- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Economics exam презентация

Содержание

- 1. Economics exam

- 2. Today’s Outline We’ll review the exam from Friday

- 3. Which of the following reasons can explain

- 4. A rise in the central bank refinance

- 5. In the IS-LM model, a decrease in

- 6. Suppose the demand for money is given

- 7. In the IS-LM model: a simultaneous increase

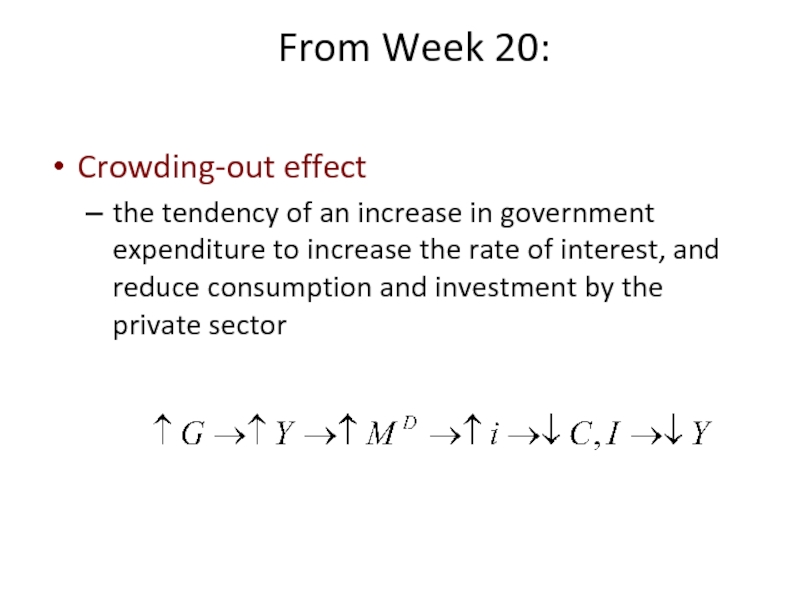

- 8. The “Crowding Out” effect following a rise

- 9. Crowding-out effect the tendency of an increase

- 10. In a liquidity trap: Monetary policy is

- 11. Note from Roy on Q7: Recall that

- 12. The IS curve depicts: A positive relationship

- 13. Week 19: The IS Curve IS Curve

- 14. If the demand for money becomes less

- 15. From Week 20: The strength of the

- 16. Assume consumption expenditures=2500, investment=2500, government purchases=1000, net

- 17. For an economy with a consumption function

- 18. For an economy characterized by: C=1800+0.6(Y-T), I=900,

- 19. A central bank can _____________ in order

- 20. A fall in the interest rate,

- 21. A rise in real income, increases

- 22. A Keynesian ‘fixed price’ macroeconomic model assumes:

