Featuring the stars of the new Vince Vaughn movie – Unfinished Business (and other celebrities)

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Why the Most Important Success Metric in SaaS Is Misleading презентация

Содержание

- 1. Why the Most Important Success Metric in SaaS Is Misleading

- 3. What’s the first metric VCs hunt for in your pitch deck? That’s easy..

- 4. CMRR Committed Monthly Recurring Revenue

- 5. “[CMRR] is the single most important metric

- 6. Ask anyone.

- 7. This is the foundational metric that everyone

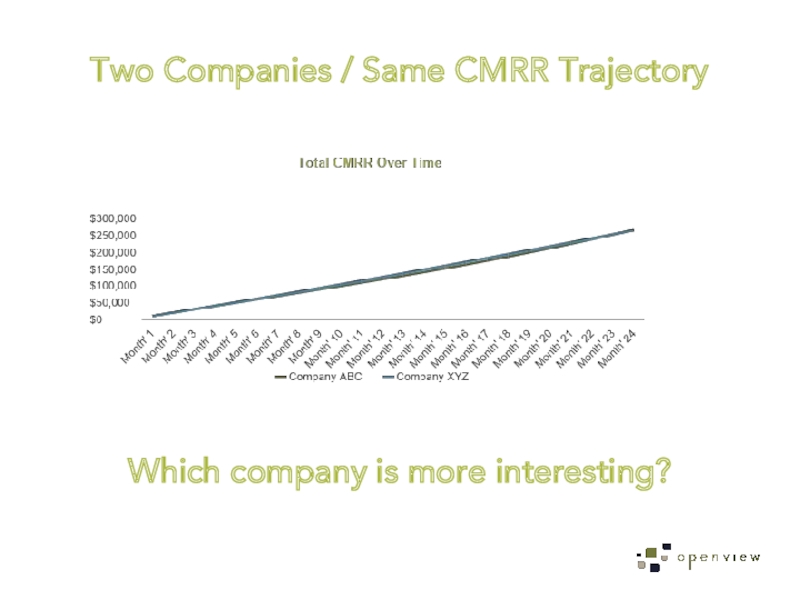

- 9. Two Companies / Same CMRR Trajectory Which company is more interesting?

- 10. It’s not a trick question.

- 11. How does a VC decide which of these two companies to invest in?

- 12. Contrary to popular opinion, it is

- 13. First things first…let’s look at the next level of detail beneath total CMRR growth trajectory

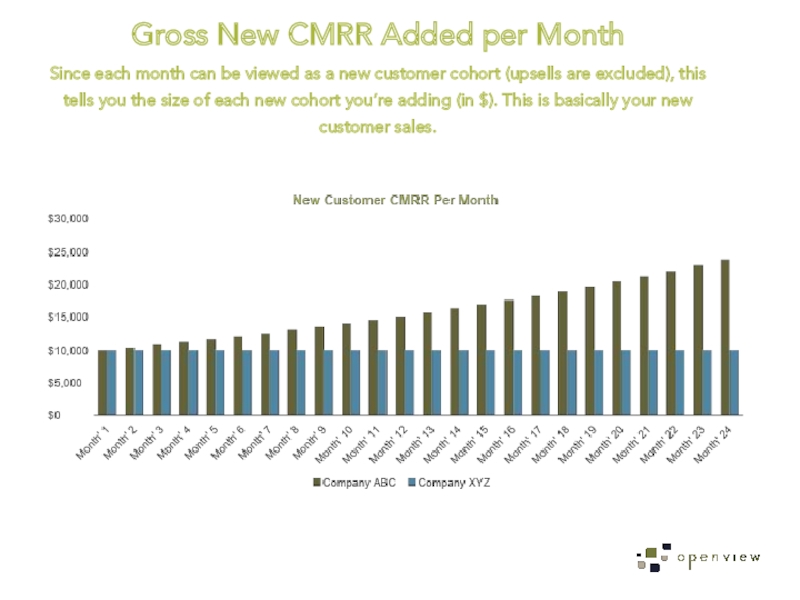

- 14. Gross New CMRR Added per Month Since

- 15. Now which company is interesting? Clearly, ABC.

