(Referendum celebrations over)

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Greek Debt Crisis : Stark Economic Reality & The Story презентация

Содержание

- 1. Greek Debt Crisis : Stark Economic Reality & The Story

- 2. Greeks are being asked to say yes (nai) or no (oxi)

- 6. A protester interrupts Angela Merkel

- 7. No vote supporters hold a

- 8. Grieken vieren feest op het Syntagmaplein

- 9. Anti-austerity 'No' voters celebrate in Athens

- 10. People celebrate in front of

- 11. 1. GREECE JOINS THE EURO

- 12. Economists and government leaders are

- 13. 2. THE 2008 FINANCIAL CRISIS HITS

- 14. 2. THE 2008 FINANCIAL CRISIS

- 15. 3. THE FIRST BAILOUT BEGINS

- 16. 3. THE FIRST BAILOUT BEGINS

- 17. 4. VIOLENCE ERUPTS

- 18. 4. VIOLENCE ERUPTS Nationwide riots

- 19. 5. SYRIZA AND TSIPRAS COME TO POWER

- 20. 5. SYRIZA AND TSIPRAS COME

- 21. 6. A TENTATIVE RECOVERY UNRAVELS

- 22. 6. A TENTATIVE RECOVERY UNRAVELS

- 23. 7. CASH CRUNCH AND CAPITAL CONTROLS

- 24. 7. CASH CRUNCH AND CAPITAL

- 25. 8. GREECE DEFAULTS AND BAILOUT EXPIRES

- 26. 8. GREECE DEFAULTS AND BAILOUT

- 27. 9. ECONOMY ON BRINK OF COLLAPSE

- 28. 9. ECONOMY ON BRINK OF

- 29. 10. D-DAY

- 30. 10. D-DAY Going by the

- 32. Before the referendum, the Greek people panic.

- 36. A man shouts slogans at

- 37. A distressed pensioner sits on

- 38. An elderly man sells corn

- 39. A security officer tries to

- 40. A pensioner argues with a

- 41. A pensioner is helped by

- 42. Police stand guard outside a

- 43. A notice at a petrol station in Athens reads "No Fuel“.

- 44. People queue to buy groceries at a shop in Athens.

- 45. Butchers wait for customers at the main market in Athens.

- 46. People shop in a supermarket with empty shelves in Athens.

- 47. Women buy cheap clothing at a flea market in Athens.

- 48. A man sells garlic a market in the centre of Athens.

- 49. A man sells second-hand items from the back of a truck in Athens.

- 50. A woman sells lottery tickets

- 51. Workers rest at the entrance

Слайд 1

The Greek tragedy is reaching its climax.

Greek Debt Crisis : Stark

Economic Reality & The Story

Слайд 6

A protester interrupts Angela Merkel as she addresses an audience of

her Christian Democratic Union party members on Saturday.

Слайд 7

No vote supporters hold a banner during celebrations in Athens as

results begin to indicate a clear victory against eurozone austerity measures.

Слайд 10

People celebrate in front of the Greek parliament after the debt

bailout deal was rejected in the referendum.

Слайд 12

Economists and government leaders are sharply divided on the move, not

just because of Greece’s weak industrial base, but also its bloated bureaucracy and widespread tax evasion - “a national sport” with up to €30 billion (S$44.9 billion) per year going uncollected.

Greece seems to prosper. Its per capita GDP more than doubles from US$12,000 in 2000 to US$31,000 in 2008. The government spends heavily on defense, generous pensions and benefits. Civil service salaries double in ten years. The spending, however, is being financed by massive low-interests loans from European governments, banks and bondholders.

Greece seems to prosper. Its per capita GDP more than doubles from US$12,000 in 2000 to US$31,000 in 2008. The government spends heavily on defense, generous pensions and benefits. Civil service salaries double in ten years. The spending, however, is being financed by massive low-interests loans from European governments, banks and bondholders.

1. GREECE JOINS THE EURO IN 2001

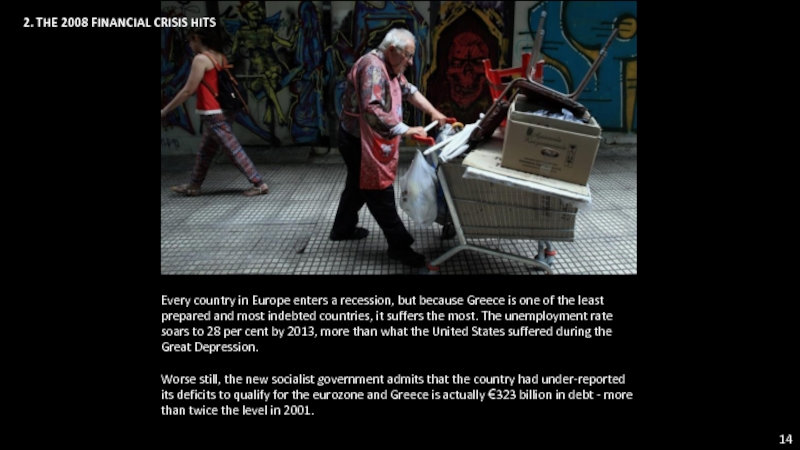

Слайд 14

2. THE 2008 FINANCIAL CRISIS HITS

Every country in Europe enters a

recession, but because Greece is one of the least prepared and most indebted countries, it suffers the most. The unemployment rate soars to 28 per cent by 2013, more than what the United States suffered during the Great Depression.