- 23. Sir John Hicks Alvin Hansen

- 24. To derive aggregate demand from ISLM, it

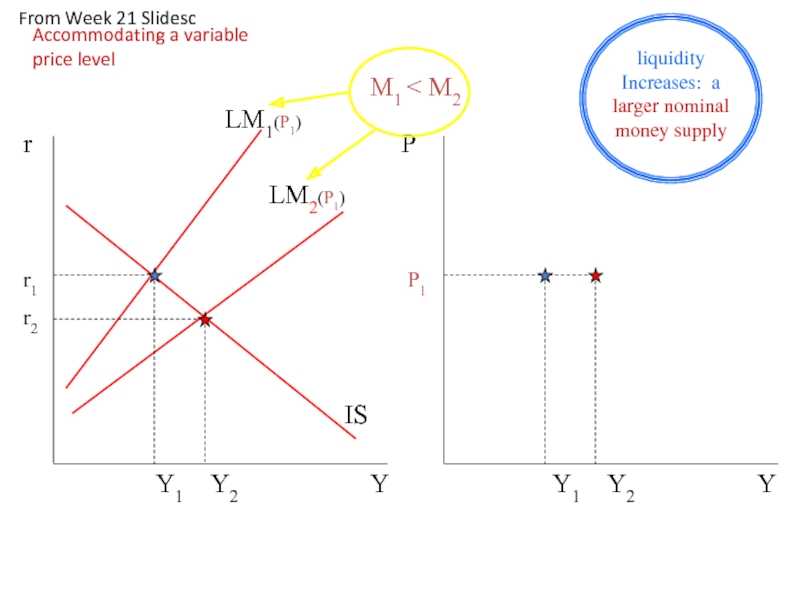

- 25. Y r LM1(P1) LM2(P1) Y P1

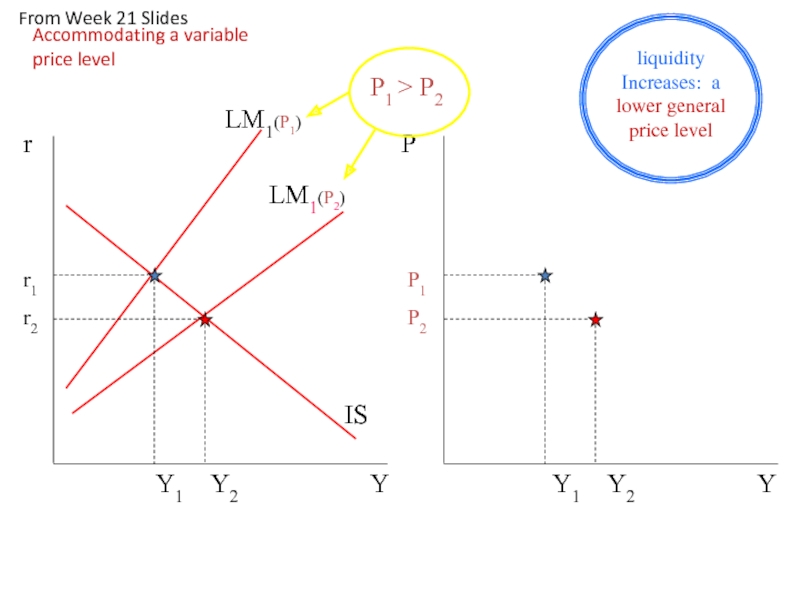

- 26. Y r LM1(P2) Y P1

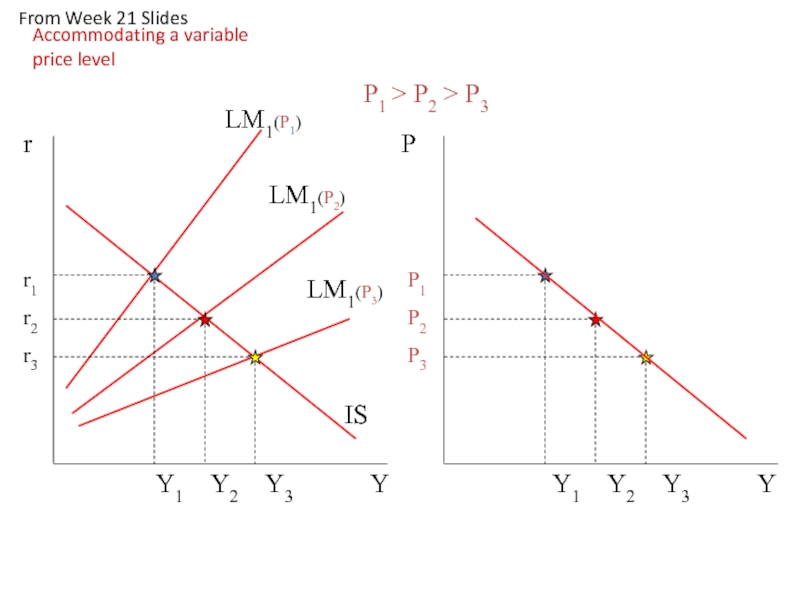

- 27. Y r LM1(P2) LM1(P3) Y P1

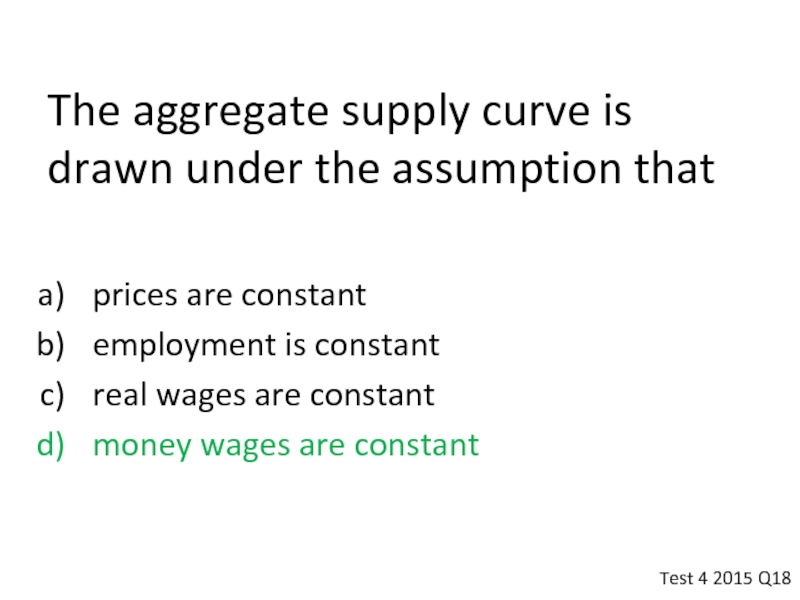

- 28. The aggregate supply curve is drawn under

- 29. The exogenous force that drives the original

- 31. Note bene: statistical correlations

- 33. The exogenous force that drives the price-expectations

- 35. Note bene: statistical correlations

- 37. Keynesian cost-push inflation occurs when trade unions

- 39. Monetarism vs Keynesianism Keynes, J.M.

- 40. Classical demand-pull inflation occurs when trade unions

- 41. Monetarism vs Keynesianism Keynes, J.M.

- 43. Monetarism argues for a stable relationship between

- 44. Within the UK account of international payments,

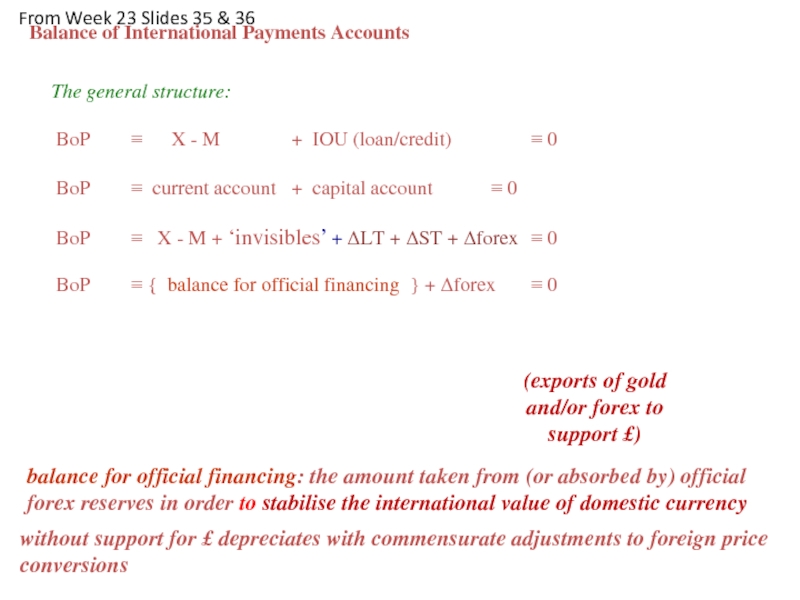

- 45. The general

- 46. With increased saving and a fall in

- 47. Last Class! Good luck on the Final Exam. Have a great summer.

Слайд 1ECON 102 Tutorial: Week 25

Shane Murphy

www.lancaster.ac.uk/postgrad/murphys4/econ15

s.murphy5@lancaster.ac.uk

Слайд 3Which of the following reasons can explain why people have preferences

It yields a high rate of return.

It yields a low rate of return.

It facilitates transaction activities and provides liquidity services.

none of the above.

Test 4 2015 Q1

Слайд 4A rise in the central bank refinance rate will:

Increase the money

Reduce the money supply.

Increase the cost of lending,

Statements (b) and (c) are correct.

Test 4 2015 Q2

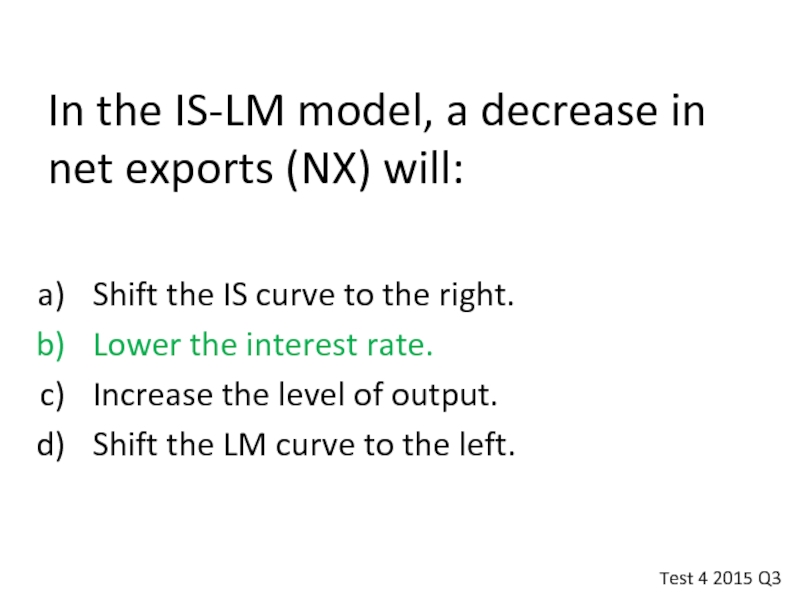

Слайд 5In the IS-LM model, a decrease in net exports (NX) will:

Shift the IS curve to the right.

Lower the interest rate.

Increase the level of output.

Shift the LM curve to the left.

