- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Green bonds are making headlines презентация

Содержание

- 1. Green bonds are making headlines

- 2. Green bonds are making headlines 80

- 3. $93tn institutional investors AuM SRI = $21tn

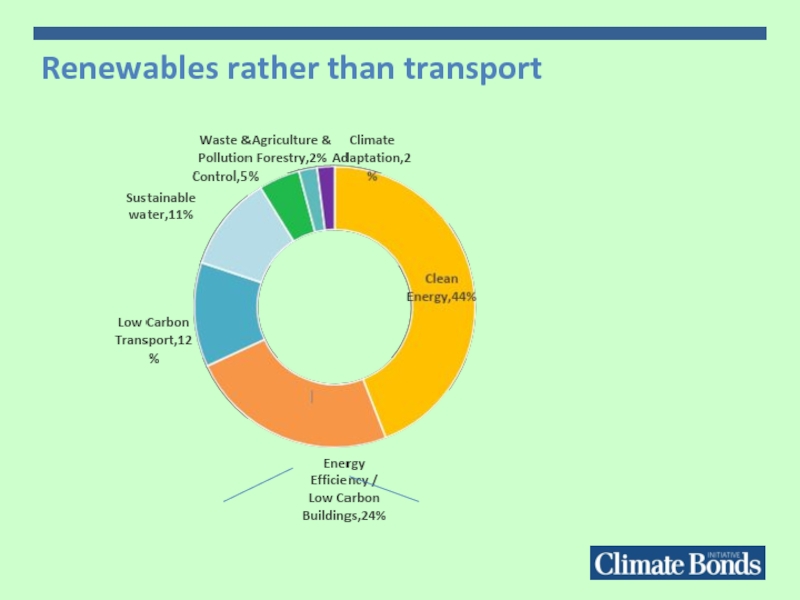

- 5. Renewables rather than transport

- 6. Green Bond Principles – ICMA Proceeds must

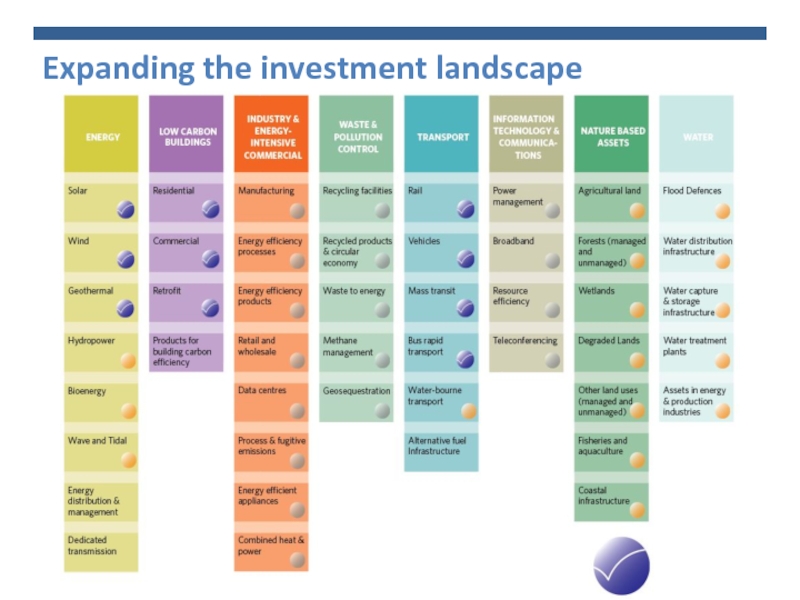

- 7. Expanding the investment landscape

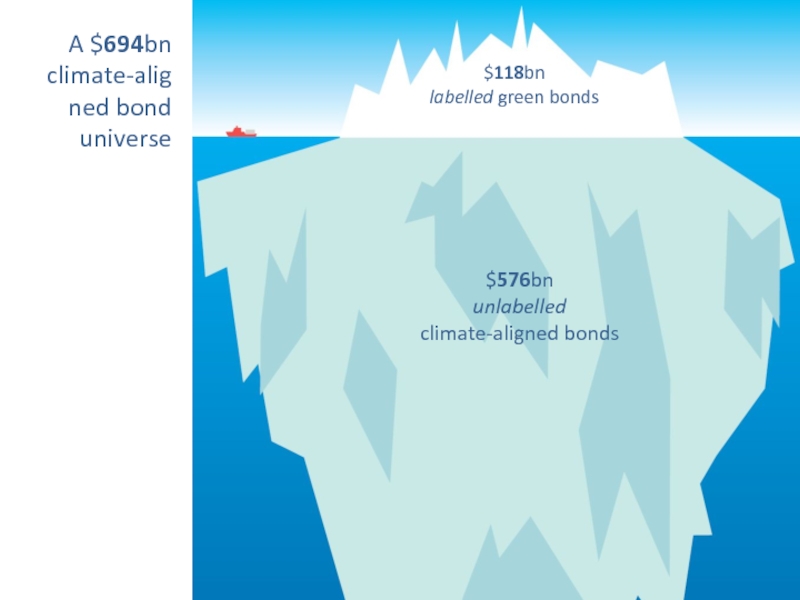

- 8. $118bn labelled green bonds A $694bn climate-aligned bond universe $576bn unlabelled climate-aligned bonds

