- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Retail Cities Asia Pacific The Dynamic Food and Beverage Scene презентация

Содержание

- 1. Retail Cities Asia Pacific The Dynamic Food and Beverage Scene

- 2. Bangkok Note: Auckland Retail refers to

- 3. Note: Bangkok Retail refers to shopping centres,

- 4. Note:Beijing Retail refers to shopping centres, Wangfujing

- 5. Note: Delhi Retail refers to shopping centres,

- 6. Note: Guangzhou Retail refers to shopping centres,

- 7. Note: Hong Kong Retail refers to shopping

- 8. Note: Jakarta retail refers to shopping centres,

- 9. Note: Melbourne retail refers to shopping centres,

- 10. Note: Mumbai retail refers to shopping centres,

- 11. Note: Seoul retail refers to High Street,

- 12. Note: Shanghai retail refers to shopping centres,

- 13. Note: Singapore retail refers to shopping centres,

- 14. Note: Sydney retail refers to shopping centres,

- 15. Note: Tokyo retail refers to High Streets,

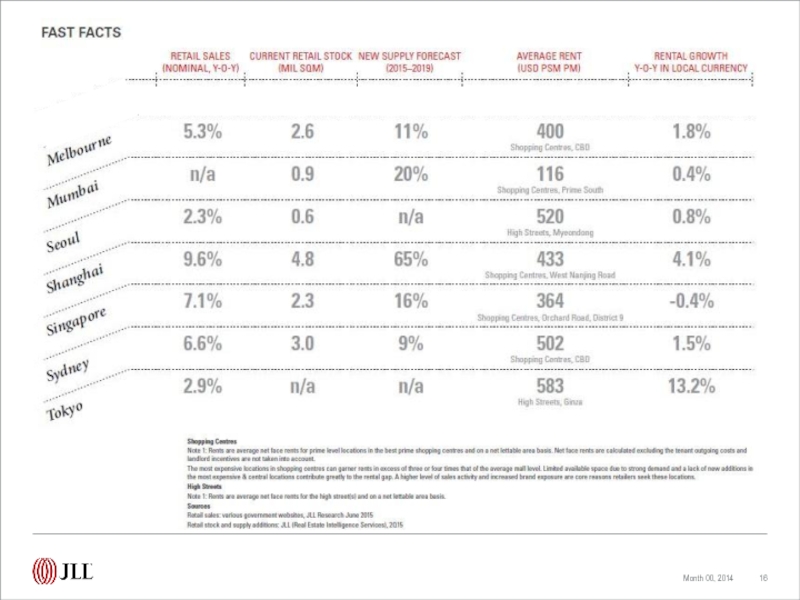

- 16. Month 00, 2014

- 17. Month 00, 2014

- 18. Thank you

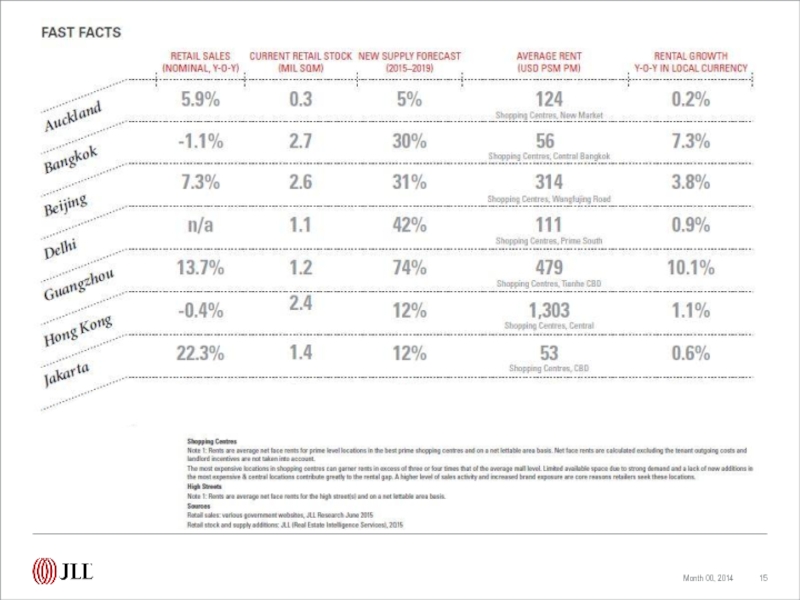

Слайд 2Bangkok

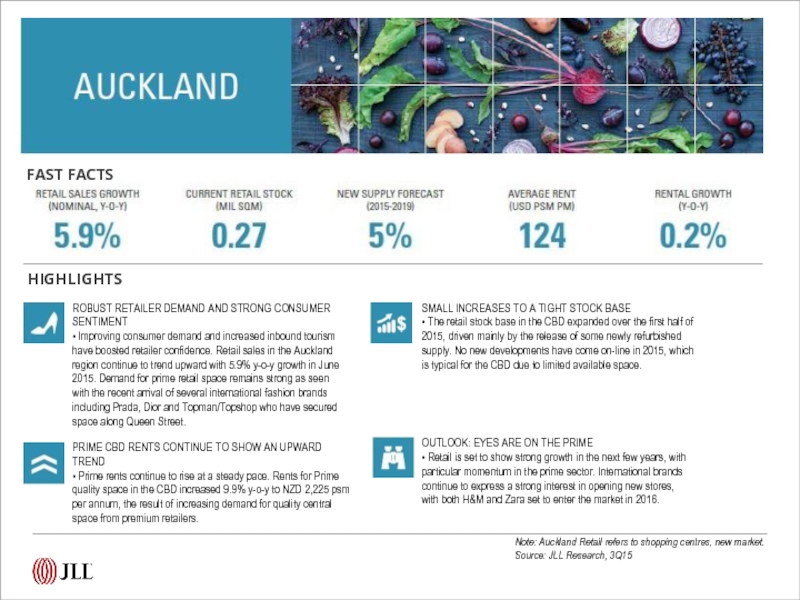

Note: Auckland Retail refers to shopping centres, new market.