Test 4 2015 Q3

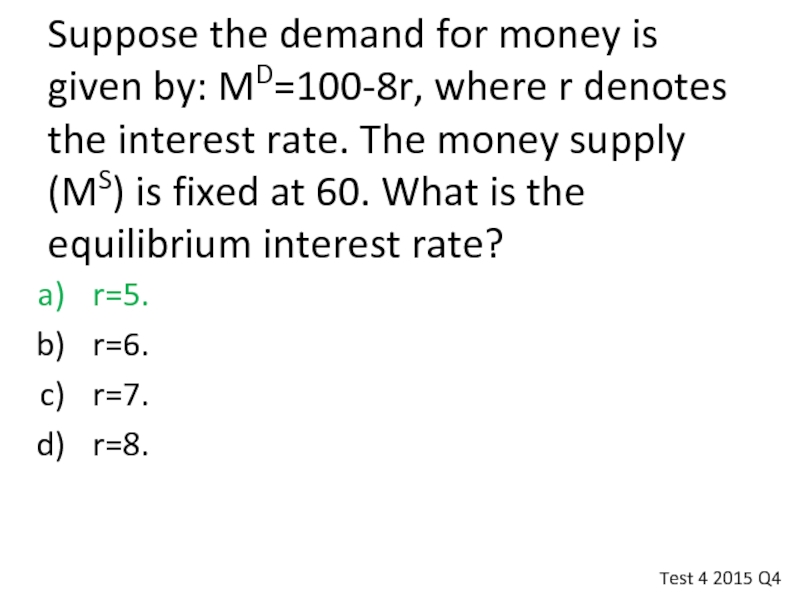

Слайд 6Suppose the demand for money is given by: MD=100-8r, where r

r=5.

r=6.

r=7.

r=8.

Test 4 2015 Q4

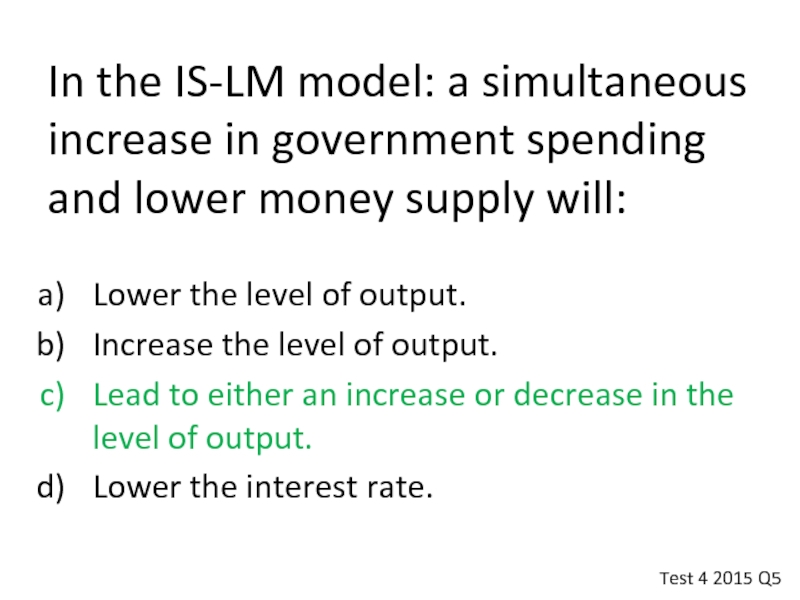

Слайд 7In the IS-LM model: a simultaneous increase in government spending and

Lower the level of output.

Increase the level of output.

Lead to either an increase or decrease in the level of output.

Lower the interest rate.

Test 4 2015 Q5

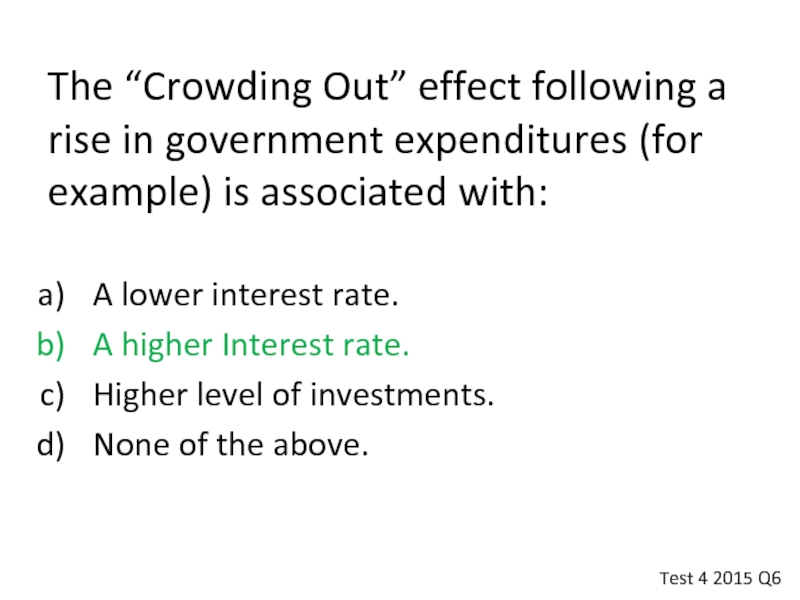

Слайд 8The “Crowding Out” effect following a rise in government expenditures (for

A lower interest rate.

A higher Interest rate.

Higher level of investments.

None of the above.

Test 4 2015 Q6

Слайд 9Crowding-out effect

the tendency of an increase in government expenditure to increase

Crowding Out

From Week 20:

Слайд 10In a liquidity trap:

Monetary policy is effective in stabilizing the economy.

Fiscal

Money demand is inelastic with respect to interest rate changes.

Statements (b) and (c) are correct.

Test 4 2015 Q7

Слайд 11Note from Roy on Q7:

Recall that the LM curve in the

As explained in class, fiscal policy or positive changes to the IS curve (such as government spending (G)) can help boost the economy and allow it to escape the liquidity trap.

Notes on the other option choices:

Solution (a) is incorrect as monetary policy, or changes in the money supply, are ineffective in stabilizing the economy, hence the term a “liquidity trap”. LM curve is completely horizontal.

Solution (c) and therefore (d) are incorrect because money demand is perfectly elastic with respect to interest rate changes.

Many indeed answered (d) but (c) is incorrect in case of a liquidity trap.

Слайд 12The IS curve depicts:

A positive relationship between output and prices

A negative

A positive relationship between output and interest rates.

A negative relationship between money demand and interest rates.

Test 4 2015 Q8

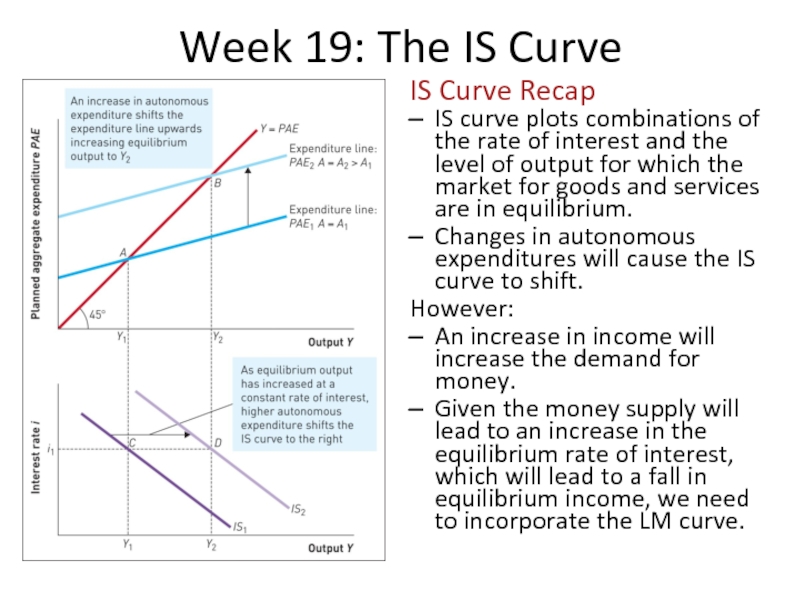

Слайд 13Week 19: The IS Curve

IS Curve Recap

IS curve plots combinations of

Changes in autonomous expenditures will cause the IS curve to shift.

