- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Tax law. (Lecture 1) презентация

Содержание

- 1. Tax law. (Lecture 1)

- 2. PIT (Personal Income Tax) – ИПН (Индивидуальный

- 3. Tax Burden under Employment Contract; Tax Burden

- 4. Tax Legislation is based on the: Constitution;

- 5. Tax Law regulate the government-directed relations associated

- 6. Sub-par.34 par.1 art.1 TC Taxes - obligatory

- 7. Subject of the tax law – taxpayer

- 8. Article 27. A Taxable Item and (or)

- 9. Principle of Personal Law – attraction of

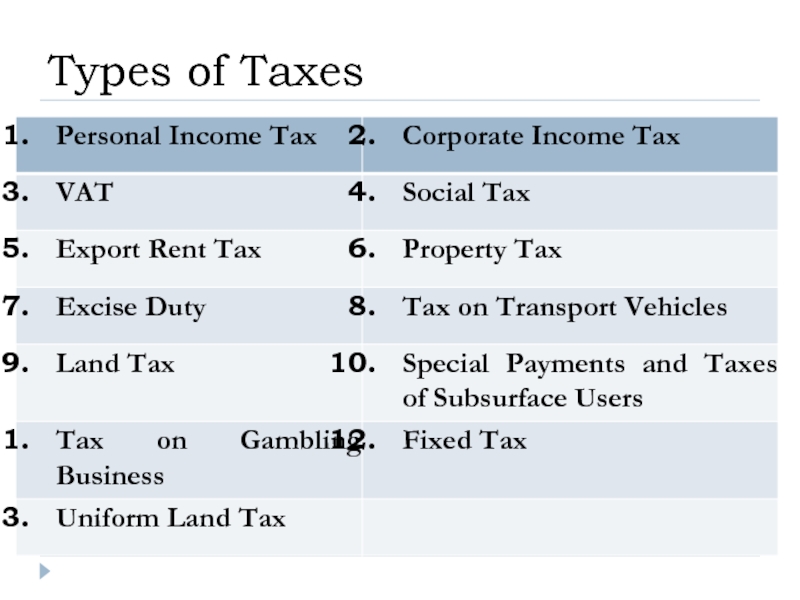

- 10. Types of Taxes

- 11. VAT, taxable items: taxable turnovers (selling goods,

- 12. Excisable Products: Alcohol; Tobacco; Gasoline; Diesel; Crude

- 13. Export Rent Tax: Crude Oil; Gas Condensate;

- 14. Hydrocarbon Resources; Solid Minerals; Common Minerals.

- 15. Paid by the owners of the Real-Estate; Subsurface Users Property Tax:

- 16. Article 26. Tax Liability The tax liability

- 17. Who has to pay PIT? Subjects

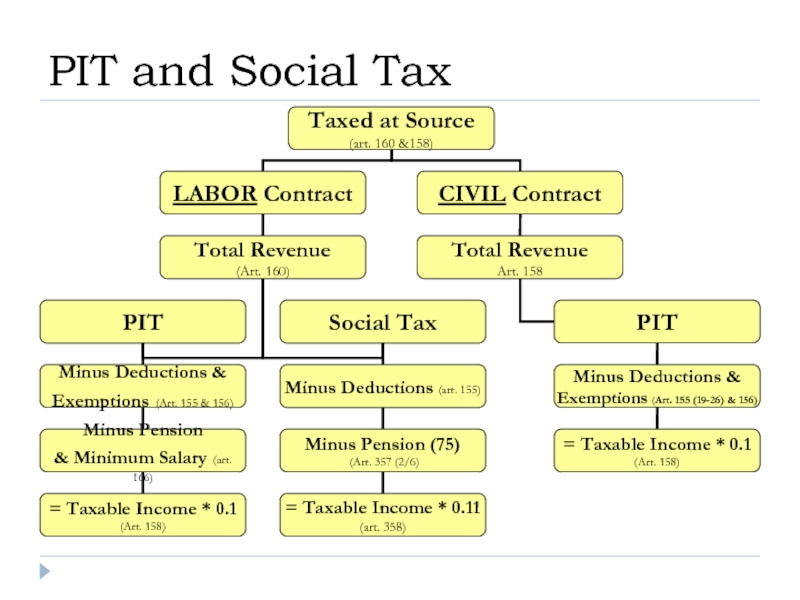

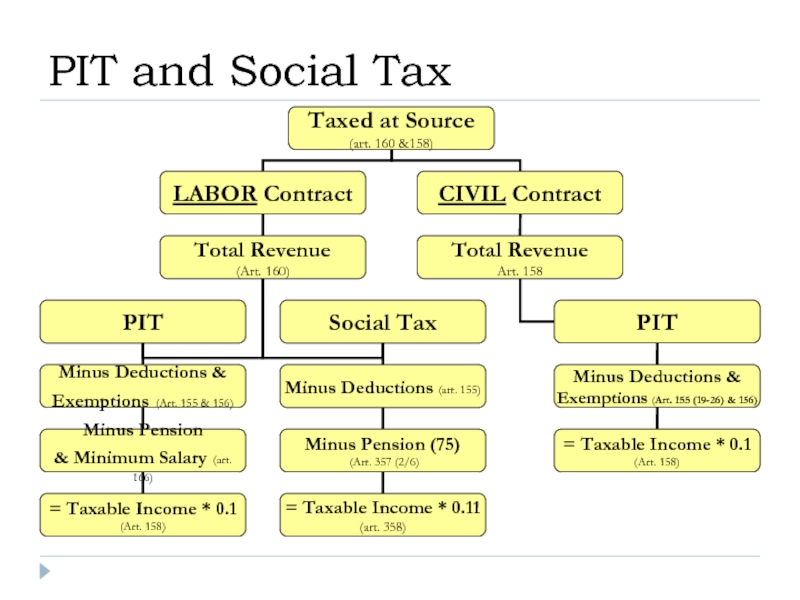

- 18. PIT and Social Tax

- 19. Object of the PIT: Revenues taxed at

- 20. Rates of the PIT: Revenues taxed at

- 21. Labor Contract: Your Official Salary is KZT

- 22. PIT – 10%; Social Tax = 11%

- 23. Calculation: Monthly pension payments are 10%; Minimum

- 24. Calculation: Salary – Deductions and Exemptions; –

- 25. Calculation: Salary – Pension = (500,000 *

- 26. Calculation: Salary – Pension = (500,000 *

- 27. When COMPANY (Tax Agent) has to pay Personal Income Tax?

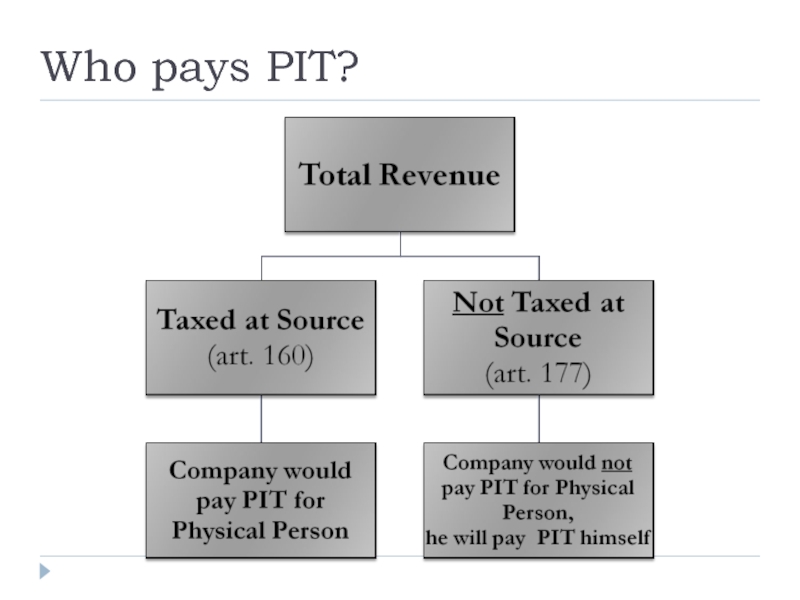

- 28. Who pays PIT?

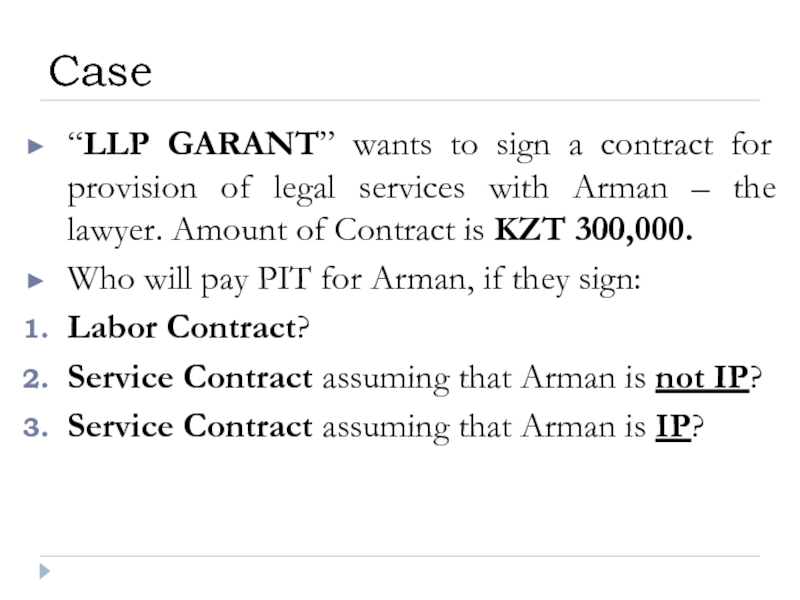

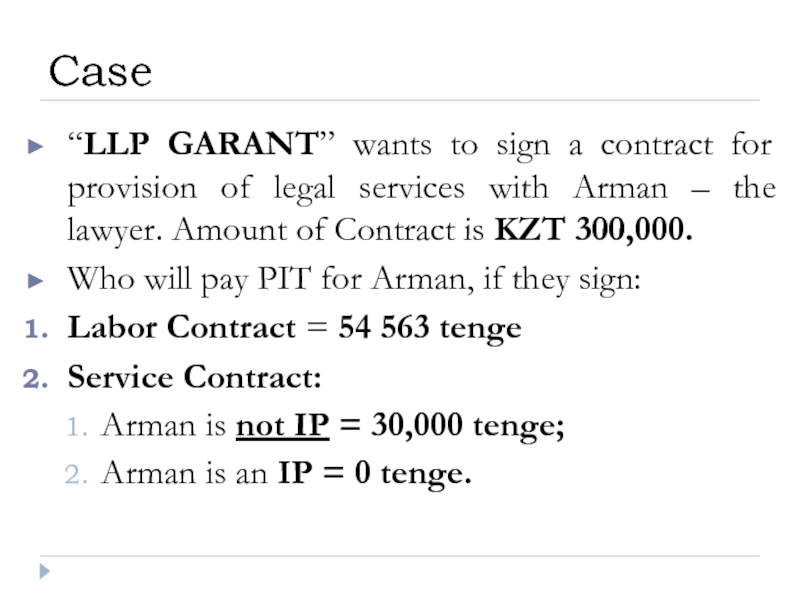

- 29. “LLP GARANT” wants to sign a contract

- 30. PIT and Social Tax

- 31. Calculation: Salary – Deductions and Exemptions; –

- 32. LABOR CONTRACT KZT 300,000. PIT = Taxable

- 33. Calculation: Salary – Deductions and Exemptions; –

- 34. Amount of Contract is KZT 300,000.

