- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Chapter Eighteen. Externalities, Open Access, and Public Goods презентация

Содержание

- 1. Chapter Eighteen. Externalities, Open Access, and Public Goods

- 2. © 2007 Pearson Addison-Wesley. All rights reserved.

- 3. © 2007 Pearson Addison-Wesley. All rights reserved.

- 4. © 2007 Pearson Addison-Wesley. All rights reserved.

- 5. © 2007 Pearson Addison-Wesley. All rights reserved.

- 6. © 2007 Pearson Addison-Wesley. All rights reserved.

- 7. © 2007 Pearson Addison-Wesley. All rights reserved.

- 8. © 2007 Pearson Addison-Wesley. All rights reserved.

- 9. © 2007 Pearson Addison-Wesley. All rights reserved.

- 10. © 2007 Pearson Addison-Wesley. All rights reserved.

- 11. © 2007 Pearson Addison-Wesley. All rights reserved.

- 12. © 2007 Pearson Addison-Wesley. All rights reserved.

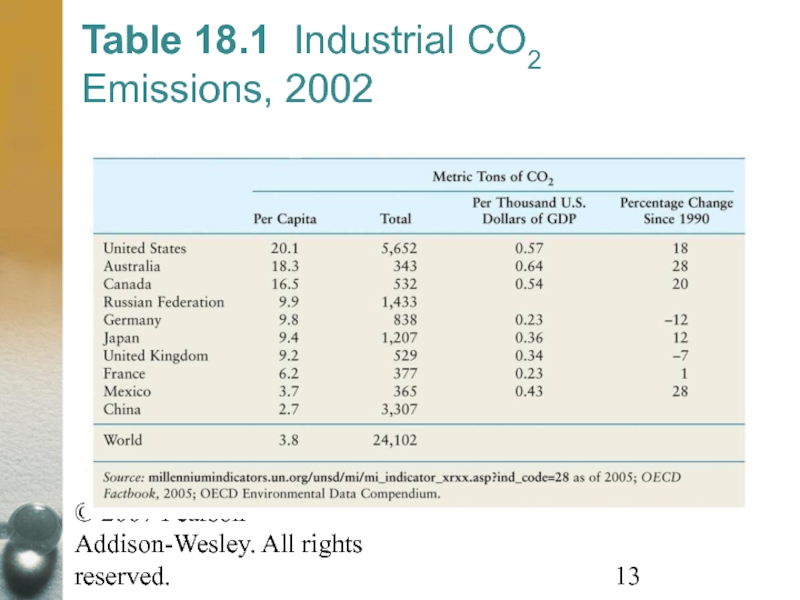

- 13. © 2007 Pearson Addison-Wesley. All rights reserved. Table 18.1 Industrial CO2 Emissions, 2002

- 14. © 2007 Pearson Addison-Wesley. All rights reserved.

- 15. © 2007 Pearson Addison-Wesley. All rights reserved.

- 16. © 2007 Pearson Addison-Wesley. All rights reserved.

- 17. © 2007 Pearson Addison-Wesley. All rights reserved.

- 18. © 2007 Pearson Addison-Wesley. All rights reserved.

- 19. © 2007 Pearson Addison-Wesley. All rights reserved.

- 20. © 2007 Pearson Addison-Wesley. All rights reserved.

- 21. © 2007 Pearson Addison-Wesley. All rights reserved.

- 22. © 2007 Pearson Addison-Wesley. All rights reserved.

- 23. © 2007 Pearson Addison-Wesley. All rights reserved.

- 24. © 2007 Pearson Addison-Wesley. All rights reserved.

- 25. © 2007 Pearson Addison-Wesley. All rights reserved.

- 26. © 2007 Pearson Addison-Wesley. All rights reserved.

- 27. © 2007 Pearson Addison-Wesley. All rights reserved.

- 28. © 2007 Pearson Addison-Wesley. All rights reserved.

- 29. © 2007 Pearson Addison-Wesley. All rights reserved.

- 30. © 2007 Pearson Addison-Wesley. All rights reserved.

- 31. © 2007 Pearson Addison-Wesley. All rights reserved.

- 32. © 2007 Pearson Addison-Wesley. All rights reserved.

- 33. © 2007 Pearson Addison-Wesley. All rights reserved.

- 34. © 2007 Pearson Addison-Wesley. All rights reserved.

- 35. © 2007 Pearson Addison-Wesley. All rights reserved.

- 36. © 2007 Pearson Addison-Wesley. All rights reserved.

- 37. © 2007 Pearson Addison-Wesley. All rights reserved.

