- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Economics and management of network. Industries презентация

Содержание

- 1. Economics and management of network. Industries

- 2. I. Cost structure of the Electricity Business. II. Capital

- 3. III. ECONOMIC & FINANCIAL ANALYSIS. RATIOS

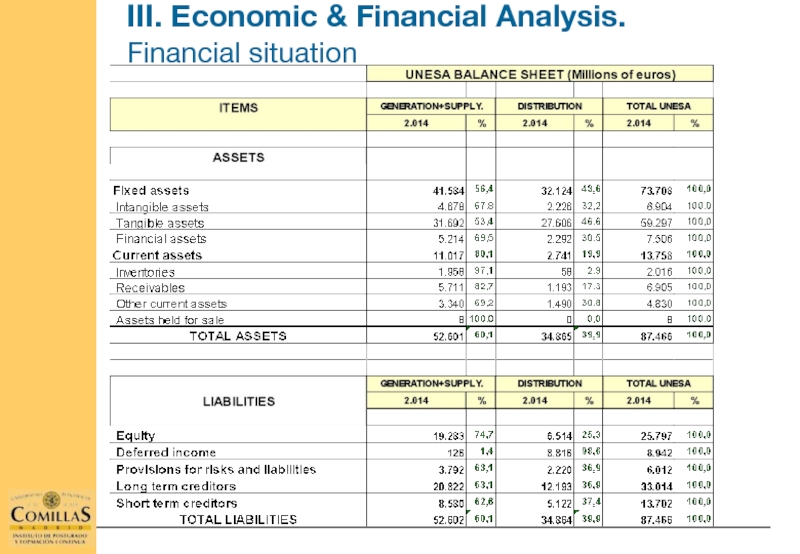

- 4. III. Economic & Financial Analysis. Financial situation

- 5. ELECTRICITY BUSINESS

- 6. ELECTRICITY BUSINESS Equity

- 7. ELECTRICITY BUSINESS Inventories Working capital

- 8. Current ratio = Current assets /

- 9. LIQUIDITY CHART AT YEAR END 2013

- 10. The business return is the main

- 11. FINANCIAL RETURN Relationship between earnings after

- 12. R.O.A = EBIT (1-t) / Total

- 13. RETURN ON EQUITY DEBT

- 14. ECONOMIC RETURN R.O.A. =

- 15. FINANCIAL RETURN AND FINANCIAL LEVERAGE (1)

- 16. FINANCIAL RETURN AND FINANCIAL LEVERAGE (2)

- 17. FINANCIAL RETURN AND FINANCIAL LEVERAGE (3)

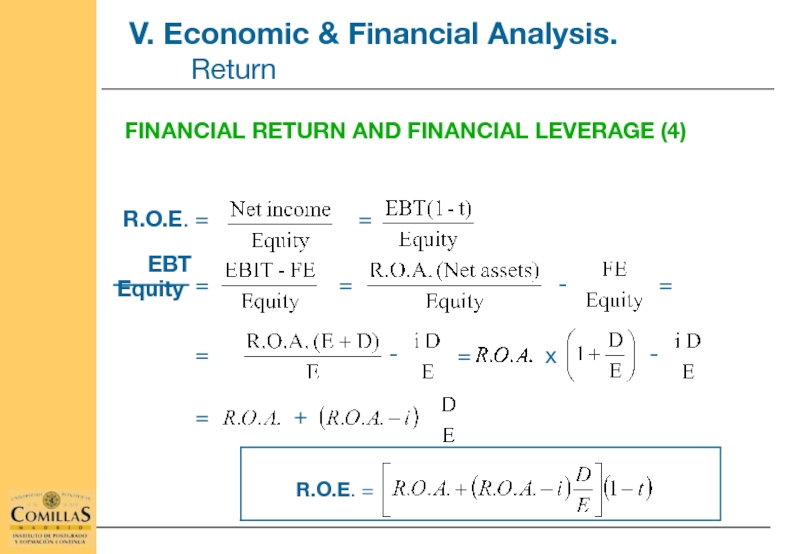

- 18. FINANCIAL RETURN AND FINANCIAL LEVERAGE (4)

- 19. I. Cost structure of the Electricity Business. II. Capital

- 20. III. ECONOMIC & FINANCIAL ANALYSIS. STOCK MARKET RATIOS

- 21. Earnings per share Dividend per share

- 22. STOCK MARKET RATIOS: Earnings per share Earnings

- 23. STOCK EXCHANGE RATIOS : Dividend per share

- 24. STOCK EXCHANGE RATIOS: Pay - out Pay

- 25. STOCK EXCHANGE RATIOS: Price Earning Ratio (PER)