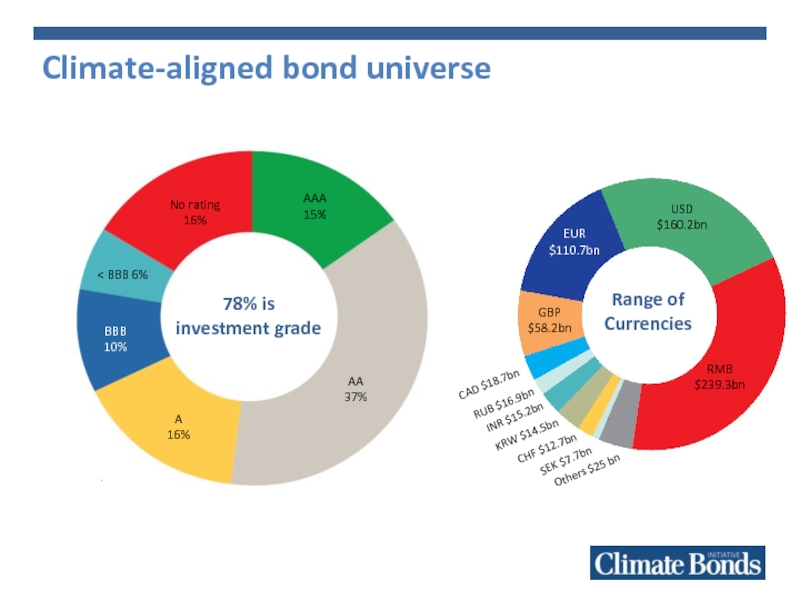

- 9. Climate-aligned bond universe AAA 15% AA

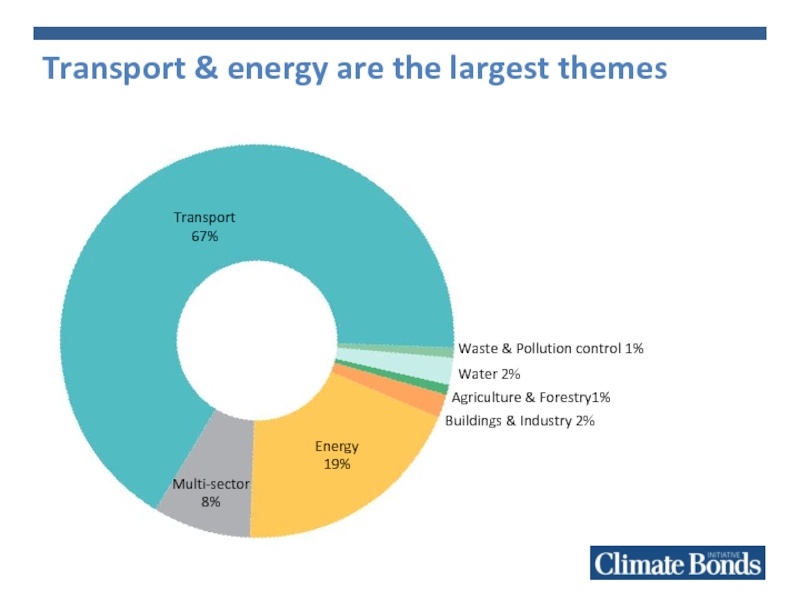

- 10. Transport & energy are the largest themes

- 11. Climate-aligned bonds are in Brasil Western Europe:

- 12. Brazil green & climate-aligned bonds Examples of

- 13. Opportunities in Brazil Agribusiness Forestry & paper Renewable energy

- 14. Roadmap Blue-chip issuance Market education Fiscally efficient

