Presenter: Jonathan Lee, Sr Energy Market Intelligence Manager, Ecova

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

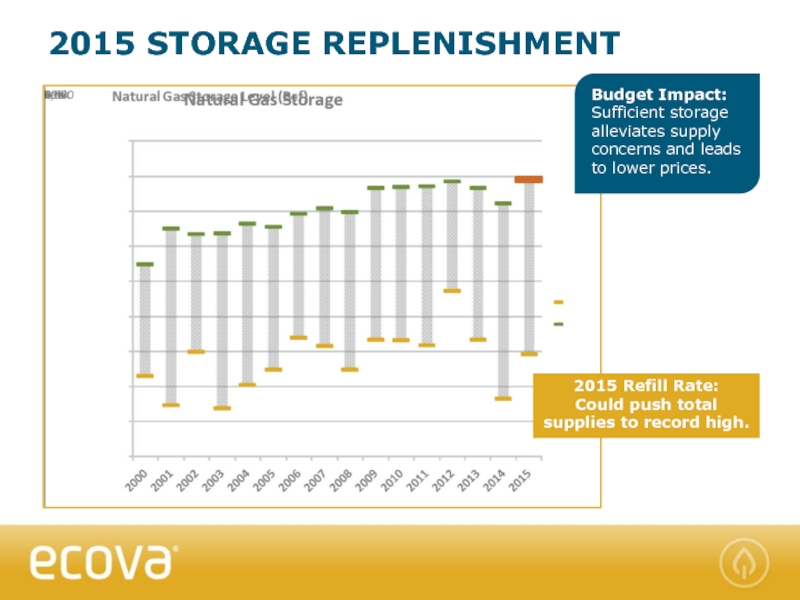

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Q3 2015 Energy Market Outlook Energy Prices and Market Intelligence Q3 Update September 10, 2015 презентация

Содержание

- 1. Q3 2015 Energy Market Outlook Energy Prices and Market Intelligence Q3 Update September 10, 2015

- 2. Prices are near a three-year low, how

- 3. Natural gas production running 7% higher in

- 4. SHALE PRODUCTION GROWTH EIA - September 2015

- 5. Power sector demand growth Pipeline infrastructure expansions

- 6. Cost of production vs. the price of

- 7. 2015 STORAGE REPLENISHMENT 2015 Refill Rate: Could push total supplies to record high.

