Слайд 1Competition and Firm Strategy

Chuck Eesley

Morgenthaler Faculty Fellow

Assistant Professor

Stanford University

Management Science &

Engineering

School of Engineering

cee@stanford.edu

How to be a Monopoly 101

(building a company Warren Buffett would invest in)

Слайд 3Excellent businesses

What are some examples?

What makes them excellent?

In small groups of

3

5-10 minutes

Слайд 4What is a competitive advantage?

Слайд 9Competitive advantage = barriers to entry

With no barriers, must constantly run

firm as efficiently as possible

Слайд 10Competitive advantage

Definition: Something a firm can do that its rivals cannot.

Слайд 12Examples

Moutai vs. Tsingdao

Sina Weibo ? QQ ? Tencent

Ebay ? Alibaba

Shanghai Jahwa

vs. P&G\

Baidu ? Google

Whirlpool ? Qingdao Haier

Hanergy ? Traditional Energy - solar overcapacity

Guangxi Wuzhou Zhongheng Group vs. Pharma firms

YY vs. Google Hangouts

BYD?

Apple vs. Xiaomi

Brand vs. low-cost

Слайд 13Traditional View

Porter’s Five Forces

Long-term, durable competitive advantage

Manufacturing-based

Efficiency-based investments in manufacturing

Use of

capital – quote about profits being all the inventory/equipment vs. cash

Слайд 18Barriers to Entry/Growth

In markets without barriers, competition is intense!

Loss of traditional

sources of competitive advantage

Low cost labor

Protected markets

Government ties (anti-corruption campaign)

Слайд 19Sources of Competitive Advantage

Monopoly

Government ties (关系)

Cost advantage (Chinese manufacturing)

Regulations (Energy, Pharma)

Capital

intensive industry

Brand (Coca-Cola)

Network effects (Microsoft Office)

2-sided networks (Ebay, Facebook, Google, Media companies)

Слайд 20It is better to buy a wonderful business at a fair

price than a fair business at a wonderful price.

Warren Buffett

Слайд 21Categories

Demand competitive advantages

Unequal access to customers

Customer captivity

Search costs

Switching costs

Government support/protection

Cost (supply)

competitive advantages

Superior technology

Patents

Larger scale + declining marginal costs

Special access to information

Слайд 22Competition with Barriers to Entry?

With barriers to entry is life necessarily

all good?

Airlines

Automobiles

Banking

Avoiding competition that leaves every participant worse off is an especially enlightened choice – one that deserves to be called “strategic”.

Слайд 23Sketch of current macro-economic situation

Export/import deficits

Chinese over-capacity in manufacturing

US over-spending

Слайд 25New View

Series of short-term competitive advantages

Could be based on technology, but

not necessary

All strategy is local

Focus on Niche-markets – difficult to dominate global markets

Services-based, retail – focus on one geography

Wal-mart, Grocery stores, Universities

Manufacturing-based – focus on one niche product

Cannot dominate global automobiles in general

Intel – only chips

Nokia ? Apple ? Xiaomi?

Слайд 26Sources of competition

Domestic competitors, same industry

Former employees

Foreign low-cost competition (Africa)

Neighboring industry

competitors (TV/Radio)

New industry competitors

AT&T ? VOIP

Hotels ? Airbnb

Taxi ? Uber

Newspapers/TV ?Social Media)

Слайд 27Adjacent markets

Perilous to chase growth across borders

Dominate a set of discrete,

contiguous markets, expand only at the edges

Example of over-expansion ? Wal-Mart

Слайд 29How to get from here to there? (Tactics)

New market, same product

New

product, same market

Not a bad idea to date before marriage

Internal venturing (intra-preneurship)

Corporate Venture Capital

Joint Venture

Alliances

Investments in VC

Acquisitions

Слайд 30Circle of Competence

Know the boundaries and push them slowly

Industry

Diversification typically hurts

performance

Geography

Wal-mart, Verizon

Product

Apple, Microsoft, Intel

Mode of entrepreneurship/investment

If you have no experience with joint ventures or acquisitions, tread slowly with the first few

Слайд 31Internal Venturing

Great option when it works

Fighting a war on two fronts

sometimes

Слайд 32Corporate Venture Capital

Tough to get right and maintain

Слайд 33The Intangible Element

Strategy must be executed faithfully

This is why company culture

is so important

It is also difficult to change

Слайд 34Trust

The highest form that civilization can reach is a seamless web

of deserved trust – not much procedure, just totally reliable people correctly trusting one another… In your own life what you want is a seamless web of deserved trust. And if your proposed marriage contract has forty-seven pages, I suggest you not enter.”

Charlie Munger (Wesco Financial annual meeting, 2008)

Слайд 35Joint Venture

Reduces risk on both sides

Has been common for Chinese firms

with foreign companies (experience)

Step below an acquisition

Step above an alliance

Other party must bring something to the table

Rotating leadership works best

Слайд 36Alliances

Both parties have to bring something to the table

Another form of

dating before marriage

Слайд 37VC investments

Great way to learn about technologies/new markets

Beware: most VC firms

lose money (only the top 25% make money)

Can be a better idea than CVC

More independence

Might not wind up strategically related

Слайд 38Acquisitions

Goal – but tricky to do well

Only buy businesses whose value

you understand.

Buy businesses for less than they are worth.

Слайд 39Acquisitions

On average acquisitions destroy value for the acquiring firm

Beware:

Paying a premium

for “synergy”

Thrill of an acquisition/enhanced size

Paying in stock - "buyer sells part of itself to acquire seller"

More successful when:

Within circle of competence - Related industry

Experience with acquisitions

Business can raise prices easily and has a high return on capital

Target is either left alone or thoughtfully integrated

Слайд 40Conglomerates that work?