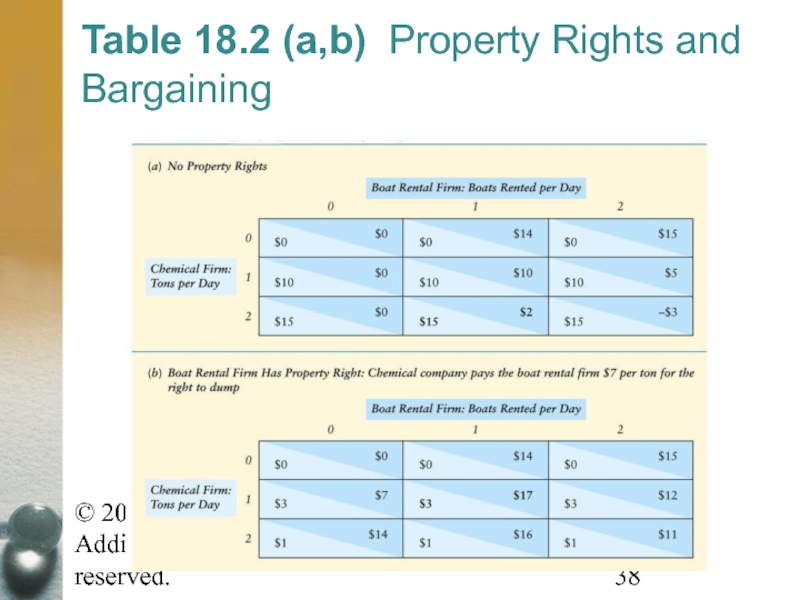

- 38. © 2007 Pearson Addison-Wesley. All rights reserved. Table 18.2 (a,b) Property Rights and Bargaining

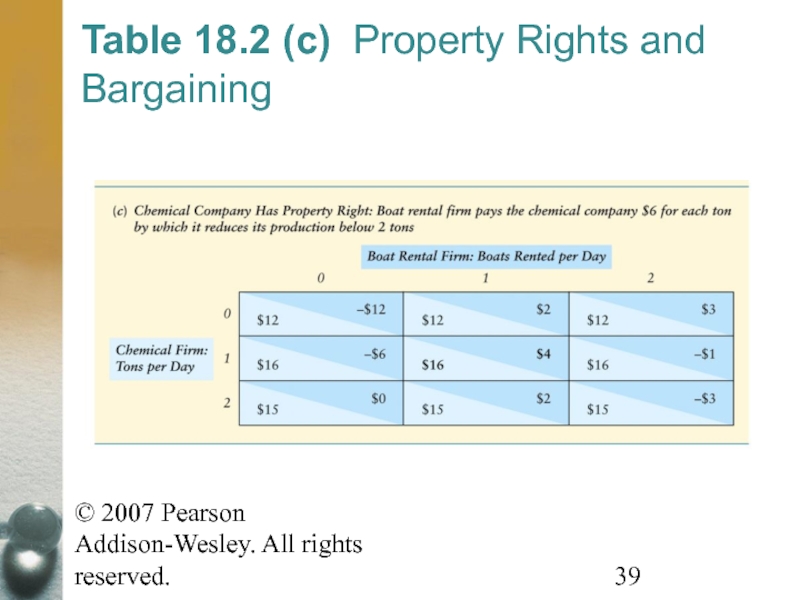

- 39. © 2007 Pearson Addison-Wesley. All rights reserved. Table 18.2 (c) Property Rights and Bargaining

- 40. © 2007 Pearson Addison-Wesley. All rights reserved.

- 41. © 2007 Pearson Addison-Wesley. All rights reserved.

- 42. © 2007 Pearson Addison-Wesley. All rights reserved.

- 43. © 2007 Pearson Addison-Wesley. All rights reserved.

- 44. © 2007 Pearson Addison-Wesley. All rights reserved.

- 45. © 2007 Pearson Addison-Wesley. All rights reserved.

- 46. © 2007 Pearson Addison-Wesley. All rights reserved.

- 47. © 2007 Pearson Addison-Wesley. All rights reserved.

- 48. © 2007 Pearson Addison-Wesley. All rights reserved.

- 49. © 2007 Pearson Addison-Wesley. All rights reserved.

- 50. © 2007 Pearson Addison-Wesley. All rights reserved.

- 51. © 2007 Pearson Addison-Wesley. All rights reserved.

- 52. © 2007 Pearson Addison-Wesley. All rights reserved.

- 53. © 2007 Pearson Addison-Wesley. All rights reserved.

- 54. © 2007 Pearson Addison-Wesley. All rights reserved.

- 55. © 2007 Pearson Addison-Wesley. All rights reserved.

- 56. © 2007 Pearson Addison-Wesley. All rights reserved.

- 57. © 2007 Pearson Addison-Wesley. All rights reserved.