Source: JLL

FAST

FACTS

HIGHLIGHTS

FAST FACTS

ROBUST RETAILER DEMAND AND STRONG CONSUMER

SENTIMENT

• Improving consumer demand and increased inbound tourism

have boosted retailer confidence. Retail sales in the Auckland

region continue to trend upward with 5.9% y-o-y growth in June

2015. Demand for prime retail space remains strong as seen

with the recent arrival of several international fashion brands

including Prada, Dior and Topman/Topshop who have secured

space along Queen Street.

PRIME CBD RENTS CONTINUE TO SHOW AN UPWARD

TREND

• Prime rents continue to rise at a steady pace. Rents for Prime

quality space in the CBD increased 9.9% y-o-y to NZD 2,225 psm

per annum, the result of increasing demand for quality central

space from premium retailers.

SMALL INCREASES TO A TIGHT STOCK BASE

• The retail stock base in the CBD expanded over the first half of

2015, driven mainly by the release of some newly refurbished

supply. No new developments have come on-line in 2015, which

is typical for the CBD due to limited available space.

OUTLOOK: EYES ARE ON THE PRIME

• Retail is set to show strong growth in the next few years, with

particular momentum in the prime sector. International brands

continue to express a strong interest in opening new stores,

with both H&M and Zara set to enter the market in 2016.

Слайд 3Note: Bangkok Retail refers to shopping centres, Central Bangkok.

Source: JLL Research,

HIGHLIGHTS

FAST FACTS

MALL RENOVATIONS IMPROVE COMPETITIVENESS

• Demand for prime retail space remained strong, and only

a handful of shopping centres performed poorly in 2Q15.

International brands continued to show a strong interest in

opening new stores, with 41 high-profile retailers opening

at EmQuartier, and six brand retailers opening at the newly

renovated The Emporium.

RENTS RISE AMID STRONG INTERNATIONAL LEASING

DEMAND

• As international retailers expanded their presence in Bangkok

and domestic demand remained robust, average prime rents

increased by 1.7% q-o-q, to THB 2,418 per sqm per month.

Capital values rose slightly less than rents, at 1.6% q-o-q,

causing market yields to expand marginally.

SIAM DISCOVERY CLOSES FOR RENOVATION

• Siam Discovery closed for renovation, resulting in the

temporary withdrawal of 26,500 sqm of leaseable space. The

pre-commitment rate at recently opened centres was high, but

the prime vacancy rate increased to 6.3% due to the ongoing

renovation of Central Plaza Pinklao and a handful of poorperforming

malls.

OUTLOOK: PRIME NEW SUPPLY WITH HIGH PRECOMMITMENTS

• Three prime projects, Central Plaza Westgate, Central Festival

East Ville and Zpell, plus three centres under refurbishment

should be completed by 1Q16, adding 305,000 sqm of retail

space. Vacancy rates may fluctuate, but strong leasing activity

plus high pre-commitment rates in the new and refurbished

malls should push rents and capital values higher. Market yields

should remain fairly stable.

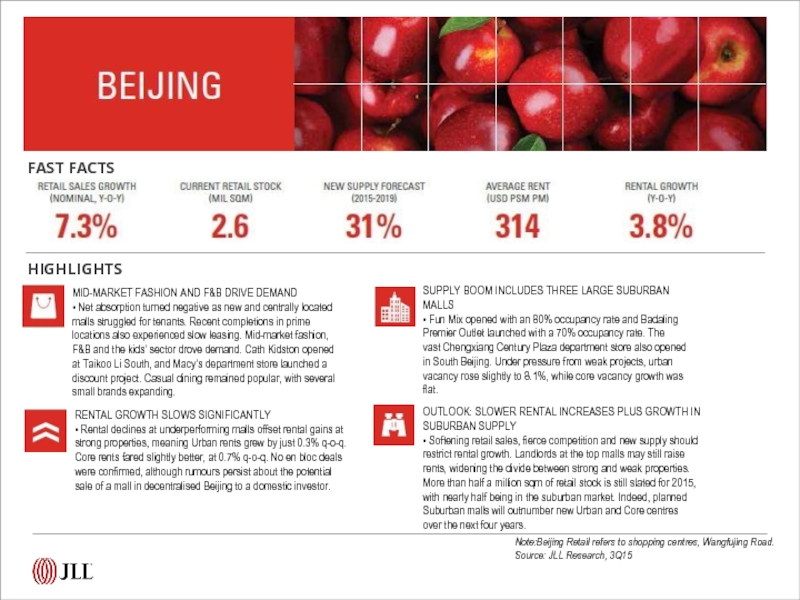

Слайд 4Note:Beijing Retail refers to shopping centres, Wangfujing Road.

Source: JLL Research, 3Q15

HIGHLIGHTS

FAST

MID-MARKET FASHION AND F&B DRIVE DEMAND

• Net absorption turned negative as new and centrally located

malls struggled for tenants. Recent completions in prime

locations also experienced slow leasing. Mid-market fashion,

F&B and the kids’ sector drove demand. Cath Kidston opened

at Taikoo Li South, and Macy’s department store launched a

discount project. Casual dining remained popular, with several

small brands expanding.

RENTAL GROWTH SLOWS SIGNIFICANTLY

• Rental declines at underperforming malls offset rental gains at

strong properties, meaning Urban rents grew by just 0.3% q-o-q.