Worse still, the new socialist government admits that the country had under-reported its deficits to qualify for the eurozone and Greece is actually €323 billion in debt - more than twice the level in 2001.

Worse still, the new socialist government admits that the country had under-reported its deficits to qualify for the eurozone and Greece is actually €323 billion in debt - more than twice the level in 2001.

Слайд 16

3. THE FIRST BAILOUT BEGINS

In May 2010, Prime Minister George Papandreou

signs the first of two bailout packages, agreeing to implement painful spending cuts and higher taxes in return for €110 billion of rescue money.

Two years later, as wages and GDP sink and unemployment rises, Greece’s “troika” of creditors - European Commission, International Monetary Fund and European Central Bank - are forced to come to its rescue again with a larger €130 billion package.

Two years later, as wages and GDP sink and unemployment rises, Greece’s “troika” of creditors - European Commission, International Monetary Fund and European Central Bank - are forced to come to its rescue again with a larger €130 billion package.

Слайд 18

4. VIOLENCE ERUPTS

Nationwide riots and strikes break out as protestors protest

at government cutbacks. Three people are killed when petrol bombs are thrown at a Marfin Egnatia Bank branch on Stadiou street. Papandreou resigns in 2011.

Слайд 20

5. SYRIZA AND TSIPRAS COME TO POWER

The government of Antonis Samaras

collapses after failing to get its presidential candiate elected. A coalition of the radical left led by Syriza Party takes over with new PM Alexis Tsipras promising an end to austerity.

This puts it on an immediate collision course with the country’s creditors with Greece’s bailout programme due to expire at the end of February.

This puts it on an immediate collision course with the country’s creditors with Greece’s bailout programme due to expire at the end of February.

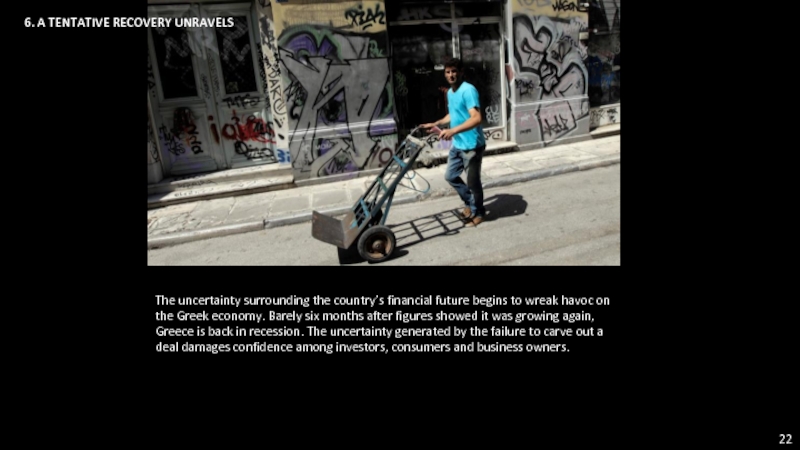

Слайд 22

6. A TENTATIVE RECOVERY UNRAVELS

The uncertainty surrounding the country’s financial future

begins to wreak havoc on the Greek economy. Barely six months after figures showed it was growing again, Greece is back in recession. The uncertainty generated by the failure to carve out a deal damages confidence among investors, consumers and business owners.

Слайд 24

7. CASH CRUNCH AND CAPITAL CONTROLS

After Greeks pull out billions of

euros from their bank accounts and ATMs run dry, Tsipras announces capital controls: Banks are shuttered and long lines form outside ATMS as Greeks are told they can only withdraw up to 60 euros a day, double for pensioners.

Anxious pensioners swarm bank branches and fights break out.

Anxious pensioners swarm bank branches and fights break out.

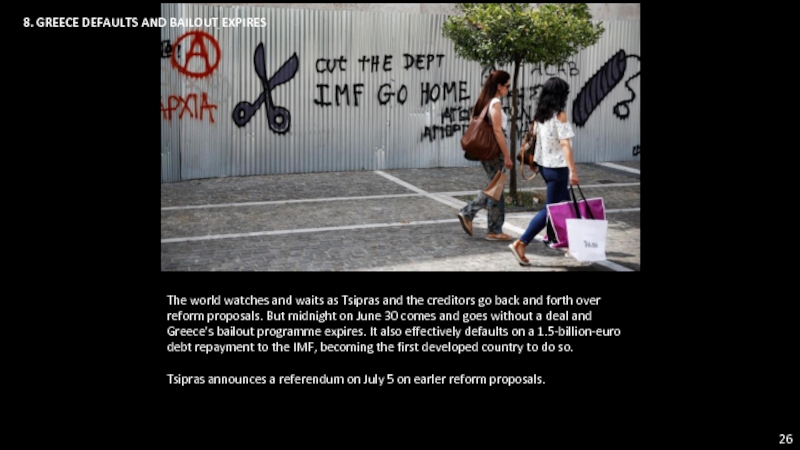

Слайд 26

8. GREECE DEFAULTS AND BAILOUT EXPIRES

The world watches and waits as

Tsipras and the creditors go back and forth over reform proposals. But midnight on June 30 comes and goes without a deal and Greece's bailout programme expires. It also effectively defaults on a 1.5-billion-euro debt repayment to the IMF, becoming the first developed country to do so.