- 58. © 2007 Pearson Addison-Wesley. All rights reserved.

- 59. © 2007 Pearson Addison-Wesley. All rights reserved.

- 60. © 2007 Pearson Addison-Wesley. All rights reserved.

- 61. © 2007 Pearson Addison-Wesley. All rights reserved.

- 62. © 2007 Pearson Addison-Wesley. All rights reserved.

- 63. © 2007 Pearson Addison-Wesley. All rights reserved. Table 18.5 Voting on $300 Traffic Signals

- 64. © 2007 Pearson Addison-Wesley. All rights reserved.

Слайд 2© 2007 Pearson Addison-Wesley. All rights reserved.

Externalities, Open Access, and

In this chapter, we examine six main topics

Externalities

The inefficiency of competition with externalities

Market structure and externalities

Allocating property rights to reduce externalities

Open-access common property

Public goods

Слайд 3© 2007 Pearson Addison-Wesley. All rights reserved.

Externalities

Externality

The direct effect of

Слайд 4© 2007 Pearson Addison-Wesley. All rights reserved.

Externalities

Externalities may either help

An externality that harms someone is called a negative externality.

A positive externality benefits others.

Слайд 5© 2007 Pearson Addison-Wesley. All rights reserved.

The inefficiency of competition

Competitive firms and consumers do not have to pay for the harms of their negative externalities, so they create excessive amounts.

Because producers are not compensated for the benefits of a positive externality, too little of such externalities is produced.

Слайд 6© 2007 Pearson Addison-Wesley. All rights reserved.

The inefficiency of competition

Private cost

The cost of production only, not including externalities

Social cost

The private cost plus the cost of the harms from externalities

Слайд 7© 2007 Pearson Addison-Wesley. All rights reserved.

Supply-and-Demand Analysis

We use a

Слайд 8© 2007 Pearson Addison-Wesley. All rights reserved.

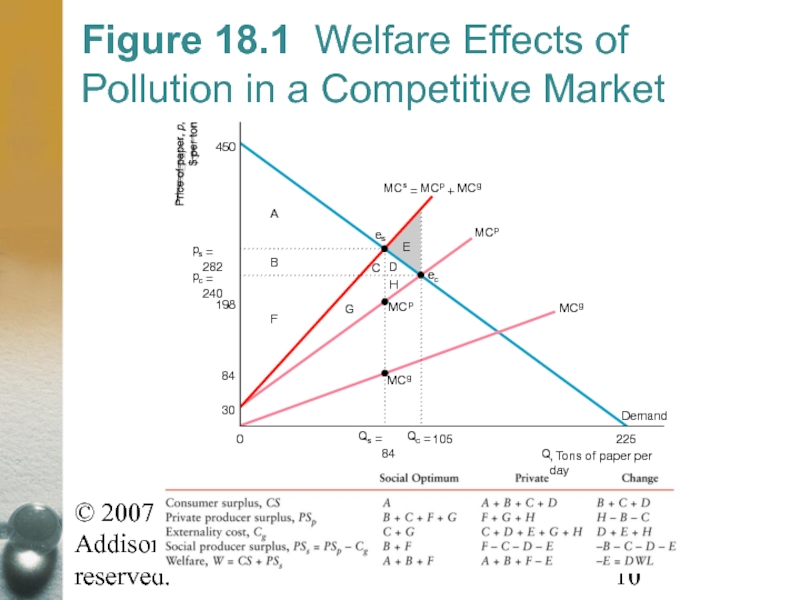

Figure 18.1 Welfare Effects

The competitive equilibrium, , is determined by the intersection of the demand curve and the competitive supply or private marginal cost curve, , which ignores the cost of pollution.

Слайд 9© 2007 Pearson Addison-Wesley. All rights reserved.

Figure 18.1 Welfare Effects

The social optimum, , is at the intersection of the demand curve and the social marginal cost curve,

, where is the marginal cost of the pollution (gunk). Private producer surplus is based on curve, and social producer surplus is based on the curve.

Слайд 10© 2007 Pearson Addison-Wesley. All rights reserved.

Figure 18.1 Welfare Effects

Demand

MC

p

MC

g

MC

g

MC

s

=

MC

p

+

MC

g

450

p

s

= 282

p

c

= 240

30

84

198

Q

c

=

105

Q

s

=

84

225

0

e

c

e

s

A

B

F

C

D

E

H

G

Q

, Tons of paper per day

MC

p

Слайд 11© 2007 Pearson Addison-Wesley. All rights reserved.

Supply-and-Demand Analysis

The figure illustrates

First, a competitive market produces excessive negative externalities.

Second, the optimal amount of pollution is greater than zero.

Слайд 12© 2007 Pearson Addison-Wesley. All rights reserved.