- 15. Green Infra Investment & INDCs Investor-country dialogue India Brazil China

- 16. Potencial de Investimentos no Brasil

Слайд 1

Bonds & Climate Change

State of the Market 2016

Brazil Edition

Sean Kidney,

Sao Paulo 2 August 2016

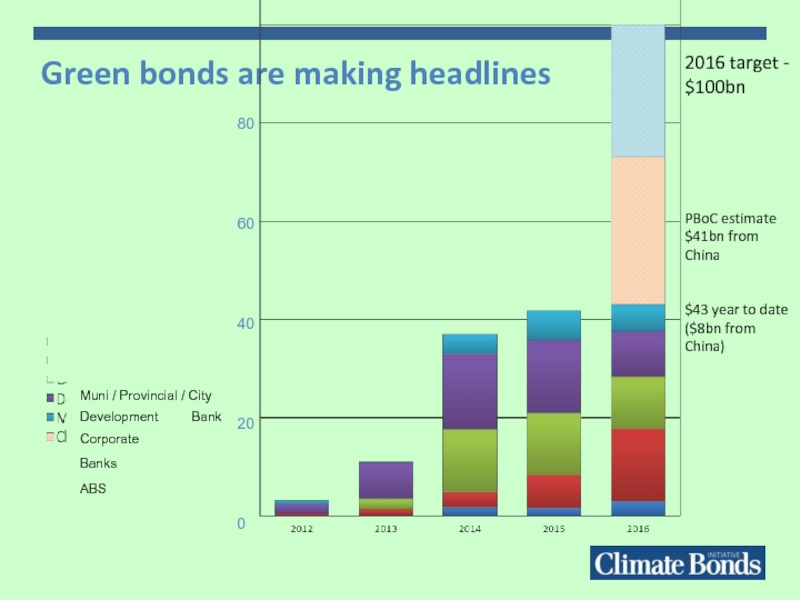

Слайд 2Green bonds are making headlines

80

60

40

20

0

2016 target - $100bn

PBoC estimate $41bn from

$43 year to date ($8bn from China)