- 8. SUPPLY OUTPACING DEMAND Gas production continues to

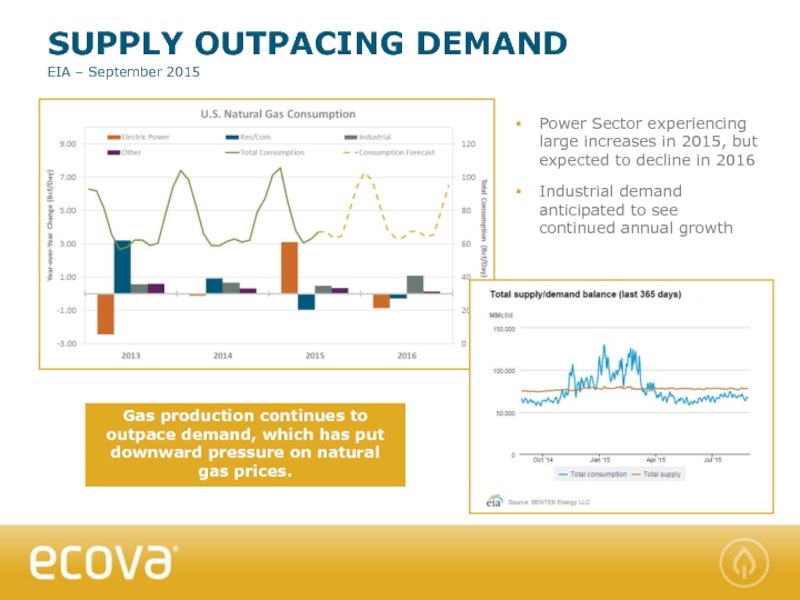

- 9. RECORD GAS-FIRED GENERATION EIA - September 2015

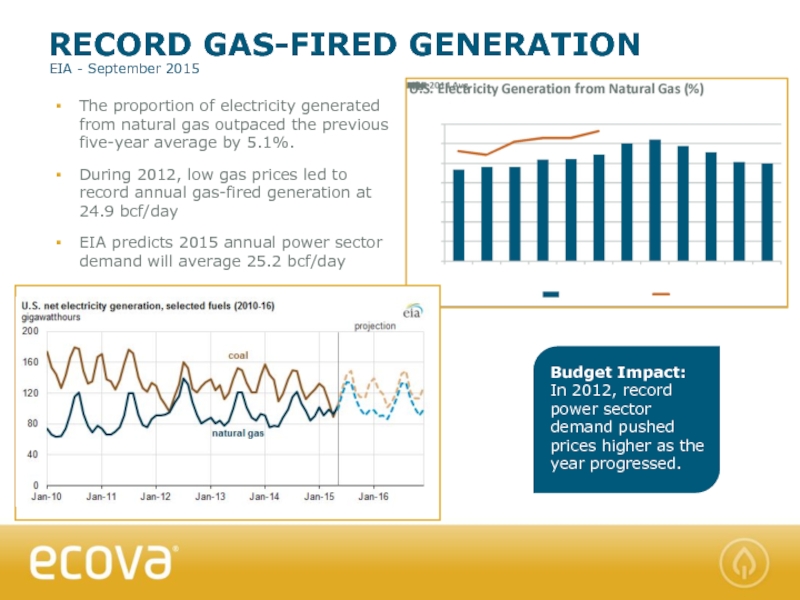

- 10. The summer of 2015 was mostly in

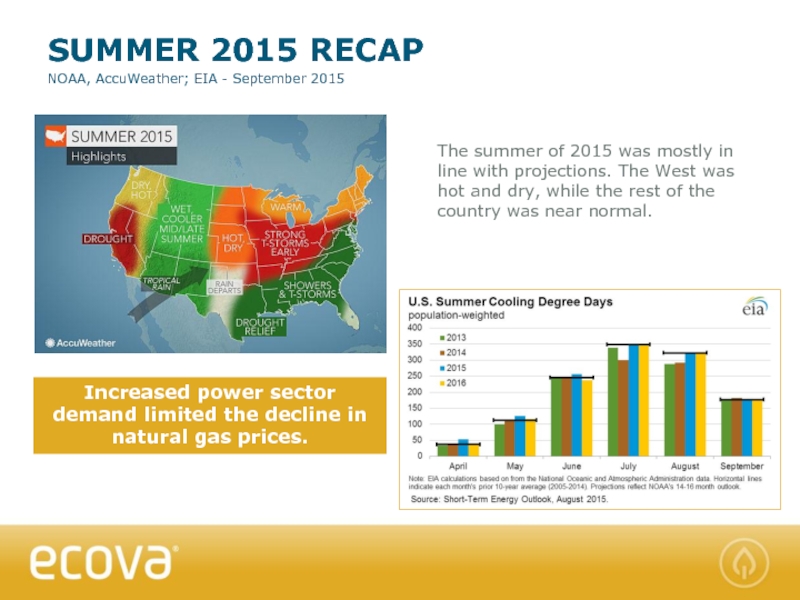

- 11. FALL TEMPERATURE OUTLOOK A cooler South Central

- 12. EARLY WINTER WEATHER OUTLOOK NOAA, Farmers’ Almanac, AccuWeather - September 2015

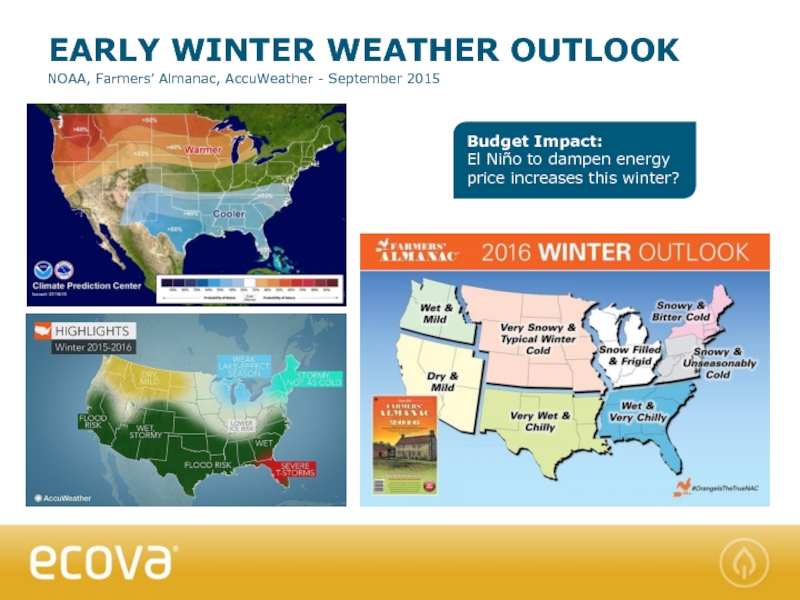

- 13. El Niño currently has greater than a

- 14. NATURAL GAS PIPELINE PROJECTS An estimated 33

- 15. REX ZONE 3 EAST TO WEST 1.2

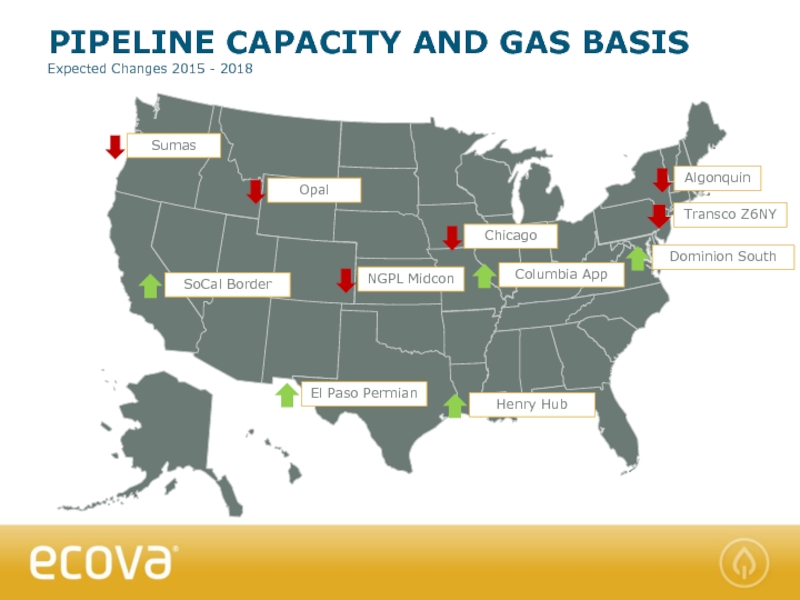

- 16. PIPELINE CAPACITY AND GAS BASIS Expected Changes 2015 - 2018

- 17. NATURAL GAS FORWARD CURVE (NYMEX) – 4 September 2015 YOY Decline: 26.6% Six-Month Decline: 9.6%