Core rents fared slightly better, at 0.7% q-o-q. No en bloc deals

were confirmed, although rumours persist about the potential

sale of a mall in decentralised Beijing to a domestic investor.

SUPPLY BOOM INCLUDES THREE LARGE SUBURBAN

MALLS

• Fun Mix opened with an 80% occupancy rate and Badaling

Premier Outlet launched with a 70% occupancy rate. The

vast Chengxiang Century Plaza department store also opened

in South Beijing. Under pressure from weak projects, urban

vacancy rose slightly to 8.1%, while core vacancy growth was

flat.

OUTLOOK: SLOWER RENTAL INCREASES PLUS GROWTH IN

SUBURBAN SUPPLY

• Softening retail sales, fierce competition and new supply should

restrict rental growth. Landlords at the top malls may still raise

rents, widening the divide between strong and weak properties.

More than half a million sqm of retail stock is still slated for 2015,

with nearly half being in the suburban market. Indeed, planned

Suburban malls will outnumber new Urban and Core centres

over the next four years.

Слайд 5Note: Delhi Retail refers to shopping centres, Prime South

Source: JLL Research,

HIGHLIGHTS

FAST FACTS

RETAILER EXITS AND STORE CLOSURES OVERSHADOW

LEASING ACTIVITY

• Global and domestic retailers are waiting for space in premium

malls, which is restricting leasing activity. Prime South, where

Gap recently debuted in India, remains the submarket of choice

for big brands and it enjoyed positive net absorption in 2Q15.

Prime Others and Suburbs saw more retailer exits and store

closures.

RENTS AND CAPITAL VALUES RISE MARGINALLY

• Strong performing malls in Prime Others recorded an increase

in rents after three quarters of holding stable, but retailers

continued to enjoy the upper hand in negotiations. A lack of

quality assets for sale continues to restrict investment activity.

NO NEW COMPLETIONS

• Except for select under-construction projects, most shopping

centre developments are struggling with weak retailer interest

and construction delays. Vacancy rose slightly to 24.5%, q-o-q,

with Prime Others recording the highest increase.

OUTLOOK: HIGH-QUALITY SUPPLY WITH HEALTHY PRECOMMITMENTS

• High-quality upcoming projects count healthy pre-commitments

and should improve absorption volumes. Increased expansion

activity by hypermarkets, multiplexes, F&B outlets and global

retailers is projected, but bricks-and-mortar retailers must

consider strengthening competition from online retailers when

planning growth strategies.

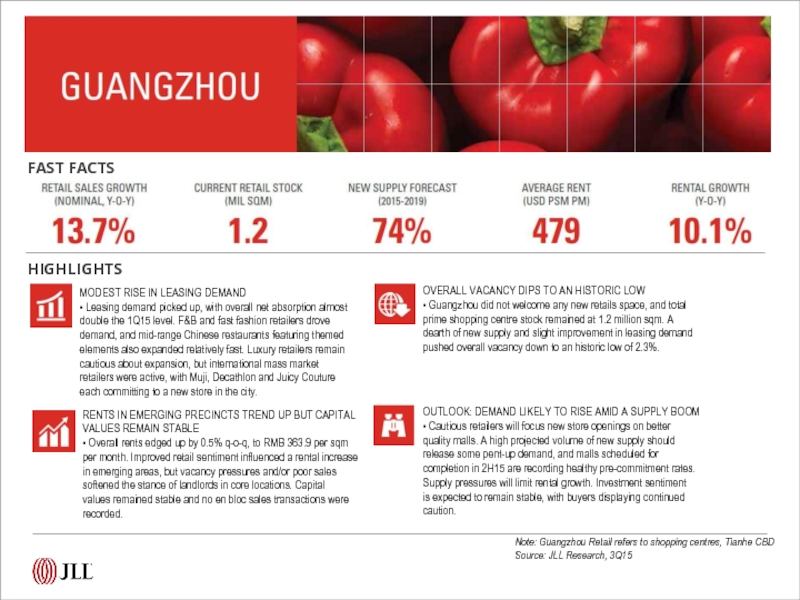

Слайд 6Note: Guangzhou Retail refers to shopping centres, Tianhe CBD

Source: JLL Research,

HIGHLIGHTS

FAST FACTS

MODEST RISE IN LEASING DEMAND

• Leasing demand picked up, with overall net absorption almost

double the 1Q15 level. F&B and fast fashion retailers drove

demand, and mid-range Chinese restaurants featuring themed

elements also expanded relatively fast. Luxury retailers remain

cautious about expansion, but international mass market

retailers were active, with Muji, Decathlon and Juicy Couture

each committing to a new store in the city.

RENTS IN EMERGING PRECINCTS TREND UP BUT CAPITAL

VALUES REMAIN STABLE

• Overall rents edged up by 0.5% q-o-q, to RMB 363.9 per sqm per month. Improved retail sentiment influenced a rental increase

in emerging areas, but vacancy pressures and/or poor sales

softened the stance of landlords in core locations. Capital

values remained stable and no en bloc sales transactions were

recorded.

OVERALL VACANCY DIPS TO AN HISTORIC LOW

• Guangzhou did not welcome any new retails space, and total

prime shopping centre stock remained at 1.2 million sqm. A

dearth of new supply and slight improvement in leasing demand

pushed overall vacancy down to an historic low of 2.3%.

OUTLOOK: DEMAND LIKELY TO RISE AMID A SUPPLY BOOM

• Cautious retailers will focus new store openings on better

quality malls. A high projected volume of new supply should

release some pent-up demand, and malls scheduled for

completion in 2H15 are recording healthy pre-commitment rates.