Reducing Externalities

Because competitive markets

Слайд 13© 2007 Pearson Addison-Wesley. All rights reserved.

Table 18.1 Industrial CO2

Слайд 14© 2007 Pearson Addison-Wesley. All rights reserved.

Reducing Externalities

If a government

Слайд 15© 2007 Pearson Addison-Wesley. All rights reserved.

Reducing Externalities

A governmental limit

Слайд 16© 2007 Pearson Addison-Wesley. All rights reserved.

Reducing Externalities

Internalize the externality

To

Слайд 17© 2007 Pearson Addison-Wesley. All rights reserved.

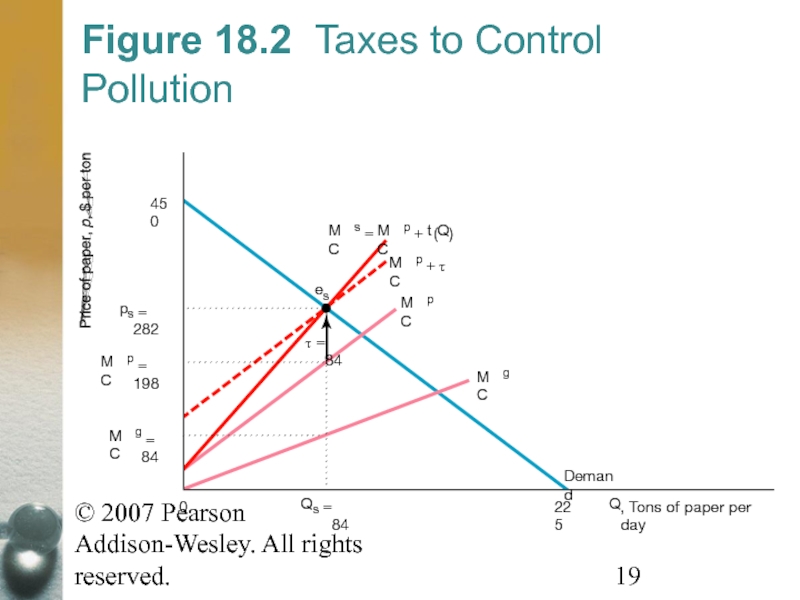

Figure 18.2 Taxes to

Placing a tax on the firms equal to the harm the gunk, , causes them to internalize the externality, so their private marginal cost is the same as the social marginal cost, . As a result, the competitive after-tax equilibrium is the same as the social optimum, .

Слайд 18© 2007 Pearson Addison-Wesley. All rights reserved.

Figure 18.2 Taxes to

Alternatively, applying a specific tax of

per ton of paper, which is the marginal harm from the gunk at , also results in the social optimum.

Слайд 19© 2007 Pearson Addison-Wesley. All rights reserved.

Figure 18.2 Taxes to

Demand

MC

p

MC

g

MC

s

=

MC

p

+

t

(

Q

)

MC

p

+

τ

τ

=

84

450

p

s

= 282

MC

p

= 198

MC

g

= 84

Q

s

=

84

225

0

e

s

Q

, Tons of paper per day

Слайд 20© 2007 Pearson Addison-Wesley. All rights reserved.

Cost-Benefit Analysis

By using a

Слайд 21© 2007 Pearson Addison-Wesley. All rights reserved.

Cost-Benefit Analysis

Welfare is maximized

Слайд 22© 2007 Pearson Addison-Wesley. All rights reserved.

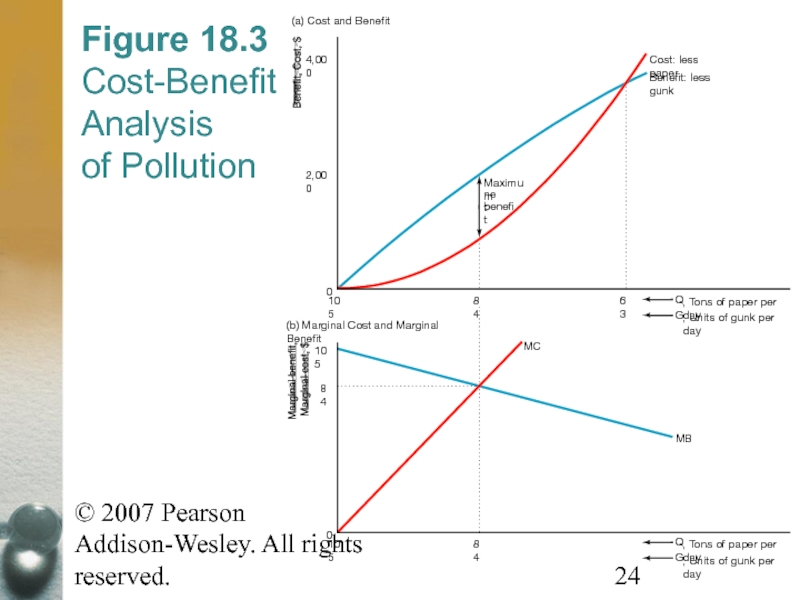

Figure 18.3 Cost-Benefit Analysis

The benefit curve reflects the reduction in harm from pollution as the amount of gunk falls from the competitive level. The cost of reducing the amount of gunk is the fall in output, which reduces consumer surplus and private producer surplus. Welfare is maximized at 84 tons of paper and 84 units of gunk, the quantities at which the difference between the benefit and cost curves, the net benefit, is greatest.