- 16. I MEAN… THAT GROWTH THO!

- 17. ABC has grown the new cohort size

- 18. THAT GROWTH THOUGH! Wait one second…

- 19. Aren’t these two charts both examining the

- 20. Huh?

- 21. Solving for end-of-month CMRR (1st Chart)

- 22. Let’s look at the inputs: Beginning-of-month CMRR:

- 23. We can conclude…Company ABC has a churn issue.

- 24. What’s the best way to measure churn

- 25. I’ve seen a lot of companies recently

- 26. People call this a leaky bucket

- 27. But… The best companies are seeing

- 28. I know I’m not the Christopher Columbus of negative churn.

- 29. But it’s important

- 30. It can be easy to ignore a leaky bucket early on

- 31. These guys are good They’re growing! Go-to-market is scaling!

- 32. But in comparison

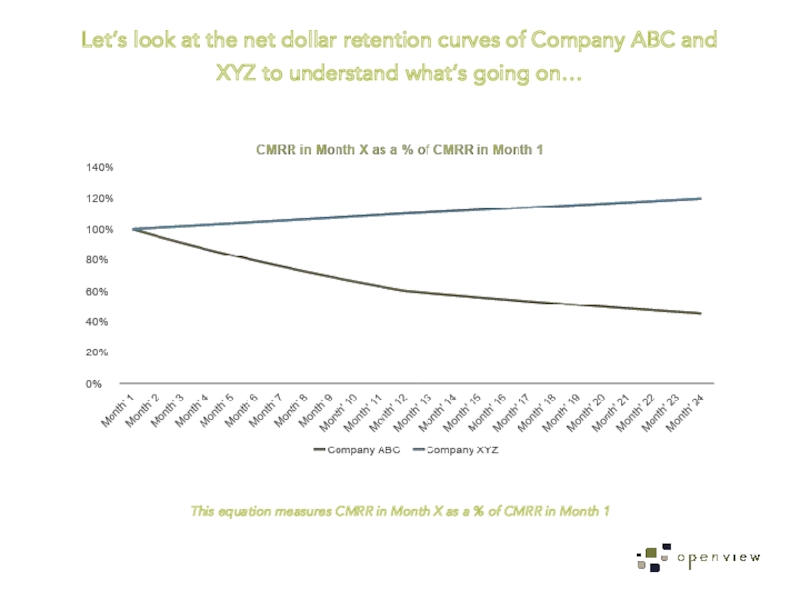

- 33. This equation measures CMRR in Month X

- 34. Wow. This is dramatic.