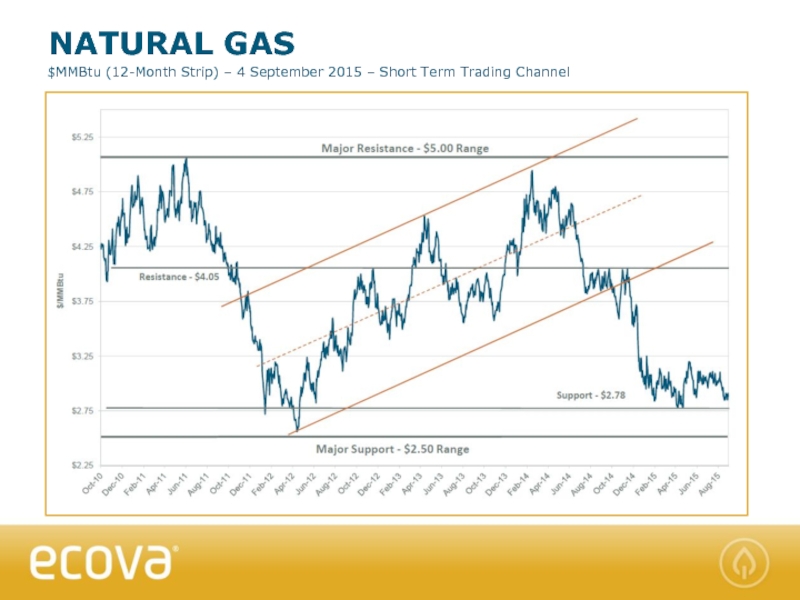

- 18. NATURAL GAS $MMBtu (12-Month Strip) – 4 September 2015 – Short Term Trading Channel