Слайд 23© 2007 Pearson Addison-Wesley. All rights reserved.

Figure 18.3 Cost-Benefit Analysis

The net benefit is maximized where the marginal benefit, , which is the slope of the benefit curve, equals the marginal cost, , the slope of the cost curve.

Слайд 24© 2007 Pearson Addison-Wesley. All rights reserved.

Figure 18.3 Cost-Benefit Analysis

Cost: less paper

Benefit: less gunk

Maximum

net

benefit

84

63

105

0

84

105

G

, Units of gunk per day

Q

, Tons of paper per day

G

, Units of gunk per day

Q

, Tons of paper per day

(a) Cost and Benefit

(b) Marginal Cost and Marginal Benefit

4,000

2,000

105

84

0

MC

MB

Слайд 25© 2007 Pearson Addison-Wesley. All rights reserved.

Market Structure and Externalities

Two

Слайд 26© 2007 Pearson Addison-Wesley. All rights reserved.

Monopoly and Externalities

Although the

Слайд 27© 2007 Pearson Addison-Wesley. All rights reserved.

Monopoly and Externalities

Which effect

Слайд 28© 2007 Pearson Addison-Wesley. All rights reserved.

Monopoly Versus Competitive Welfare

In the absence of externalities, welfare is greater under competition than under an unregulated monopoly.

However, with an externality, welfare may be greater with monopoly than with competition.

Слайд 29© 2007 Pearson Addison-Wesley. All rights reserved.

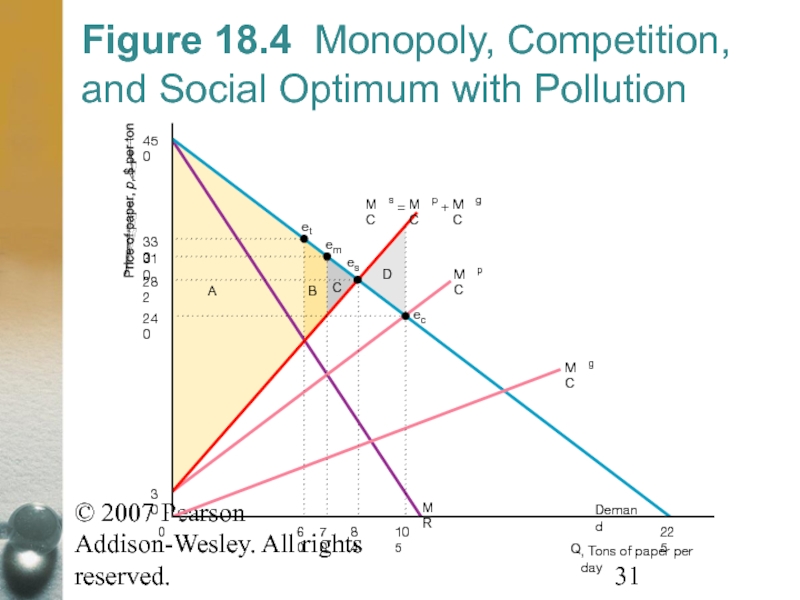

Figure 18.4 Monopoly, Competition,

At the competitive equilibrium, , more is produced than at the social optimum, . As a result, the deadweight loss in the competitive market is . The monopoly equilibrium, , is determined by the intersection of the marginal revenue and the private marginal cost, , curves.

Слайд 30© 2007 Pearson Addison-Wesley. All rights reserved.

Figure 18.4 Monopoly, Competition,

The social welfare (based on the marginal social cost, , curve) under monopoly is . Here the deadweight loss of monopoly, , is less than the deadweight loss under competition, .

Слайд 31© 2007 Pearson Addison-Wesley. All rights reserved.

Figure 18.4 Monopoly, Competition,

Q

, Tons of paper per day

Demand

MR

MC

p

MC

g

MC

s

=

MC

p

+

MC

g

450

330

310

282

240

30

84

105

225

70

60

0

e

m

e

c

e

s

e

t

A

B

C

D

Слайд 32© 2007 Pearson Addison-Wesley. All rights reserved.

