- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Tax law. (Lecture 2) презентация

Содержание

- 1. Tax law. (Lecture 2)

- 2. PIT (Personal Income Tax) – ИПН (Индивидуальный

- 3. Tax Burden under Employment Contract; Tax Burden

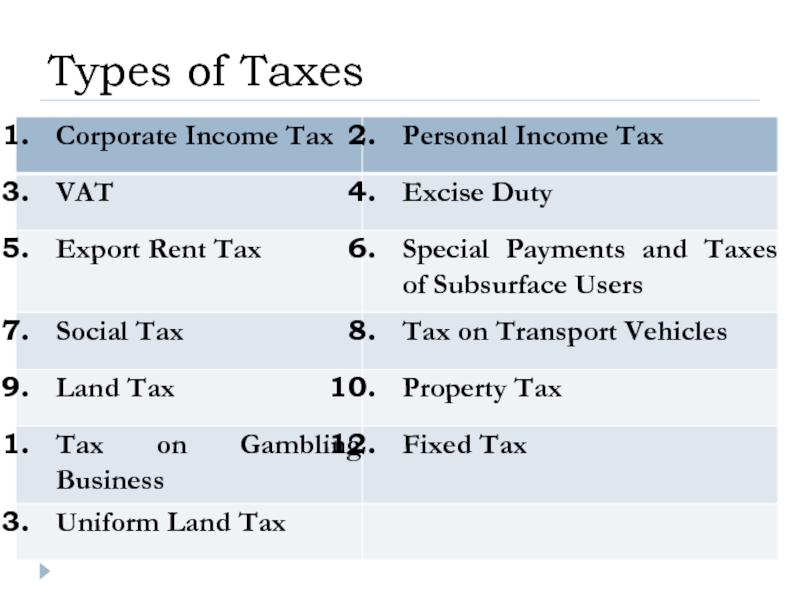

- 4. Types of Taxes

- 5. Object of the PIT: Revenues taxed at

- 6. Rates of the PIT: Revenues taxed at

- 7. Paid by the IP’s and LE’s. For

- 8. LABOR CONTRACT KZT 300,000. Taxable Income –

- 9. LABOR CONTRACT KZT 300,000. - Pension: 300K

- 10. Let’s assume that Arman also get’s free

- 11. November - 20 working days Calculation: 1,500 * 20 = KZT 30,000; Case

- 12. Tax Liability Calculation: 300,000 + 30,000 =

- 13. Amount of Contract is KZT 300,000.

- 14. For Legal Entities: Taxable Income = (Aggregate

- 15. Alex’s salary is KZT 1 mln.

- 16. Art.163. Tax Code Income of employees taxable

- 17. Art.163. Tax Code 1) the money in

- 18. 1. Total revenue = all income (in

- 19. Deductions & Exemptions (art. 155 & 156)