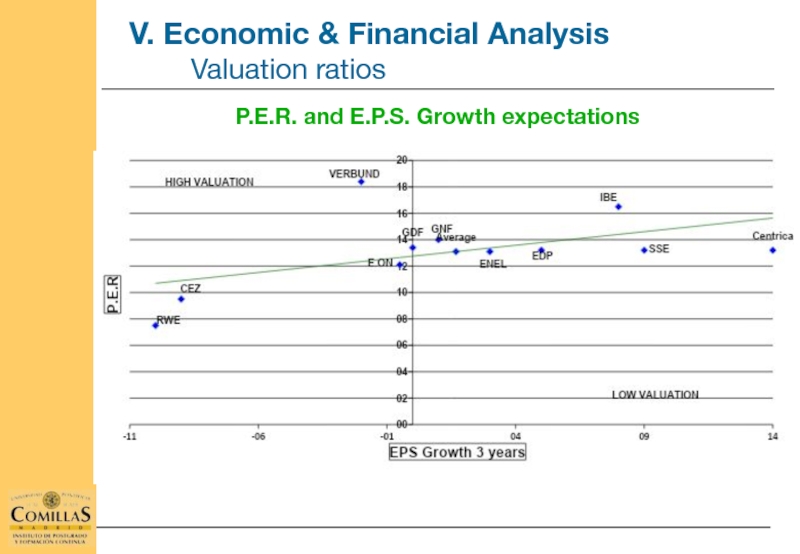

- 26. P.E.R. and E.P.S. Growth expectations

- 27. STOCK EXCHANGE RATIOS: EV / EBITDA Enterprise

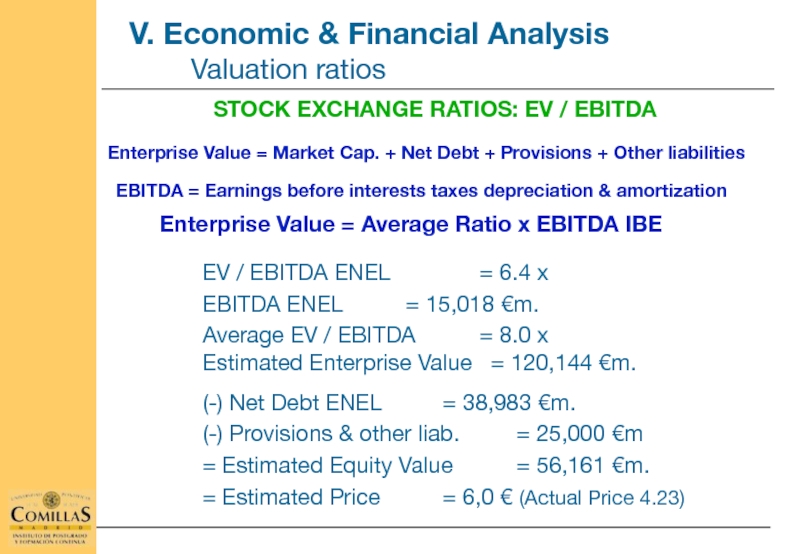

- 28. EV / Ebitda and Ebitda Growth expectations

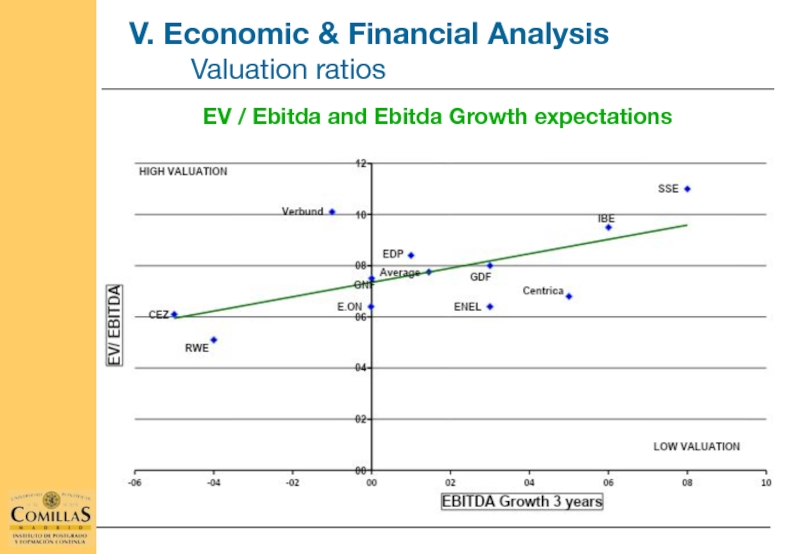

- 29. I. Cost structure of the Electricity Business. II. Capital

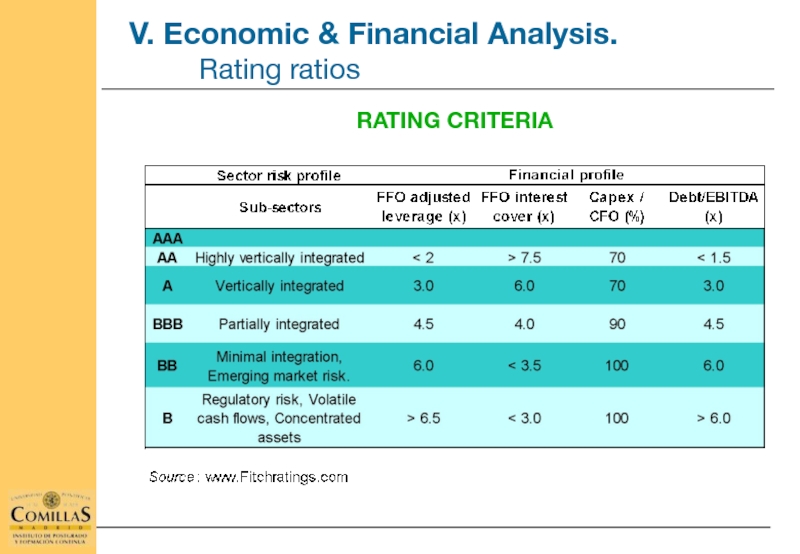

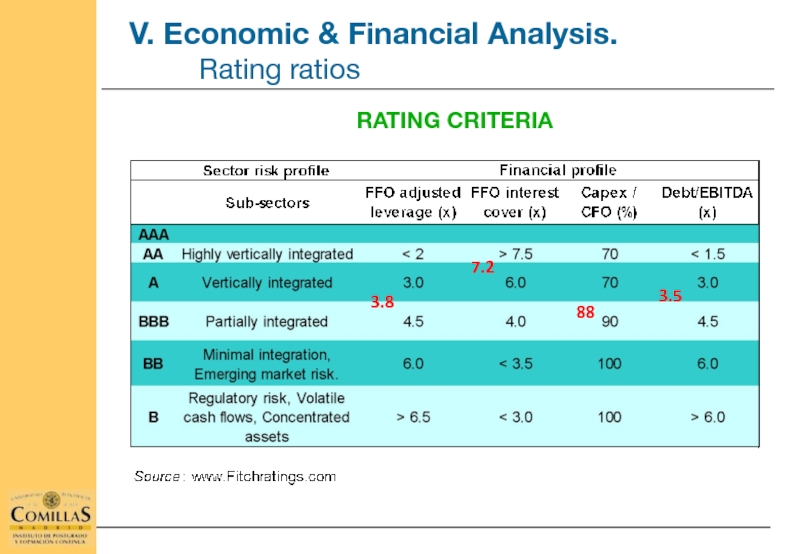

- 30. RATING CRITERIA

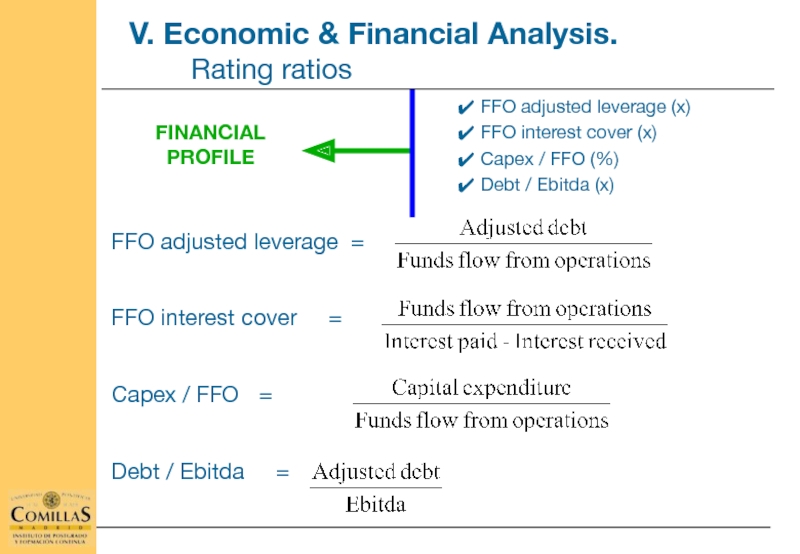