Taxing Externalities in Noncompetitive

Trying to solve a negative externality problem is more complex in a noncompetitive market than in a competitive market.

Слайд 33© 2007 Pearson Addison-Wesley. All rights reserved.

Taxing Externalities in Noncompetitive

To achieve a social optimum in a competitive market, the government only has to reduce the externality, possibly by decreasing output.

In a noncompetitive market, the government must eliminate problems arising from both externalities and the exercise of market power.

Слайд 34© 2007 Pearson Addison-Wesley. All rights reserved.

Allocating Property Rights to

Instead of controlling externalities directly through emissions fees and emissions standards, the government may take an indirect approach by assigning a property right: an exclusive privilege to use an asset.

Слайд 35© 2007 Pearson Addison-Wesley. All rights reserved.

Allocating Property Rights to

If no one holds a property right for a good or a bad, the good or bad is unlikely to have a price.

Слайд 36© 2007 Pearson Addison-Wesley. All rights reserved.

Allocating Property Rights to

For many bads, such as pollution, and for some goods, property rights are not clearly defined. No one has exclusive property rights to the sir we breathe. Because of this lack of a price, a polluter’s private marginal cost of production is less than the full social marginal cost.

Слайд 37© 2007 Pearson Addison-Wesley. All rights reserved.

Coase Theorem

According to the

Слайд 38© 2007 Pearson Addison-Wesley. All rights reserved.

Table 18.2 (a,b) Property

Слайд 39© 2007 Pearson Addison-Wesley. All rights reserved.

Table 18.2 (c) Property

Слайд 40© 2007 Pearson Addison-Wesley. All rights reserved.

Coase Theorem

If there are

Efficiency is achieved regardless of who receives the property rights.

Слайд 41© 2007 Pearson Addison-Wesley. All rights reserved.

Coase Theorem

Who gets the

Слайд 42© 2007 Pearson Addison-Wesley. All rights reserved.

Problems with the Coase

First, if transaction costs are very high, it might not pay for the two sides to meet.

Second, if firms engage in strategic bargaining behavior, an agreement may not be reached.

Third, if either side lacks information about the costs or benefits or reducing pollution, a nonefficient outcome may occur.

Слайд 43© 2007 Pearson Addison-Wesley. All rights reserved.

Markets for Pollution

If high

Слайд 44© 2007 Pearson Addison-Wesley. All rights reserved.

Markets for Pollution

Under this

Слайд 45© 2007 Pearson Addison-Wesley. All rights reserved.

Markets for Pollution

Bu using

Слайд 46© 2007 Pearson Addison-Wesley. All rights reserved.

Open-Access Common Property

Open-Access Common

Resources to which everyone has free access

Слайд 47© 2007 Pearson Addison-Wesley. All rights reserved.

Overuse of Open-Access Common

Because people do not have to pay to use open-access common property resources, they are overused.

e.g.

Common Pools.

The Internet.

Roads

Fisheries.

Слайд 48© 2007 Pearson Addison-Wesley. All rights reserved.

Solving the Commons Problem

Government

Overuse of a common resource occurs because individuals do not bear the full social cost. However, by applying a tax or fee equal to the externality harm that each individual imposes on others, a government forces each person to internalize the externality.

Слайд 49© 2007 Pearson Addison-Wesley. All rights reserved.

Solving the Commons Problem

Government

Alternatively, the government can restrict access to the commons. One typical approach is to grant access on a first-come, first-served basis.

Слайд 50© 2007 Pearson Addison-Wesley. All rights reserved.

Solving the Commons Problem

Assigning

An alternative approach to resolving the commons problem is to assign private property rights.

Слайд 51© 2007 Pearson Addison-Wesley. All rights reserved.

Public Goods

Public Good

A commodity

Слайд 52© 2007 Pearson Addison-Wesley. All rights reserved.