- 35. Amount of Contract is KZT 300,000.

- 36. Amount of Contract is KZT 300,000.

- 37. “LLP GARANT” wants to sign a contract

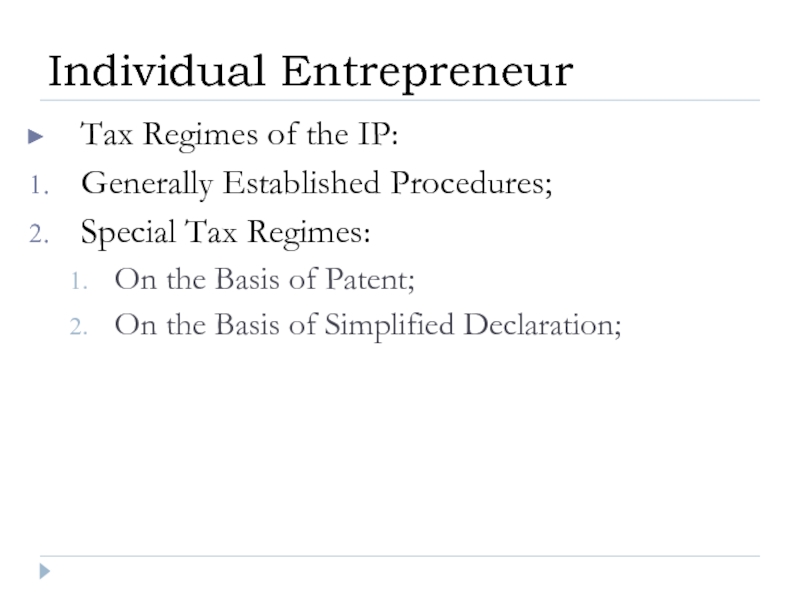

- 38. Tax Regimes of the IP: Generally Established

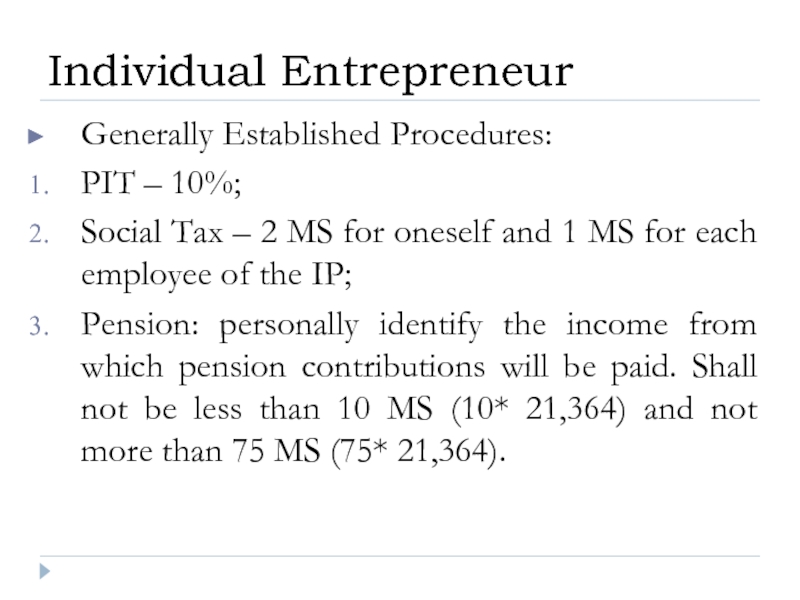

- 39. Generally Established Procedures: PIT – 10%; Social

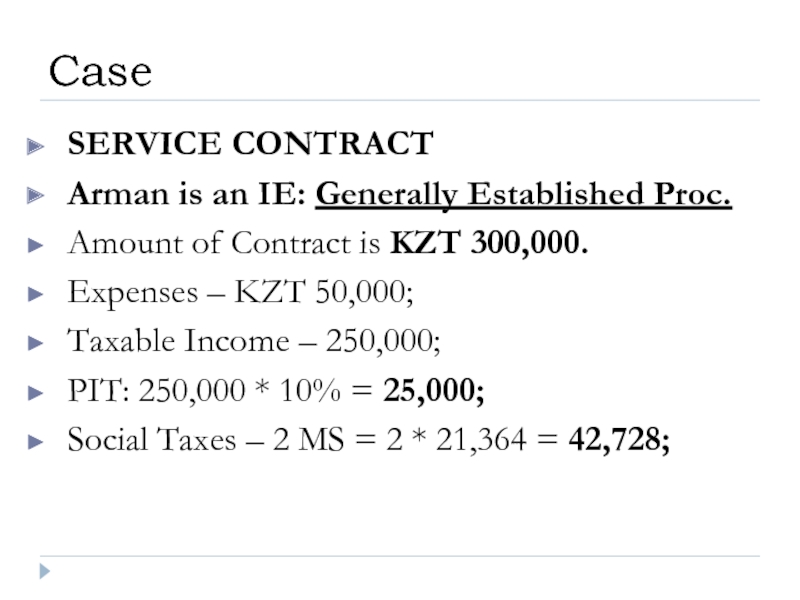

- 40. SERVICE CONTRACT Arman is an IE: Generally

- 41. Special Tax Regime - Patent: PIT –

- 42. SERVICE CONTRACT Arman is an IE: Patent

- 43. Special Tax Regime – Simplified Declaration: PIT

- 44. SERVICE CONTRACT Arman is an IE: Simplified

- 45. Types of Taxes

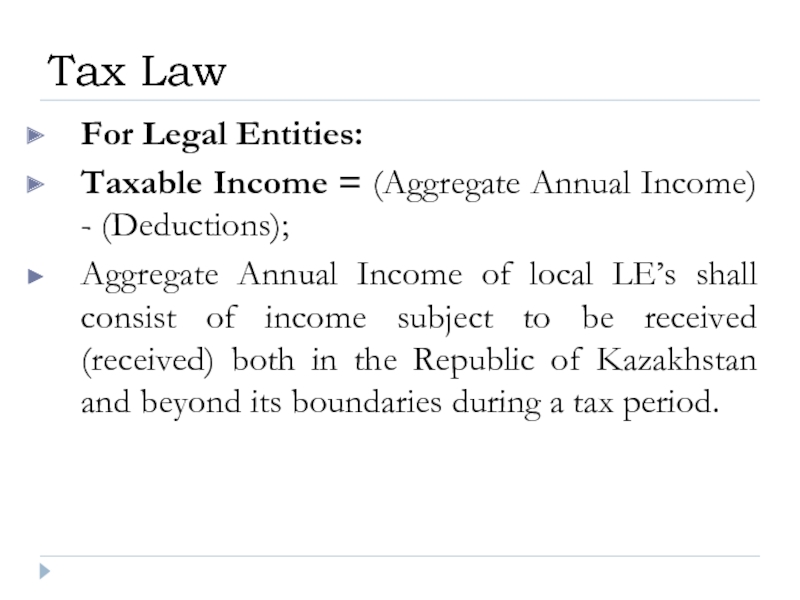

- 46. For Legal Entities: Taxable Income = (Aggregate

Слайд 2PIT (Personal Income Tax) – ИПН (Индивидуальный Подоходный Налог);

MS (Minimum Salary)

Pension - ОПВ (Обязательные Пенсионные Взносы);

Revenue (Income) – Доход

Total Personal Revenue – Совокупный личный доход

Net Income – Чистый доход

Terms & Translations

Слайд 3Tax Burden under Employment Contract;

Tax Burden under Civil Contract;

Tax Burden of

Goal

Слайд 4Tax Legislation is based on the:

Constitution;

Code of the RK on Taxes

and other Normative Legal Acts.

Governing Laws

Слайд 5Tax Law regulate the government-directed relations associated with establishing, introduction and

Tax Law

Слайд 6Sub-par.34 par.1 art.1 TC

Taxes - obligatory monetary payments to the budget

Tax Law

Слайд 7Subject of the tax law – taxpayer who obliged to pay

Taxpayers divided into physical persons and legal entities; as well they could be divided into residents and non-residents.

Subject of the Tax Law

Слайд 8Article 27. A Taxable Item and (or) Item Related to Taxation