- 31. FFO adjusted leverage (x) FFO interest

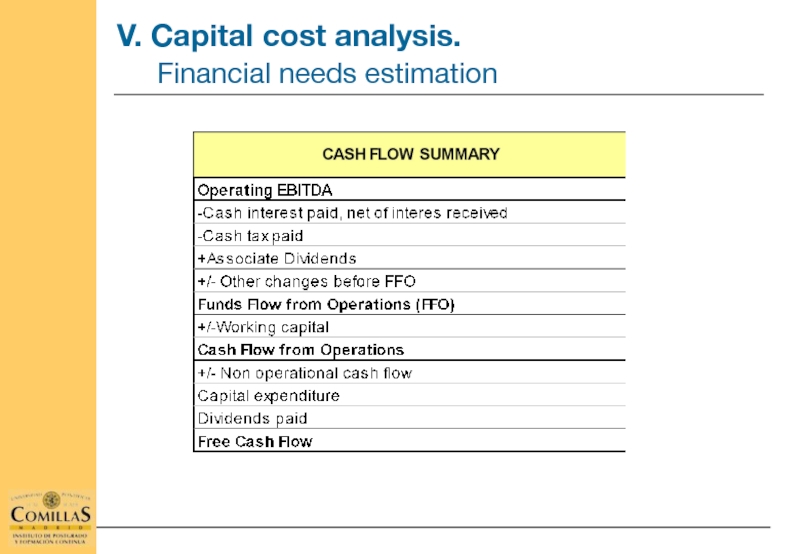

- 32. V. Capital cost analysis. Financial needs estimation

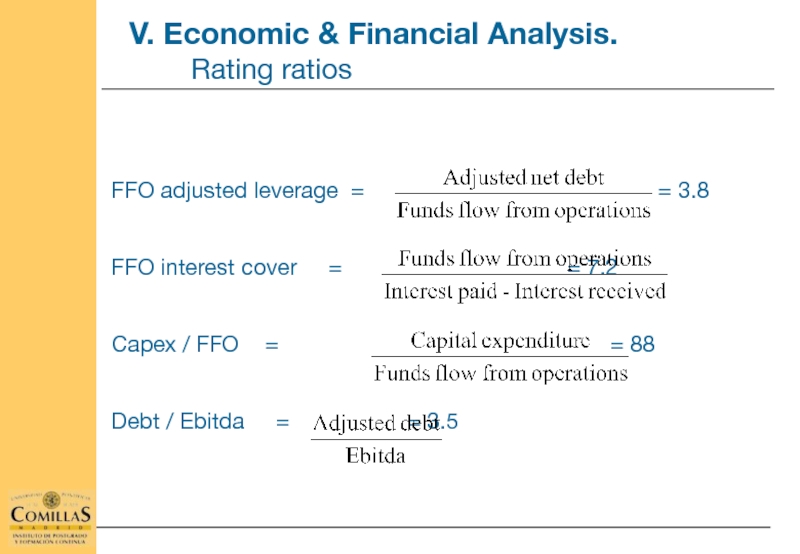

- 33. FFO adjusted leverage =

- 34. RATING CRITERIA 3.5 88 7.2 3.8

- 35. THANK YOU VERY MUCH

Слайд 1Ignacio Martínez

imartinez@unesa.es

FINANCIAL ANALYSIS OF THE ELECTRIC POWER INDUSTRY

COST AND RETURN ANALYSIS

Erasmus

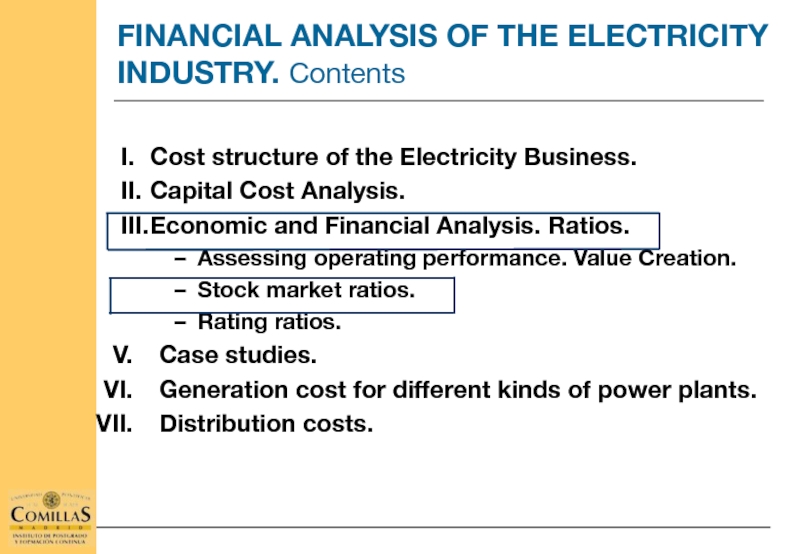

Слайд 2I. Cost structure of the Electricity Business.

