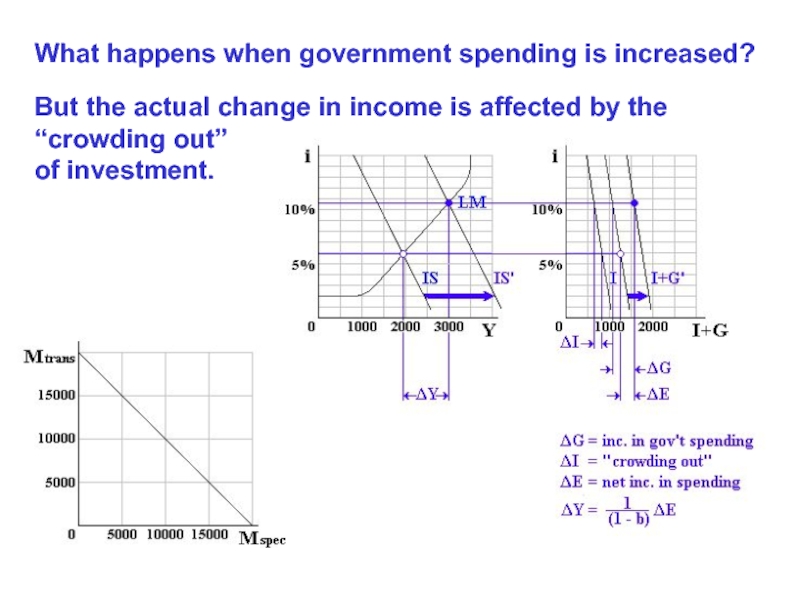

Слайд 7What happens when government spending is increased?

But the actual change in

Слайд 10The LM curve shifts rightward, lowering interest rates.

What happens when the

Слайд 11What happens when the money supply is increased?

The LM curve shifts

Слайд 12What happens when the money supply is increased?

The LM curve shifts

Note that the multiplier applies to the interest-induced change in investment.

Because of the inelasticity of investment demand, monetary policy is relatively ineffective.

Слайд 13What happens when an increase in government spending is “fully accommodated”

Слайд 14What happens when an increase in government spending is “fully accommodated”

Слайд 15What happens when an increase in government spending is “fully accommodated”

Both IS and LM shift rightward, leaving interest rates unchanged.

Слайд 16What happens when an increase in government spending is “fully accommodated”

Both IS and LM shift rightward, leaving interest rates unchanged.

Слайд 17What happens when an increase in government spending is “fully accommodated”

Both IS and LM shift rightward, leaving interest rates unchanged.

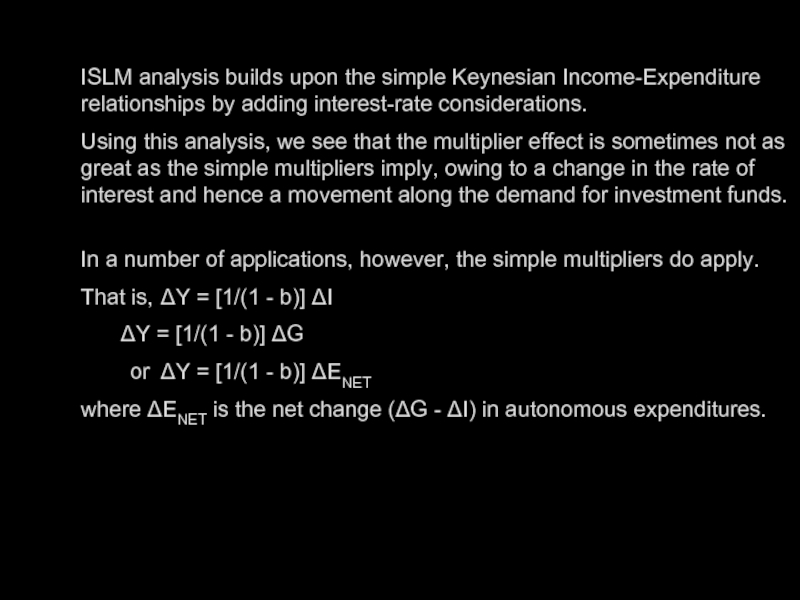

Слайд 56ISLM analysis builds upon the simple Keynesian Income-Expenditure relationships by adding

Using this analysis, we see that the multiplier effect is sometimes not as great as the simple multipliers imply, owing to a change in the rate of interest and hence a movement along the demand for investment funds.

In a number of applications, however, the simple multipliers do apply.

That is, ΔY = [1/(1 - b)] ΔI

ΔY = [1/(1 - b)] ΔG

or ΔY = [1/(1 - b)] ΔENET

where ΔENET is the net change (ΔG - ΔI) in autonomous expenditures.