The

Tax Law

Слайд 9Principle of Personal Law – attraction of national (local) physical persons

Principle of Territorial Law – obligation to pay taxes regardless of nationality;

Principle of Residence – divide into residents and non-residents, later to pay taxes from revenues derived from sources in the country of taxation.

Subject of the Tax Law

Слайд 11VAT, taxable items:

taxable turnovers (selling goods, works and services in the

taxable import.

VAT – equals to 12%;

VAT

The minimum turnover shall be 30 000 MCI.

Слайд 12Excisable Products:

Alcohol;

Tobacco;

Gasoline;

Diesel;

Crude Oil;

Gas Condensate;

Excise Duty

Subjects – producers/importers of excisable products.

Слайд 14Hydrocarbon Resources;

Solid Minerals;

Common Minerals.

Subsurface Users

Special Payments and Taxes of Subsurface Users:

Слайд 16Article 26. Tax Liability

The tax liability the taxpayer’s obligation to be

Tax Law

Слайд 17Who has to pay PIT?

Subjects of the PIT:

Physical person – resident;

Physical

Personal Income Tax

Слайд 19Object of the PIT:

Revenues taxed at source (i.e. income from: salary,

Revenues not taxed at source (property income, income of IE, lawyers, private notaries, income derived from sources outside of RK).

Personal Income Tax

Слайд 20Rates of the PIT:

Revenues taxed at source - at the rate

Income from dividends – at a rate of 5%;

Other rates stipulated by the Tax Code.

Personal Income Tax

Слайд 21Labor Contract:

Your Official Salary is KZT 500,000;

What will be the amount

What will be your Net Income?

Case

Слайд 23Calculation:

Monthly pension payments are 10%;

Minimum Salary equals to – 21,364 tenge.

The rest amount is subject for the PIT equal to 10%.