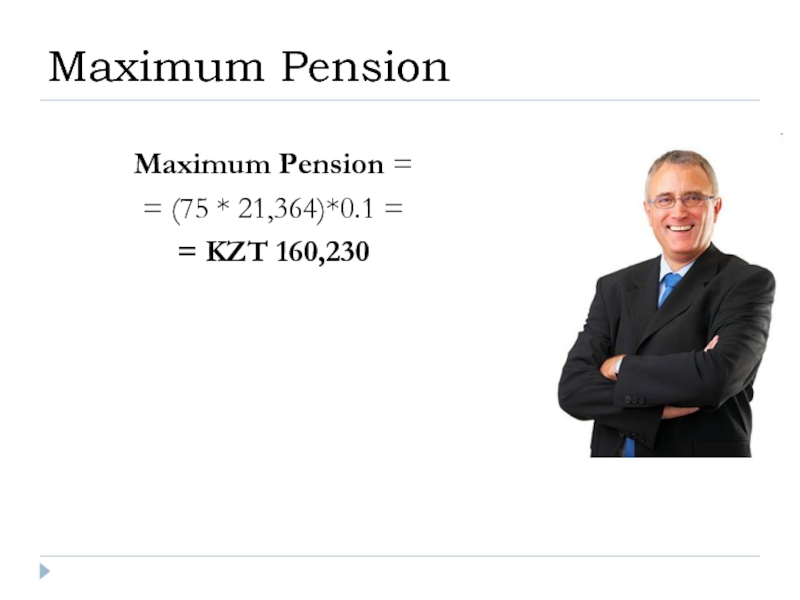

- 20. Maximum Pension Maximum Pension = = (75 * 21,364)*0.1 = = KZT 160,230

- 21. PIT (Labor Law) PIT = Taxable income

- 22. Social Tax (Labor Law) ST = Taxable

- 23. Tax Burden (Labor Law) Tax Burden of

- 24. Tax Regimes of the IP

- 25. Generally Established Procedures: PIT – 10%; Social

- 26. SERVICE CONTRACT Arman is an IE: Generally

- 27. Special Tax Regime - Patent: PIT –

- 28. SERVICE CONTRACT Arman is an IE: Patent

- 29. Special Tax Regime – Simplified Declaration: PIT

- 30. SERVICE CONTRACT Arman is an IE: Simplified

Слайд 2PIT (Personal Income Tax) – ИПН (Индивидуальный Подоходный Налог);

MS (Minimum Salary)

Pension (Compulsory Pension Contributions) - ОПН (Обязательные Пенсионные Взносы);

Terms & Translations

Слайд 3Tax Burden under Employment Contract;

Tax Burden under Civil Contract;

Tax Burden of

Goal

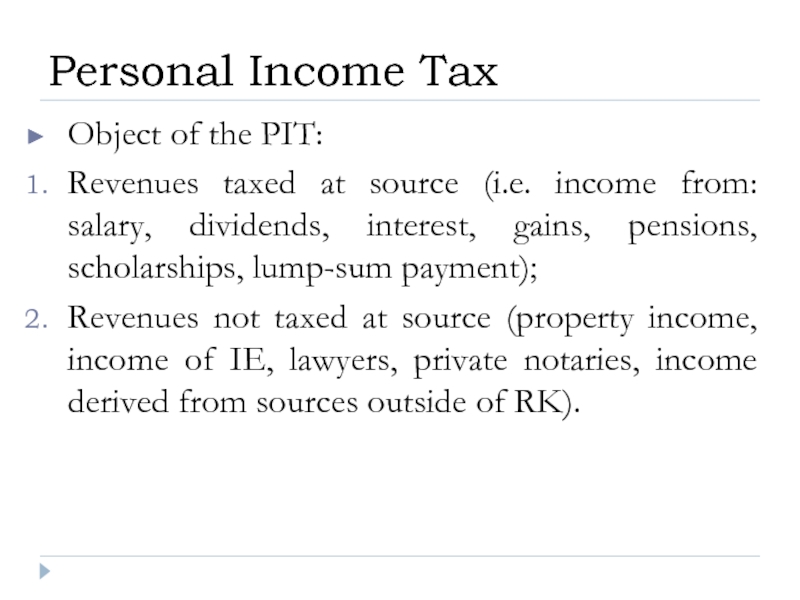

Слайд 5Object of the PIT:

Revenues taxed at source (i.e. income from: salary,

Revenues not taxed at source (property income, income of IE, lawyers, private notaries, income derived from sources outside of RK).

Personal Income Tax

Слайд 6Rates of the PIT:

Revenues taxed at source - at the rate

Income from dividends – at a rate of 5%;

Other rates stipulated by the Tax Code.

Personal Income Tax

Слайд 7Paid by the IP’s and LE’s.

For IP:

GEP – 2 MCI;

Patent –

Simplified Declaration – 1,5%.

Social Tax for Employees - 11%.

Social Tax

Слайд 8LABOR CONTRACT KZT 300,000.

Taxable Income – Deductions – Pensions – Minimum

Case

Слайд 9LABOR CONTRACT KZT 300,000.

- Pension: 300K * 10% = 270,000;

- Minimum

- PIT = 248,636 * 10% = 24,864.

Social Tax =(Taxable Income – Pensions) * 11% = (300,000 – 30,000)*11% = 29,700;

Total Taxes = PIT + Social Tax =

= 24 863 + 29 700 = KZT 54 563

Case

Слайд 10Let’s assume that Arman also get’s free lunch at the expense

Each lunch costs – KZT 1,500;

Does Arman bears tax liability for free lunches?

Calculate tax liability of Arman.