- 19. OUTLOOK: NATURAL GAS PRICING EIA - September 2015

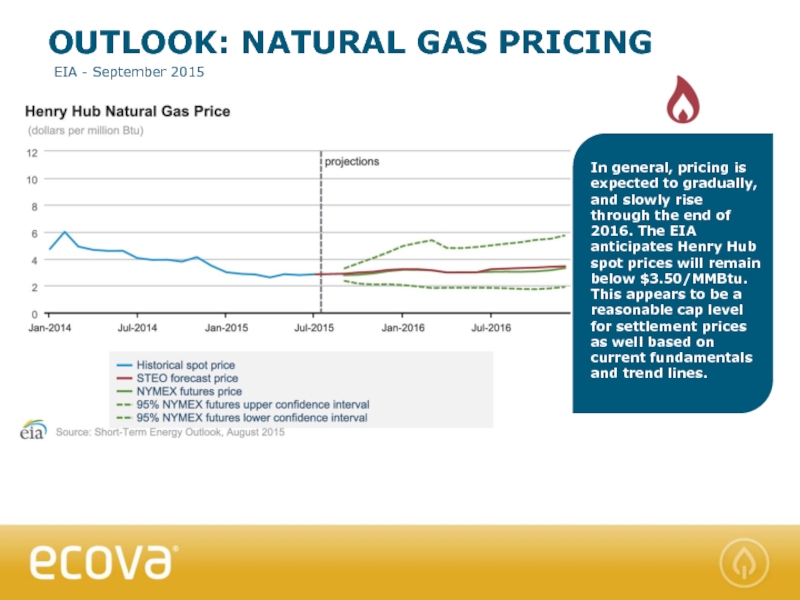

- 20. WHOLESALE ELECTRICITY $MWh (12-Month Strip) – 4 September 2015

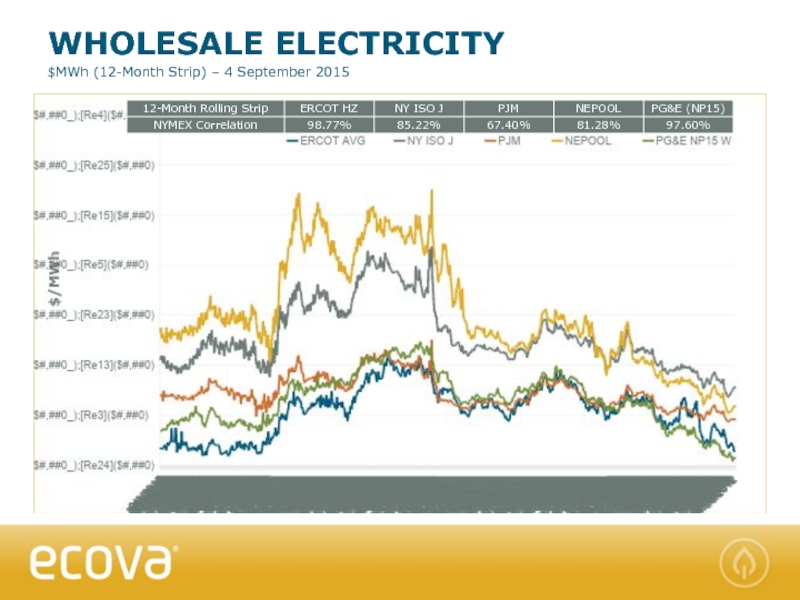

- 21. WHOLESALE ELECTRICITY YOY DECLINE Rolling 12-Month Strip: 4 September 2015

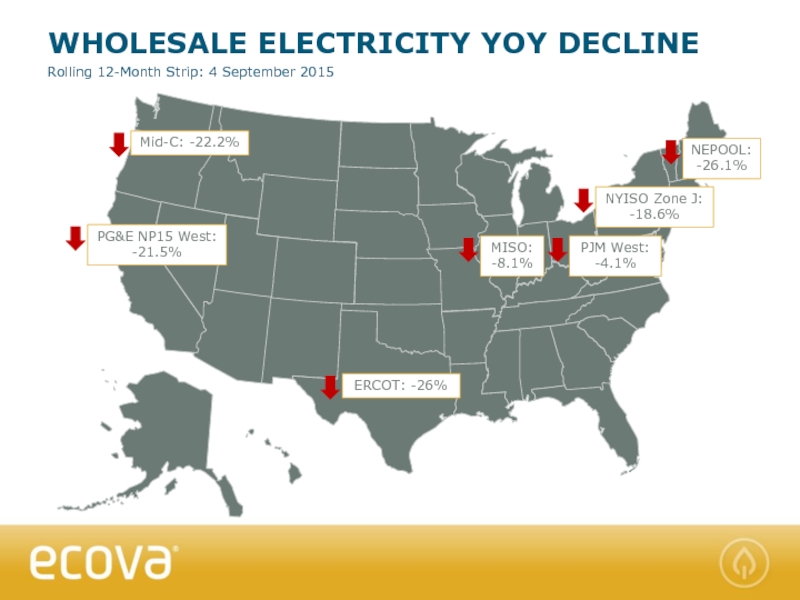

- 22. OUTLOOK: COMMERCIAL ELECTRIC PRICING EIA Average Retail Rates ($/MWh) - September 2015

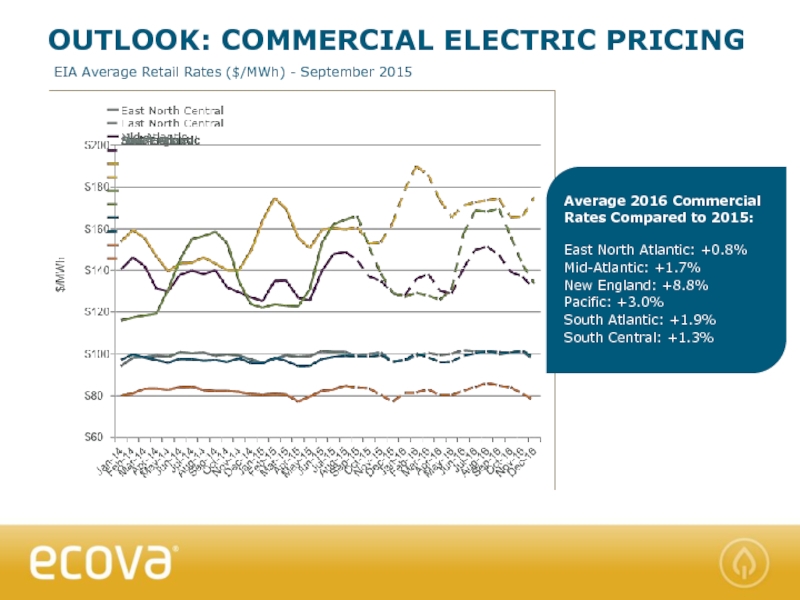

- 23. PJM CAPACITY PERFORMANCE PJM - September 2015

- 24. CLEAN POWER PLAN EIA – 3 August

- 25. 2016 ENERGY BUDGET PLANNING TIPS #1: START

- 26. NATURAL GAS AND WHOLESALE ELECTRICITY ARE NEAR

- 27. NEW! Energy Market Watch Newsletter Subscribe

- 28. UPCOMING WEBINARS INSIDE ENERGY & SUSTAINABILITY

- 29. Q&A Questions, comments, suggestions? webinars@ecova.com

- 30. Thank you!

Слайд 1Q3 2015 Energy Market Outlook

Energy Prices and Market Intelligence Q3

Слайд 2Prices are near a three-year low, how did we get here?

Natural

Power Sector Demand: Helped keep the downside limited.

Summer Recap: Near the 10-year norm.

What’s on the horizon?

Natural Gas Pipeline Projects: Impact to volatility and basis prices.

LNG Exports: First LNG export facility coming online late 2015.

PJM Capacity Performance: FERC approved PJM’s new capacity structure.

2016 Budget Influencers

Downside Pressure: Gas production, healthy natural gas storage, weak winter demand, pipeline capacity additions.

Upside Potential: Gas-fired generation growth, LNG exports, EPA regulations, unexpected weather, reliability enhancements.