PIT

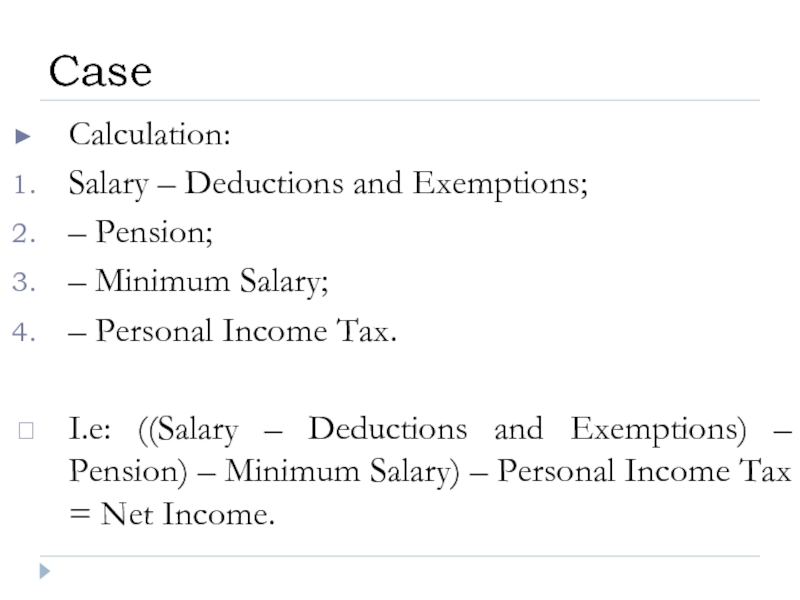

Слайд 24Calculation:

Salary – Deductions and Exemptions;

– Pension;

– Minimum Salary;

– Personal Income Tax.

I.e:

Case

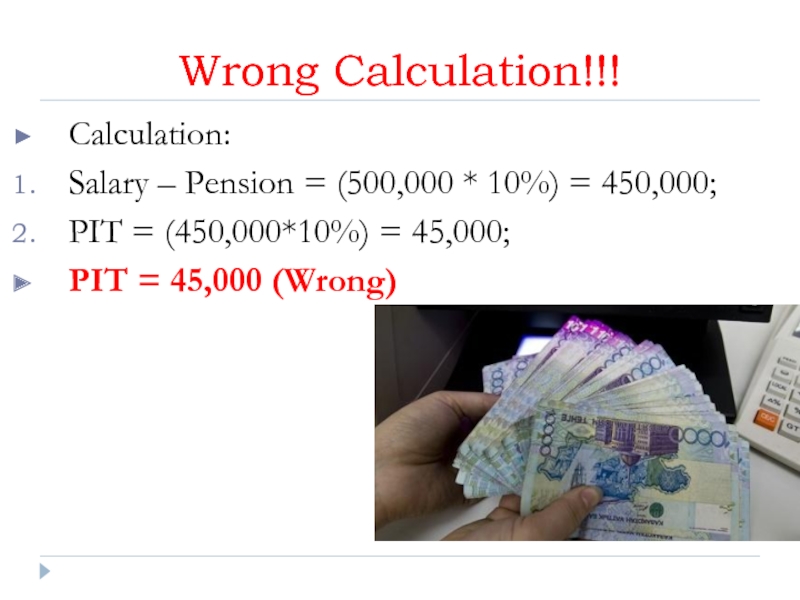

Слайд 25Calculation:

Salary – Pension = (500,000 * 10%) = 450,000;

PIT = (450,000*10%)

PIT = 45,000 (Wrong)

Wrong Calculation!!!

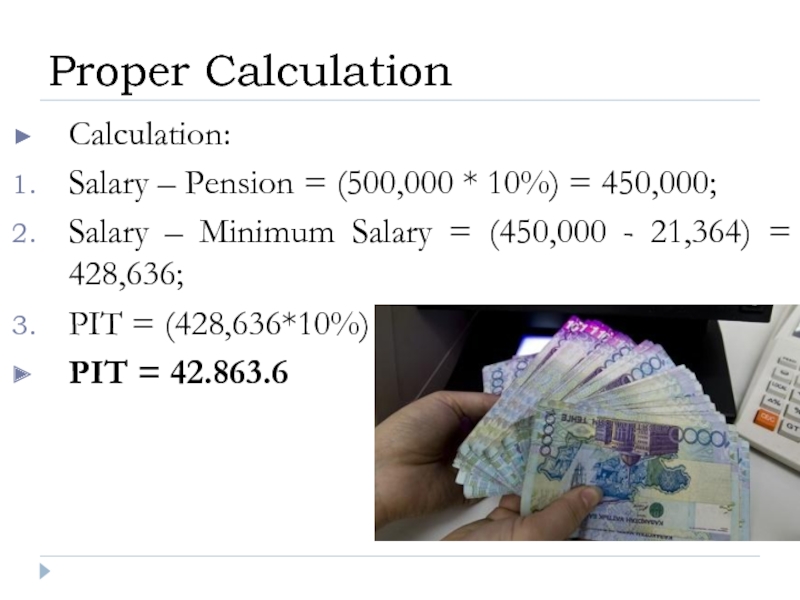

Слайд 26Calculation:

Salary – Pension = (500,000 * 10%) = 450,000;

Salary – Minimum

PIT = (428,636*10%) = 42,863.6;

PIT = 42.863.6

Proper Calculation

Слайд 29“LLP GARANT” wants to sign a contract for provision of legal

Who will pay PIT for Arman, if they sign:

Labor Contract?

Service Contract assuming that Arman is not IP?