Tsipras announces a referendum on July 5 on earler reform proposals.

Tsipras announces a referendum on July 5 on earler reform proposals.

Слайд 28

9. ECONOMY ON BRINK OF COLLAPSE

As the cash crunch bites, six

businesses a day are forced under. Food, petrol and vital medicine start running out because companies can’t pay their suppliers with bank transfers now banned. Tourism, the mainstay of the Greek economy, is badly hit as some 50,000 holidaymakers cancel their bookings.

Banks meanwhile say they have just €1 billion in cash left - equal to just €90 a head - barely enough to survive the weekend.

Banks meanwhile say they have just €1 billion in cash left - equal to just €90 a head - barely enough to survive the weekend.

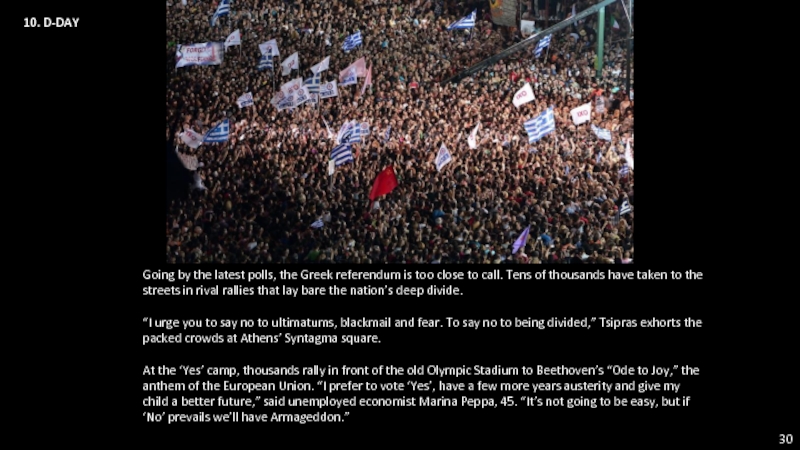

Слайд 30

10. D-DAY

Going by the latest polls, the Greek referendum is too

close to call. Tens of thousands have taken to the streets in rival rallies that lay bare the nation’s deep divide.

“I urge you to say no to ultimatums, blackmail and fear. To say no to being divided,” Tsipras exhorts the packed crowds at Athens’ Syntagma square.

At the ‘Yes’ camp, thousands rally in front of the old Olympic Stadium to Beethoven’s “Ode to Joy,” the anthem of the European Union. “I prefer to vote ‘Yes’, have a few more years austerity and give my child a better future,” said unemployed economist Marina Peppa, 45. “It’s not going to be easy, but if ‘No’ prevails we’ll have Armageddon.”

“I urge you to say no to ultimatums, blackmail and fear. To say no to being divided,” Tsipras exhorts the packed crowds at Athens’ Syntagma square.

At the ‘Yes’ camp, thousands rally in front of the old Olympic Stadium to Beethoven’s “Ode to Joy,” the anthem of the European Union. “I prefer to vote ‘Yes’, have a few more years austerity and give my child a better future,” said unemployed economist Marina Peppa, 45. “It’s not going to be easy, but if ‘No’ prevails we’ll have Armageddon.”

Слайд 36

A man shouts slogans at the police during an anti-austerity protest

calling for a vote of "no" in central Athens, Greece.

Слайд 37

A distressed pensioner sits on the ground outside a national bank

branch, as banks opened only for pensioners to allow them to withdraw their pensions, with a limit of 120 euros, in Thessaloniki.

Слайд 38

An elderly man sells corn in front of the Greek parliament

as people celebrate the result of the referendum.

Слайд 39

A security officer tries to control pensioners as they jostle to

enter a National Bank branch to receive part of their pension, in Iraklio on the island of Crete.

Слайд 40

A pensioner argues with a member of staff as he queues

to enter a National Bank branch to receive part of his pension in Athens.

Слайд 50

A woman sells lottery tickets in front of posters urging a

'No' vote in the referendum, in Thessaloniki.

Слайд 51

Workers rest at the entrance of Athens' main fish market.

7/07/2015 王文堯

Kaohsiung Taiwan R.O.C

All photos were taken from The Guardian,IBT, Straits Times,AP,Internet….etc.

All photos were taken from The Guardian,IBT, Straits Times,AP,Internet….etc.

THE END