ENERGY MARKET INTELLIGENCE

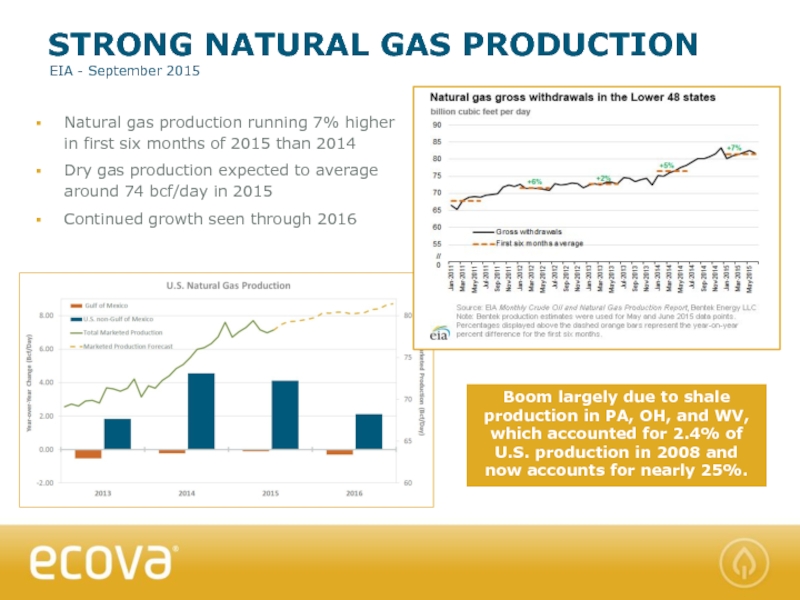

Слайд 3Natural gas production running 7% higher in first six months of

Dry gas production expected to average around 74 bcf/day in 2015

Continued growth seen through 2016

STRONG NATURAL GAS PRODUCTION

EIA - September 2015

Boom largely due to shale production in PA, OH, and WV, which accounted for 2.4% of U.S. production in 2008 and now accounts for nearly 25%.

