- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

5 Reasons Nordstrom Inc Shareholders Should be Optimistic About the Future презентация

Содержание

- 1. 5 Reasons Nordstrom Inc Shareholders Should be Optimistic About the Future

- 2. Rough Third Quarter Nordstrom (NYSE: JWN) reported

- 3. Rough Third Quarter Shares in Nordstrom

- 4. Rough Third Quarter Despite these

- 5. #1: Investing in a connected world Nordstrom

- 6. #2: Expanding Customer Base Nordstrom has been

- 7. #3: Canadian Expansion Nordstrom currently has

- 8. #4: Supply chain, supply chain, supply chain

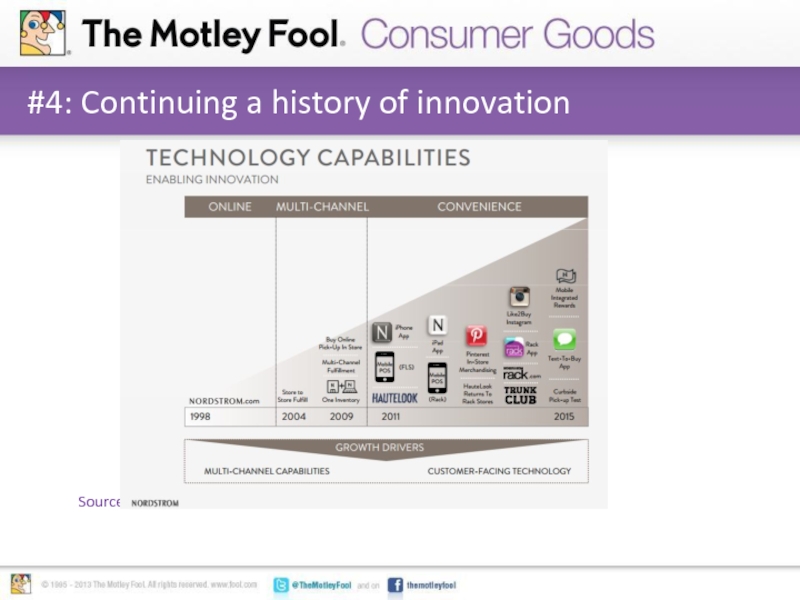

- 9. #4: Continuing a history of innovation

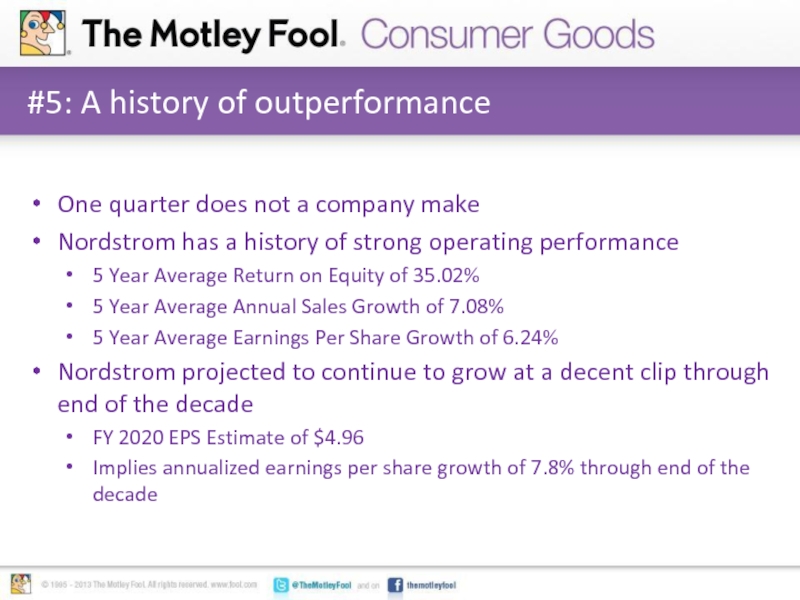

- 10. #5: A history of outperformance One

- 11. Foolish Final Thoughts Disillusioned Nordstrom shareholders need

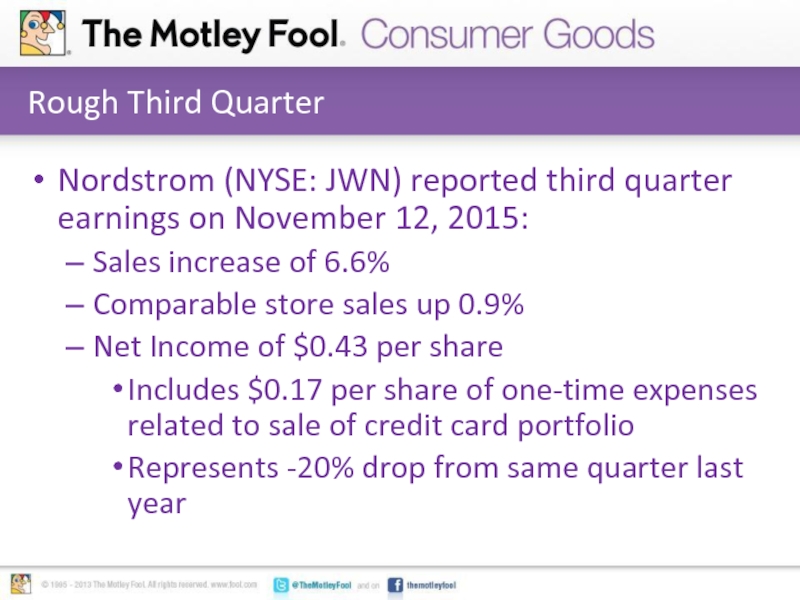

Слайд 2Rough Third Quarter

Nordstrom (NYSE: JWN) reported third quarter earnings on November

12, 2015:

Sales increase of 6.6%

Comparable store sales up 0.9%