However:

An increase in income will increase the demand for money.

Given the money supply will lead to an increase in the equilibrium rate of interest, which will lead to a fall in equilibrium income, we need to incorporate the LM curve.

Слайд 14If the demand for money becomes less responsive to changes in

The LM curve becomes flatter.

The IS curve becomes flatter.

The LM curve becomes steeper.

The IS curve becomes steeper.

Test 4 2015 Q9

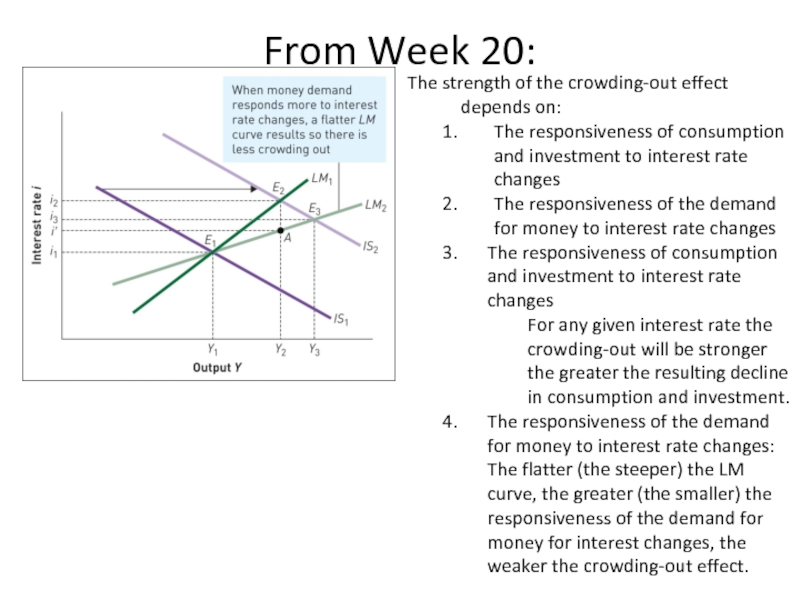

Слайд 15From Week 20:

The strength of the crowding-out effect depends on:

The responsiveness

The responsiveness of the demand for money to interest rate changes

The responsiveness of consumption and investment to interest rate changes

For any given interest rate the crowding-out will be stronger the greater the resulting decline in consumption and investment.

The responsiveness of the demand for money to interest rate changes: The flatter (the steeper) the LM curve, the greater (the smaller) the responsiveness of the demand for money for interest changes, the weaker the crowding-out effect.

Слайд 16Assume consumption expenditures=2500, investment=2500, government purchases=1000, net exports=0. What is the

Y=6000, S=2500.

Y=6000, S=2000.

Y=5000, S=1000.

none of the above.

Test 4 2015 Q10

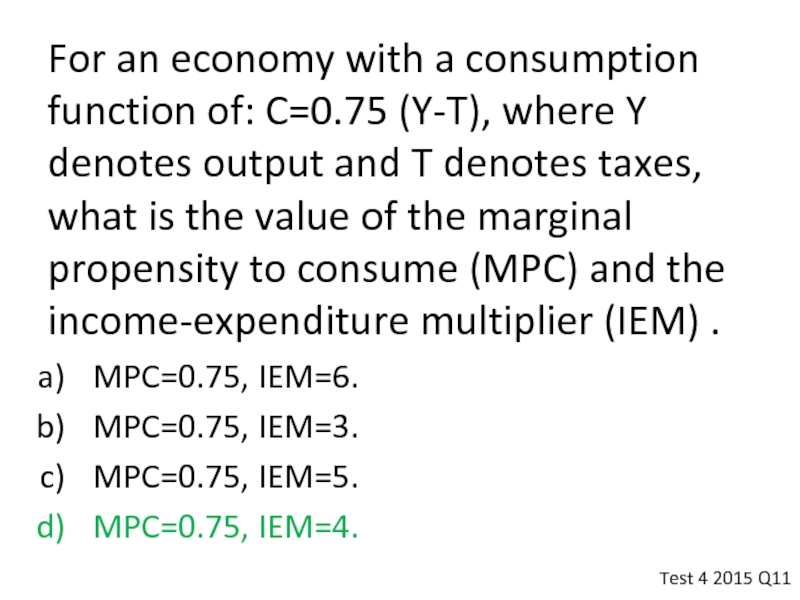

Слайд 17For an economy with a consumption function of: C=0.75 (Y-T), where

MPC=0.75, IEM=6.

MPC=0.75, IEM=3.

MPC=0.75, IEM=5.

MPC=0.75, IEM=4.

Test 4 2015 Q11

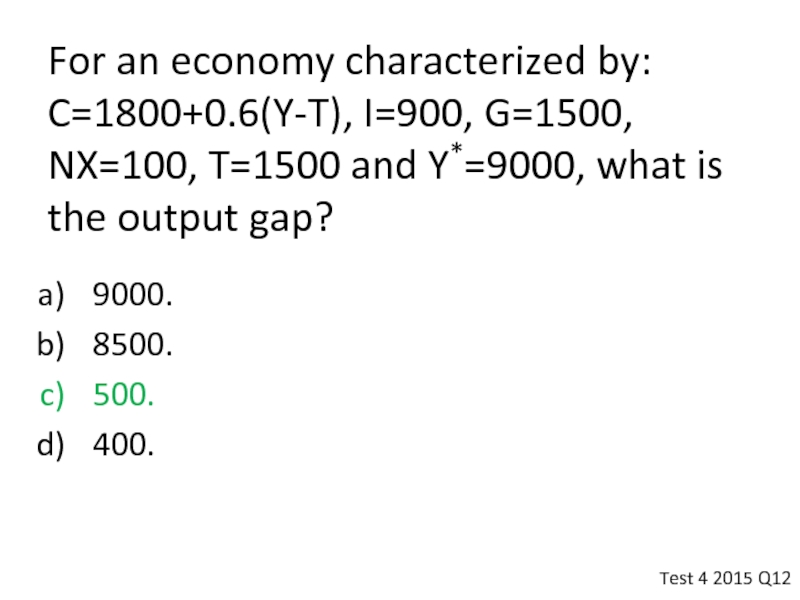

Слайд 18For an economy characterized by: C=1800+0.6(Y-T), I=900, G=1500, NX=100, T=1500 and

9000.

8500.

500.

400.