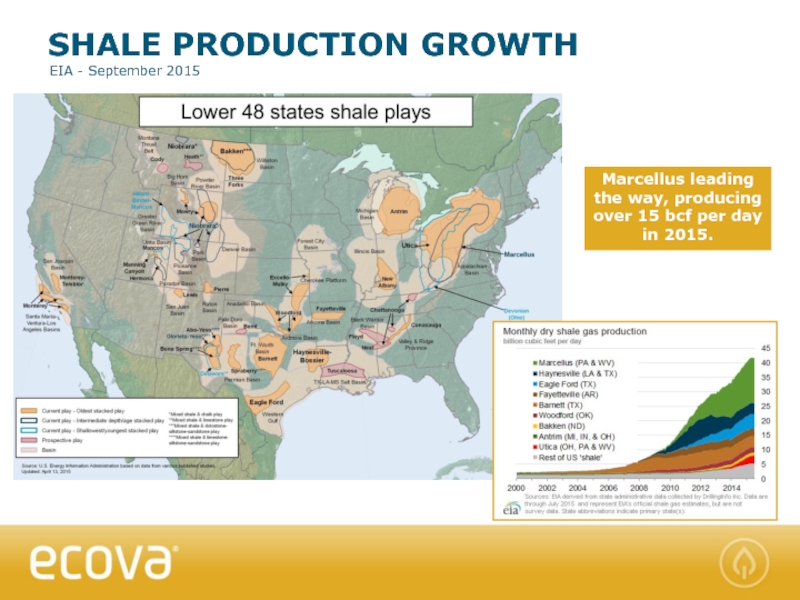

Слайд 4SHALE PRODUCTION GROWTH

EIA - September 2015

Marcellus leading the way, producing over

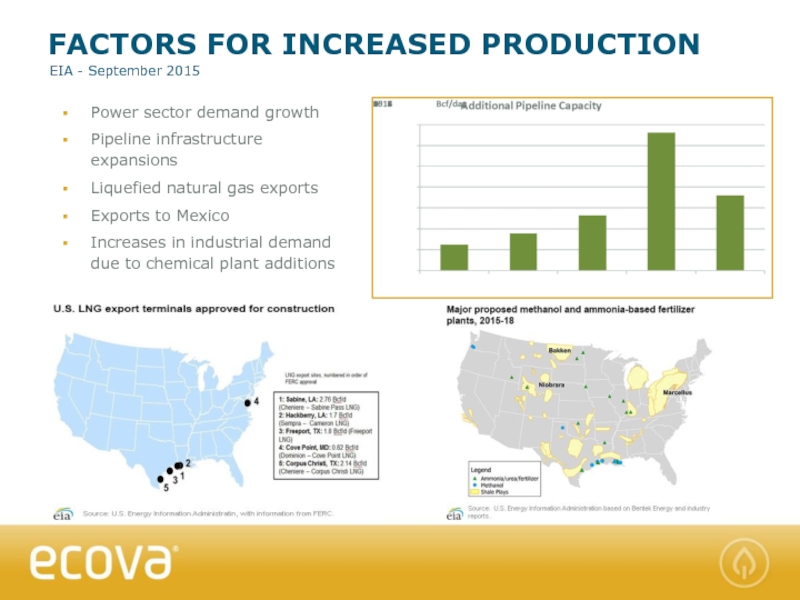

Слайд 5Power sector demand growth

Pipeline infrastructure expansions

Liquefied natural gas exports

Exports to Mexico

Increases

FACTORS FOR INCREASED PRODUCTION

EIA - September 2015

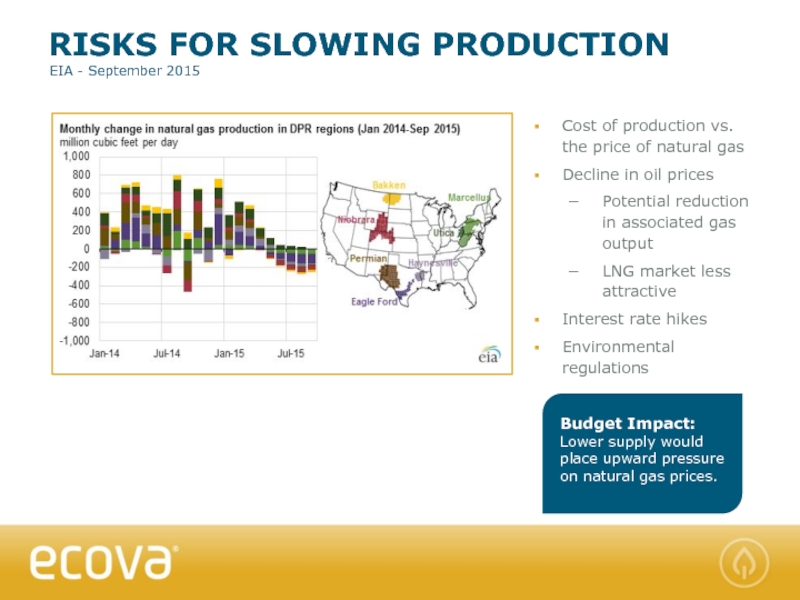

Слайд 6Cost of production vs. the price of natural gas

Decline in oil

Potential reduction in associated gas output

LNG market less attractive

Interest rate hikes

Environmental regulations

RISKS FOR SLOWING PRODUCTION

EIA - September 2015

Слайд 8SUPPLY OUTPACING DEMAND

Gas production continues to outpace demand, which has put

Power Sector experiencing large increases in 2015, but expected to decline in 2016

Industrial demand anticipated to see continued annual growth

EIA – September 2015

Слайд 9RECORD GAS-FIRED GENERATION

EIA - September 2015

The proportion of electricity generated from

During 2012, low gas prices led to record annual gas-fired generation at 24.9 bcf/day

EIA predicts 2015 annual power sector demand will average 25.2 bcf/day

Слайд 10The summer of 2015 was mostly in line with projections. The

Increased power sector demand limited the decline in natural gas prices.

SUMMER 2015 RECAP

NOAA, AccuWeather; EIA - September 2015

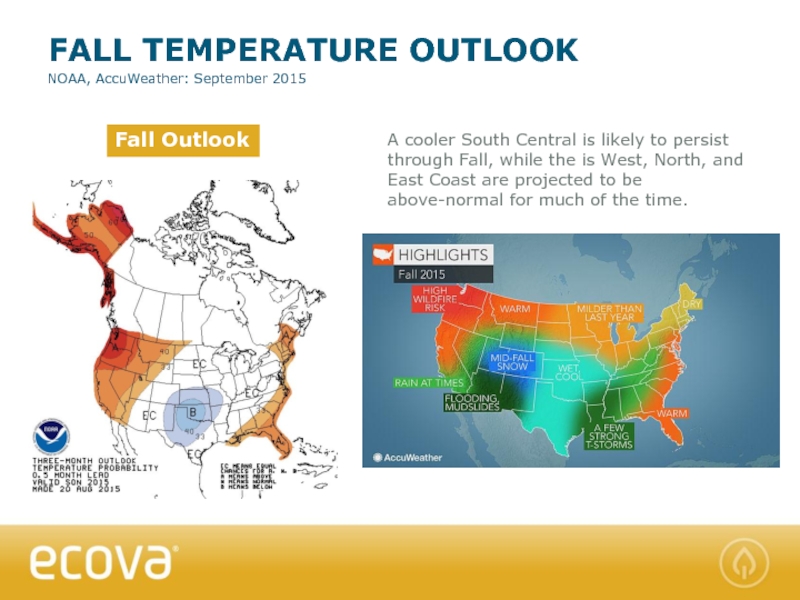

Слайд 11FALL TEMPERATURE OUTLOOK

A cooler South Central is likely to persist through

NOAA, AccuWeather: September 2015

Fall Outlook

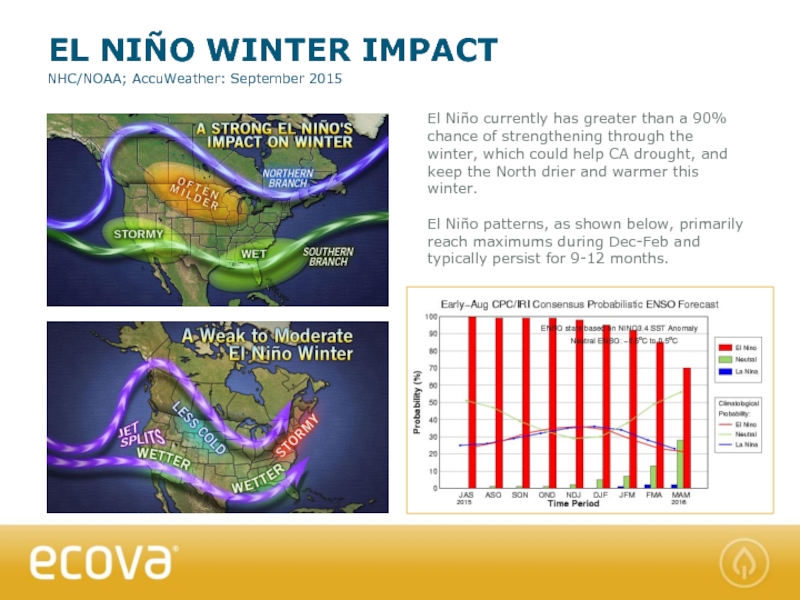

Слайд 13El Niño currently has greater than a 90% chance of strengthening

El Niño patterns, as shown below, primarily reach maximums during Dec-Feb and typically persist for 9-12 months.