II. Capital Cost Analysis.

III. Economic and Financial

Economic and Financial Return. Value Creation.

Rating ratios.

Stock market ratios.

Case studies.

Generation cost of power plants.

Distribution costs.

FINANCIAL ANALYSIS OF THE ELECTRICITY INDUSTRY. Contents

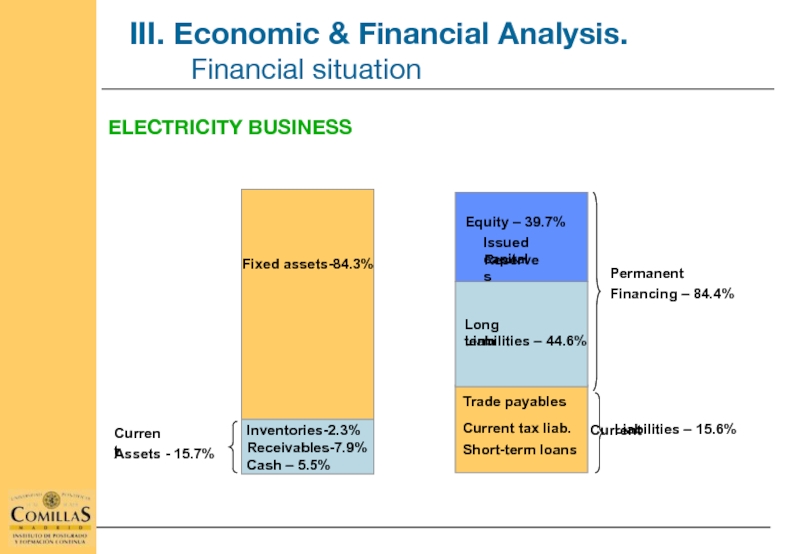

Слайд 5

ELECTRICITY BUSINESS

Permanent

Financing – 84.4%

Current

Assets - 15.7%

Equity – 39.7%

Issued capital

Liabilities – 44.6%

Cash – 5.5%

Receivables-7.9%

Trade payables

Fixed assets-84.3%

Inventories-2.3%

Long term

Current

Reserves

Current tax liab.

Short-term loans

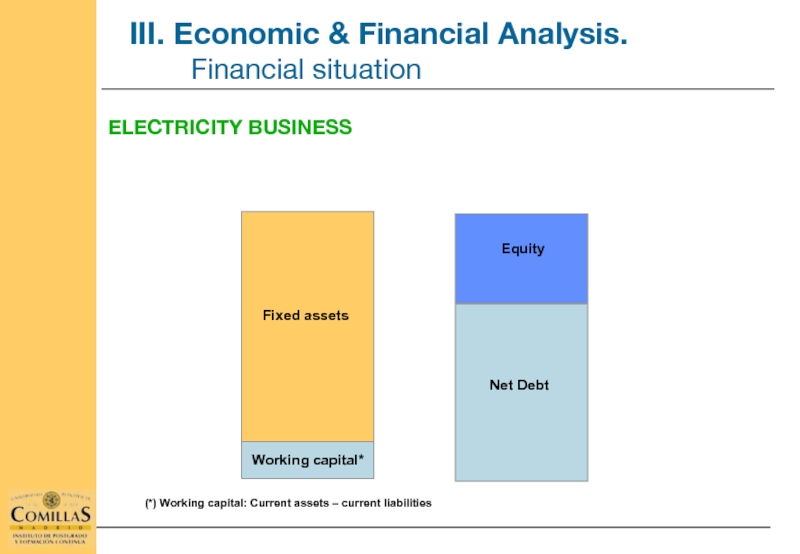

III. Economic & Financial Analysis.

Financial situation

Слайд 6

ELECTRICITY BUSINESS

Equity

Working capital*

Fixed assets

Net Debt

III. Economic & Financial Analysis.

Financial situation

(*)