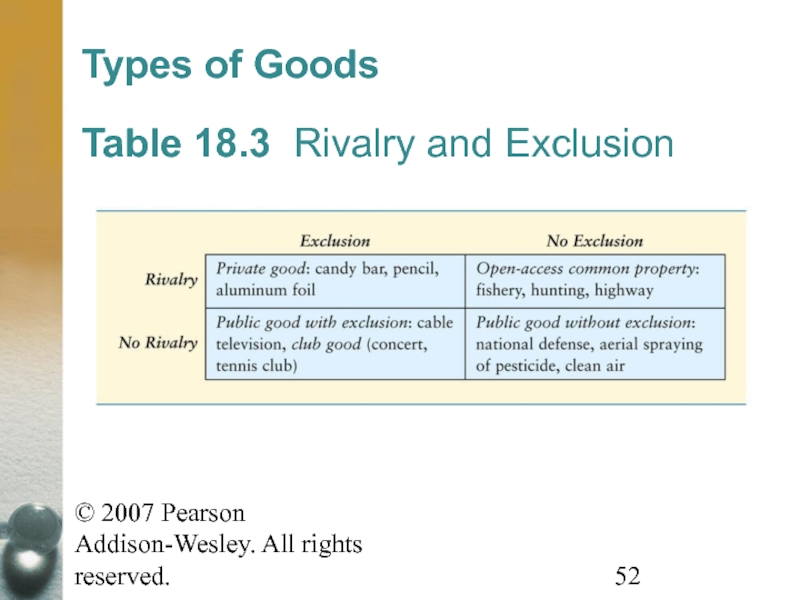

Table 18.3 Rivalry and

Types of Goods

Слайд 53© 2007 Pearson Addison-Wesley. All rights reserved.

Markets for public goods

Markets do not exist for nonexclusive public goods.

If the government does not provide a nonexclusive public good, no one provides it.

Markets for Public Goods

Слайд 54© 2007 Pearson Addison-Wesley. All rights reserved.

Demand for Public Goods

Because

Слайд 55© 2007 Pearson Addison-Wesley. All rights reserved.

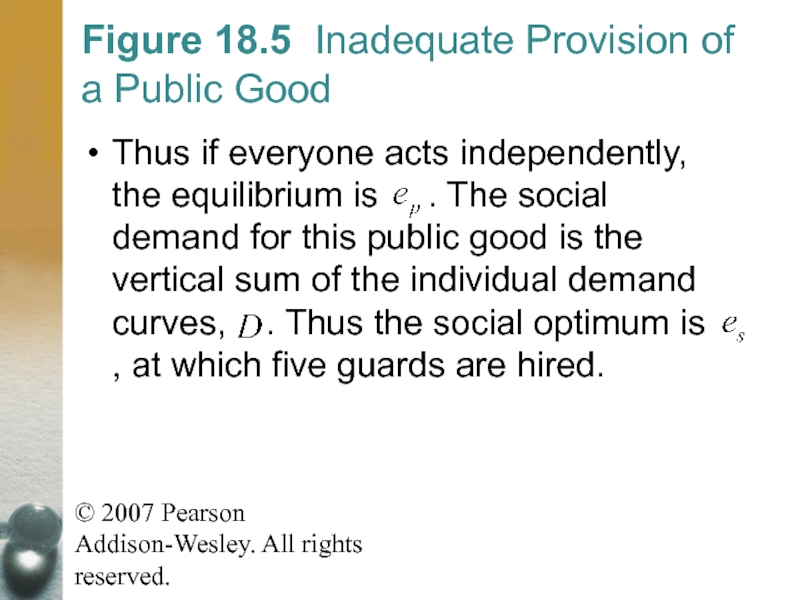

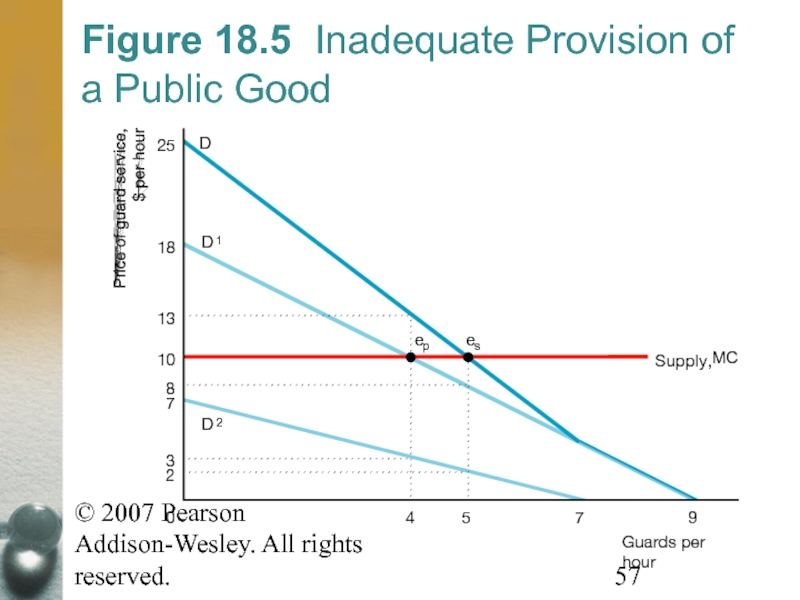

Figure 18.5 Inadequate Provision

Security guards protect both tenants of the mall. If each guard costs $10 per hour, the television store, with demand , is willing to hire four guards per hour. The ice-cream parlor, with demand , is not willing to hire any guards.