Case

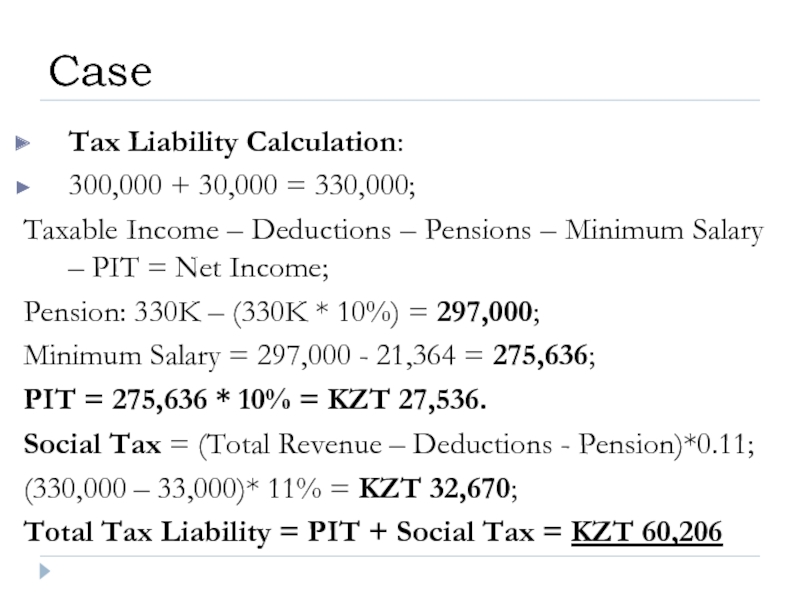

Слайд 12Tax Liability Calculation:

300,000 + 30,000 = 330,000;

Taxable Income – Deductions –

Pension: 330K – (330K * 10%) = 297,000;

Minimum Salary = 297,000 - 21,364 = 275,636;

PIT = 275,636 * 10% = KZT 27,536.

Social Tax = (Total Revenue – Deductions - Pension)*0.11;

(330,000 – 33,000)* 11% = KZT 32,670;

Total Tax Liability = PIT + Social Tax = KZT 60,206

Case

Слайд 13Amount of Contract is KZT 300,000.

SERVICE CONTRACT

Arman is an IE (Individual

Company doesn’t have to pay any taxes for Arman.

Case

Слайд 14For Legal Entities:

Taxable Income = (Aggregate Annual Income) - (Deductions);

Aggregate Annual

Tax Law

Слайд 15Alex’s salary is KZT 1 mln.

Business Trip for 12 days

Carlton Hotel for 12 nights.

Cost per night was KZT 200,000.

Bonus - KZT 1 mln.

Vacation in France - 5 mln.

Company renovated his apartment for KZT 600,000.

How much will be tax burden of the company on Alex’s income?

Case

Слайд 16Art.163. Tax Code

Income of employees taxable at source of payments shall

Tax Code

Слайд 17Art.163. Tax Code

1) the money in cash and (or) non-cash forms

2) the employee's income in kind;

3) the employee's income in the form of material benefits.

Tax Code

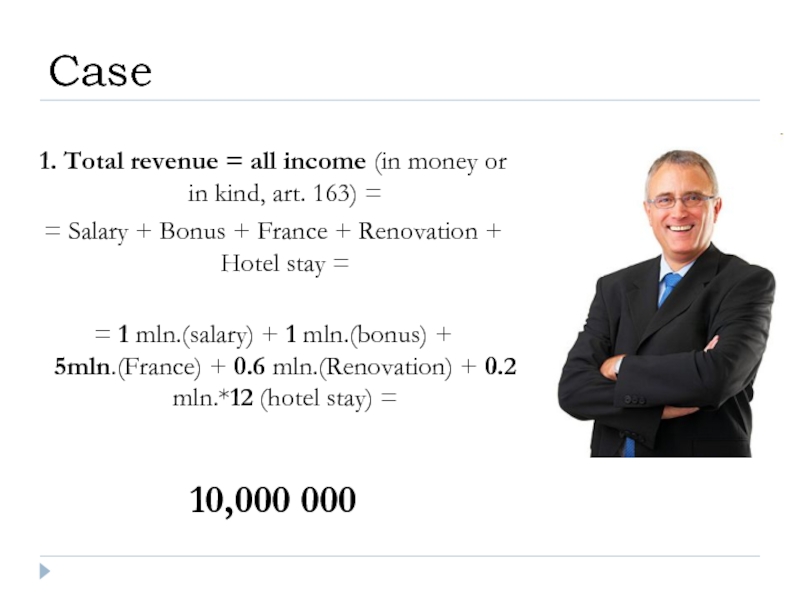

Слайд 181. Total revenue = all income (in money or in kind,

= Salary + Bonus + France + Renovation + Hotel stay =

= 1 mln.(salary) + 1 mln.(bonus) + 5mln.(France) + 0.6 mln.(Renovation) + 0.2 mln.*12 (hotel stay) =

10,000 000

Case

Слайд 19Deductions & Exemptions (art. 155 & 156) =

= business trip (art.