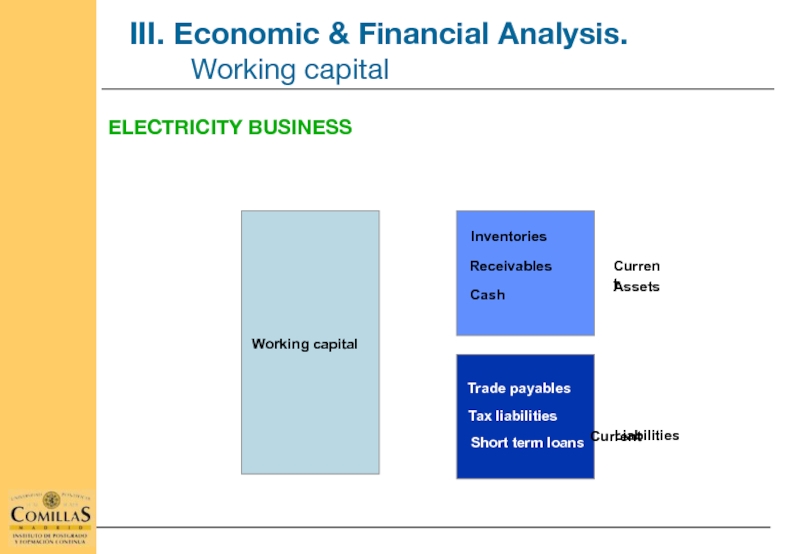

Слайд 7

ELECTRICITY BUSINESS

Inventories

Working capital

III. Economic & Financial Analysis.

Working capital

Trade payables

Tax liabilities

Short term

Receivables

Cash

Current

Liabilities

Assets

Current

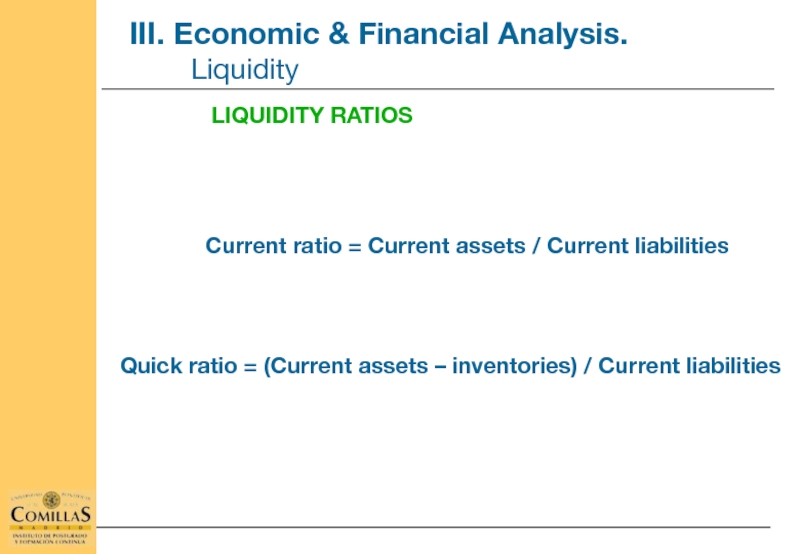

Слайд 8

Current ratio = Current assets / Current liabilities

LIQUIDITY RATIOS

Quick ratio =

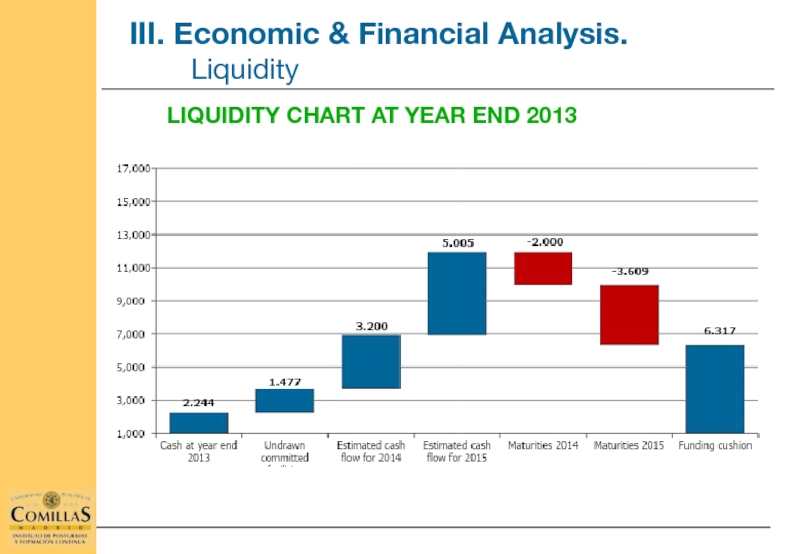

Слайд 10

The business return is the main performance indicator and the most

Economic return: It indicates the performance of the assets employed in the production process

Financial return: It indicates the performance of the capital invested by the business owners

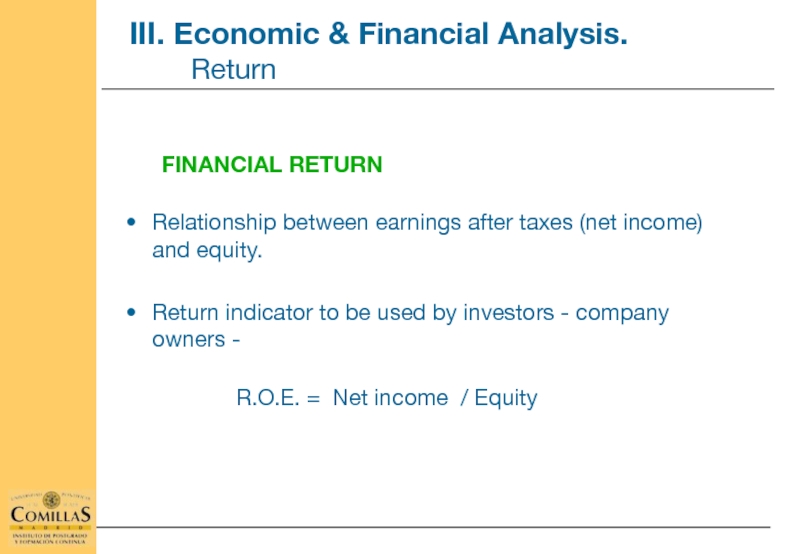

Слайд 11FINANCIAL RETURN

Relationship between earnings after taxes (net income) and equity.

