- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Tech M&A Preparing your tech business for sale grantthornton.com/duediligence презентация

Содержание

- 1. Tech M&A Preparing your tech business for sale grantthornton.com/duediligence

- 2. CONGRATULATIONS! You have an offer You've attracted

- 3. The due diligence process The acquirer will

- 4. Issues can lower the price Multiple issues

- 5. Preparation is key Find out what you

- 6. #1: Financial due diligence How robust are

- 7. #2: Tax due diligence Key areas

- 8. #3: IT due diligence Are your IT

- 9. #4: Operational due diligence Can your company

- 10. #5: HR due diligence Will the buyer

- 11. #6: Cultural due diligence Are values and

- 12. Be proactive Every facet of your company’s

- 13. Marc Chiang Partner Transaction Advisory Services Grant

Слайд 3The due diligence process

The acquirer will now look closely

at your

Financials

Operations

Systems

Performance

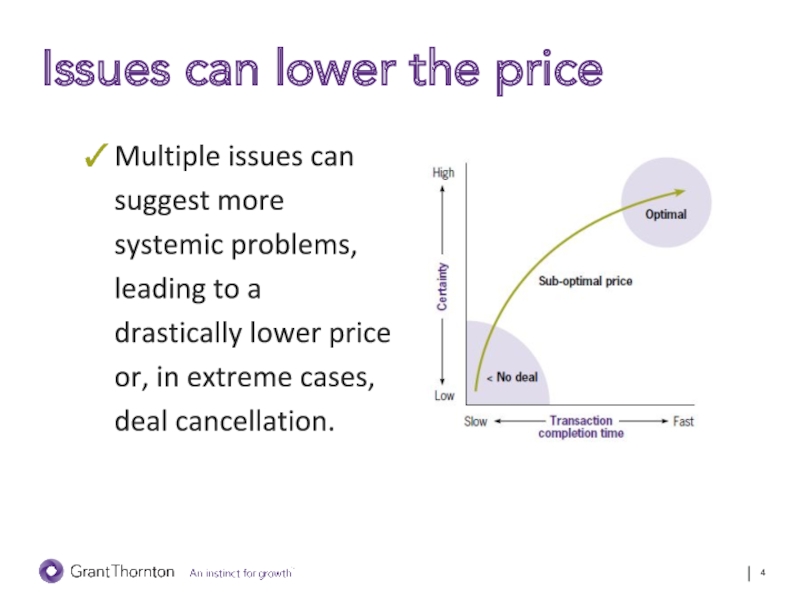

Слайд 4Issues can lower the price

Multiple issues can suggest more systemic problems,

Слайд 5Preparation is key

Find out what you need to know now —

Next up, the 6 critical areas of focus in preparing for acquirer due diligence.

Want to get the big picture? Read the full article>

Слайд 6#1: Financial due diligence

How robust are your financials?

Key areas to consider:

Working

Receivables

Active clients

Sources of value

Financial systems

Accounting methods/policies

TIP: Base your analysis on billings data to show the

tie to financials; properly account for credit memos.

Слайд 7 #2: Tax due diligence

Key areas to consider:

U.S. and foreign income

State and local taxes/Sales tax

Unclaimed R&D tax credits

Accumulated NOLs for federal income tax

Corporate structure and change-in-control agreements

How complete and current are your

tax records?

TIP: Prepare detailed records over a range of years.

Слайд 8#3: IT due diligence

Are your IT infrastructure and systems a potential

integration

Key areas to consider:

Network architecture

Use of cloud services

Information flows

Capacity

TIP: Proactively flag any platforms, functions or strategies that may pose challenges. Read more>

Слайд 9#4: Operational due diligence

Can your company deliver the expected

market value post-acquisition?

Key

Software/intellectual property

Confidentiality policies

Key employees

Documentation

Software release calendar

Mix of direct sales/resellers

TIP: Be prepared to share details on product development, launches and coding.

Слайд 10#5: HR due diligence

Will the buyer be able to retain key

Key areas to consider:

Effective communication

Proactive outreach

Recruiting

Compensation packages

TIP: Identify and communicate with key employees.

Слайд 11#6: Cultural due diligence

Are values and culture a good fit?

Key areas

Communication

Transparency

Inclusion

Download the presentation>

TIP: Identify the key cultural attributes of the acquirer and

seller to highlight commonalities and resolve differences.

Слайд 12Be proactive

Every facet of your company’s operations – the underlying financials

Слайд 13Marc Chiang

Partner

Transaction Advisory Services

Grant Thornton LLP

415.318.2206

marc.chiang@us.gt.com

Steven Perkins

Managing Director

Technology Industry Practice

Grant Thornton

703.637.2830

steven.perkins@us.gt.com

Information

Contacts

Ready to start your own pre-deal due diligence review? Contact Steve or Marc today.