Max 8 MCI for abroad;

Max 6 MCI within RK;

(no more than 40 days)

8*MCI (1982 tenge)*12 days (business trip) =

KZT 190,272

Deductions & Exemptions

Слайд 21PIT (Labor Law)

PIT = Taxable income *0.1

= (Total Revenue – Deductions

=(10,000,000 (total revenue) –190,272 (deductions & exemptions) – 160,230 (pension) – 21,364 (minimum salary))*0.1=

= 962,813.4

Слайд 22Social Tax (Labor Law)

ST = Taxable income *0.11 =

(Total Revenue

(10,000,000 (total revenue) – 190,272 (deductions) – 160,230 (pension)) * 0.11=

= 1,061,445

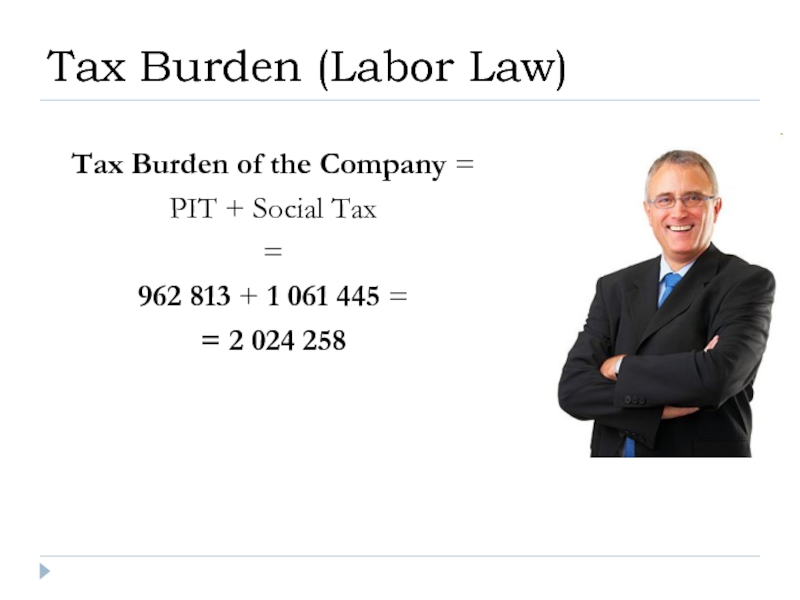

Слайд 23Tax Burden (Labor Law)

Tax Burden of the Company =

PIT +

=

962 813 + 1 061 445 =

= 2 024 258

Слайд 24Tax Regimes of the IP

PIT – 10%;

Social Tax – 2 MCI; Social Tax 1,5%; Social Tax 1%;

Deductions; No Deductions No Deductions;