Supply pressures will limit rental growth. Investment sentiment

is expected to remain stable, with buyers displaying continued

caution.

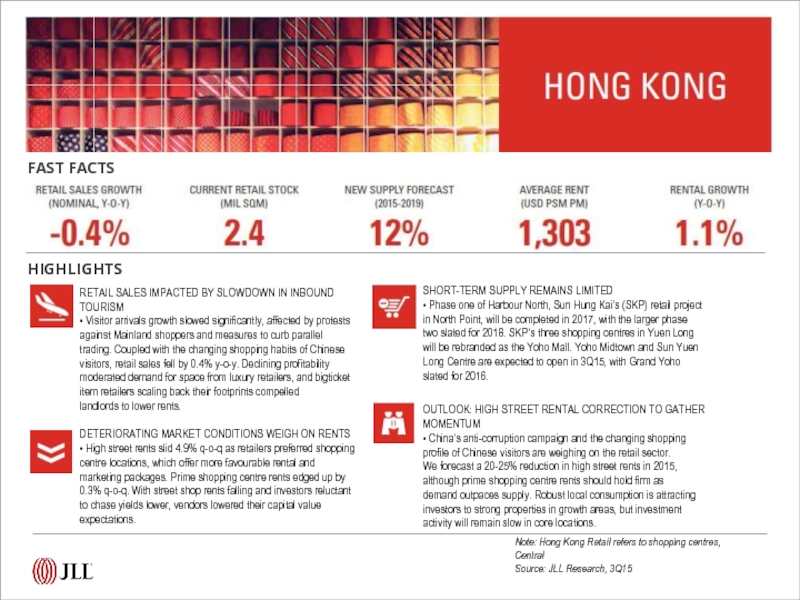

Слайд 7Note: Hong Kong Retail refers to shopping centres, Central

Source: JLL Research,

HIGHLIGHTS

FAST FACTS

RETAIL SALES IMPACTED BY SLOWDOWN IN INBOUND

TOURISM

• Visitor arrivals growth slowed significantly, affected by protests

against Mainland shoppers and measures to curb parallel

trading. Coupled with the changing shopping habits of Chinese

visitors, retail sales fell by 0.4% y-o-y. Declining profitability

moderated demand for space from luxury retailers, and bigticket

item retailers scaling back their footprints compelled

landlords to lower rents.

DETERIORATING MARKET CONDITIONS WEIGH ON RENTS

• High street rents slid 4.9% q-o-q as retailers preferred shopping

centre locations, which offer more favourable rental and

marketing packages. Prime shopping centre rents edged up by

0.3% q-o-q. With street shop rents falling and investors reluctant

to chase yields lower, vendors lowered their capital value

expectations.

SHORT-TERM SUPPLY REMAINS LIMITED

• Phase one of Harbour North, Sun Hung Kai’s (SKP) retail project

in North Point, will be completed in 2017, with the larger phase

two slated for 2018. SKP’s three shopping centres in Yuen Long

will be rebranded as the Yoho Mall. Yoho Midtown and Sun Yuen

Long Centre are expected to open in 3Q15, with Grand Yoho

slated for 2016.

OUTLOOK: HIGH STREET RENTAL CORRECTION TO GATHER

MOMENTUM

• China’s anti-corruption campaign and the changing shopping

profile of Chinese visitors are weighing on the retail sector.

We forecast a 20-25% reduction in high street rents in 2015,

although prime shopping centre rents should hold firm as

demand outpaces supply. Robust local consumption is attracting

investors to strong properties in growth areas, but investment

activity will remain slow in core locations.

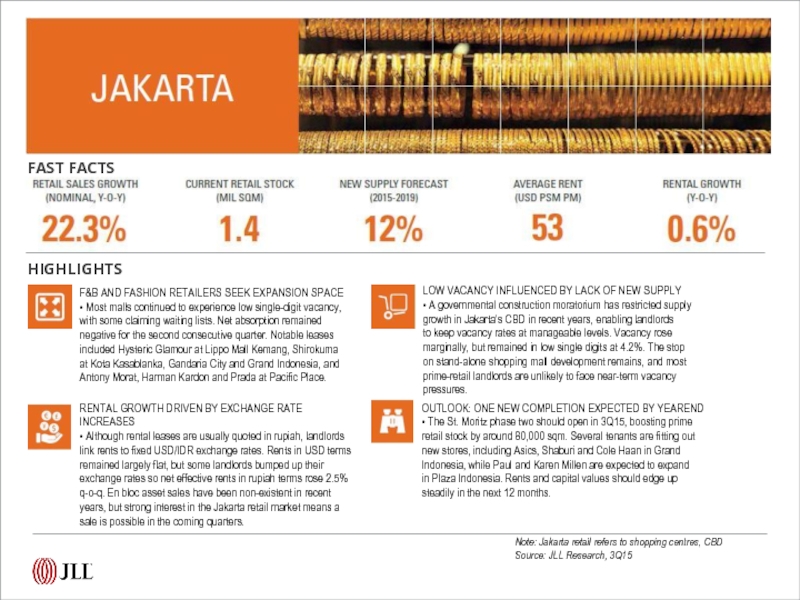

Слайд 8Note: Jakarta retail refers to shopping centres, CBD

Source: JLL Research, 3Q15

HIGHLIGHTS

FAST

F&B AND FASHION RETAILERS SEEK EXPANSION SPACE

• Most malls continued to experience low single-digit vacancy,

with some claiming waiting lists. Net absorption remained

negative for the second consecutive quarter. Notable leases

included Hysteric Glamour at Lippo Mall Kemang, Shirokuma

at Kota Kasablanka, Gandaria City and Grand Indonesia, and

Antony Morat, Harman Kardon and Prada at Pacific Place.