Service Contract assuming that Arman is IP?

Case

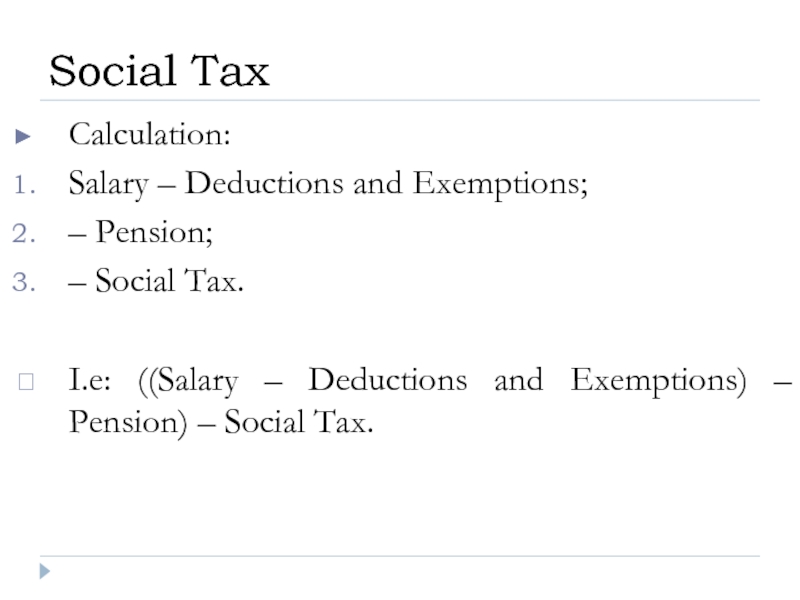

Слайд 31Calculation:

Salary – Deductions and Exemptions;

– Pension;

– Social Tax.

I.e: ((Salary – Deductions

Social Tax

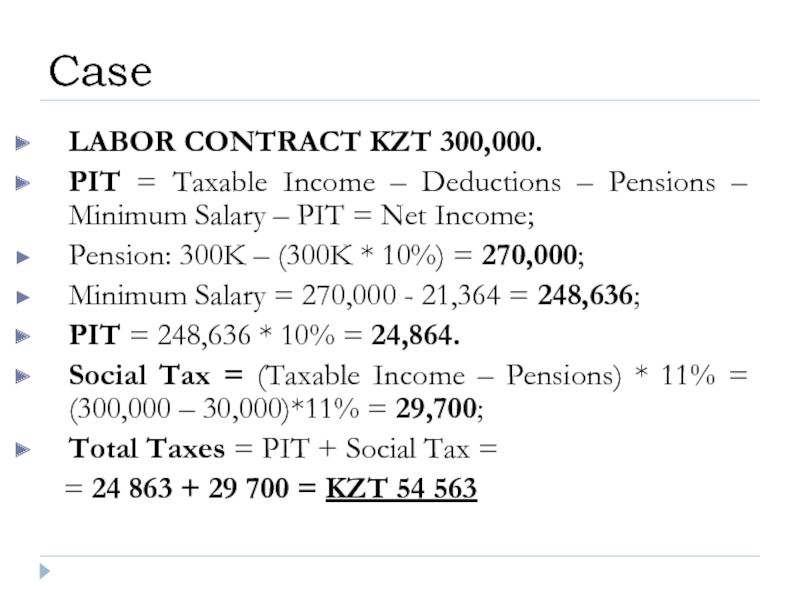

Слайд 32LABOR CONTRACT KZT 300,000.

PIT = Taxable Income – Deductions – Pensions

Pension: 300K – (300K * 10%) = 270,000;

Minimum Salary = 270,000 - 21,364 = 248,636;

PIT = 248,636 * 10% = 24,864.

Social Tax = (Taxable Income – Pensions) * 11% = (300,000 – 30,000)*11% = 29,700;

Total Taxes = PIT + Social Tax =

= 24 863 + 29 700 = KZT 54 563

Case

Слайд 33Calculation:

Salary – Deductions and Exemptions;

– Pension;

– Minimum Salary;

– Personal Income Tax.

I.e:

Case

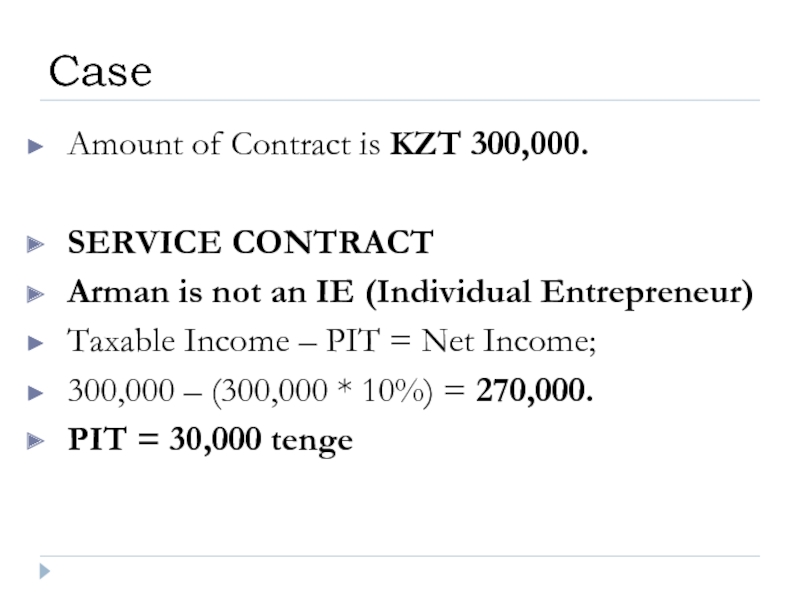

Слайд 34Amount of Contract is KZT 300,000.