Net Income of $0.43 per share

Includes $0.17 per share of one-time expenses related to sale of credit card portfolio

Represents -20% drop from same quarter last year

Sales increase of 6.6%

Comparable store sales up 0.9%

Net Income of $0.43 per share

Includes $0.17 per share of one-time expenses related to sale of credit card portfolio

Represents -20% drop from same quarter last year

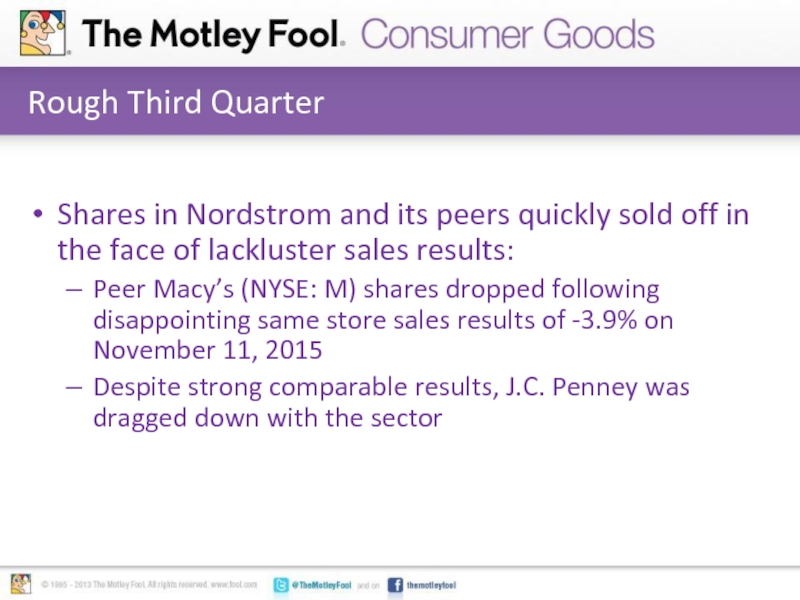

Слайд 3Rough Third Quarter

Shares in Nordstrom and its peers quickly sold off

in the face of lackluster sales results:

Peer Macy’s (NYSE: M) shares dropped following disappointing same store sales results of -3.9% on November 11, 2015

Despite strong comparable results, J.C. Penney was dragged down with the sector

Peer Macy’s (NYSE: M) shares dropped following disappointing same store sales results of -3.9% on November 11, 2015

Despite strong comparable results, J.C. Penney was dragged down with the sector

Слайд 4Rough Third Quarter

Despite these poor quarterly results, Nordstrom has a bright

future. Here’s why.