EL NIÑO WINTER IMPACT

NHC/NOAA; AccuWeather: September 2015

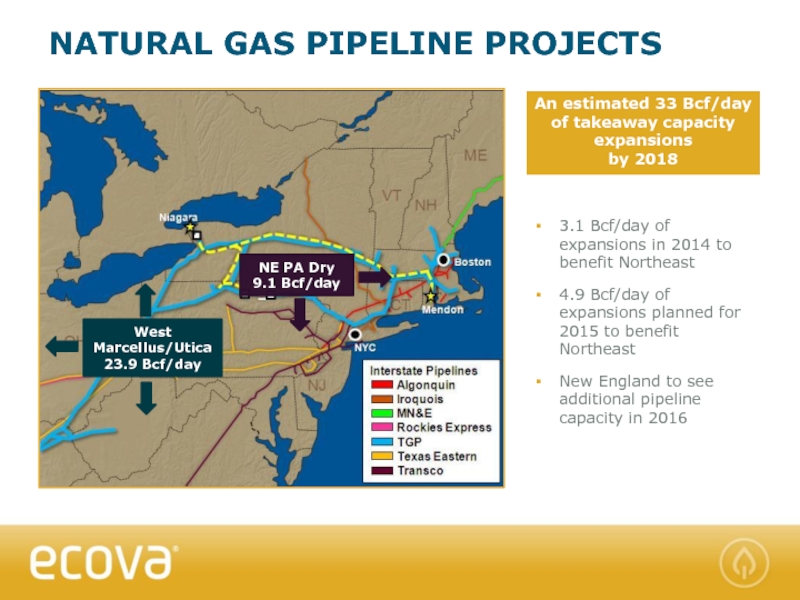

Слайд 14NATURAL GAS PIPELINE PROJECTS

An estimated 33 Bcf/day of takeaway capacity expansions

3.1 Bcf/day of expansions in 2014 to benefit Northeast

4.9 Bcf/day of expansions planned for 2015 to benefit Northeast

New England to see additional pipeline capacity in 2016

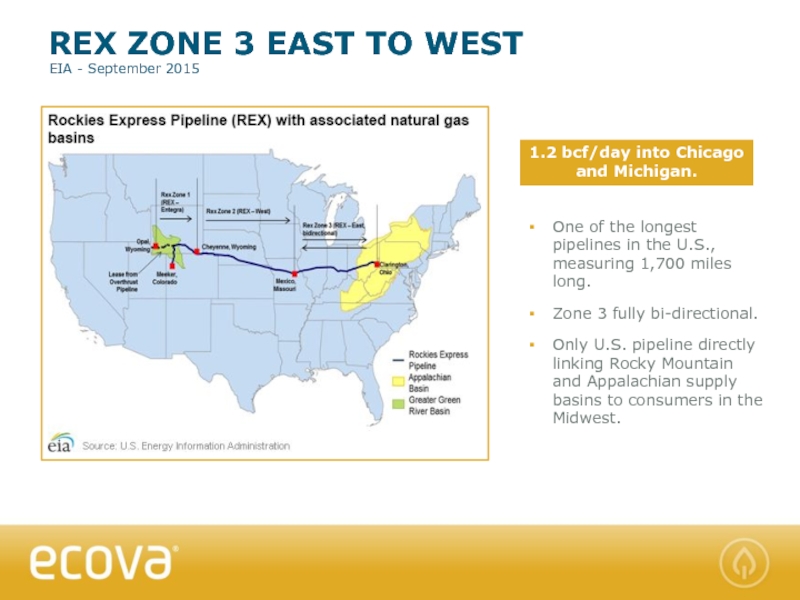

Слайд 15REX ZONE 3 EAST TO WEST

1.2 bcf/day into Chicago and Michigan.

EIA

One of the longest pipelines in the U.S., measuring 1,700 miles long.

Zone 3 fully bi-directional.

Only U.S. pipeline directly linking Rocky Mountain and Appalachian supply basins to consumers in the Midwest.