- 35. And the rose-colored glasses come off

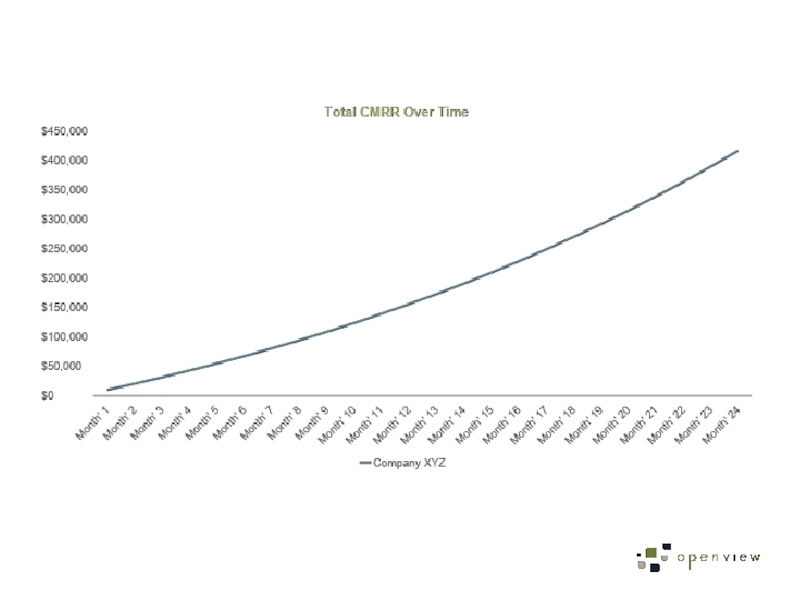

- 36. Let’s assume XYZ is able to scale

- 37. +

- 38. =

- 40. Compared to ABC…

- 42. XYZ pulls away from ABC. XYZ

- 43. Which makes VCs say…

- 44. Let’s invest in XYZ!

- 45. What you need to remember Improving net

- 46. Blake Bartlett OpenView Venture Partners @blakebartlett

Слайд 1

Blake Bartlett

OpenView Venture Partners

@blakebartlett

Why the Most Important

Success Metric in SaaS

Is

Misleading

Слайд 5“[CMRR] is the single most important metric for a Cloud business

to monitor, as the change in CMRR provides the clearest visibility into the health of any Cloud business.”

Bessemer Venture Partners

Laws of Cloud Computing

Bessemer Venture Partners

Laws of Cloud Computing

Слайд 7This is the foundational metric that everyone scours the pitch deck

to find.

But is CMRR growth everything?

Слайд 12

Contrary to popular opinion, it is (a little) more scientific than

a blindfolded dart-throwing contest.

Слайд 13First things first…let’s look at the next level of detail beneath

total CMRR growth trajectory

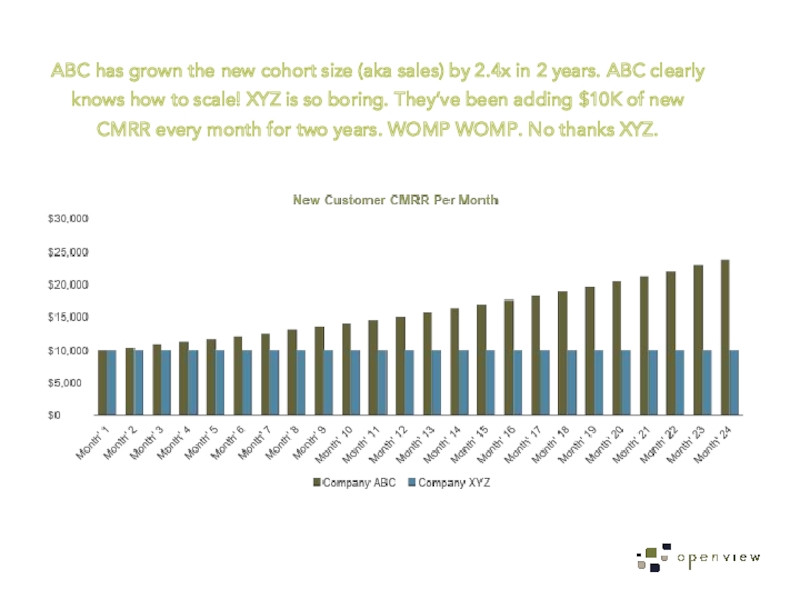

Слайд 14Gross New CMRR Added per Month Since each month can be viewed

as a new customer cohort (upsells are excluded), this tells you the size of each new cohort you’re adding (in $). This is basically your new customer sales.

Слайд 17ABC has grown the new cohort size (aka sales) by 2.4x

in 2 years. ABC clearly knows how to scale! XYZ is so boring. They’ve been adding $10K of new CMRR every month for two years. WOMP WOMP. No thanks XYZ.

Слайд 19Aren’t these two charts both examining the same two companies?

Identical on

one chart →

Completely different on other →

Completely different on other →

Слайд 21

Solving for end-of-month CMRR (1st Chart) is pretty simple arithmetic.