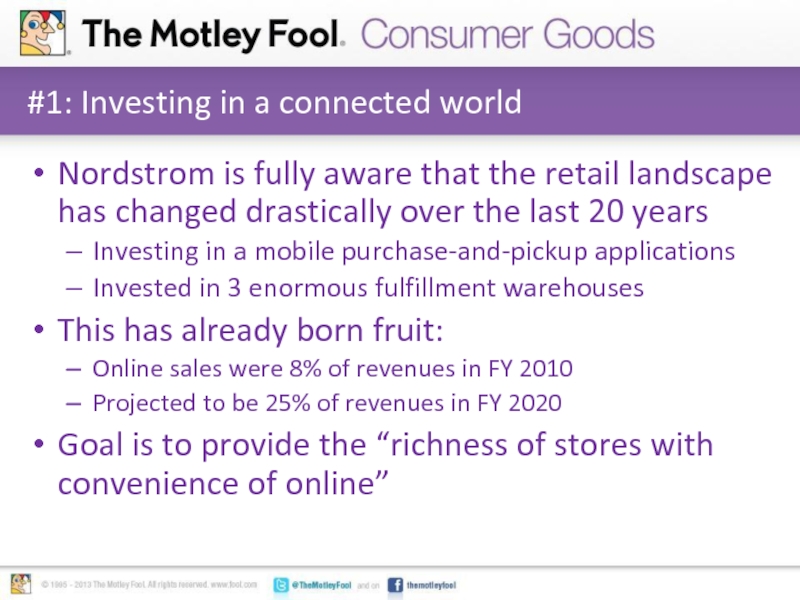

Слайд 5#1: Investing in a connected world

Nordstrom is fully aware that the

retail landscape has changed drastically over the last 20 years

Investing in a mobile purchase-and-pickup applications

Invested in 3 enormous fulfillment warehouses

This has already born fruit:

Online sales were 8% of revenues in FY 2010

Projected to be 25% of revenues in FY 2020

Goal is to provide the “richness of stores with convenience of online”

Investing in a mobile purchase-and-pickup applications

Invested in 3 enormous fulfillment warehouses

This has already born fruit:

Online sales were 8% of revenues in FY 2010

Projected to be 25% of revenues in FY 2020

Goal is to provide the “richness of stores with convenience of online”

Слайд 6#2: Expanding Customer Base

Nordstrom has been successfully expanding beyond traditional department

stores:

Nordstrom Rack, JWN’s off-price chain initiative, continues to exceed expectations:

Has grown from 86 locations in FY 2010 to over 194 today

Expected to grow to over 300 locations by FY 2020

Purchased personalized clothing online retailer “Trunk Club”

Integrating with rest of Nordstrom’s offerings

Nordstrom Rack, JWN’s off-price chain initiative, continues to exceed expectations:

Has grown from 86 locations in FY 2010 to over 194 today

Expected to grow to over 300 locations by FY 2020

Purchased personalized clothing online retailer “Trunk Club”

Integrating with rest of Nordstrom’s offerings

Слайд 7#3: Canadian Expansion

Nordstrom currently has plans to break into Canadian

market in a big way

$1 billion estimated sales potential

Calgar, Ottawa, and Vancouver flagship stores already open

3 stores planned for Toronto in the next year

Early results are extremely positive

Stores already open in Canadian market experienced record-setting openings for any new store opening

$1 billion estimated sales potential

Calgar, Ottawa, and Vancouver flagship stores already open

3 stores planned for Toronto in the next year

Early results are extremely positive

Stores already open in Canadian market experienced record-setting openings for any new store opening

Слайд 8#4: Supply chain, supply chain, supply chain

Nordstrom building up strong fulfillment

capabilities for online purchases

Currently has 3 enormous facilities across U.S.:

Cedar Rapids, IA for full-price order fulfillment

Elizabethtown, PA for full-price order fulfillment

San Bernadino, CA for off-price order fulfillment

Offering free shipping and returns in order to engender customer use and loyalty

Currently has 3 enormous facilities across U.S.:

Cedar Rapids, IA for full-price order fulfillment

Elizabethtown, PA for full-price order fulfillment

San Bernadino, CA for off-price order fulfillment

Offering free shipping and returns in order to engender customer use and loyalty

Слайд 9#4: Continuing a history of innovation

Source: Nordstrom Inc. Investor

Presentation December 7, 2015

Слайд 10#5: A history of outperformance

One quarter does not a company make

Nordstrom

has a history of strong operating performance

5 Year Average Return on Equity of 35.02%

5 Year Average Annual Sales Growth of 7.08%

5 Year Average Earnings Per Share Growth of 6.24%

Nordstrom projected to continue to grow at a decent clip through end of the decade

FY 2020 EPS Estimate of $4.96

Implies annualized earnings per share growth of 7.8% through end of the decade

5 Year Average Return on Equity of 35.02%

5 Year Average Annual Sales Growth of 7.08%

5 Year Average Earnings Per Share Growth of 6.24%

Nordstrom projected to continue to grow at a decent clip through end of the decade

FY 2020 EPS Estimate of $4.96

Implies annualized earnings per share growth of 7.8% through end of the decade

Слайд 11Foolish Final Thoughts

Disillusioned Nordstrom shareholders need not fear

Long term picture is

solid

Nordstrom continues to invest in the future while still operating an exceptional retail operation

Given current P/E of 13.4 and forward growth profile the sky is definitely not falling

Nordstrom continues to invest in the future while still operating an exceptional retail operation

Given current P/E of 13.4 and forward growth profile the sky is definitely not falling