Can Hire Employee Can Hire Employee Cannot Hire

Individual Entrepreneur

Generally Established Procedures

Simplified Declaration

Patent

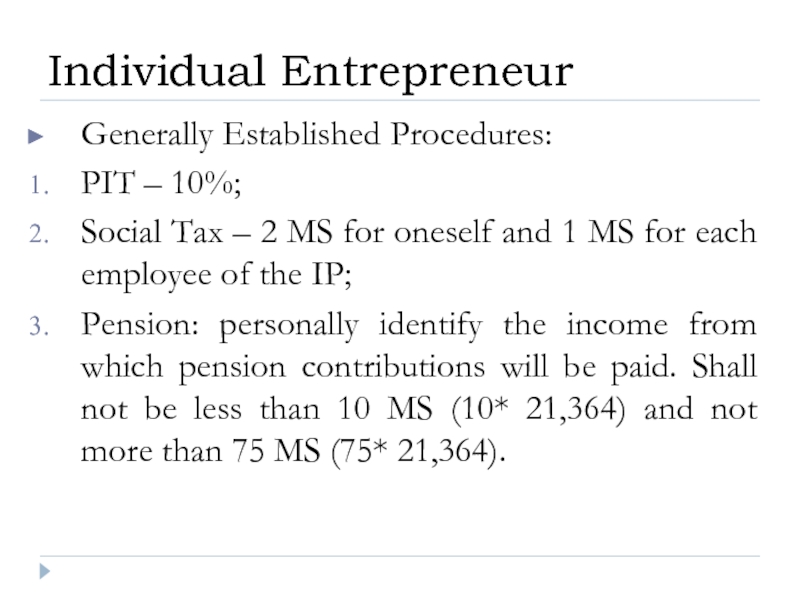

Слайд 25Generally Established Procedures:

PIT – 10%;

Social Tax – 2 MS for oneself

Pension: personally identify the income from which pension contributions will be paid. Shall not be less than 10 MS (10* 21,364) and not more than 75 MS (75* 21,364).

Individual Entrepreneur

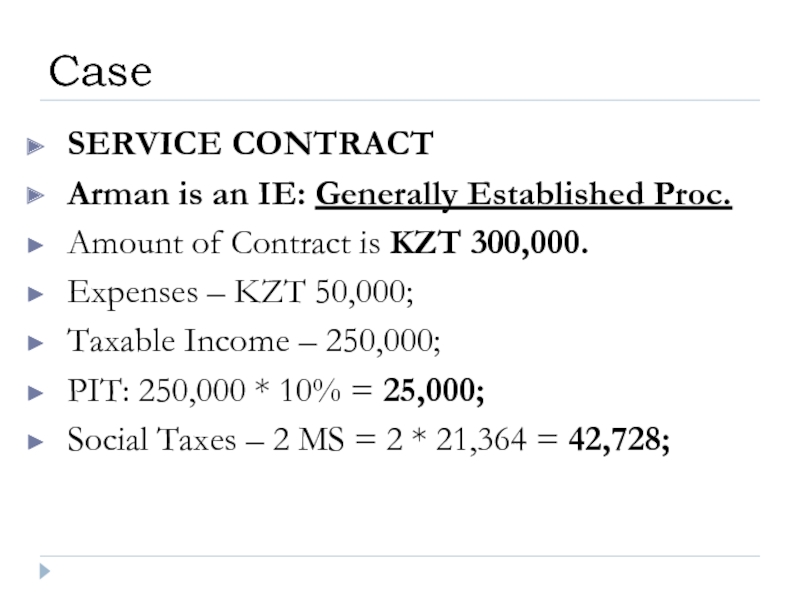

Слайд 26SERVICE CONTRACT

Arman is an IE: Generally Established Proc.

Amount of Contract is

Expenses – KZT 50,000;

Taxable Income – 250,000;

PIT: 250,000 * 10% = 25,000;

Social Taxes – 2 MS = 2 * 21,364 = 42,728;

Case

Слайд 27Special Tax Regime - Patent:

PIT – 1%;

Social Tax – 1%

*Note: IP

Individual Entrepreneur

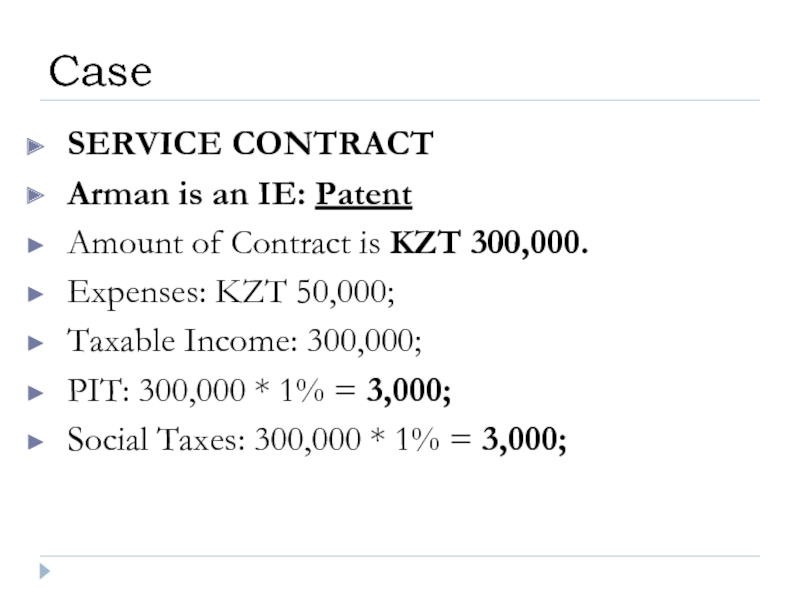

Слайд 28SERVICE CONTRACT

Arman is an IE: Patent

Amount of Contract is KZT 300,000.