Return indicator

R.O.E. = Net income / Equity

Слайд 12

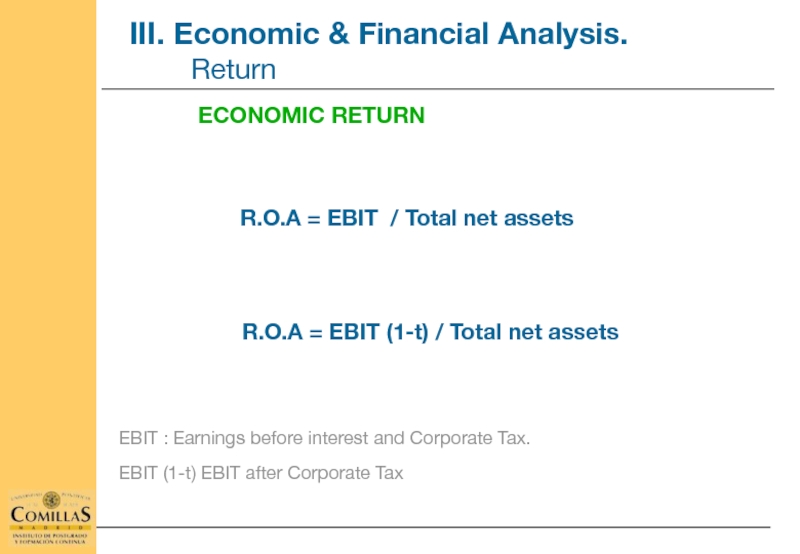

R.O.A = EBIT (1-t) / Total net assets

EBIT : Earnings before

EBIT (1-t) EBIT after Corporate Tax

ECONOMIC RETURN

R.O.A = EBIT / Total net assets

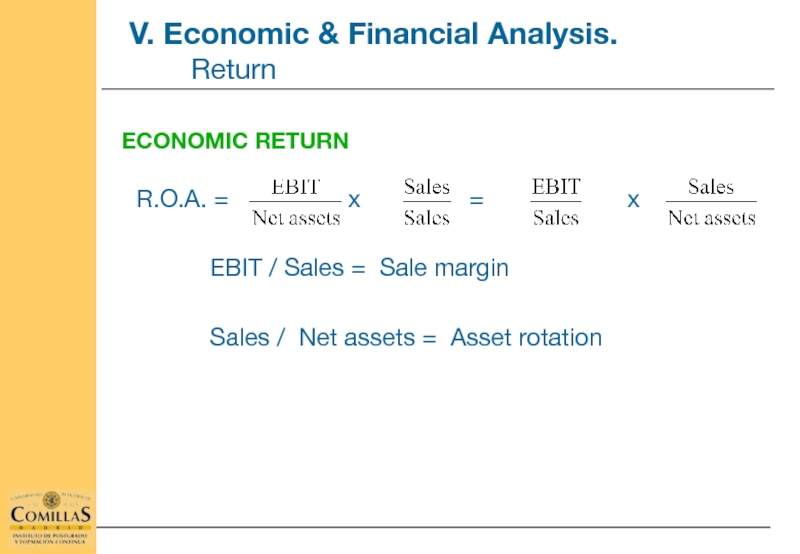

Слайд 14ECONOMIC RETURN

R.O.A. = x

EBIT / Sales = Sale margin

Sales / Net assets = Asset rotation

Слайд 16

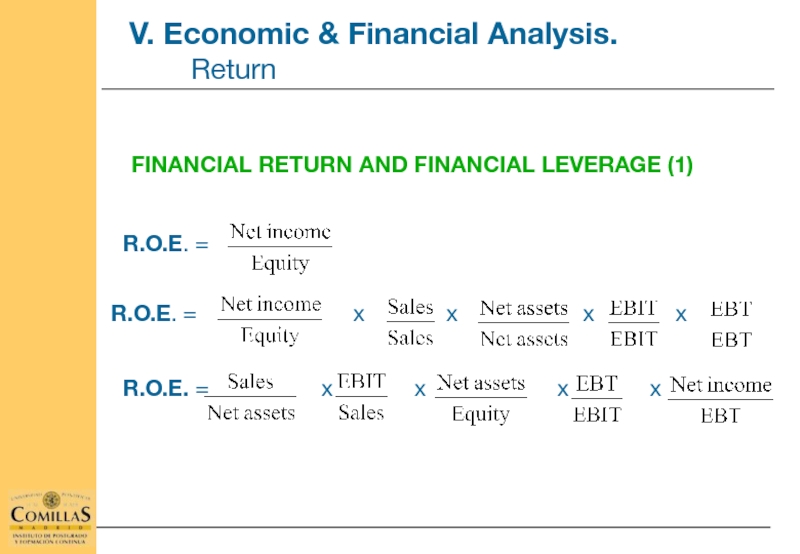

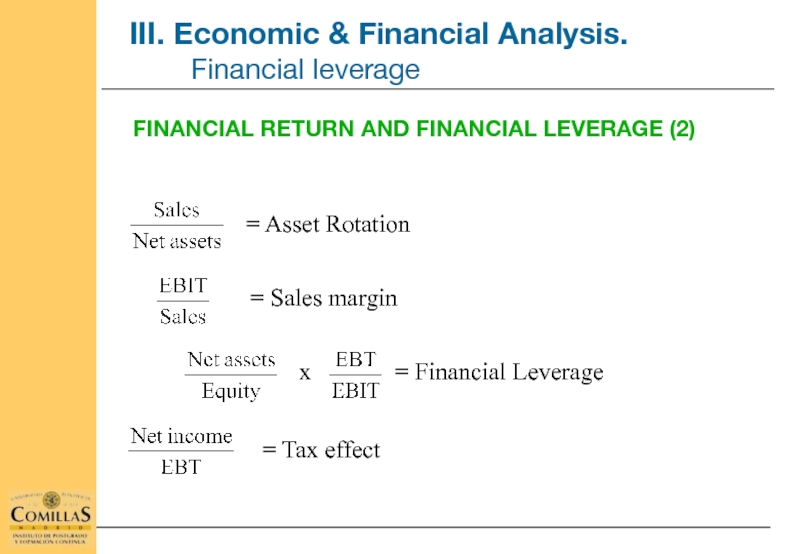

FINANCIAL RETURN AND FINANCIAL LEVERAGE (2)

