- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Introduction to Investments (Chapter 1) презентация

Содержание

- 1. Introduction to Investments (Chapter 1)

- 2. Meaning of Investments Commitment of money that

- 3. Why do individuals invest? To achieve a

- 4. Why Study Investments? The Personal Aspects To

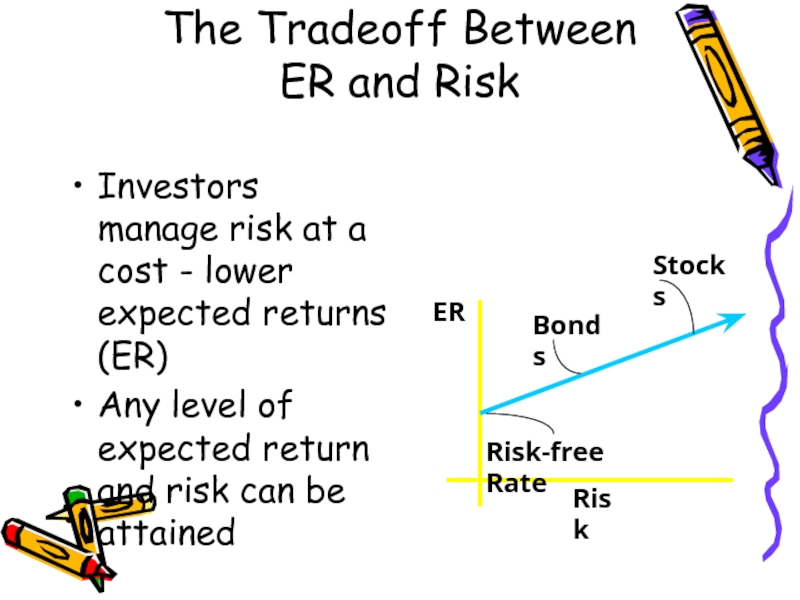

- 5. Underlying investment decisions: the tradeoff between expected

- 6. Investors manage risk at a cost -

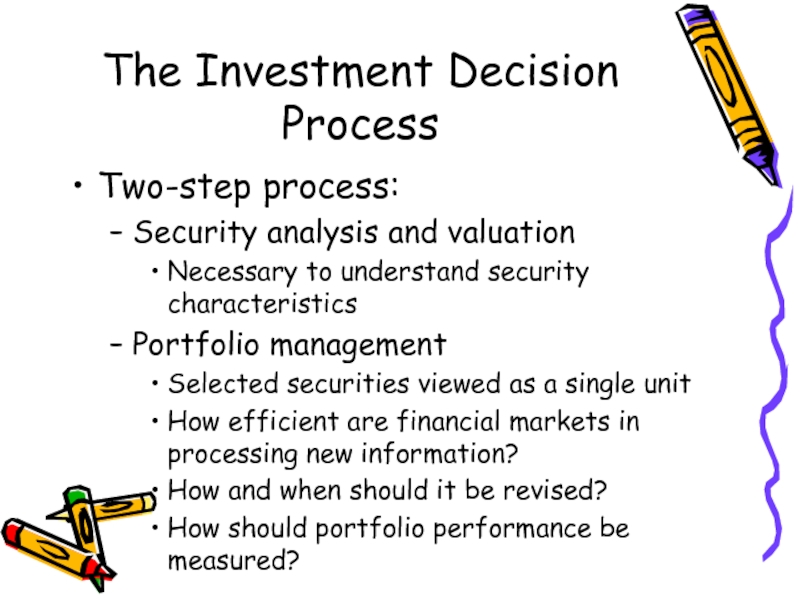

- 7. Two-step process: Security analysis and valuation Necessary

- 8. Uncertainty in ex post returns dominates decision

- 9. Sources of Risk Interest Rate Risk Purchasing

Слайд 2Meaning of Investments

Commitment of money that is expected to generate additional

Current commitment of dollars for a period of time to desire future payments that will compensate the investor for

The time the funds are committed

The expected rate of inflation, and

The uncertainty of the future payments

The investor can can be an individual, a government, and/or a corporation

Слайд 3Why do individuals invest?

To achieve a higher level of consumption in

To improve our welfare in the future

Investments help us achieve tradeoff between current consumption and future consumption

Basic element of all investment decisions: trade-off between expected return and risk

Слайд 4Why Study Investments?

The Personal Aspects

To earn better returns in relation to

Knowledge of investments help investors understand the relationship between risk and return

Investment as a Profession

To become a licensed broker (series 7 exam), to become CFA/CFP/CMA, knowledge of investments is needed

Слайд 5Underlying investment decisions: the tradeoff between expected return and risk

Expected return

Risk: the possibility that the realized return will be different than the expected return

Investment Decisions

Слайд 6Investors manage risk at a cost - lower expected returns (ER)

Any

Risk

ER

Risk-free Rate

Bonds

Stocks

The Tradeoff Between

ER and Risk

Слайд 7Two-step process:

Security analysis and valuation

Necessary to understand security characteristics

Portfolio management

Selected securities

How efficient are financial markets in processing new information?

How and when should it be revised?

How should portfolio performance be measured?

The Investment Decision Process

Слайд 8Uncertainty in ex post returns dominates decision process

Future unknown and must

Foreign financial assets: opportunity to enhance return or reduce risk

Quick adjustments needed to a changing environment

The Internet and investment opportunities

Institutional investors important

Factors Affecting the Process

Слайд 9Sources of Risk

Interest Rate Risk

Purchasing Power Risk

Bull-Bear Market Risk

Default Risk

Liquidity Risk

Callability

Convertibility Risk

Political Risk