RENTAL GROWTH DRIVEN BY EXCHANGE RATE INCREASES

• Although rental leases are usually quoted in rupiah, landlords

link rents to fixed USD/IDR exchange rates. Rents in USD terms

remained largely flat, but some landlords bumped up their

exchange rates so net effective rents in rupiah terms rose 2.5%

q-o-q. En bloc asset sales have been non-existent in recent

years, but strong interest in the Jakarta retail market means a

sale is possible in the coming quarters.

LOW VACANCY INFLUENCED BY LACK OF NEW SUPPLY

• A governmental construction moratorium has restricted supply

growth in Jakarta’s CBD in recent years, enabling landlords

to keep vacancy rates at manageable levels. Vacancy rose

marginally, but remained in low single digits at 4.2%. The stop

on stand-alone shopping mall development remains, and most

prime-retail landlords are unlikely to face near-term vacancy

pressures.

OUTLOOK: ONE NEW COMPLETION EXPECTED BY YEAREND

• The St. Moritz phase two should open in 3Q15, boosting prime

retail stock by around 80,000 sqm. Several tenants are fitting out

new stores, including Asics, Shaburi and Cole Haan in Grand

Indonesia, while Paul and Karen Millen are expected to expand

in Plaza Indonesia. Rents and capital values should edge up

steadily in the next 12 months.

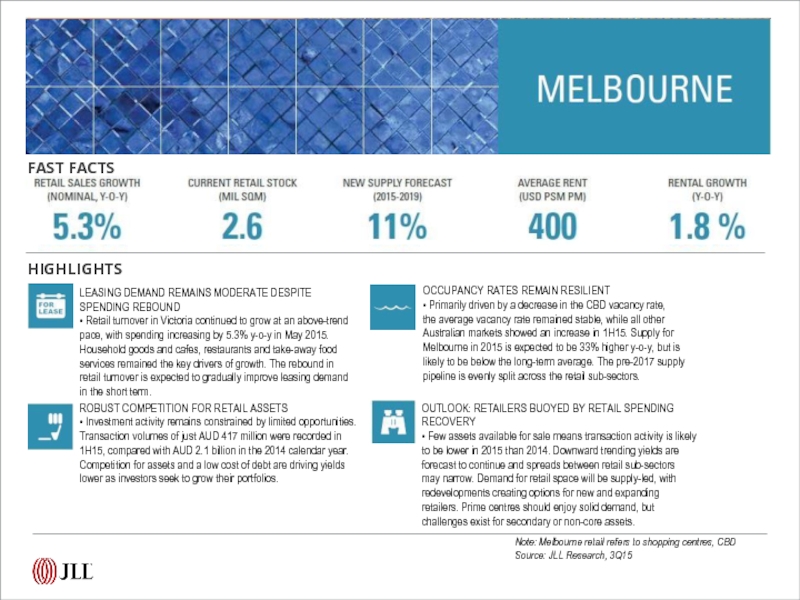

Слайд 9Note: Melbourne retail refers to shopping centres, CBD

Source: JLL Research, 3Q15

HIGHLIGHTS

FAST

LEASING DEMAND REMAINS MODERATE DESPITE

SPENDING REBOUND

• Retail turnover in Victoria continued to grow at an above-trend

pace, with spending increasing by 5.3% y-o-y in May 2015.

Household goods and cafes, restaurants and take-away food

services remained the key drivers of growth. The rebound in

retail turnover is expected to gradually improve leasing demand

in the short term.

ROBUST COMPETITION FOR RETAIL ASSETS

• Investment activity remains constrained by limited opportunities.

Transaction volumes of just AUD 417 million were recorded in

1H15, compared with AUD 2.1 billion in the 2014 calendar year.

Competition for assets and a low cost of debt are driving yields

lower as investors seek to grow their portfolios.

OCCUPANCY RATES REMAIN RESILIENT

• Primarily driven by a decrease in the CBD vacancy rate,

the average vacancy rate remained stable, while all other

Australian markets showed an increase in 1H15. Supply for

Melbourne in 2015 is expected to be 33% higher y-o-y, but is

likely to be below the long-term average. The pre-2017 supply

pipeline is evenly split across the retail sub-sectors.

OUTLOOK: RETAILERS BUOYED BY RETAIL SPENDING

RECOVERY

• Few assets available for sale means transaction activity is likely

to be lower in 2015 than 2014. Downward trending yields are

forecast to continue and spreads between retail sub-sectors

may narrow. Demand for retail space will be supply-led, with

redevelopments creating options for new and expanding

retailers. Prime centres should enjoy solid demand, but

challenges exist for secondary or non-core assets.