= Asset Rotation

= Sales margin

= Financial

= Tax effect

x

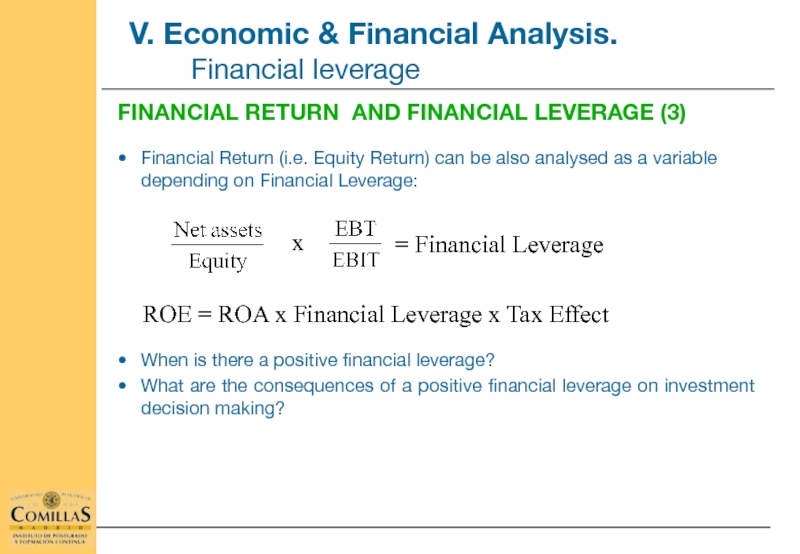

Слайд 17FINANCIAL RETURN AND FINANCIAL LEVERAGE (3)

Financial Return (i.e. Equity Return) can

When is there a positive financial leverage?

What are the consequences of a positive financial leverage on investment decision making?

= Financial Leverage

x

ROE = ROA x Financial Leverage x Tax Effect

Слайд 19I. Cost structure of the Electricity Business.

II. Capital Cost Analysis.

III. Economic and Financial

Assessing operating performance. Value Creation.

Stock market ratios.

Rating ratios.

Case studies.

Generation cost for different kinds of power plants.

Distribution costs.

FINANCIAL ANALYSIS OF THE ELECTRICITY INDUSTRY. Contents

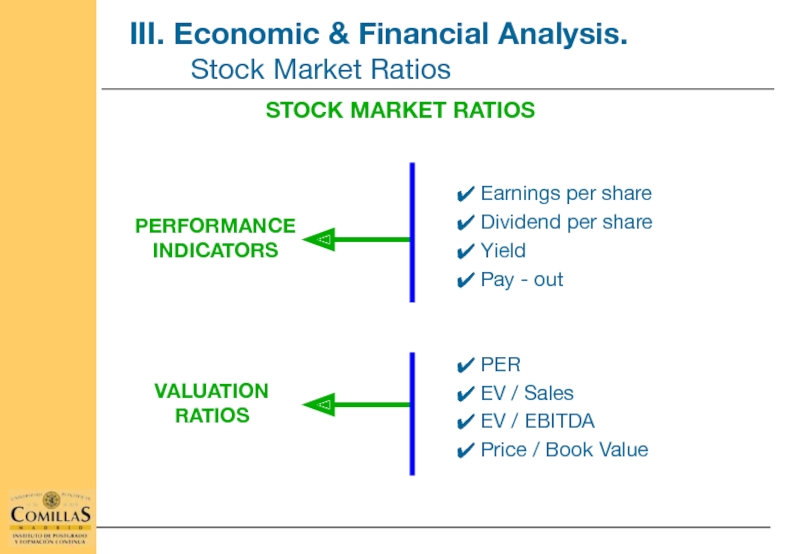

Слайд 21

Earnings per share

Dividend per share

Yield

Pay - out

PER

EV / Sales

EV / EBITDA

Price

PERFORMANCE

INDICATORS

VALUATION

RATIOS

STOCK MARKET RATIOS

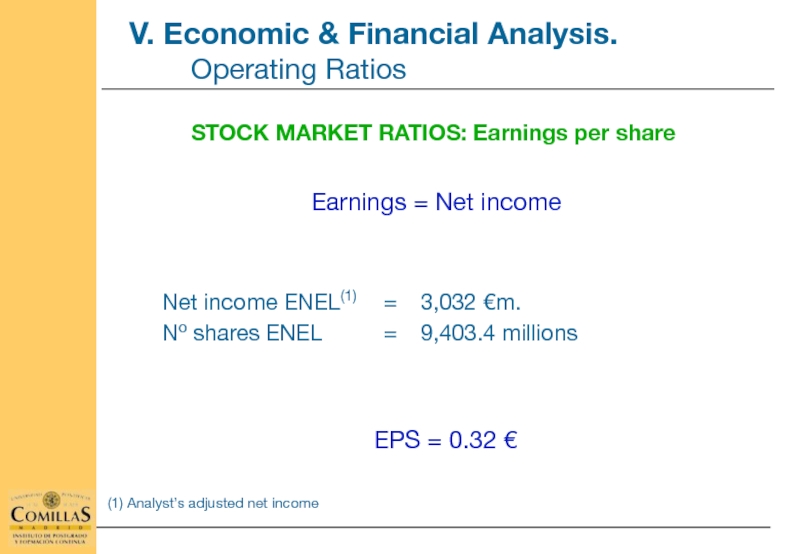

Слайд 22STOCK MARKET RATIOS: Earnings per share

Earnings = Net income

Net income ENEL(1)

