- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

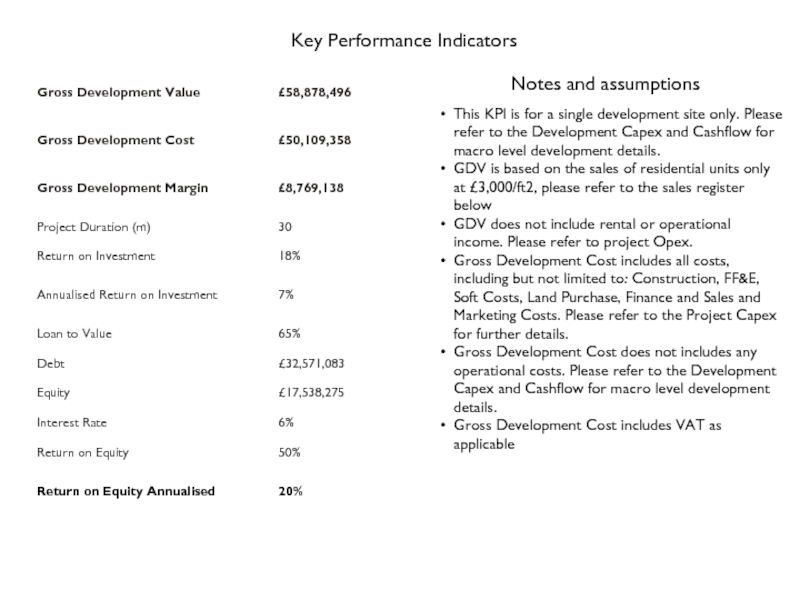

International business management презентация

Содержание

- 1. International business management

- 2. ECONOMIC RISK ANALYSIS Question : Is my

- 3. ECONOMIC RISK ANALYSIS (ERA) IMF uses quantitative

- 4. ERA EXAM QUESTION PART I: QUANTITATIVE DATA

- 5. FINDING THE DATA Most of the data

- 6. 1. GDP GROWTH Question: is the economy

- 7. GDP GROWTH AROUND THE WORLD As more

- 8. GDP GROWTH TARGETS Need to find a

- 9. GDP RISK AND RETURN FOR EMERGING ECONOMIES

- 10. GDP RISK AND RETURN FOR OTHER ECONOMIES

- 11. 2: INFLATION – % CONSUMER PRICES

- 12. INFLATION Question: Are prices under control? Answer:

- 13. INFLATION AND RISK/RETURN Most central banks are

- 14. 3. CURRENT ACCOUNT DEFICIT – CAD Developing

- 15. CURRENT ACCOUNT DEFICIT – CAD Question: how

- 16. CURRENT ACCOUNT DEFICIT – CAD For developing

- 17. DEVELOPED COUNTRY COMPARISON: USA

- 18. CRITICISM OF THE IMF QUANTITATIVE APPROACH Many

- 19. ERA EXAM QUESTION PART II: FDI

- 20. FACTORS INFLUENCING FDI The economic factors

- 21. GREENWICH MNEMONIC - GLIFTS GLIFTS is

- 22. USING GLIFTS G – GDP per capita

- 23. OTHER INTERESTING DATA… An entrepreneur will browse

- 24. SEMINAR TASK Come prepared with your

- 25. SOURCES World Bank IMF (for CAD/GDP)

Слайд 1

INTERNATIONAL BUSINESS MANAGEMENT

Economic Risk – Economic Risk for Developing and Emerging

Dr Michael Wynn-Williams wm82@gre.ac.uk

Слайд 2ECONOMIC RISK ANALYSIS

Question : Is my money safe in that country?

Answer

Some factors to consider :

Exchange rates

Growth of domestic credit

bank rates

prices, WPI and CPI

industrial production

unemployment

trade , exports imports invisibles, CAD

government consumption

GDP, current and constant prices

population

Слайд 3ECONOMIC RISK ANALYSIS (ERA)

IMF uses quantitative analysis for evaluating economies

Economic risk

Guidelines devised at Greenwich evaluate the security of doing business in the country

Developing and emerging countries tend to trade in a narrow range of products and depend on cash flow

The three main measures of a country’s financial standing:

GDP – how much is it producing?

Inflation – how well controlled?

Current Account – are the imports affordable?

The first part of compulsory Exam Question 1 uses simple IMF-style quantitative formulas to measure economic performance against a standard

The second part of the question identifies and evaluates the main economic factors in order to make a qualitative investment decision in the country

Слайд 4ERA EXAM QUESTION PART I: QUANTITATIVE DATA

The first part of the

The guidelines devised at the University of Greenwich are useful in evaluating emerging economies

Слайд 5FINDING THE DATA

Most of the data is available from the World

The data is for all countries, not just developing economy clients of The Bank

One piece of data, for the current account/GDP, comes from the IMF World Economic Outlook (WEO)

In the exam the data will comprise the World Bank figures + CAD/GDP

The data sheet will be a Word file

Слайд 61. GDP GROWTH

Question: is the economy growing at a sustainable rate?

Answer:

Gross domestic product (GDP) measures everything produced in the country regardless of nationality

Real (constant prices) GDP increases show genuine growth in the economy

Positive, steady growth is always good but the gains may be unevenly distributed

Undesirable GDP conditions:

High growth – rising wages, inflation, imports and interest rates

Low growth – poor exploitation of resources, poor competitiveness, low wealth creation

Recession – wealth destruction, hysteresis effects

Слайд 7GDP GROWTH AROUND THE WORLD

As more resources are brought into use

Слайд 8GDP GROWTH TARGETS

Need to find a balance between a booming economy

An overheating economy with high inflation is usually treated with high interest rates

A recessionary economy with low inflation is usually treated with low interest rates

Stagflation (low growth, high inflation) is a challenging paradox!