(1) Berkshire would be a diffuse conglomerate, averse only

to activities about which it could not make useful predictions.

(2) Its top company would do almost all business through separately incorporated subsidiaries whose CEOs would operate with very extreme autonomy.

(3) There would be almost nothing at conglomerate headquarters except a tiny office suite containing a Chairman, a CFO, and a few assistants who mostly helped the CFO with auditing, internal control, etc.

(4) Berkshire subsidiaries would always prominently include casualty insurers. Those insurers as a group would be expected to produce, in due course, dependable underwriting gains while also producing substantial “float” (from unpaid insurance liabilities) for investment.

(5) There would be no significant system-wide personnel system, stock option system, other incentive system, retirement system, or the like, because the subsidiaries would have their own systems, often different.

(6) Berkshire’s Chairman would reserve only a few activities for himself.

Then names several activities that Buffett does, mostly limited to managing investments, a lot of reading, and CEO replacements when necessary.

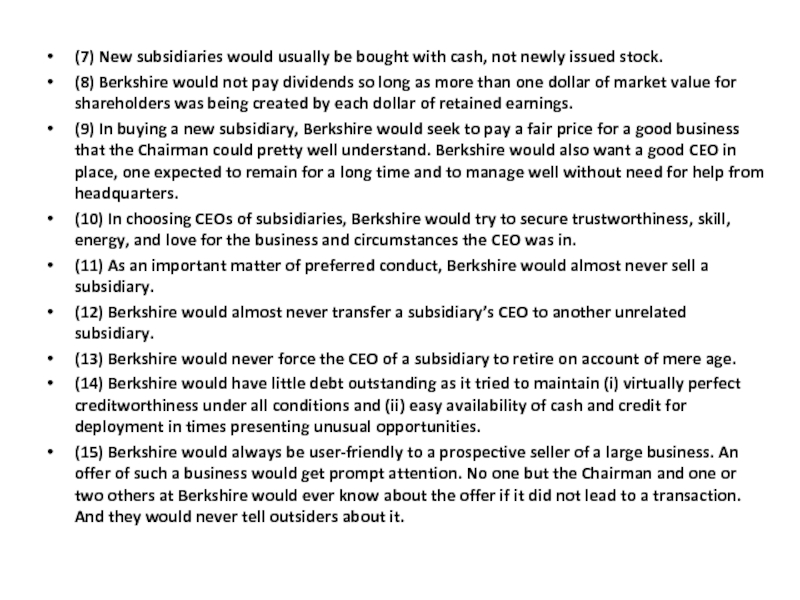

Слайд 41(7) New subsidiaries would usually be bought with cash, not newly

issued stock.

(8) Berkshire would not pay dividends so long as more than one dollar of market value for shareholders was being created by each dollar of retained earnings.

(9) In buying a new subsidiary, Berkshire would seek to pay a fair price for a good business that the Chairman could pretty well understand. Berkshire would also want a good CEO in place, one expected to remain for a long time and to manage well without need for help from headquarters.

(10) In choosing CEOs of subsidiaries, Berkshire would try to secure trustworthiness, skill, energy, and love for the business and circumstances the CEO was in.

(11) As an important matter of preferred conduct, Berkshire would almost never sell a subsidiary.

(12) Berkshire would almost never transfer a subsidiary’s CEO to another unrelated subsidiary.

(13) Berkshire would never force the CEO of a subsidiary to retire on account of mere age.

(14) Berkshire would have little debt outstanding as it tried to maintain (i) virtually perfect creditworthiness under all conditions and (ii) easy availability of cash and credit for deployment in times presenting unusual opportunities.

(15) Berkshire would always be user-friendly to a prospective seller of a large business. An offer of such a business would get prompt attention. No one but the Chairman and one or two others at Berkshire would ever know about the offer if it did not lead to a transaction. And they would never tell outsiders about it.

Слайд 42Metrics

Margins

Turnover

Growth

Earnings growth

Return on capital

Management

ROE

Intrinsic value

Слайд 43Example: MOOCs and Universities

MOOCs as potential disruptive technology

What is the source

of the competitive advantage/moat in academia?

Is this threatened by MOOCs?

Christensen vs. Porter

Debate: Disrupt your own business or use tech to extend your competitive advantage?

Слайд 44Beware the Institutional Imperative

Analogous to Newton’s first law of motion

An institution

(e.g. a business) will resist any change to its current direction

Innovation is a dirty term in organizations

Behavior of peer companies will be mindlessly imitated

Corporate projects will materialize to soak up time (just as work expands to fill available time)

Слайд 45What to avoid

Institutional Imperative

Purportedly strategic moves

Acquiring companies

Entering other markets

Lowering price (by

reducing margins)

Pet projects (risky R&D)

First mover advantage

Everyone else is doing it…

Слайд 46Framework

What business is worth being in?

Monopoly, not commodity (what is the

source of the moat?)

What price is worth paying to be in that business?

Слайд 47Claim:

China would be better off copying Berkshire Hathaway than copying Silicon

Valley.

Charlie Munger (Warran Buffett’s business partner)

Is this true?

Слайд 50Outline – what we covered

Excellent businesses

Strategy

Moats

Circle of Competence

Practical tactics

Beware the Institutional

Imperative

Values

Слайд 51Wisdom acquisition is a moral duty.

- Charlie Munger, USC commencement speech,

2007

Слайд 52Competition and Firm Strategy

Chuck Eesley

Morgenthaler Faculty Fellow

Assistant Professor

Stanford University

Management Science &

Engineering

School of Engineering

cee@stanford.edu

How to be a Monopoly 101

(building a company Warren Buffett would invest in)