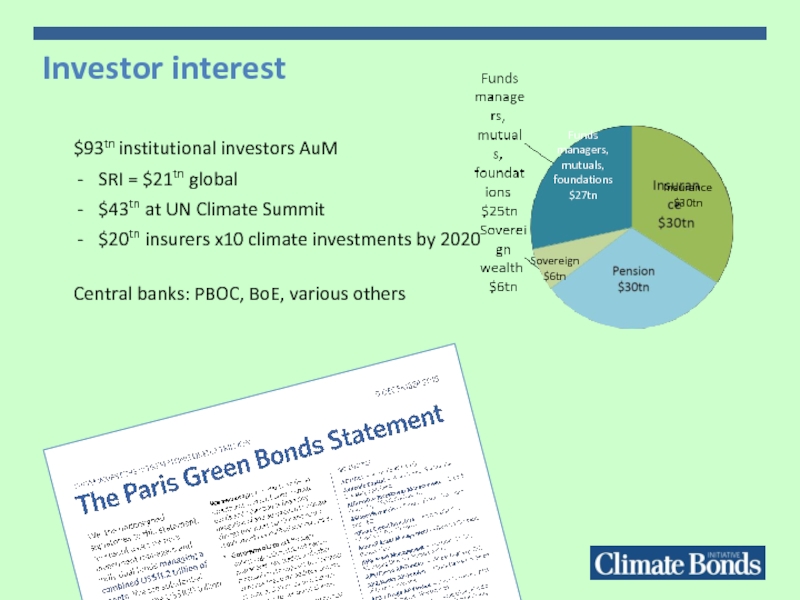

Слайд 3$93tn institutional investors AuM

SRI = $21tn global

$43tn at UN Climate Summit

$20tn

Central banks: PBOC, BoE, various others

Investor interest

Insurance

$30tn

Sovereign

$6tn

Funds managers, mutuals, foundations $27tn

Слайд 4

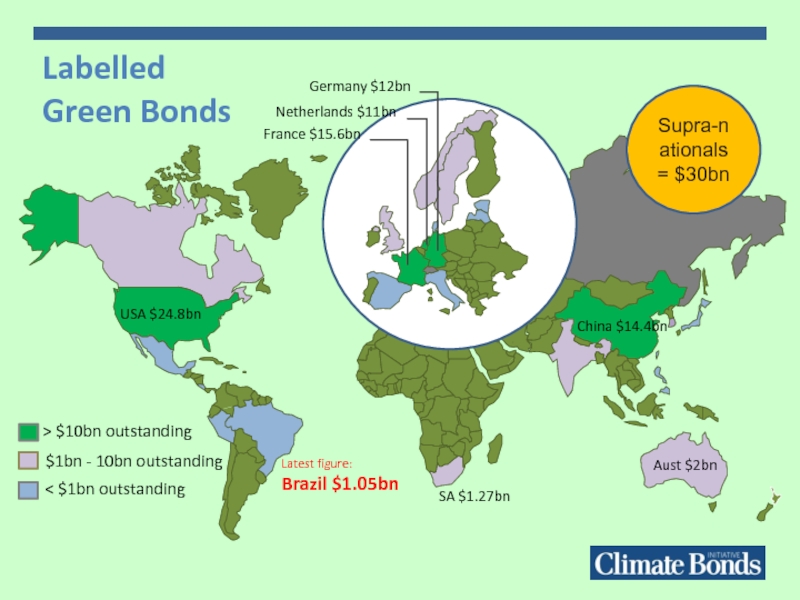

USA $24.8bn

China $14.4bn

Supra-nationals = $30bn

Labelled

Green Bonds

Latest figure:

Brazil $1.05bn

Слайд 6Green Bond Principles – ICMA Proceeds must go to green / Explain

Rules for a new market

China: Central Bank-led

France: “Energy and Ecological Transition for Climate” Label

Moody’s green rating: quality of review & reporting

G20 Green Bond recommendations

Слайд 8$118bn

labelled green bonds

A $694bn

climate-aligned bond universe

$576bn

unlabelled climate-aligned bonds

Слайд 9Climate-aligned bond universe

AAA

15%

AA

37%

A

16%

< BBB 6%

No rating

16%

BBB

10%

78% is investment

Слайд 10Transport & energy are the largest themes

Transport

67%

Energy

19%

Multi-sector

8%

Water 2%

Buildings

Waste & Pollution control 1%

Agriculture & Forestry1%

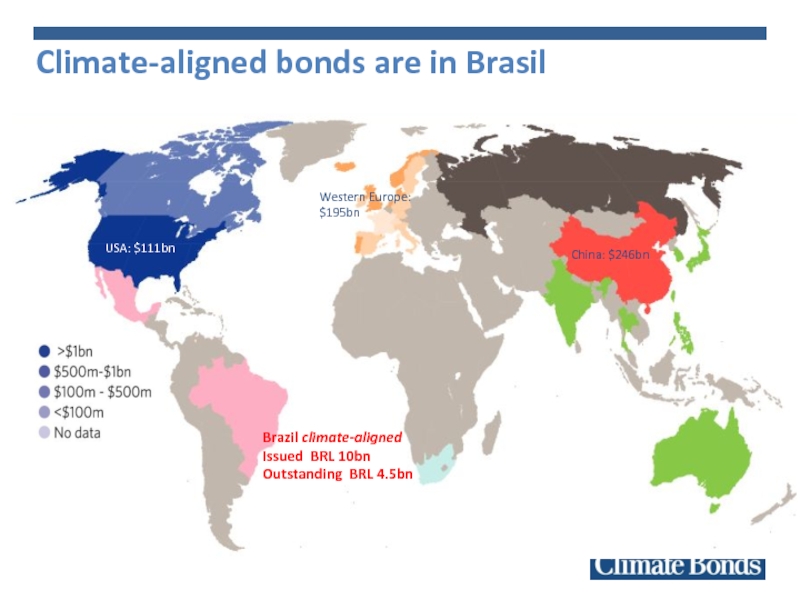

Слайд 11Climate-aligned bonds are in Brasil

Western Europe: $195bn

USA: $111bn

China: $246bn

Brazil climate-aligned

Issued BRL

Outstanding BRL 4.5bn

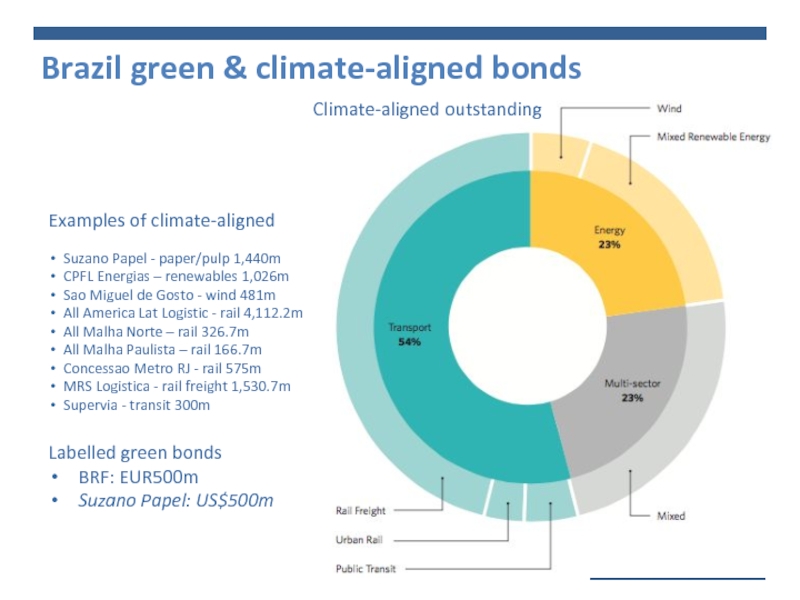

Слайд 12Brazil green & climate-aligned bonds

Examples of climate-aligned

Suzano Papel - paper/pulp 1,440m

CPFL Energias – renewables 1,026m

Sao Miguel de Gosto - wind 481m

All America Lat Logistic - rail 4,112.2m

All Malha Norte – rail 326.7m

All Malha Paulista – rail 166.7m

Concessao Metro RJ - rail 575m

MRS Logistica - rail freight 1,530.7m

Supervia - transit 300m

Labelled green bonds

BRF: EUR500m

Suzano Papel: US$500m

Climate-aligned outstanding