- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The Evolution of Residential Solar Financing презентация

Содержание

- 1. The Evolution of Residential Solar Financing

- 2. Solar is expensive, so adoption was slow

- 3. Along came the solar lease Leases allowed

- 4. SolarCity takes the lease and runs SolarCity

- 5. Lease now dominates solar financing In part

- 6. What does the future look like?

- 7. Loans will grow in importance The lease

- 8. Will crowdfunding be a key? Mosaic and

- 9. Future looks much like buying a car

- 10. The players you need to know in

- 11. There’s an energy boom happening in the

Слайд 2Solar is expensive, so adoption was slow

Installing solar panels on a

In 2007, Sunrun launched the first solar lease, which brought down initial costs to as little as $0 and cut costs into manageable monthly payments.

Over time, companies like SolarCity, Clean Power Finance, and SunPower became big players in the solar lease, expanding installations and lowering costs along the way.

Investors also became more comfortable with the lease, now supplying hundreds of millions of dollars in tax equity financing to the industry.

As costs fall, will the lease stay the dominant financing method, or will homeowners want to own their systems?

The answer may define who creates value in the future of residential solar.

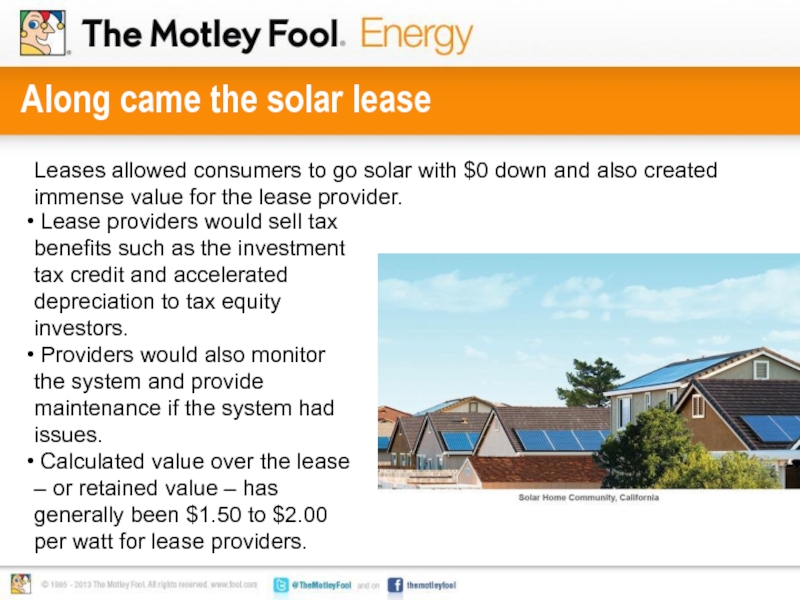

Слайд 3Along came the solar lease

Leases allowed consumers to go solar with

Lease providers would sell tax benefits such as the investment tax credit and accelerated depreciation to tax equity investors.

Providers would also monitor the system and provide maintenance if the system had issues.

Calculated value over the lease – or retained value – has generally been $1.50 to $2.00 per watt for lease providers.

Слайд 4SolarCity takes the lease and runs

SolarCity quickly took the industry by

SolarCity has signed nearly 50,000 new customer contracts in the past year.

Management has set a goal of 1 million solar customers by 2018.

The company has $2.5 billion in payments under contract and an estimated retained value of $1.3 billion.

Слайд 5Lease now dominates solar financing

In part because of SolarCity’s dominance, the

The share of residential systems built under solar leases ballooned from 42% in 2011 to a projected 68% in 2014.

Until recently, few other financing options were available to homeowners, except leases or paying out of pocket with cash.

Слайд 6What does the future look like?

New financing methods are starting

SunPower recently signed a $200 million financing deal with Admirals Bank that will increase its loan offerings.

Mosaic is now offering a crowdsourced solar loan in California that comes with an operating and maintenance plan from Enphase.

Loans are primarily given as personal loans, but in the future they can be securitized by the solar system itself, or by the home.

Like leases, as investors become more comfortable with how loans are structured and securitized and with the reliability of payments, there will be more offerings at lower rates.

Слайд 7Loans will grow in importance

The lease dominates the market today, but

GTM Research predicts that the share of the market that leases solar will peak in 2014 and fall to 63% in 2018.

Leases have also been found to hinder home sales to new buyers.

One the cash/loan side, a study by the Lawrence Berkeley National Laboratory finds that an owned solar system adds $25,000 in value to a home.

Слайд 8Will crowdfunding be a key?

Mosaic and Enphase recently announced a partnership

Mosaic will instantly fund a designed solar system after a credit check and will create a long-term (20-year) loan.

An operating and maintenance plan through Enphase will be offered as part of the package.

SolarCity has also looked into using crowdfunding through an online system that would allow small investors in a pool of residential solar assets.

Crowdfunding could be a key to cutting a lengthy approval process and keeping interest rates low for homeowners.

Слайд 9Future looks much like buying a car

At the end of the

Cash, leases, and loans will be available to homeowners.

Some buyers will put a premium on owning their solar system, especially if leases are found to negatively affect home value in the long term.

Operating and maintenance (similar to warranties in auto) will see increased availability through loans, currently available only with leases.

I think that in the long term, leases will trend toward the 20% market share currently seen in the auto industry.

Слайд 10The players you need to know in solar financing

In residential solar,

SolarCity is the biggest player in residential solar, installing 67 MW in Q1. The company had a 29% market share in Q2, according to GTM Research.

SunPower installed 35 MW through third-party installers.

Enphase Energy is one of the largest inverter suppliers to residential solar and is now doing O&M for Mosaic, a new offering for the company.