Sustainable GDP growth target depends on the economy

Developed – slow and steady at 2.0-3.0%

Emerging – relatively high rate 6.0-10%

Developing – relatively very high growth 7.0-11.0%

Rate of return should match the risk

Слайд 9GDP RISK AND RETURN FOR EMERGING ECONOMIES

Sustainable high rates of growth

Слайд 12INFLATION

Question: Are prices under control?

Answer: compare the inflation with the 2.0%

Various measures of inflation (RPI, CPI). World Bank use GDP deflator accounting for the nominal change in GDP i.e. reveals real GDP change

The GDP deflator is inflation for all output, not a basket of goods

High inflation

High inflation means constant adjustment to prices

Usually necessitates high interest rates.

Debt values are eroded over time

Low inflation/Deflation

Low inflation is too narrow a target, can slip into deflation

Deflation may require negative interest rates – tricky!

Some consumers may wait for further price reductions

Debts values increase over time

Слайд 13INFLATION AND RISK/RETURN

Most central banks are targeting 2.0% CPI inflation

Some central

On balance, 0.0-2.0% inflation is probably considered low risk

World Bank data shows inflation as GDP deflator

Слайд 143. CURRENT ACCOUNT DEFICIT – CAD

Developing countries are often dominated by

It can become highly volatile as trade fluctuates

Слайд 15CURRENT ACCOUNT DEFICIT – CAD

Question: how great is the short-term trade

Answer: compare the current account deficit (CAD) and the gross domestic product (GDP)

CAD itself is not a worry:

It is funded from the capital account

It may be small compared to the total assets and liabilities

It may be a sign of strong domestic growth

The capital account could be showing good foreign investment

CAD/GDP percentage

It should be relatively stable over the years

It should be greater than -2% (i.e. -2.1% is high risk, -1.9% is low risk)

Слайд 16CURRENT ACCOUNT DEFICIT – CAD

For developing economies CAD can be a

Fall in investment means imports cannot be afforded

A fall in exports creates a higher dependency on foreign funds

A high surplus can also be cause for concern

Economic growth is dependent on demand in other countries

Domestic consumers have less access to desirable imports

The government needs to counter pressure on the currency to rise in value

Risk Values

Слайд 17DEVELOPED COUNTRY COMPARISON: USA

Our analysis shows that GDP growth and inflation

However, CAD/GDP is over the line, meaning it is high risk. Indeed, it is never expected to be within guidelines!

Is it realistic to say the USA is “high risk” compared to emerging economies?

Слайд 18CRITICISM OF THE IMF QUANTITATIVE APPROACH

Many feel that the IMF style

Criticisms:

It is a creature of the US and Europe

It has a neo-liberal agenda for low government spending, privatisation and debt repayment

It treats all countries the same

IMF’s defence

It is invited by the host government

It is the last resort – everything else has failed

The worse the taste the better the medicine

Слайд 19ERA EXAM QUESTION PART II:

FDI INVESTMENT DECISION

The second half of

The decision of which sector of the economy to invest in can only be based on the information in the datasheet.

There are three sectors to choose from:

Agriculture

Industry

Services

The FDI decision should identify and analyse the most appropriate economic factors

Слайд 20FACTORS INFLUENCING FDI

The economic factors that are appropriate to the FDI

FDI entrepreneurs need to analyse trends in the data to uncover any new opportunities

It is also important to identify specific data that indicates new opportunities

To help you remember the most important factors, we have a Greenwich mnemonic:

GLIFTS

Слайд 21GREENWICH MNEMONIC - GLIFTS

GLIFTS is only there to help you remember

It will point you towards the most basic information, but you can use any factor you think is important

GLIFTS will give you up to 6 economic factors – at least 5 are needed for the exam

Слайд 22USING GLIFTS

G – GDP per capita growth rate (the trend). May

L - Life expectancy. Gives you an idea of the general well being of the population and the degree to which the government is looking after everyone

I – Inflation (GDP deflator): is the trend steady or out of control? Indicates the economic competency of the government

F – FDI, measure of how well the country is attracting foreign investors, particularly the trend

T – Technology

S – School

Слайд 23OTHER INTERESTING DATA…

An entrepreneur will browse data looking for items of

This is when your creativity reaches its peak!

Some data that might catch your eye and deserve further consideration:

Poverty Headcount

Malnutrition

Immunisation

Boy/girl ratio in education

Water access

Agriculture, industry, services added value

Gross capital formation

Time to start a business

Net migration

Total debt service

Слайд 24SEMINAR TASK

Come prepared with your calculators.

We will be doing two sets

Working out the ERA for an emerging country – data sheets available in the tutorial folder

Considering the country as a candidate for investment

Слайд 25SOURCES

World Bank

IMF (for CAD/GDP) – latest World Economic Outlook report

Australia CAD/GDP

US Debt Service – Creditflowinvestor.com

IMF paper on MRR – Boorman, J. and S. Ingves (2001), Issues in Reserves Adequacy and Management

Bank of England current account information sheet

IMF guide to financial terminology

UN debt service ratio definition