Nº shares ENEL = 9,403.4 millions

EPS = 0.32 €

(1) Analyst’s adjusted net income

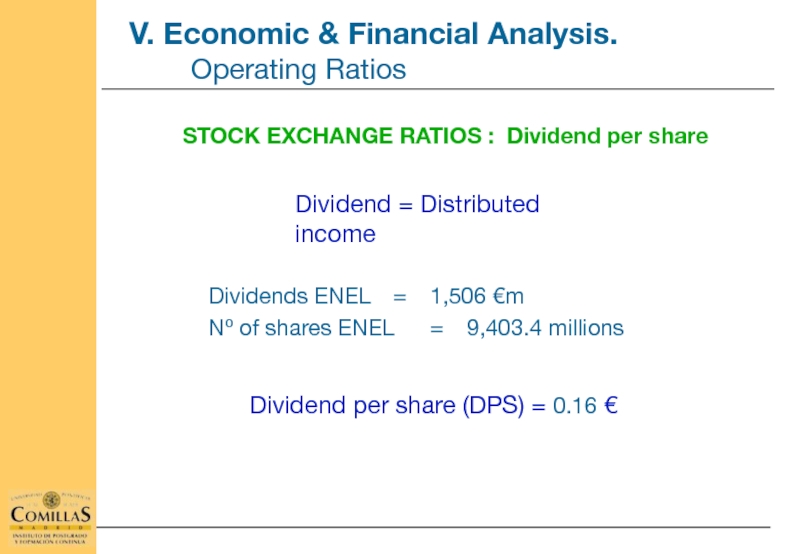

Слайд 23STOCK EXCHANGE RATIOS : Dividend per share

Dividend = Distributed income

Dividends ENEL

Nº of shares ENEL = 9,403.4 millions

Dividend per share (DPS) = 0.16 €

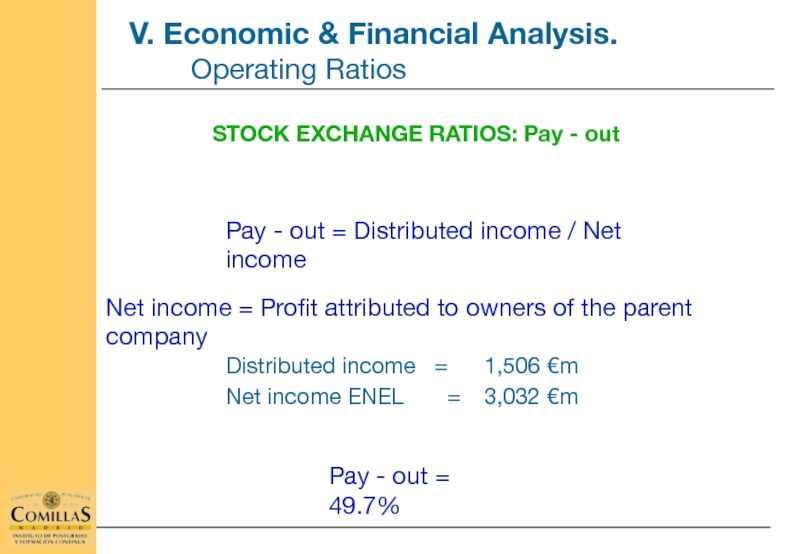

Слайд 24STOCK EXCHANGE RATIOS: Pay - out

Pay - out = Distributed income

Distributed income = 1,506 €m

Net income ENEL = 3,032 €m

Pay - out = 49.7%

Net income = Profit attributed to owners of the parent company

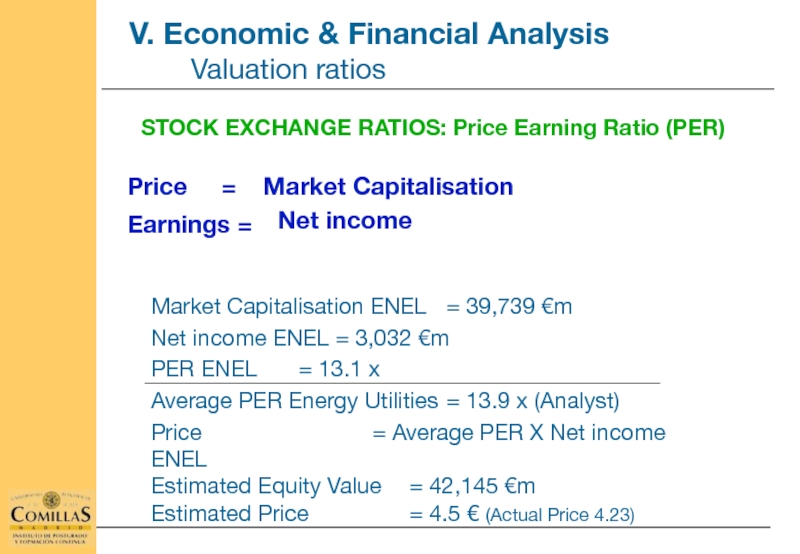

Слайд 25STOCK EXCHANGE RATIOS: Price Earning Ratio (PER)

Net income

Market Capitalisation ENEL = 39,739

Net income ENEL = 3,032 €m

PER ENEL = 13.1 x

Average PER Energy Utilities = 13.9 x (Analyst)

Price = Average PER X Net income ENEL

Estimated Equity Value = 42,145 €m

Estimated Price = 4.5 € (Actual Price 4.23)

Price = Market Capitalisation

Earnings =

Слайд 27STOCK EXCHANGE RATIOS: EV / EBITDA

Enterprise Value = Average Ratio x

EV / EBITDA ENEL = 6.4 x

EBITDA ENEL = 15,018 €m.

Average EV / EBITDA = 8.0 x

Estimated Enterprise Value = 120,144 €m.

(-) Net Debt ENEL = 38,983 €m.

(-) Provisions & other liab. = 25,000 €m

= Estimated Equity Value = 56,161 €m.

= Estimated Price = 6,0 € (Actual Price 4.23)

Enterprise Value = Market Cap. + Net Debt + Provisions + Other liabilities

EBITDA = Earnings before interests taxes depreciation & amortization

Слайд 29I. Cost structure of the Electricity Business.

II. Capital Cost Analysis.

III. Economic and Financial

Assessing operating performance. Value Creation.

Stock market ratios.

Rating ratios.

Case studies.

Generation cost for different kinds of power plants.

Distribution costs.

FINANCIAL ANALYSIS OF THE ELECTRICITY INDUSTRY. Contents

Слайд 31

FFO adjusted leverage (x)

FFO interest cover (x)

Capex / FFO (%)

Debt /

FINANCIAL

PROFILE

FFO adjusted leverage =

FFO interest cover =

Capex / FFO =

Debt / Ebitda =

Слайд 33

FFO adjusted leverage =

FFO interest cover = = 7.2

Capex / FFO = = 88

Debt / Ebitda = = 3.5