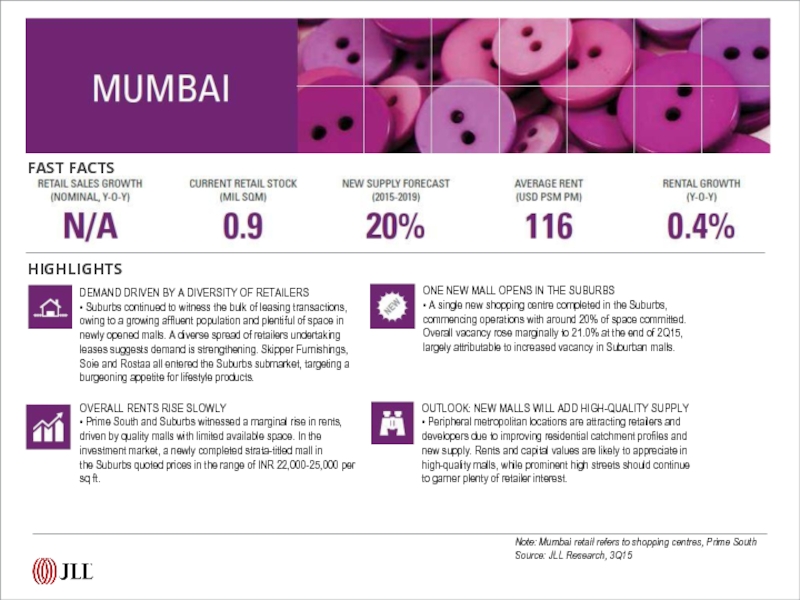

Слайд 10Note: Mumbai retail refers to shopping centres, Prime South

Source: JLL Research,

HIGHLIGHTS

FAST FACTS

DEMAND DRIVEN BY A DIVERSITY OF RETAILERS

• Suburbs continued to witness the bulk of leasing transactions,

owing to a growing affluent population and plentiful of space in

newly opened malls. A diverse spread of retailers undertaking

leases suggests demand is strengthening. Skipper Furnishings,

Soie and Rostaa all entered the Suburbs submarket, targeting a

burgeoning appetite for lifestyle products.

OVERALL RENTS RISE SLOWLY

• Prime South and Suburbs witnessed a marginal rise in rents,

driven by quality malls with limited available space. In the

investment market, a newly completed strata-titled mall in

the Suburbs quoted prices in the range of INR 22,000-25,000 per

sq ft.

ONE NEW MALL OPENS IN THE SUBURBS

• A single new shopping centre completed in the Suburbs,

commencing operations with around 20% of space committed.

Overall vacancy rose marginally to 21.0% at the end of 2Q15,

largely attributable to increased vacancy in Suburban malls.

OUTLOOK: NEW MALLS WILL ADD HIGH-QUALITY SUPPLY

• Peripheral metropolitan locations are attracting retailers and

developers due to improving residential catchment profiles and

new supply. Rents and capital values are likely to appreciate in

high-quality malls, while prominent high streets should continue

to garner plenty of retailer interest.

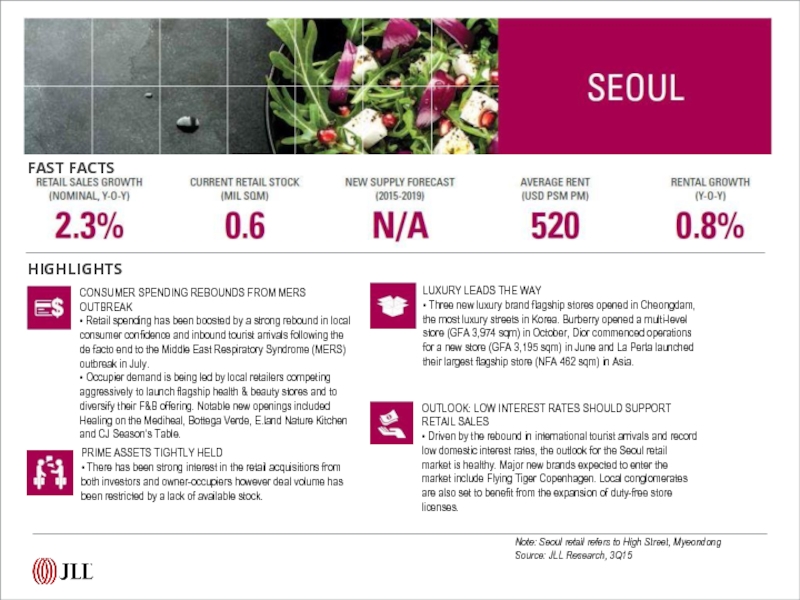

Слайд 11Note: Seoul retail refers to High Street, Myeondong

Source: JLL Research, 3Q15

HIGHLIGHTS

FAST

CONSUMER SPENDING REBOUNDS FROM MERS

OUTBREAK

• Retail spending has been boosted by a strong rebound in local

consumer confidence and inbound tourist arrivals following the

de facto end to the Middle East Respiratory Syndrome (MERS)

outbreak in July.

• Occupier demand is being led by local retailers competing

aggressively to launch flagship health & beauty stores and to

diversify their F&B offering. Notable new openings included

Healing on the Mediheal, Bottega Verde, E.land Nature Kitchen

and CJ Season’s Table.

PRIME ASSETS TIGHTLY HELD

• There has been strong interest in the retail acquisitions from

both investors and owner-occupiers however deal volume has

been restricted by a lack of available stock.

LUXURY LEADS THE WAY

• Three new luxury brand flagship stores opened in Cheongdam,

the most luxury streets in Korea. Burberry opened a multi-level

store (GFA 3,974 sqm) in October, Dior commenced operations

for a new store (GFA 3,195 sqm) in June and La Perla launched

their largest flagship store (NFA 462 sqm) in Asia.

OUTLOOK: LOW INTEREST RATES SHOULD SUPPORT

RETAIL SALES

• Driven by the rebound in international tourist arrivals and record

low domestic interest rates, the outlook for the Seoul retail

market is healthy. Major new brands expected to enter the

market include Flying Tiger Copenhagen. Local conglomerates

are also set to benefit from the expansion of duty-free store

licenses.

Слайд 12Note: Shanghai retail refers to shopping centres, West Nanjing Road

Source: JLL

HIGHLIGHTS

FAST FACTS

STRONG DEMAND FROM FAST FASHION AND KIDS

BRANDS

• Luxury retailers remained cautious about store openings,

although successful price adjustments by Chanel and Gucci

are influencing other brands to consider a similar strategy. Fast

fashion and child-related retailers led leasing activity. Forever 21

opened two stores and committed to a flagship on Huaihai Road,

while Disney unveiled its global flagship in Lujiazui and Legoland

will open in Putuo.