End-of-Month CMRR

=

Beginning-of-month CMRR + New Customer CMRR + Upsell CMRR - Downgrade CMRR - Churned CMRR.

Beginning-of-month CMRR + New Customer CMRR + Upsell CMRR - Downgrade CMRR - Churned CMRR.

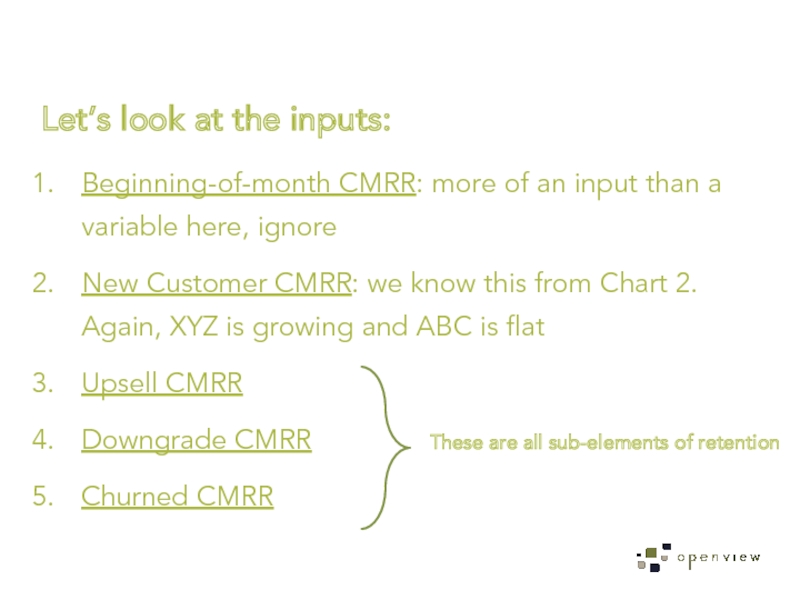

Слайд 22Let’s look at the inputs:

Beginning-of-month CMRR: more of an input than

a variable here, ignore

New Customer CMRR: we know this from Chart 2. Again, XYZ is growing and ABC is flat

Upsell CMRR

Downgrade CMRR

Churned CMRR

New Customer CMRR: we know this from Chart 2. Again, XYZ is growing and ABC is flat

Upsell CMRR

Downgrade CMRR

Churned CMRR

These are all sub-elements of retention

Слайд 24What’s the best way to measure churn and benchmark against other

SaaS companies?

Net dollar retention.

If I acquire $1 of CMRR today, what is that $1 worth over time?

Слайд 25I’ve seen a lot of companies recently with strong CMRR growth But

weak net dollar retention – with $1 of CMRR shrinking to 40-50¢ within 12 months

Слайд 27But… The best companies are seeing that $1 grow (not shrink) over

time.

Welcome to net negative churn.

Слайд 33This equation measures CMRR in Month X as a % of

CMRR in Month 1

Let’s look at the net dollar retention curves of Company ABC and XYZ to understand what’s going on…

Слайд 36Let’s assume XYZ is able to scale its go-to-market like ABC.

Which will give us a true apples-to-apples comparison

Слайд 42XYZ pulls away from ABC. XYZ is now ~58% bigger than ABC. All

thanks to superior net dollar retention.

Слайд 45What you need to remember

Improving net dollar retention gives you much

more leverage on the go-to-market front.

The 1-2 punch of accelerating customer acquisition and healthy retention is the magic formula for exponential growth and lots of VC love.

The 1-2 punch of accelerating customer acquisition and healthy retention is the magic formula for exponential growth and lots of VC love.

Слайд 46

Blake Bartlett

OpenView Venture Partners

@blakebartlett

You can find more content on

expansion-stage growth at

www.openviewpartners.com

Thanks!

Thanks!

![“[CMRR] is the single most important metric for a Cloud business to monitor, as the](/img/tmb/2/137430/19549503307b89f15946c7ec5b1262c1-800x.jpg)