SERVICE CONTRACT

Arman is not an IE

Taxable Income – PIT = Net Income;

300,000 – (300,000 * 10%) = 270,000.

PIT = 30,000 tenge

Case

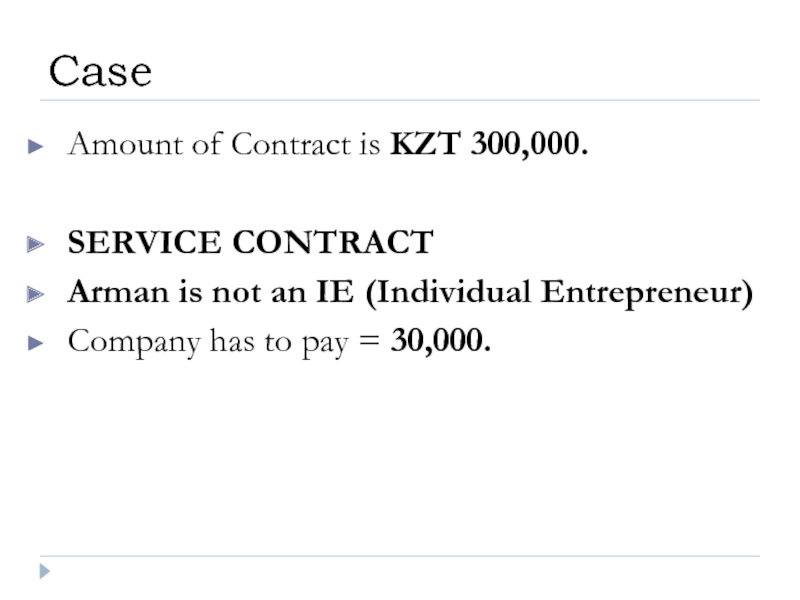

Слайд 35Amount of Contract is KZT 300,000.

SERVICE CONTRACT

Arman is not an IE

Company has to pay = 30,000.

Case

Слайд 36Amount of Contract is KZT 300,000.

SERVICE CONTRACT

Arman is an IE (Individual

Company doesn’t have to pay any taxes for Arman.

Case

Слайд 37“LLP GARANT” wants to sign a contract for provision of legal

Who will pay PIT for Arman, if they sign:

Labor Contract = 54 563 tenge

Service Contract:

Arman is not IP = 30,000 tenge;

Arman is an IP = 0 tenge.

Case

Слайд 38Tax Regimes of the IP:

Generally Established Procedures;

Special Tax Regimes:

On the Basis

On the Basis of Simplified Declaration;

Individual Entrepreneur

Слайд 39Generally Established Procedures:

PIT – 10%;

Social Tax – 2 MS for oneself

Pension: personally identify the income from which pension contributions will be paid. Shall not be less than 10 MS (10* 21,364) and not more than 75 MS (75* 21,364).

Individual Entrepreneur

Слайд 40SERVICE CONTRACT

Arman is an IE: Generally Established Proc.

Amount of Contract is

Expenses – KZT 50,000;

Taxable Income – 250,000;

PIT: 250,000 * 10% = 25,000;

Social Taxes – 2 MS = 2 * 21,364 = 42,728;

Case

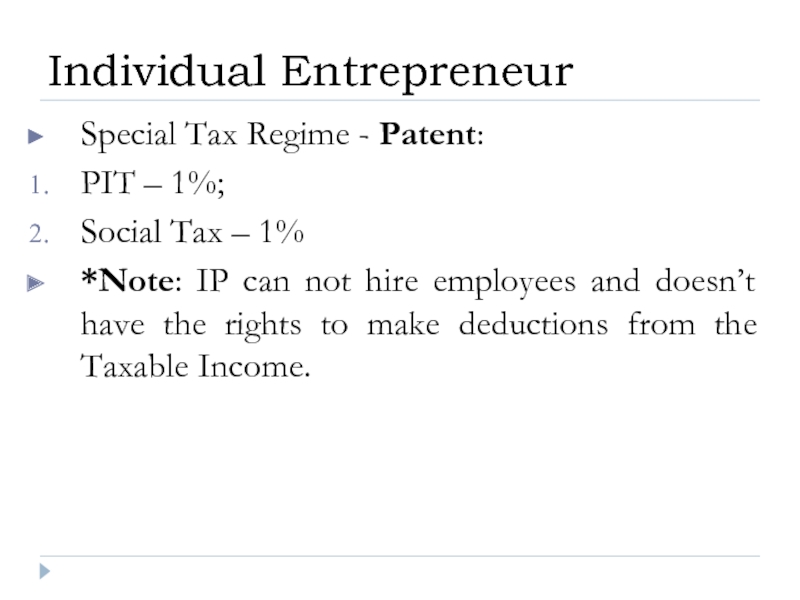

Слайд 41Special Tax Regime - Patent:

PIT – 1%;