RENT LEVELS EDGE UP AS INVESTMENT ACTIVITY

INCREASES

• Core area ground floor rents increased by 1.9% q-o-q, to RMB

52.3 per sqm per day, while non-core rents rose 1.1%, to RMB

20.6 per sqm per day. Strong rental growth was observed in both

markets by successful malls undergoing tenant adjustment.

Ivanhoe Cambridge and APG invested USD 920 million in

Chongbang, a developer renowned for its lifestyle malls in

Shanghai.

FOUR NEW PROJECTS OPEN IN CENTRAL AREAS

• New World Daimaru Department Store, anchored by luxury

brands, and three mid-range malls – Crystal Galleria, Star Live

Plaza and Xinlin Station – opened with a total GFA of 366,000

sqm. Vacancy rose to 11.5% in the Core area, but decreased

to 7.5% in the non-core area, as several malls introduced

entertainment and experience-oriented tenants on the upper

floors.

OUTLOOK: INTENSE COMPETITION EXPECTED IN NONCORE

AREAS

• Ongoing caution by luxury retailers will contrast with stable

expansion by fast fashion and F&B brands, while landlords

increasingly covet child-related brands. More than 20 noncore

projects are slated to open by end-2016, and malls with

inexperienced landlords in saturated areas will have low

bargaining power. Rental growth will be bolstered by premium

brands expanding to mature malls in key submarkets.

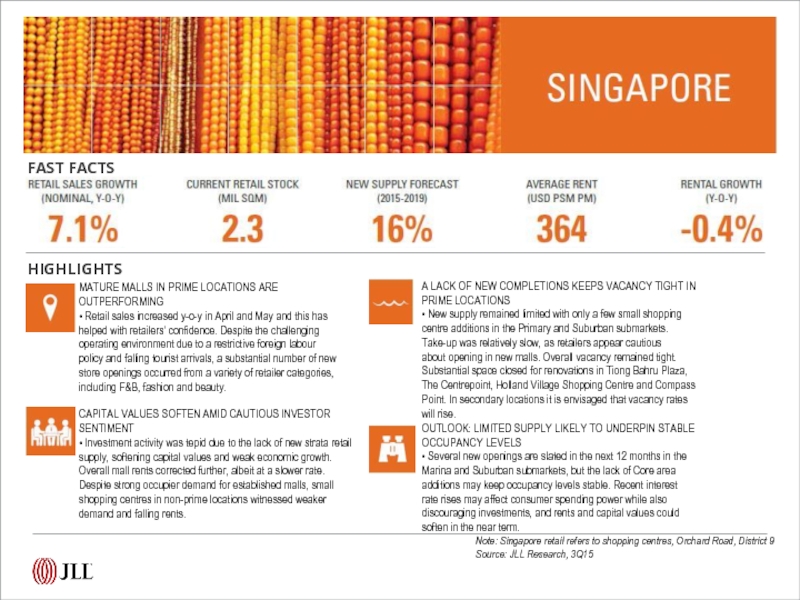

Слайд 13Note: Singapore retail refers to shopping centres, Orchard Road, District 9

Source:

HIGHLIGHTS

FAST FACTS

MATURE MALLS IN PRIME LOCATIONS ARE

OUTPERFORMING

• Retail sales increased y-o-y in April and May and this has

helped with retailers’ confidence. Despite the challenging

operating environment due to a restrictive foreign labour

policy and falling tourist arrivals, a substantial number of new

store openings occurred from a variety of retailer categories,

including F&B, fashion and beauty.

CAPITAL VALUES SOFTEN AMID CAUTIOUS INVESTOR

SENTIMENT

• Investment activity was tepid due to the lack of new strata retail

supply, softening capital values and weak economic growth.

Overall mall rents corrected further, albeit at a slower rate.

Despite strong occupier demand for established malls, small

shopping centres in non-prime locations witnessed weaker

demand and falling rents.

A LACK OF NEW COMPLETIONS KEEPS VACANCY TIGHT IN

PRIME LOCATIONS

• New supply remained limited with only a few small shopping

centre additions in the Primary and Suburban submarkets.

Take-up was relatively slow, as retailers appear cautious

about opening in new malls. Overall vacancy remained tight.

Substantial space closed for renovations in Tiong Bahru Plaza,

The Centrepoint, Holland Village Shopping Centre and Compass

Point. In secondary locations it is envisaged that vacancy rates

will rise.

OUTLOOK: LIMITED SUPPLY LIKELY TO UNDERPIN STABLE

OCCUPANCY LEVELS

• Several new openings are slated in the next 12 months in the

Marina and Suburban submarkets, but the lack of Core area

additions may keep occupancy levels stable. Recent interest

rate rises may affect consumer spending power while also

discouraging investments, and rents and capital values could

soften in the near term.