Слайд 56© 2007 Pearson Addison-Wesley. All rights reserved.

Figure 18.5 Inadequate Provision

Thus if everyone acts independently, the equilibrium is . The social demand for this public good is the vertical sum of the individual demand curves, . Thus the social optimum is , at which five guards are hired.

Слайд 57© 2007 Pearson Addison-Wesley. All rights reserved.

Figure 18.5 Inadequate Provision

Guards per hour

Supply,

MC

25

18

13

10

8

7

3

2

5

7

9

4

0

e

p

e

s

D

1

D

D

2

Слайд 58© 2007 Pearson Addison-Wesley. All rights reserved.

Free Riding

Many people are

Слайд 59© 2007 Pearson Addison-Wesley. All rights reserved.

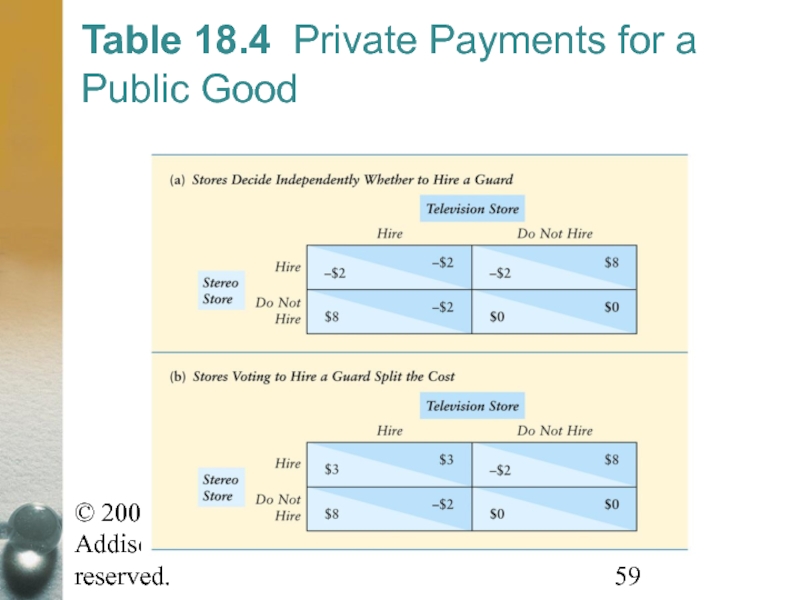

Table 18.4 Private Payments

Слайд 60© 2007 Pearson Addison-Wesley. All rights reserved.

Free Riding

In each of

Слайд 61© 2007 Pearson Addison-Wesley. All rights reserved.

Reducing Free Riding

Governmental or

Methods that may be used include social pressure, merges, compulsion, and privatization.

Слайд 62© 2007 Pearson Addison-Wesley. All rights reserved.

Valuing Public Goods

To ensure

Слайд 63© 2007 Pearson Addison-Wesley. All rights reserved.

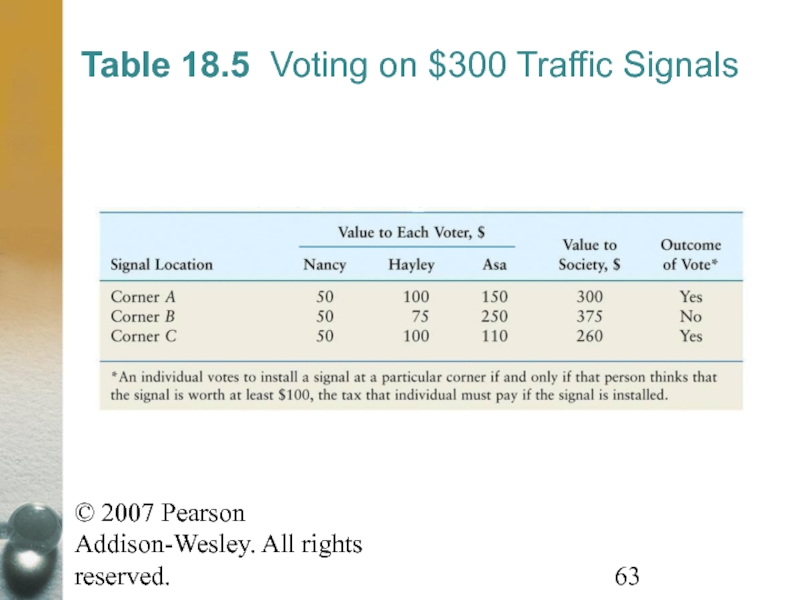

Table 18.5 Voting on

Слайд 64© 2007 Pearson Addison-Wesley. All rights reserved.

Valuing Public Goods

The problem

Thus such majority voting fails to value the public good fully and hence does not guarantee that it is efficiently provided.