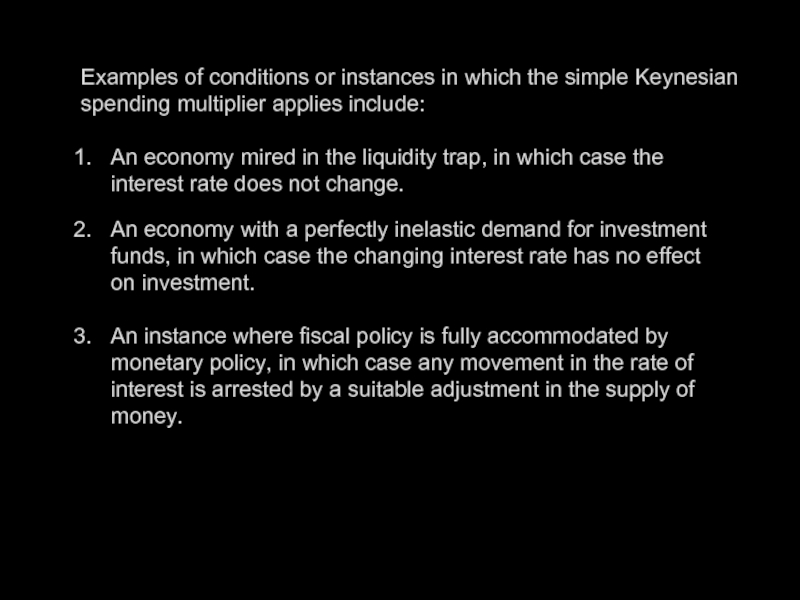

Слайд 57Examples of conditions or instances in which the simple Keynesian spending

An economy mired in the liquidity trap, in which case the interest rate does not change.

An economy with a perfectly inelastic demand for investment funds, in which case the changing interest rate has no effect on investment.

An instance where fiscal policy is fully accommodated by monetary policy, in which case any movement in the rate of interest is arrested by a suitable adjustment in the supply of money.

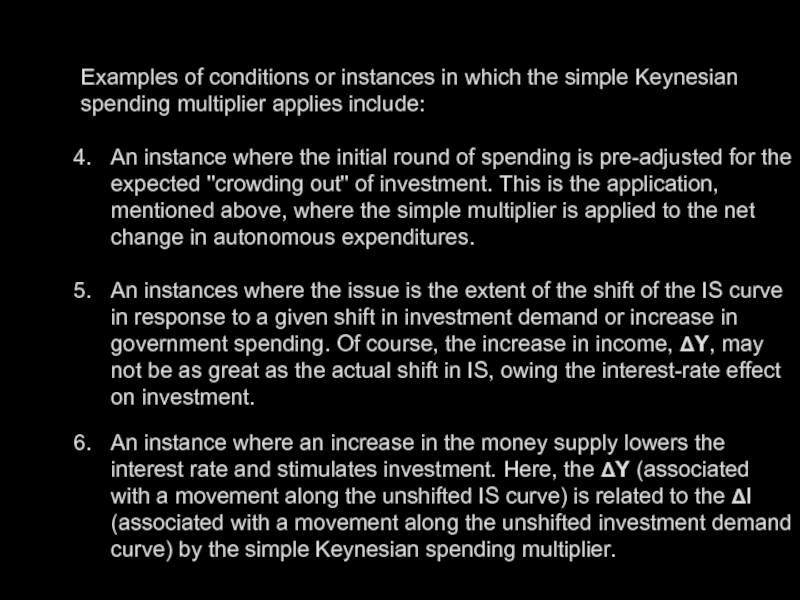

Слайд 58Examples of conditions or instances in which the simple Keynesian spending

An instance where the initial round of spending is pre-adjusted for the expected "crowding out" of investment. This is the application, mentioned above, where the simple multiplier is applied to the net change in autonomous expenditures.

An instances where the issue is the extent of the shift of the IS curve in response to a given shift in investment demand or increase in government spending. Of course, the increase in income, ΔY, may not be as great as the actual shift in IS, owing the interest-rate effect on investment.

An instance where an increase in the money supply lowers the interest rate and stimulates investment. Here, the ΔY (associated with a movement along the unshifted IS curve) is related to the ΔI (associated with a movement along the unshifted investment demand curve) by the simple Keynesian spending multiplier.

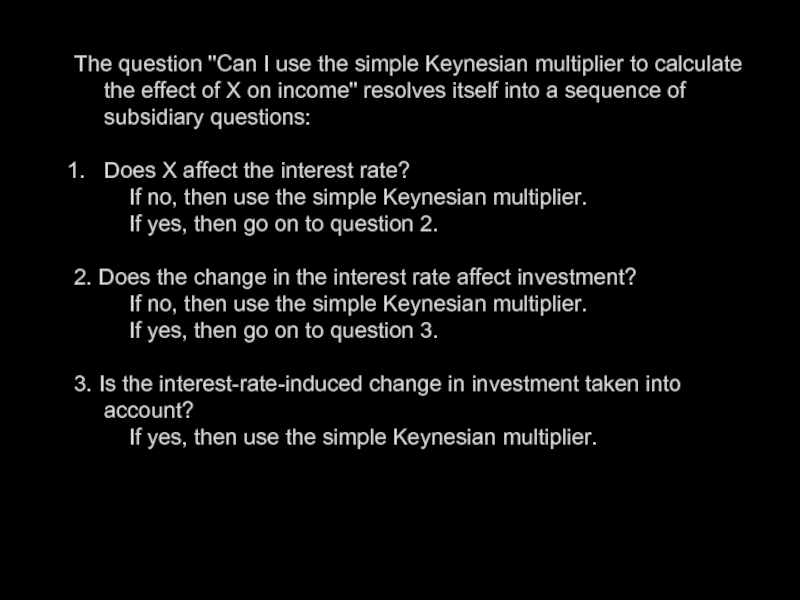

Слайд 59The question "Can I use the simple Keynesian multiplier to calculate

Does X affect the interest rate? If no, then use the simple Keynesian multiplier. If yes, then go on to question 2.

2. Does the change in the interest rate affect investment? If no, then use the simple Keynesian multiplier. If yes, then go on to question 3.

3. Is the interest-rate-induced change in investment taken into account? If yes, then use the simple Keynesian multiplier.