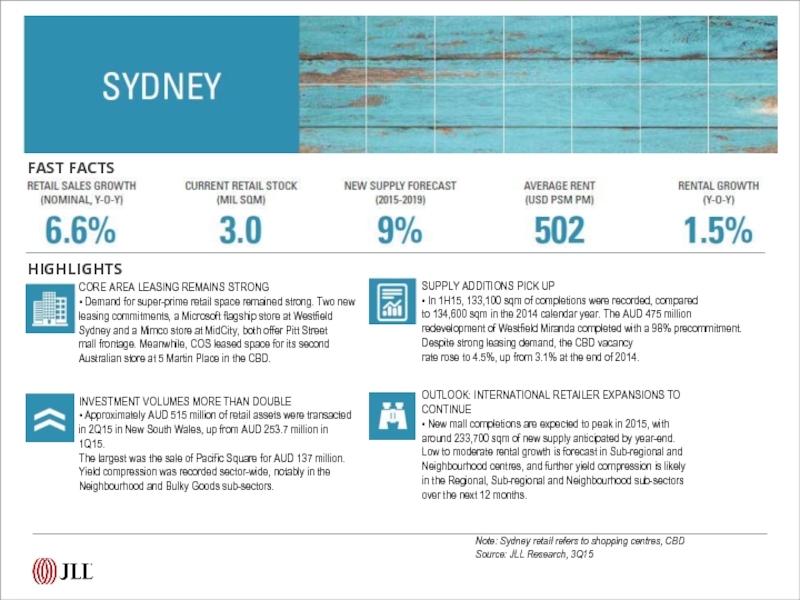

Слайд 14Note: Sydney retail refers to shopping centres, CBD

Source: JLL Research, 3Q15

HIGHLIGHTS

FAST

CORE AREA LEASING REMAINS STRONG

• Demand for super-prime retail space remained strong. Two new

leasing commitments, a Microsoft flagship store at Westfield

Sydney and a Mimco store at MidCity, both offer Pitt Street

mall frontage. Meanwhile, COS leased space for its second

Australian store at 5 Martin Place in the CBD.

INVESTMENT VOLUMES MORE THAN DOUBLE

• Approximately AUD 515 million of retail assets were transacted

in 2Q15 in New South Wales, up from AUD 253.7 million in 1Q15.

The largest was the sale of Pacific Square for AUD 137 million.

Yield compression was recorded sector-wide, notably in the

Neighbourhood and Bulky Goods sub-sectors.

SUPPLY ADDITIONS PICK UP

• In 1H15, 133,100 sqm of completions were recorded, compared

to 134,600 sqm in the 2014 calendar year. The AUD 475 million

redevelopment of Westfield Miranda completed with a 98% precommitment.

Despite strong leasing demand, the CBD vacancy

rate rose to 4.5%, up from 3.1% at the end of 2014.

OUTLOOK: INTERNATIONAL RETAILER EXPANSIONS TO

CONTINUE

• New mall completions are expected to peak in 2015, with

around 233,700 sqm of new supply anticipated by year-end.

Low to moderate rental growth is forecast in Sub-regional and

Neighbourhood centres, and further yield compression is likely

in the Regional, Sub-regional and Neighbourhood sub-sectors

over the next 12 months.

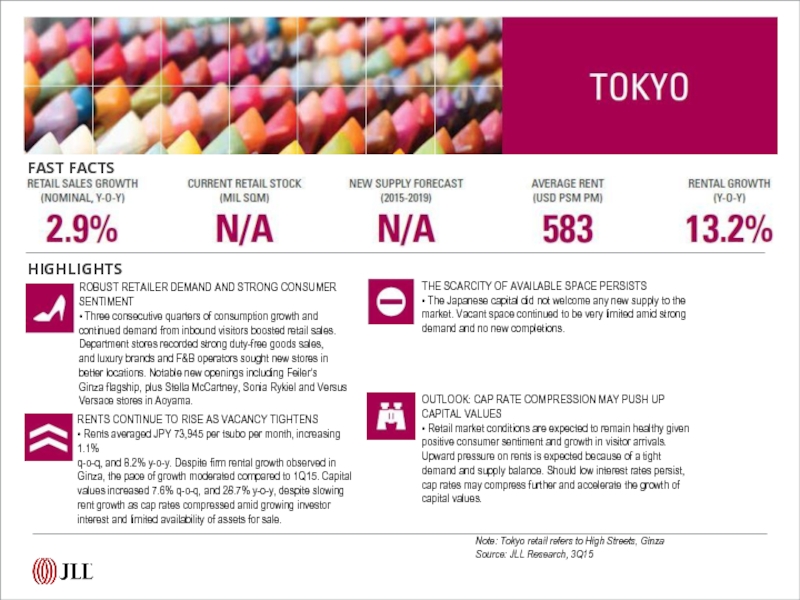

Слайд 15Note: Tokyo retail refers to High Streets, Ginza

Source: JLL Research, 3Q15

HIGHLIGHTS

FAST

ROBUST RETAILER DEMAND AND STRONG CONSUMER

SENTIMENT

• Three consecutive quarters of consumption growth and

continued demand from inbound visitors boosted retail sales.

Department stores recorded strong duty-free goods sales,

and luxury brands and F&B operators sought new stores in

better locations. Notable new openings including Feiler’s

Ginza flagship, plus Stella McCartney, Sonia Rykiel and Versus

Versace stores in Aoyama.

RENTS CONTINUE TO RISE AS VACANCY TIGHTENS

• Rents averaged JPY 73,945 per tsubo per month, increasing 1.1%

q-o-q, and 8.2% y-o-y. Despite firm rental growth observed in

Ginza, the pace of growth moderated compared to 1Q15. Capital

values increased 7.6% q-o-q, and 28.7% y-o-y, despite slowing

rent growth as cap rates compressed amid growing investor

interest and limited availability of assets for sale.

THE SCARCITY OF AVAILABLE SPACE PERSISTS

• The Japanese capital did not welcome any new supply to the

market. Vacant space continued to be very limited amid strong

demand and no new completions.

OUTLOOK: CAP RATE COMPRESSION MAY PUSH UP

CAPITAL VALUES

• Retail market conditions are expected to remain healthy given

positive consumer sentiment and growth in visitor arrivals.

Upward pressure on rents is expected because of a tight

demand and supply balance. Should low interest rates persist,

cap rates may compress further and accelerate the growth of

capital values.