Test 4 2015 Q12

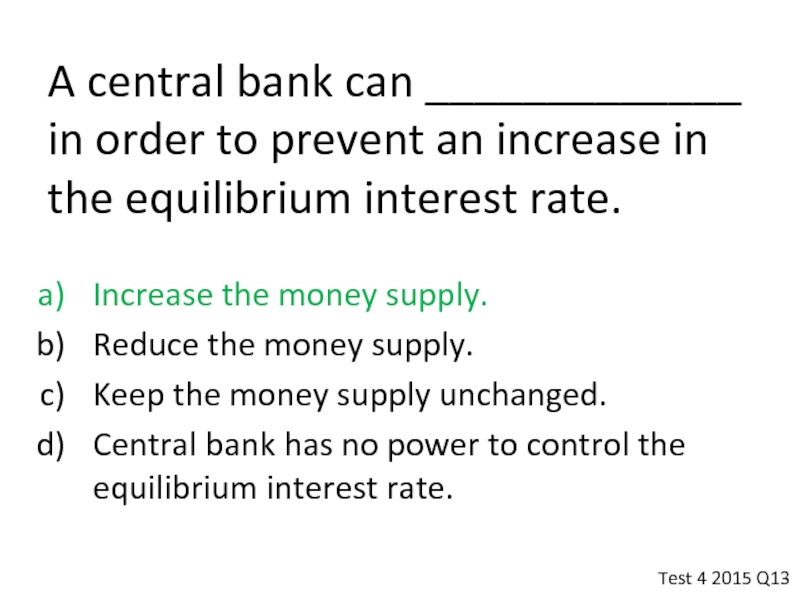

Слайд 19A central bank can _____________ in order to prevent an increase

Increase the money supply.

Reduce the money supply.

Keep the money supply unchanged.

Central bank has no power to control the equilibrium interest rate.

Test 4 2015 Q13

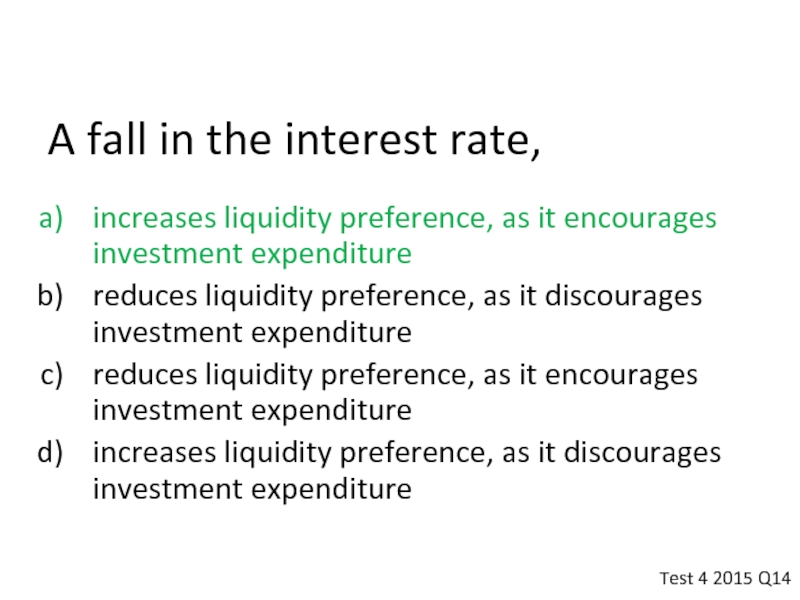

Слайд 20A fall in the interest rate,

increases liquidity preference, as it

reduces liquidity preference, as it discourages investment expenditure

reduces liquidity preference, as it encourages investment expenditure

increases liquidity preference, as it discourages investment expenditure

Test 4 2015 Q14

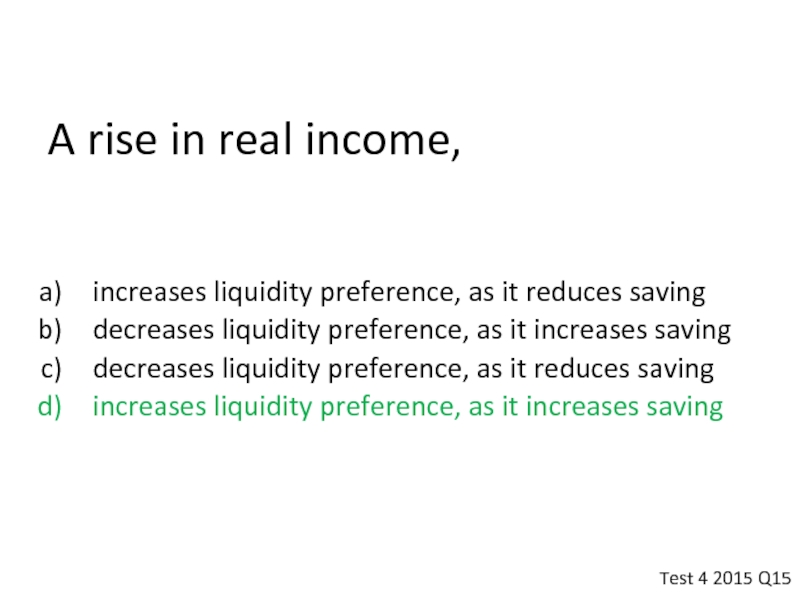

Слайд 21A rise in real income,

increases liquidity preference, as it reduces

decreases liquidity preference, as it increases saving

decreases liquidity preference, as it reduces saving

increases liquidity preference, as it increases saving

Test 4 2015 Q15

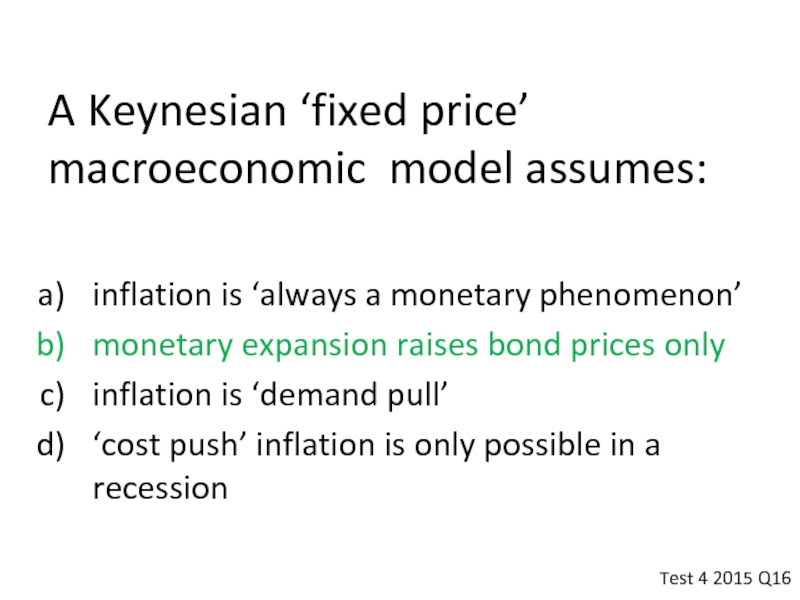

Слайд 22A Keynesian ‘fixed price’ macroeconomic model assumes:

inflation is ‘always a

monetary expansion raises bond prices only

inflation is ‘demand pull’