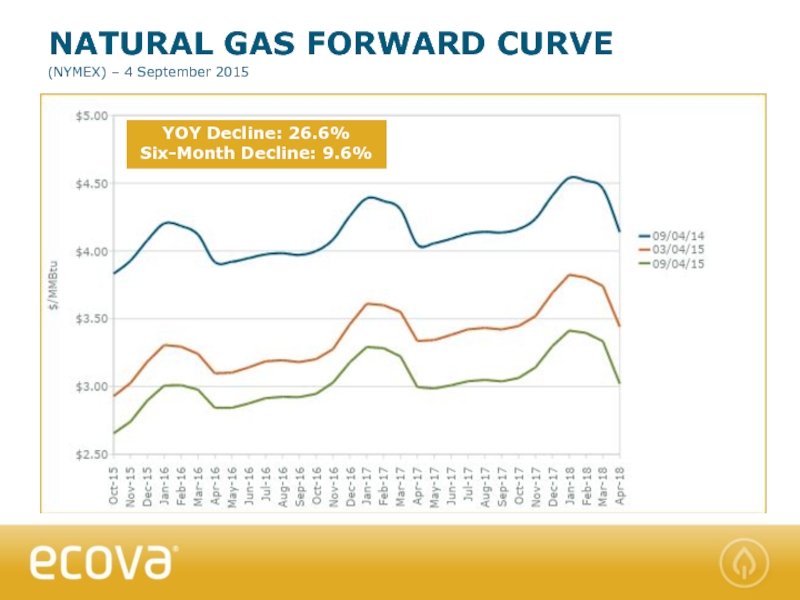

Слайд 17NATURAL GAS FORWARD CURVE

(NYMEX) – 4 September 2015

YOY Decline: 26.6%

Six-Month Decline:

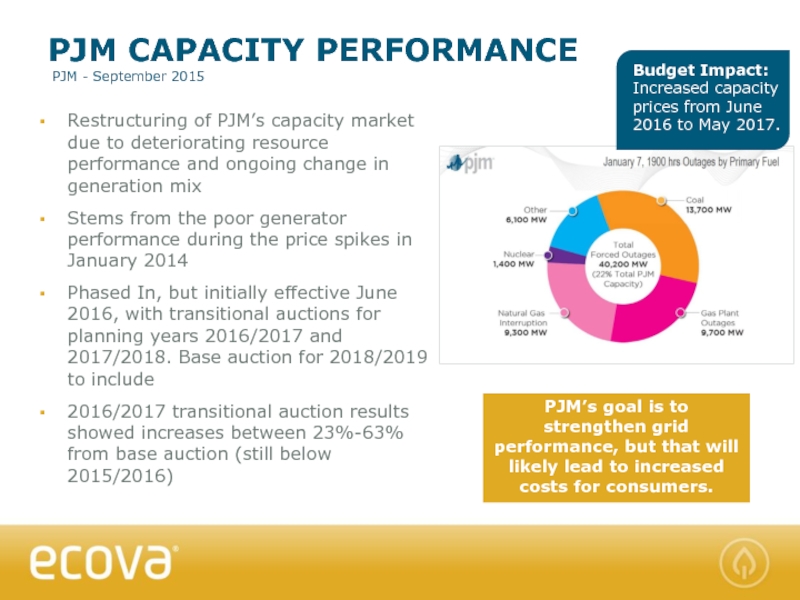

Слайд 23PJM CAPACITY PERFORMANCE

PJM - September 2015

PJM’s goal is to strengthen grid

Restructuring of PJM’s capacity market due to deteriorating resource performance and ongoing change in generation mix

Stems from the poor generator performance during the price spikes in January 2014

Phased In, but initially effective June 2016, with transitional auctions for planning years 2016/2017 and 2017/2018. Base auction for 2018/2019 to include

2016/2017 transitional auction results showed increases between 23%-63% from base auction (still below 2015/2016)

Слайд 24CLEAN POWER PLAN

EIA – 3 August 2015

Implementation of the Clean Power

Clean Power Plan goal to reduce carbon dioxide emissions from power plants

Carbon pollution from power sector set to be 32% below 2005 levels by 2030. (An increase of 2% from last year’s proposal)

States must submit initial plans to EPA on how they will meet the standards by Sept 2016 and final complete plan by Sept 2018

Must meet progressive goals starting 2022 through 2029. (Two year delay to start of program, originally 2020)

Coal expected to fall to 27% of generation mix by 2030, while renewables expected to double to 28%

Слайд 252016 ENERGY BUDGET PLANNING TIPS

#1: START WITH SITE SPECIFIC BASELINES

Energy market

#2: ENGAGE STAKEHOLDERS EARLY AND OFTEN

Communicating the fundamental factors affecting regional energy markets can help reduce surprises when they occur (i.e. extreme winter of 2013/2014). It also develops further communication around energy procurement strategy, potential building enhancements, and cost-cutting initiatives.

#3: TRACK VARIANCES FOR COST AND USAGE

By tracking variances in cost and usage, you can better understand what’s driving the variance. Also analyze multiple levels (portfolio, regional/division, site) to identify trends or isolate poor performers.

#4: ADJUST AND COMMUNICATE AS NEEDED

The energy markets are in a constant state of change. Identify fundamental shifts in the market to evaluate whether the current strategy needs to be adjusted.

Слайд 26NATURAL GAS AND WHOLESALE ELECTRICITY ARE NEAR THEIR LOWEST LEVEL SINCE

Strong natural gas production weighing heavily on wholesale natural gas and electricity prices

POWER SECTOR DEMAND FOR NATURAL GAS TO INCREASE

With around 14,000 MW of coal-plant retirements scheduled for 2015, gas-fired generation will continue to grow and potentially introduce more volatility.

EL NIÑO STRENGTHENING INTO WINTER

El Niño typically brings warmer/drier conditions to the major gas consuming North during winter, which could reduce pipeline constraint related volatility in New York and New England

NATURAL GAS PRICE FORECAST

Wholesale natural gas prices are expected to slowly rise into 2016. At this point, upside risk is more likely than further downside moves

MAJOR TAKEAWAYS