Social Tax – 1%

*Note: IP

Individual Entrepreneur

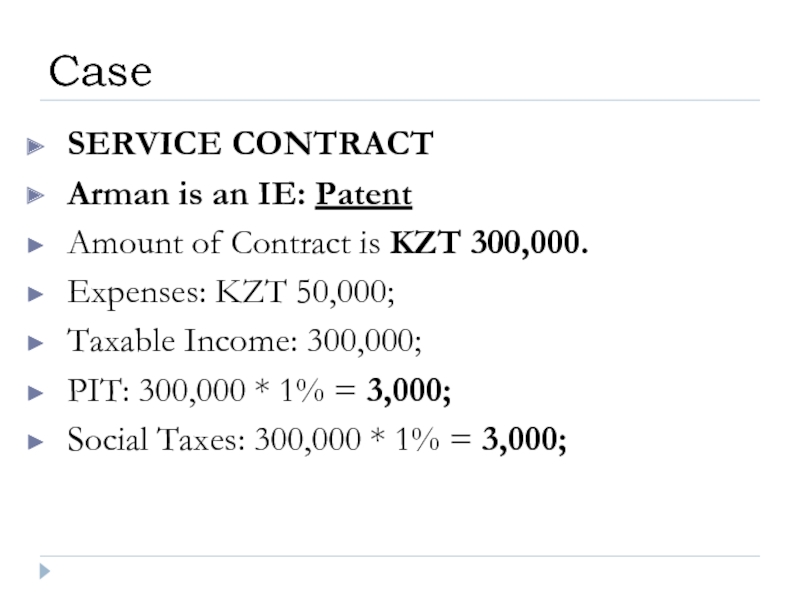

Слайд 42SERVICE CONTRACT

Arman is an IE: Patent

Amount of Contract is KZT 300,000.

Expenses:

Taxable Income: 300,000;

PIT: 300,000 * 1% = 3,000;

Social Taxes: 300,000 * 1% = 3,000;

Case

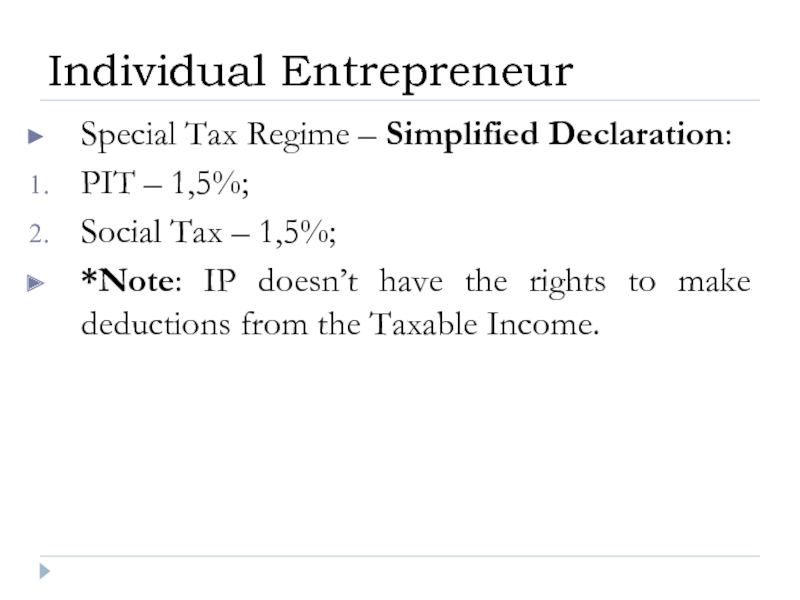

Слайд 43Special Tax Regime – Simplified Declaration:

PIT – 1,5%;

Social Tax – 1,5%;

*Note:

Individual Entrepreneur

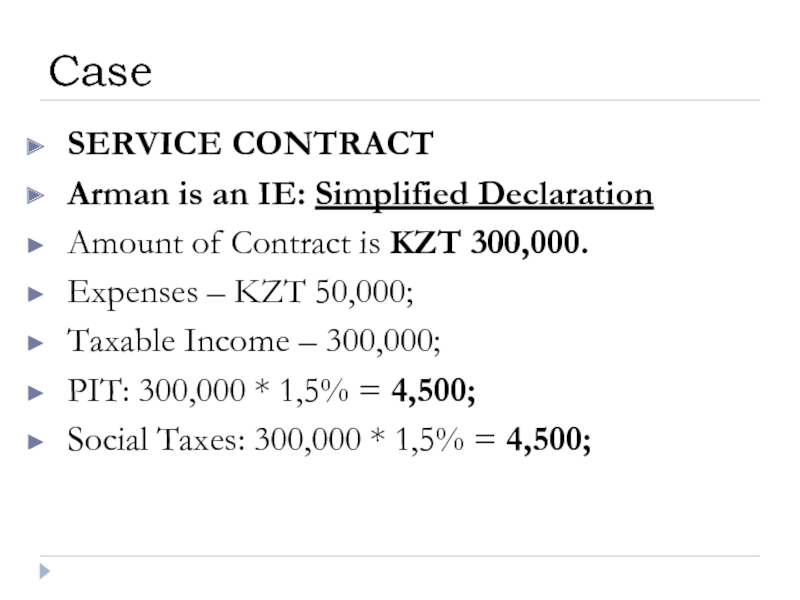

Слайд 44SERVICE CONTRACT

Arman is an IE: Simplified Declaration

Amount of Contract is KZT

Expenses – KZT 50,000;

Taxable Income – 300,000;

PIT: 300,000 * 1,5% = 4,500;

Social Taxes: 300,000 * 1,5% = 4,500;

Case

Слайд 46For Legal Entities:

Taxable Income = (Aggregate Annual Income) - (Deductions);

Aggregate Annual

Tax Law