‘cost push’ inflation is only possible in a recession

Test 4 2015 Q16

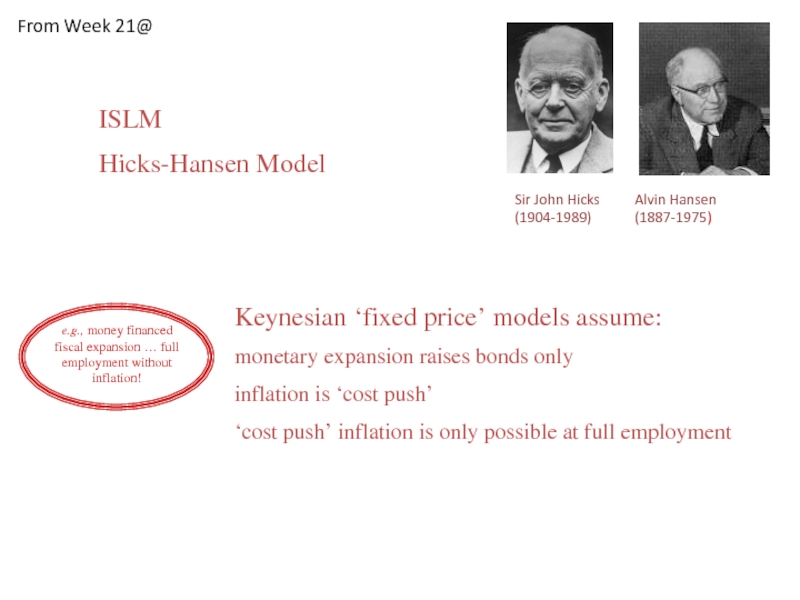

Слайд 23

Sir John Hicks Alvin Hansen

(1904-1989) (1887-1975)

e.g., money financed

fiscal expansion

ISLM

Hicks-Hansen Model

Keynesian ‘fixed price’ models assume:

monetary expansion raises bonds only

inflation is ‘cost push’

‘cost push’ inflation is only possible at full employment

From Week 21@

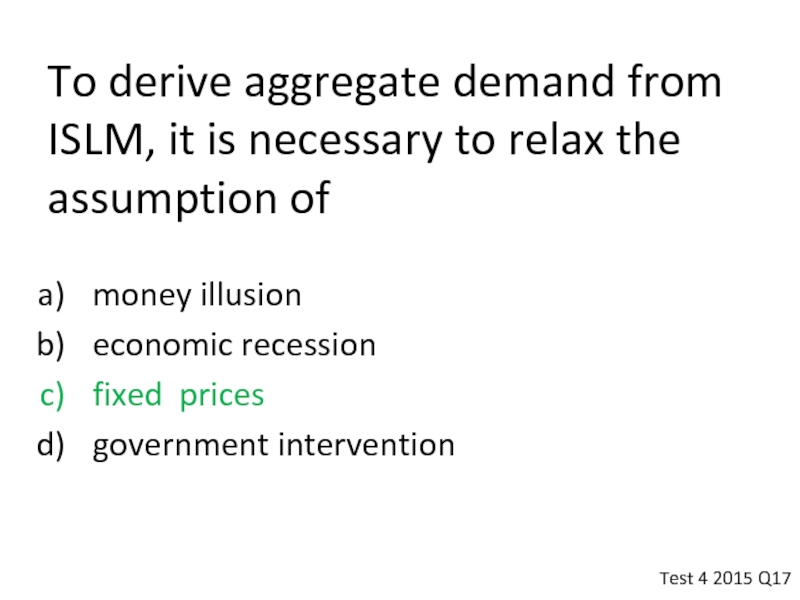

Слайд 24To derive aggregate demand from ISLM, it is necessary to relax

money illusion

economic recession

fixed prices

government intervention

Test 4 2015 Q17

Слайд 25

Y

r

LM1(P1)

LM2(P1)

Y

P1

Y1 Y2

Y1 Y2

r1

r2

IS

P

M1 < M2

liquidity

Increases: a

larger nominal money supply

Accommodating a variable price level

From Week 21 Slidesc

Слайд 26

Y

r

LM1(P2)

Y

P1

P2

Y1 Y2

Y1 Y2

r1

r2

IS

P

LM1(P1)

P1 > P2

liquidity

Increases: a

lower general

price level

Accommodating a variable price level

From Week 21 Slides

Слайд 27

Y

r

LM1(P2)

LM1(P3)

Y

P1 > P2 > P3

P1

P2

P3

Y1 Y2

Y1 Y2 Y3

r1

r2

r3

IS

P

LM1(P1)

Accommodating a variable price level

From Week 21 Slides

Слайд 28The aggregate supply curve is drawn under the assumption that

prices

employment is constant

real wages are constant

money wages are constant

Test 4 2015 Q18

Слайд 29The exogenous force that drives the original Phillips curve is

the business

monetary policy

trade unions

inflation

Test 4 2015 Q19

Слайд 30

Job search and the

‘In Phillips’ original treatment, variations in unemployment lead to variations in the rate of inflation. In Friedman’s view such a relationship is not only transient; the direction of causation flows the other way. In his analysis, unanticipated variations in the rate of inflation cause fluctuations in the level of unemployment (in the short run).

Burton, J., 1982, ‘The Varieties of Monetarism and their Policy Implications’, The Three Banks Review, pp. 13-31

From Week 22 Slides

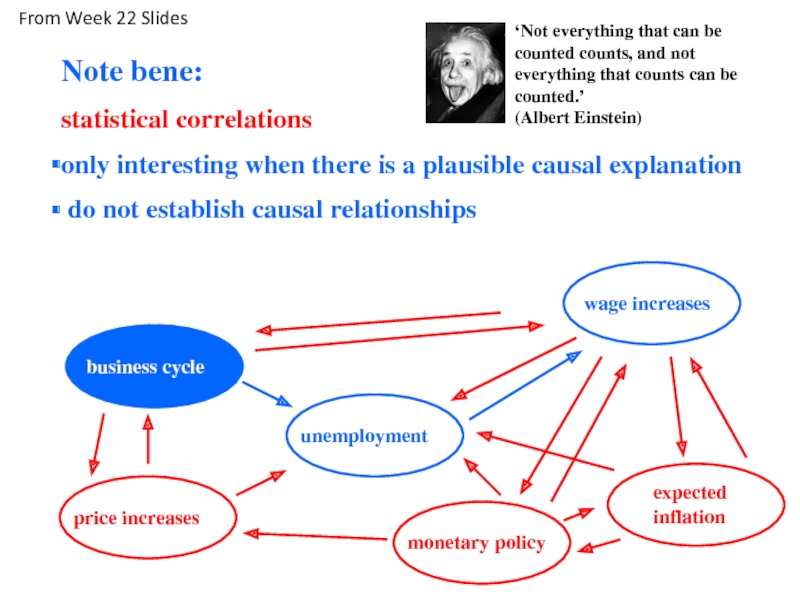

Слайд 31

Note bene:

statistical correlations

only interesting when there is a plausible

do not establish causal relationships

‘Not everything that can be counted counts, and not everything that counts can be counted.’