Expenses:

Taxable Income: 300,000;

PIT: 300,000 * 1% = 3,000;

Social Taxes: 300,000 * 1% = 3,000;

Case

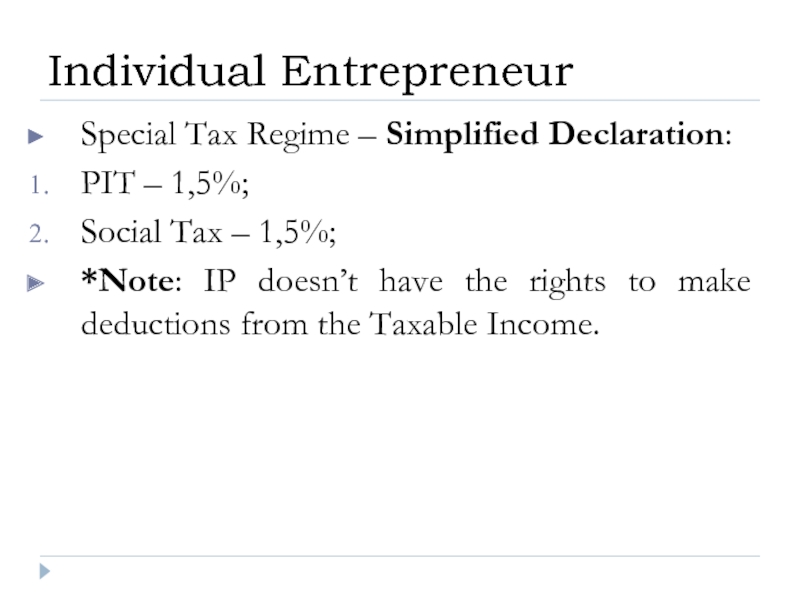

Слайд 29Special Tax Regime – Simplified Declaration:

PIT – 1,5%;

Social Tax – 1,5%;

*Note:

Individual Entrepreneur

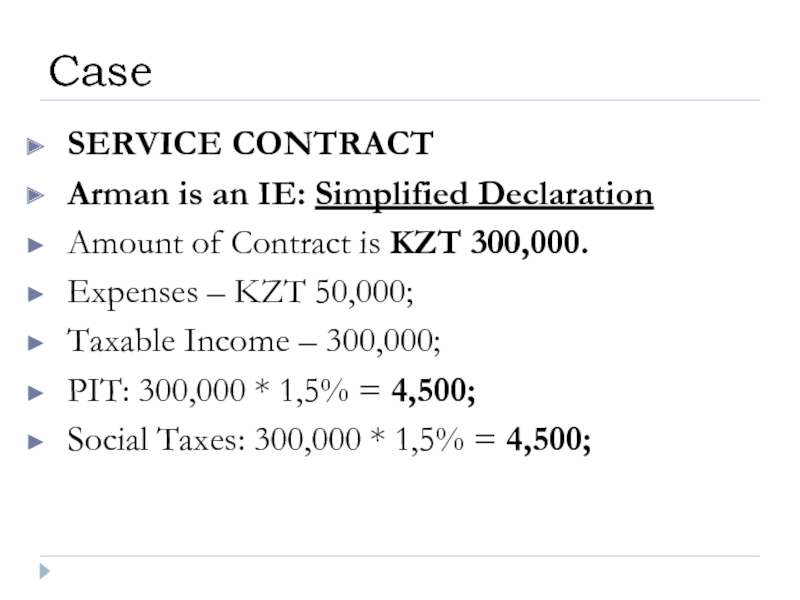

Слайд 30SERVICE CONTRACT

Arman is an IE: Simplified Declaration

Amount of Contract is KZT

Expenses – KZT 50,000;

Taxable Income – 300,000;

PIT: 300,000 * 1,5% = 4,500;

Social Taxes: 300,000 * 1,5% = 4,500;

Case