(Albert Einstein)

unemployment

wage increases

business cycle

monetary policy

price increases

expected inflation

From Week 22 Slides

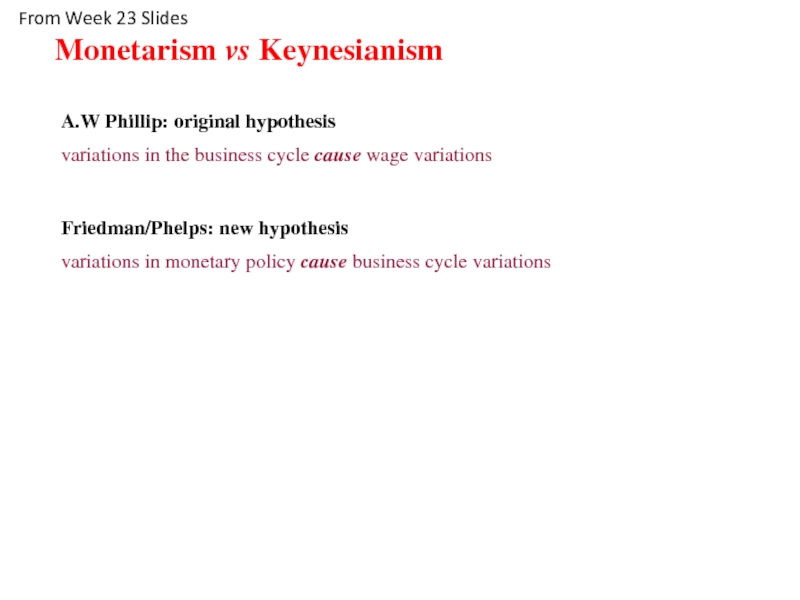

Слайд 32

A.W Phillip: original hypothesis

variations

Friedman/Phelps: new hypothesis

variations in monetary policy cause business cycle variations

Monetarism vs Keynesianism

From Week 23 Slides

Слайд 33The exogenous force that drives the price-expectations augmented Phillips curve is

the

monetary policy

trade unions

inflation

Test 4 2015 Q20

Слайд 34

Job search and the

‘In Phillips’ original treatment, variations in unemployment lead to variations in the rate of inflation. In Friedman’s view such a relationship is not only transient; the direction of causation flows the other way. In his analysis, unanticipated variations in the rate of inflation cause fluctuations in the level of unemployment (in the short run).

Burton, J., 1982, ‘The Varieties of Monetarism and their Policy Implications’, The Three Banks Review, pp. 13-31

From Week 22 Slides

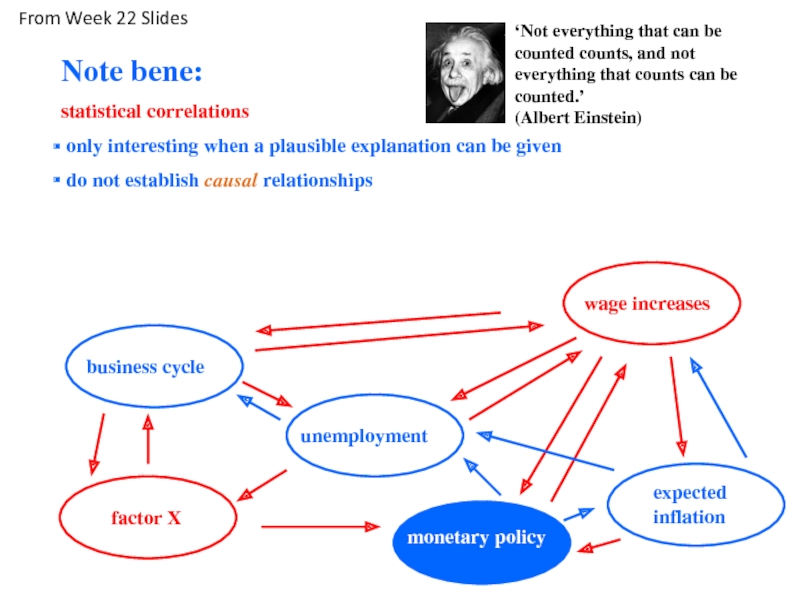

Слайд 35

Note bene:

statistical correlations

only interesting when a plausible explanation

do not establish causal relationships

unemployment

wage increases

business cycle

monetary policy

factor X

‘Not everything that can be counted counts, and not everything that counts can be counted.’

(Albert Einstein)

expected inflation

From Week 22 Slides

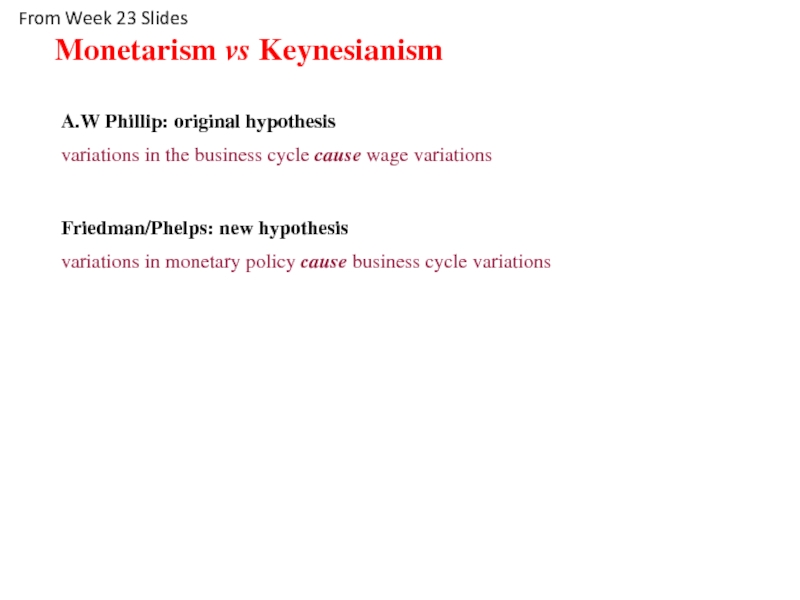

Слайд 36

A.W Phillip: original hypothesis

variations

Friedman/Phelps: new hypothesis

variations in monetary policy cause business cycle variations

Monetarism vs Keynesianism

From Week 23 Slides

Слайд 37Keynesian cost-push inflation occurs

when trade unions go on strike

when money supply

as full employment is approached

with a deficit in the trade balance

Test 4 2015 Q21

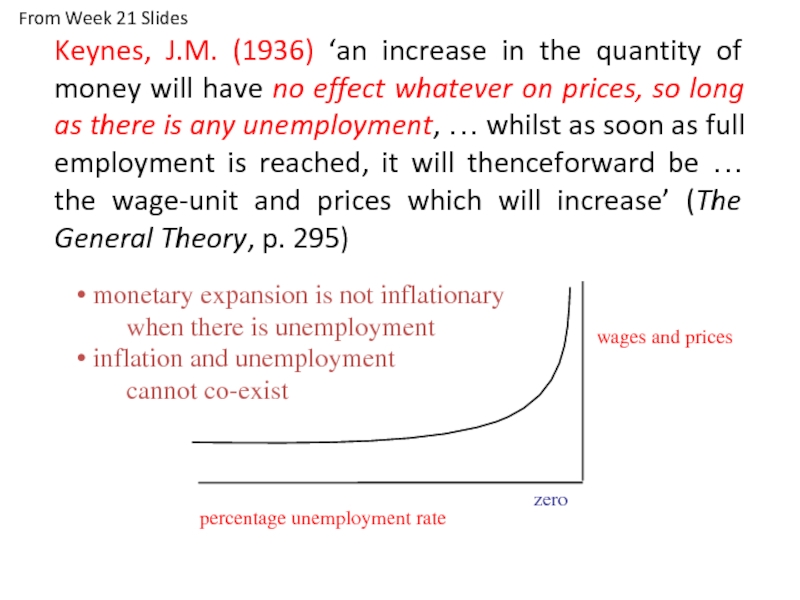

Слайд 38

Keynes, J.M. (1936) ‘an

wages and prices

percentage unemployment rate

zero

monetary expansion is not inflationary

when there is unemployment

inflation and unemployment

cannot co-exist

From Week 21 Slides

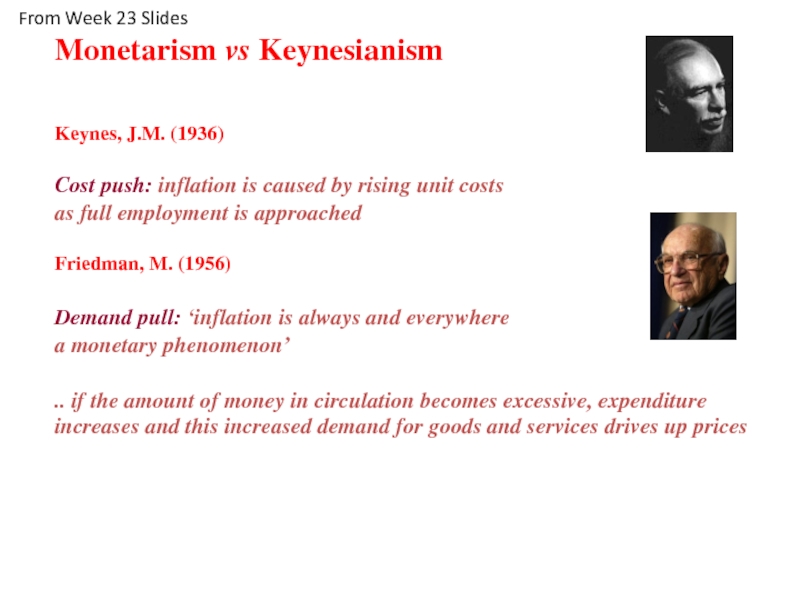

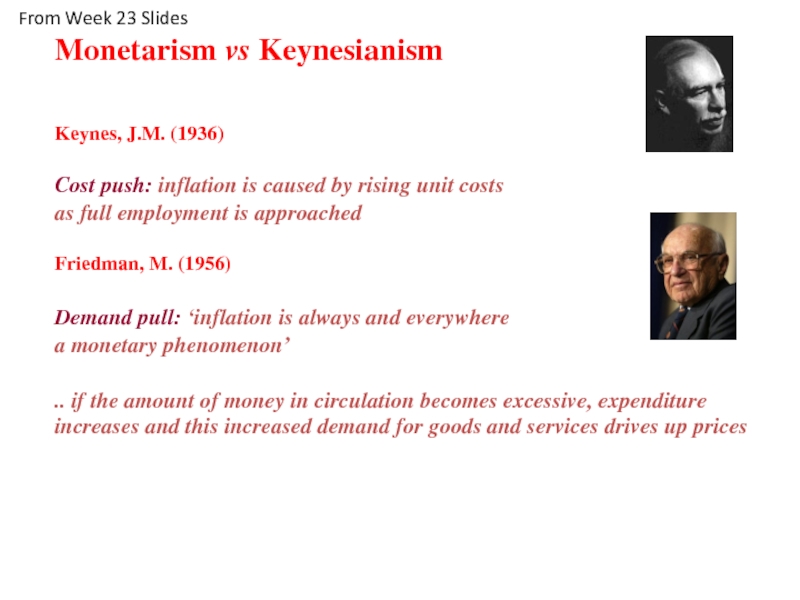

Слайд 39

Monetarism vs Keynesianism

Keynes, J.M. (1936)

Cost push: inflation is caused by

as full employment is approached

Friedman, M. (1956)

Demand pull: ‘inflation is always and everywhere

a monetary phenomenon’

.. if the amount of money in circulation becomes excessive, expenditure increases and this increased demand for goods and services drives up prices

From Week 23 Slides

Слайд 40Classical demand-pull inflation occurs

when trade unions go on strike

when money supply

as full employment is approached

with a deficit in the trade balance

Test 4 2015 Q22

Слайд 41

Monetarism vs Keynesianism

Keynes, J.M. (1936)

Cost push: inflation is caused by

as full employment is approached

Friedman, M. (1956)

Demand pull: ‘inflation is always and everywhere

a monetary phenomenon’

.. if the amount of money in circulation becomes excessive, expenditure increases and this increased demand for goods and services drives up prices

From Week 23 Slides

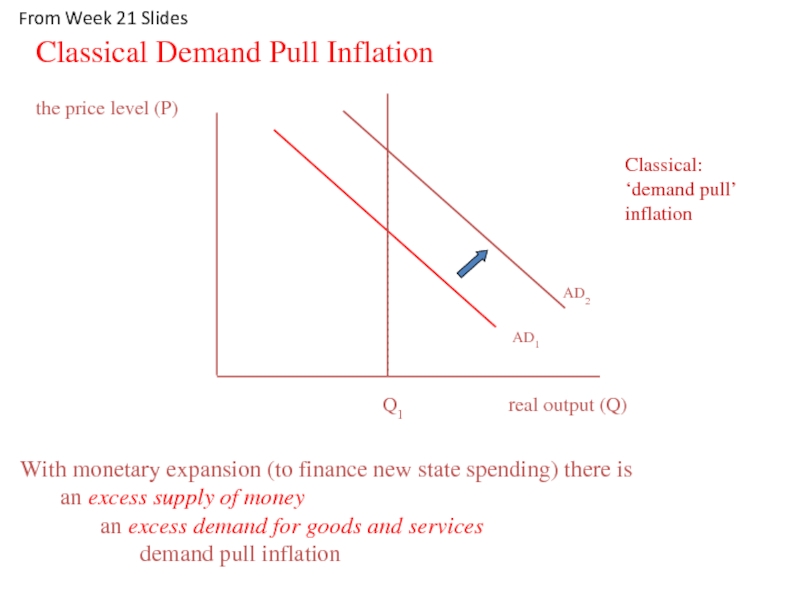

Слайд 42

AD1

Classical Demand

AD2

real output (Q)

Q1

Classical:

‘demand pull’ inflation

the price level (P)

With monetary expansion (to finance new state spending) there is

an excess supply of money

an excess demand for goods and services

demand pull inflation

From Week 21 Slides

Слайд 43Monetarism argues for a stable relationship between

real balances and the transactions

inflation and unemployment

nominal money supply and nominal income

government expenditure and the general level of prices

Test 4 2015 Q23

Слайд 44Within the UK account of international payments, the ‘balance for official

a surplus on capital account

a capital account equilibrium

a fixed exchange rate target

sovereign debt equilibrium

Test 4 2015 Q24

Слайд 45

The general structure:

BoP ≡ X - M + IOU (loan/credit)

BoP ≡ current account + capital account ≡ 0

BoP ≡ X - M + ‘invisibles’ + ΔLT + ΔST + Δforex ≡ 0

BoP ≡ { balance for official financing } + Δforex ≡ 0

Balance of International Payments Accounts

balance for official financing: the amount taken from (or absorbed by) official forex reserves in order to stabilise the international value of domestic currency

(exports of gold and/or forex to support £)

From Week 23 Slides 35 & 36

without support for £ depreciates with commensurate adjustments to foreign price conversions

Слайд 46With increased saving and a fall in the rate of interest,

relatively greater incentive to long-term real capital investment

relatively greater incentive to short-term real capital investment

a tendency for the prices of consumer goods to rise

a tendency for the prices of consumer goods to fall

Test 4 2015 Q25